- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

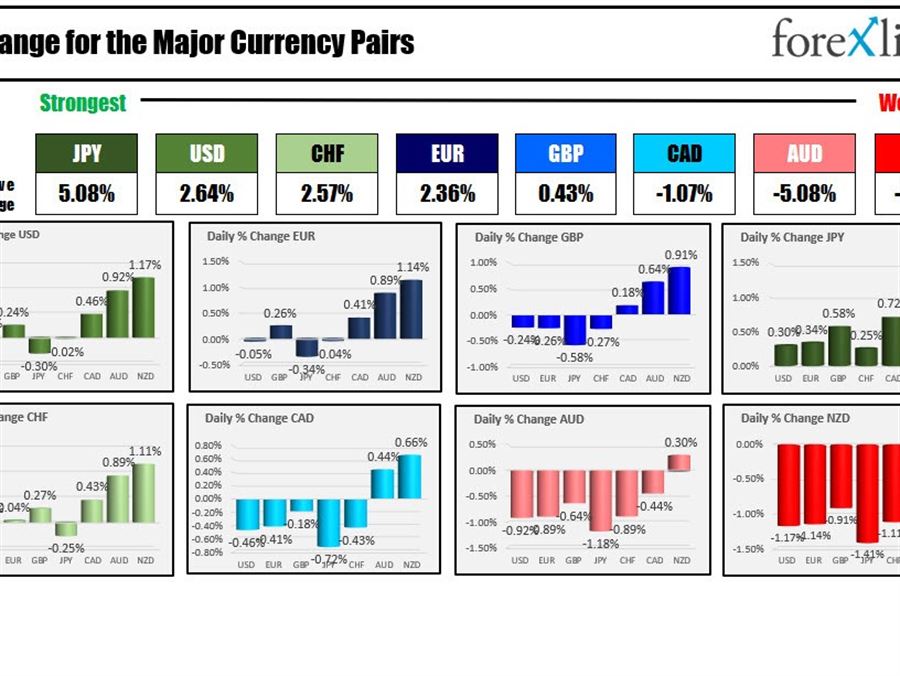

The strongest to the weakest of the major currencies

The JPY is the strongest and the NZD is the weakest as the North American session begins, leading to demand for the relative safety of the JPY and the USD and out of the NZD and AUD to complete the flow of funds storyline.

The rally in stocks from yesterday, is also fading today ahead of Fed Chair's testimony on Capitol Hill. The Fed chair will be testifying in front of the Senate Banking Committee today (and will do the same at the House tomorrow). The testimony will begin at 9 AM. At the last Fed meeting the Fed pivoted to a 75 basis point hike at the last minute. Fed's Barkin blamed the tumble in the Michigan consumer sentiment index as the straw that broke the camel's back.. Expect the Fed Chair to now highlight the all out need to fight inflation at all costs as it seems to be the new mantra from Fed officials. The Fed chairs testimony begins at 9:30 AM ET.

President Biden has called on Congress to suspend the Federal gas tax. The plan is to suspend for 3 months, and requests states to do the same (or find similar consumer relief). He asks the industry to put record profits to work and for retailers to promptly lower prices. The impact would be $0.18 for gas and $0.24 for diesel. Crude oil is down with also the fear of a global recession looming.

Ahead of the Fed chair, will be SNB Jordan who is expected to speak at 9 AM ET. Last week, the SNB surprised the market by launching their interest rate rise with a 50 basis point increase.

Canada CPI data will be released at 8:30 AM ET with the expectation for a 1.0% rise for the month. Overnight the UK CPI hit a record of 9.1%. The Core measure was less than expectations at 5.9% vs 6.0% (was 6.2% last month)

Looking at other markets:

* Spot gold is up $4.66 or 0.26% at $1837.45

* spot silver is down -$0.20 or -0.90% at $21.46

* WTI crude oil is down sharply. The August contract is -5.52 at $103.95

* The price bitcoin is trading down -2.72% at $20480

In the pre-market for US stocks, the futures are implying a lower open after a good start to the week yesterda

* Dow industrial average is down -382 points after yesterdays 641.47 point rise

* S&P index down -55 points after yesterdays 89.95 point rise

* NASDAQ index is down -187 points after yesterdays 270.94 point rise

In the European equity markets the major indices are also trading lower

* German DAX, down -268.6 points or -2.02%

* France's CAC down 102.13 points or -1.71%

* UK's FTSE 100 down -92 points or -1.3%

* Spain's Ibex - down 150 points or -1.82%

* Italy's FTSE MIB down -146 points or -2.05%

The US debt market, yields are moving lower after modest gains yesterday.

US yields are lower at the start of North American session

In the European debt market, yields for benchmark 10 year yields are also sharply lower as fears of recession sent interest rates lower

European benchmark 10 year yields

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/SSdnSm

http://dlvr.it/SSdnSm

- Get link

- X

- Other Apps

Comments

Post a Comment