Major economic news is not scheduled for today. Therefore, we should not expect drastic changes in the market.

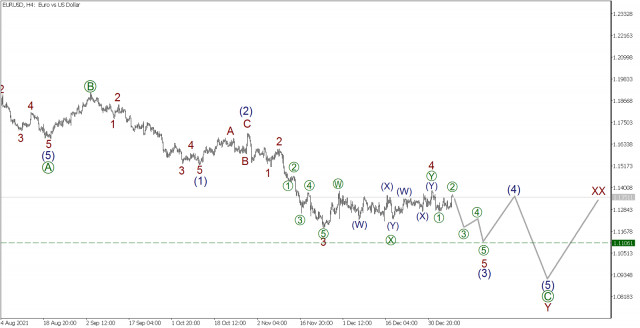

EUR/USD, H4 timeframe:

Just like the previous trading week, the formation of the middle part of a large correctional trend can be seen. It is highly possible that a triple zigzag is being built, within which sub-wave Y is formed.

Sub-wave Y can take the form of a simple zigzag [A]-[B]-[C]. The first two parts of this simple zigzag are already done. Since the first half of September 2021, there was a decline in prices in the final downward wave [C].

Wave [C], particularly its initial part, hints at a simple five-wave impulse (1)-(2)-(3)-(4)-(5). The impulse sub-wave 3 is now forming within the framework of this impulse.

As part of impulse 3, completed sub-waves 1-2-3-4 and the first two parts of the last fifth sub-wave can be observed.

It is likely that market participants will see the price decline in sub-waves [3]-[4]-[5], towards the level of 1.1106 in the coming trading days, as shown in the chart.

Currently, one can consider opening sell deals in order to take profit at a specified level.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SGqxPk

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Subscribe to:

Post Comments (Atom)

Dollar slips as FX traders gird for U.S election outcome - CNBC

“Any delays and/or disputes over vote counting can also add to currency volatility this week.” Uncertainty all around. The winner may not b...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

http://dlvr.it/TF2Sfb

No comments:

Post a Comment