- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

After the spring fever, which ended with a global sell-off of all indices and a bearish reversal, many retail traders again tried to get back into the game. However, before the S&P 500 had time to accelerate, a new blow from the meme-stock market brought new losses to the bulls. However, the survey showed that traders are not ready to follow the bearish trend.

Retail traders saved markets by keeping trades open during tough times

According to analysts, this time it was a fairly large army of "mom-dad" investors that suffered, that is, traders with little trading experience and without a strong educational base.

Wall Street was talking about this type of investor when they tried to explain the July rise in cryptocurrencies. Now they are suspected of provoking the latest global surge in US indices.In my opinion, if this reflects the real state of affairs, then only partially.

Yes, one cannot but agree that the retail investor base has changed dramatically in recent years, especially after the COVID-19 pandemic. The rise of social media (hello Reddit) and online trading sites and apps has created younger and more market-savvy individuals who complement the more traditional older investors who make monthly contributions to their pension funds.

This army of traders, if it can be suspected of naivety, then after the last two extremely volatile years of trading, they have clearly gained experience and are in no hurry to part with their money.

Wall Street analysts paint us a portrait of a fickle, speculative day trader who just wants to make a quick buck, especially in the riskier and more complex parts of financial markets like cryptocurrencies.

To some extent this is true, let's not deny the obvious. This is also a direct consequence of the surge in liquidity in financial markets after the pandemic, which the Federal Reserve is now trying to reverse. Yet research shows that retail investors are not as easy-going as institutional investors might have thought.For example, a survey of 1,000 retail investors in the United States conducted by the social investment platform eToro in June, when the market was in a bearish peak, showed that 80% of them buy or sell assets monthly or less often.

At the time of the survey, about 65% of respondents were holding their investments, 29% were holding and buying more, and only 6% had sold. These numbers give us a completely different picture of what is happening in small trades.

According to the traditional school of investing, young investors are less likely to keep their investments. Yet 42% of investors aged 18 to 34 did just that, and 43% held and bought more. Sold only 15% of the total.

Typically, retail investors are late to the peak of profitable deals and exit them last and with the worst hangover. Many of them lost some headroom earlier this year, when the S&P 500 (.SPX) posted its worst first half performance in more than half a century.

Of course, one might think that retail investors are generally not the most sophisticated or nimble, and that they probably suffered huge losses as the market went against them for months on end. But if they had given up and sold them, the market crash could have been even worse.

And more importantly, according to this survey, they never really left. They kept their positions in the trades, not allowing the market to collapse even more. And it's impressive.

Therefore, the sharks of Wall Street immediately suspected these hurry-ups that it was they who were now pulling the markets up. Just this week, retail investors were again taken aback by the wild swings in shares of home improvement retailer Bed Bath & Beyond. Meme shares soared over 130% at the start of the week, but fell 20% on Thursday and 40% in early trading on Friday. It comes after billionaire Ryan Cohen suddenly sold his stake in troubled retailer Bed Bath & Beyond - just days after he went bullish on stock options.

For Cohen himself, the deal could bring in between $55 million and $60 million. But the traders, who hurried to invest in the newly popular funds, did not do well.

Not good for other meme companies. Retail favorites GameStop and AMC Entertainment continued their decline on Friday, leaving most of their weekly profits behind. GameStop and AMC Entertainment lost between 4% and 6%. E-commerce firm Vinco Ventures plunged 17%. Interestingly, Cohen also owns a stake in GameStop.

And yet, despite the current dip, BBBY and call option buying volumes by retail investors are up more than 70 times their all-time average, with current five-day net buying up to $188 million on Wednesday.

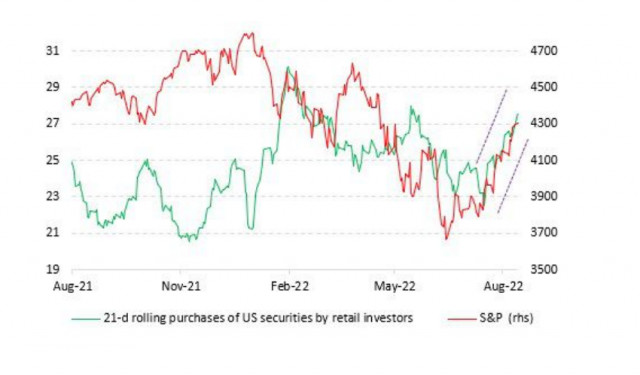

However, the market is still on a positive wave: step away from meme stocks and look towards the luminaries: the S&P 500 and Nasdaq Composite rebounded almost 20% and 25%, respectively, from their mid-June lows. This has certainly been helped by the strong growth in retail investor buying, which currently averages $1.36 billion per day, with a 21-day moving average of over $27 billion.

Moreover, the data shows that retail investors remained active buyers throughout the January-June market downturn. Yes, the 21-day moving average fell to $23 billion over the summer, but it's still well above last year's low of about $21 billion.

What does this tell us? That the markets don't want to accept the reality of a bearish downturn, preferring to hold positions and bet on the bulls as soon as there is the slightest opportunity for growth.

According to the technical data, the bearish decline is already in full swing. Thus, Citi analysts have identified 22 bear market rallies since the 1920s, lasting from two to 128 trading days and ranging in size from 11% to 47%. There were three such episodes from 2001 to 2002, four in the period 2008-2009, and two this year.

However, I want to caution you. The influence of retail traders on the markets is largely seasonal. It's August now, when liquidity is low and the big investment companies usually take their staff on vacation, so it's the off season... and an opportunity for the retail bulls, who have increased their influence due to this factor. In late August - early September, the market of large investors will revive, and the game will follow different rules.

The real economy is slow to recover, a recession is waving a red flag in China, the conflict in Ukraine is dragging on, and the coronavirus promises us a fresh strain this season. So there are not so many grounds for optimism. With this in mind, we can expect a rather difficult autumn-winter season, including for traders.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SX0D2M

http://dlvr.it/SX0D2M

- Get link

- X

- Other Apps

Comments

Post a Comment