Long-term perspective.

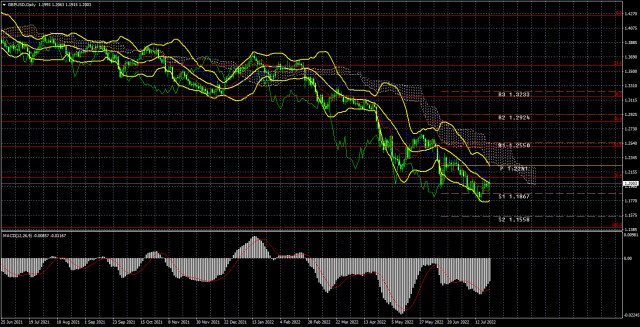

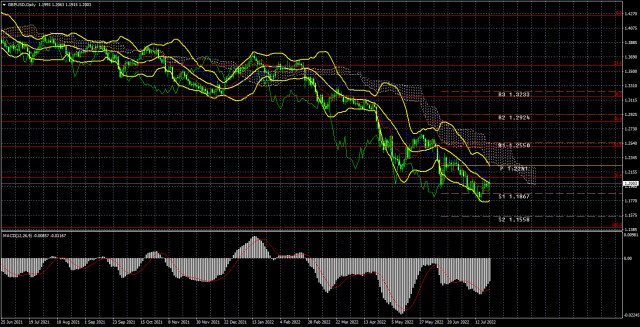

The GBP/USD currency pair has climbed by 140 points in the past week. We do not even know if it is worthwhile to study the movements of the pound/dollar pair individually, given that they are identical to those of the euro/dollar pair. It is a joke, but the pound is trading practically identically with the euro this week, despite macroeconomic and fundamental conditions being different. Additionally, the pound began to rise at the start of the week, although it is unclear what caused it. There were several macroeconomic reports in the United Kingdom, but not all could be deemed noteworthy and important. For example, on Monday, unemployment and wage figures were released that did not significantly deviate from projections. On Wednesday, a report was released indicating that inflation jumped to 9.4 percent annually. On Friday, numbers on economic activity were released that were not as dismal as in the EU or the United States. In addition, numerous additional rounds of voting for the new Prime Minister of the United Kingdom took held this week, leaving only two contenders for the vacant office. As expected, here are Rishi Sunak and Liz Truss. In the near future, the last round of voting will commence, in which all 160 thousand members of the Conservative Party will participate. The identity of the new Conservative leader might be revealed as early as next week. What difference does it make for the British pound if it continues to emulate the euro in every way? The "method" remains unchanged. The pound failed to surpass the critical line after adjusting to it. As long as the price continues below this line, the bearish sentiment persists, and the pound's fall versus the US dollar can restart any time. The Fed will host a meeting next week at which the rate may be increased by 1% immediately. The dollar's expansion is nearly certain in this situation.

COT evaluation.

The most recent COT report on the British pound revealed minimal fluctuations. The non-commercial group closed 1,900 buy contracts and 3,700 sell contracts throughout the week. Therefore, the net position of non-commercial traders rose by 1,800. What does it matter if the mood of the key players continues to be "pronounced bearish," as shown by the second indicator in the preceding illustration? And regardless of the circumstances, the pound remains incapable of exhibiting even a minimal upward correction. The net position has been declining for three months and slowly increasing for several months, but it makes no difference if the British pound continues to devalue against the US dollar. We have already stated that the COT data does not account for the demand for the dollar, which is likely still rather high. Therefore, even to strengthen the British currency, its demand must develop faster and stronger than the dollar's demand. The Non-commercial group has opened a total of 89 thousand sales contracts and just 32 thousand buy contracts now. For these values to stabilize, long-term growth in net positions will be required. Neither macroeconomic data nor fundamental developments provide support for the British pound. We can only rely on corrective growth, but we expect the pound to continue to fall in the medium run.

Evaluation of fundamental occurrences.

This week, there were virtually no significant occurrences in the United States. On Friday, business activity indices indicated a severe fall in the services sector. The indicator has fallen below 50.0, which is negative and signals the emergence of economic issues in the United States. Nonetheless, the US dollar, which has been declining for most of the week, is still quite strong compared to the euro or the pound. The conclusions of the Fed meeting will be released the following week, and we have every reason to anticipate an immediate rise in the US dollar.

Regarding the British pound, it is likely that it will continue to mirror the euro in all respects. It is impossible to determine why this is occurring, but the fact that both currency pairs are trading practically identically can greatly assist traders. For instance, the euro has a channel on the junior TF, but the pound does not; yet, overcoming the channel for the euro almost implies movement in the same direction for the pound.

Trading strategy for the week of July 25-29:

1) The pound/dollar pair continues its long-term decline. Thus, purchases are not significant at present and cannot be considered until the price breaks above the Ichimoku cloud. The pair retains theoretical growth potential, but the current underlying environment makes it impossible to anticipate a significant rise in the pound. Before fixing the key line, we do not even consider a further increase in the value of the British pound.

2) The pound is perilously close to its two-year lows. There are no technical reasons to anticipate an upward increase at this time. A price rebound from the key line could trigger a fresh round of the pound's decline; consequently, sales with a target of 1.1410 (100% Fibonacci) are still appropriate now.

Explanations of the figures:

Price levels of support and resistance (resistance /support), Fibonacci levels – levels used as entry points for buying and sales. Take Profit levels may be positioned nearby.

Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD (5, 34, 5).

The first indicator on the COT charts is the net position size of each trading category.

On the COT charts, indicator 2 represents the net position size for the "Non-commercial" group.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SVQ10t

Comments

Post a Comment