Analysis of transactions in the EUR / USD pair

Upcoming reports on the euro area could increase pressure on EUR / USD, that is why it is best to take short positions in the market. PMI data for December is the first to be released, followed by the retail sales report in Italy.

The US will also release PMI reports in the afternoon and its decline will limit the upside potential of dollar, especially since weak data on ADP employment is expected. But the highlight is the Fed minutes as it will indicate the plans of the central bank regarding interest rates.

For long positions:

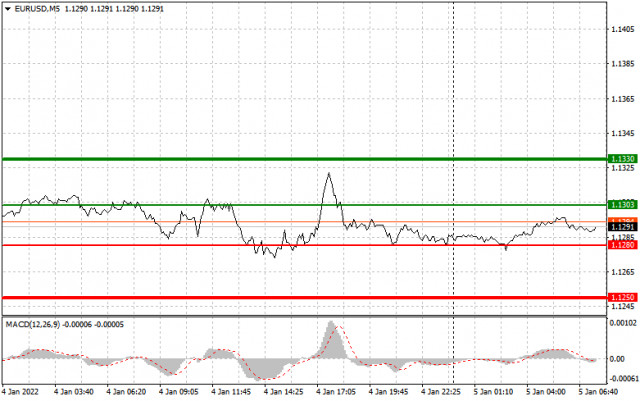

Buy euro when the quote reaches 1.1303 (green line on the chart) and take profit at the price of 1.1330. Growth is very unlikely today because upcoming data on the eurozone is expected to be weak.

Before buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.1280, but the MACD line should be in the oversold area, as only by that will the market reverse to 1.1303 and 1.1330.

For short positions:

Sell euro when the quote reaches 1.1280 (red line on the chart) and take profit at the price of 1.3480. Strong data from the US will prompt a decline in EUR / USD.

Before selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro could also be sold at 1.1303, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.1280 and 1.1250.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR / USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR / USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SGYVKn

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Subscribe to:

Post Comments (Atom)

1 in 7 prop firms closed in 2024: Brokeree Solutions shares insights - FX News Group

Using publicly available data, Brokeree collected and analyzed information about: Country of registration;; Trading platforms utilized;; Fe...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

http://dlvr.it/TF2Sfb

No comments:

Post a Comment