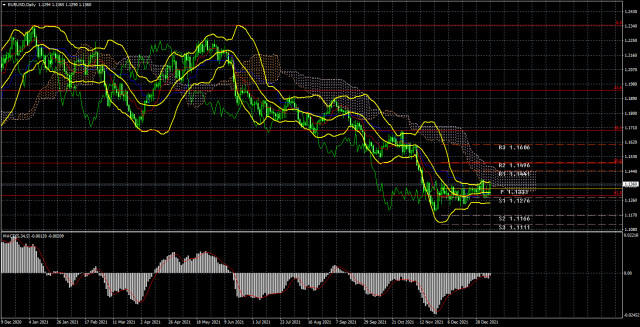

Well, the holidays are over and it's time to start working again. The euro/dollar pair spent the pre-holiday two weeks quite actively (judging by the volatility), but it was still located inside the side channel, which has approximate boundaries of 1.1230 and 1.1360. The current week has ended near the upper limit and this is the fifth or sixth attempt to leave the channel through it. As we have already said in previous articles, a slight upward bias is present for the euro/dollar pair, However, at the same time, it is not possible to extract any benefit from understanding this, since there is no trend movement. There is also little sense in the fact that the euro currency has risen by 120-130 points in a month and a half. So it turns out that the technical picture has not changed in the last month and a half, so nothing special can be said about it now. The lines of the Ichimoku indicator have practically no value since they are weak in the flat. On a 24-hour TF, the flat looks just like a temporary phenomenon, but on a 4-hour TF, the flat looks like a flat.

The hope, as before, is for macroeconomic statistics and fundamental events. This hope may be justified, but we also believe that the flat can end by itself. Over the past month, there have been enough important events and reports that could help the pair get out of the side channel. Even this Friday, an important and unexpected (in its significance) Nonfarm Payrolls report was published. Thus, we believe that sooner or later the demand for one of the currencies will increase or decrease so much that the pair will leave the side channel by itself. But so far this is not happening and the illusory chances of the influence of the "foundation" remain. Therefore, we will consider all the important events of the next week.

There will be very few important events in the European Union. On Monday, the unemployment rate for November will be published. According to experts' forecasts, this indicator will remain at the level of 7.3%, which is a very high value. For example, in the United States, unemployment has already fallen to 3.9%. On Tuesday, Christine Lagarde will make a speech, from which the market will expect at least some "hawkish" hints and statements. And it is unlikely to wait. On Wednesday, a report on industrial production in the EU for November will be published, the growth rate of which may decrease to 0.3-0.5% m/m. ECB Vice President Luis de Guindos will speak on Thursday. On Friday - once again Christine Lagarde. Recall that not every speech of the chairman of the central bank provokes the reaction of traders. For this reaction to take place, it is required that Lagarde make some kind of loud statement. At this time, traders can expect her to strengthen the "hawkish" mood to keep up with the Fed and the Bank of England. However, if tightening monetary policy in the United States is a reasonable step, then the European economy continues to stand on its feet "with the help of two crutches," as Lagarde herself said last year. Simply put, the completion of the PEPP program now is the maximum that can be expected from the European regulator. Moreover, if in the States we are talking about unloading the Fed's balance sheet, then the ECB will increase the standard APP stimulus program immediately after the completion of PEPP in March. Of course, in a smaller volume, but one way or another, the money will continue to flow into the EU economy. And this is still a stimulus, this is still an "ultra-deep" monetary policy. Therefore, if we talk about the prospects of the euro on the fundamental background, they remain quite weak. However, it should be remembered that the dollar has somehow become more expensive for most of 2021, so the factors that provoked its growth may have already been worked out several times by traders. After all, it's no secret that the Fed will raise the key rate two or three times this year. Consequently, this decision of the Fed, which has not yet been made, may already be embedded in the current dollar exchange rate.

Trading recommendations for the EUR/USD pair:

The technical picture of the EUR/USD pair on the 4-hour chart according to the Ichimoku strategy looks extremely eloquent. The pair is located between the levels of 1.1236 and 1.1360 and cannot leave this channel in any way. During one week, the pair may cross the Senkou Span B and Kijun-sen lines several times, since they are weak in the flat. Therefore, in the current situation, we should wait for the pair to exit the side channel. Since there is still a minimum upward slope, it is not possible to work even on a rebound from the channel boundaries. They're too blurry.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SGpBzZ

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Subscribe to:

Post Comments (Atom)

Rupee falls 14 paise to all-time low of 84.23 against U.S. dollar in early trade - The Hindu

Forex traders said with the U.S. election underway, markets are already showing signs of volatility — a trend likely to calm once a clear w...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

http://dlvr.it/TF2Sfb

No comments:

Post a Comment