- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

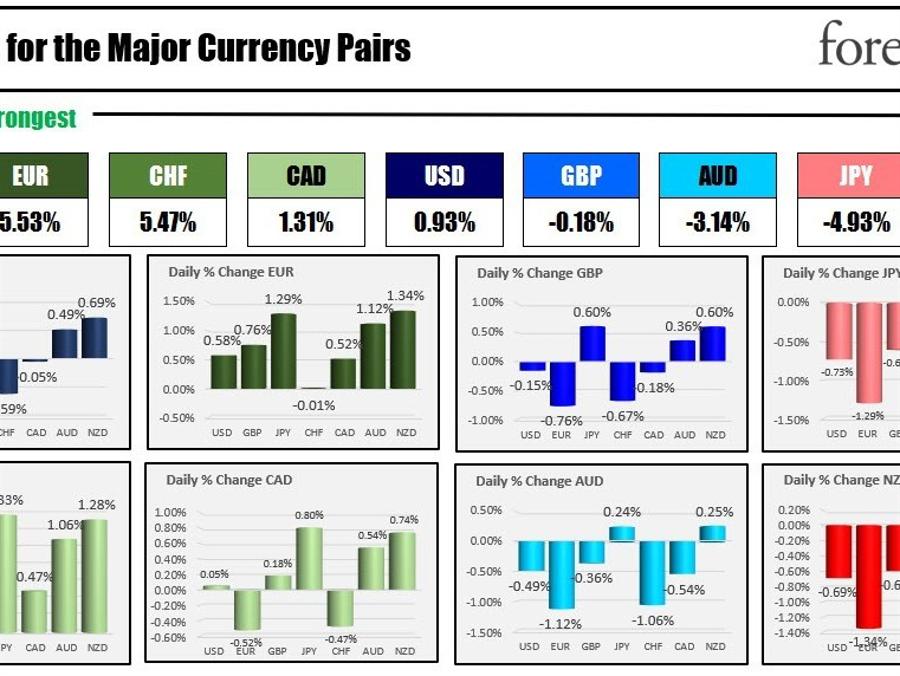

As the North American trading session commences, the Euro (EUR) is currently the strongest currency, while the New Zealand Dollar (NZD) is the weakest. A more stable financial environment in both Europe and the US has contributed to the Euro's strength.

The KRE regional bank ETF is trading at $45.08, an increase from yesterday's closing price of $43.56. First Republic shares are currently trading at $14.43, up from the closing level of $12.18; however, the share price did experience a significant 47% drop yesterday. Credit Suisse shares remain stable, while UBS shares are trading higher at $19.83, up from $18.80 at yesterday's close.

European bond yields have also risen, with the German 10-year yield increasing by 17.4 basis points. US bond yields are following a similar upward trend. The US Dollar (USD) is showing mixed performance as markets await the Federal Reserve meeting scheduled for tomorrow at 2 PM ET.

The Federal Reserve is expected to raise interest rates by 25 basis points, although some analysts, such as those from Goldman, Moody's Analytics, and Wells Fargo, predict no change in policy. The current interest rate stands at 4.75%. Uncertainty also surrounds the dot plot, or the expected terminal rate, which was 5.1% in December. The range for 2023 was estimated to be between 4.9% and 5.6%.

It is important to remember that the Fed targets a range of 25 basis points; thus, a reading of 5.1% actually corresponds to a range of 5.0% – 5.25%. If the Fed raises rates by 25 basis points, it would bring the interest rate to 5.0%. Taking cues from the European Central Bank (ECB), the Federal Reserve may emphasize a data-dependent approach moving forward.

Questions still remain: Will 5% be the terminal rate? Will the Fed announce a conditional pause to allow the market to stabilize? Or will they continue with their current trajectory until there are clear signs of lower inflation levels or further slowdown in employment growth?

The Federal Reserve will also release central tendency estimates for key economic indicators, including PCE inflation, unemployment, and GDP. These projections will provide insight into the Fed's expectations for year-end figures, which were as follows in December: headline PCE inflation at 3.1%, core PCE inflation at 3.5%, unemployment at 4.6%, and GDP growth at 0.5%. The central tendency estimates from December will serve as a reference point for understanding the Fed's outlook on the economy.

A snapshot of the market currently shows:

* Spot gold is trading down $12.84 -0.65% at $1965.63

* Spot silver is trading down seven cents -0.33% at $22.45

* Crude oil is trading at $68.54. The contract settled at $67.64 yesterday.

* Bitcoin is trading at $20,095.

Looking at the premarket levels for US stocks shares are higher for the second consecutive day:

* Dow Industrial Average is up 289 points after rising 382.60 points yesterday

* S&P index of 36 points after yesterday's 34.91 point rise

* NASDAQ is up 102 points after rising 45.02 points yesterday

In the European equity markets, the major indices are also trading higher:

* German DAX +1.81%

* Frances CAC +1.72%

* UK's FTSE 100 +1.55%

* Spain's Ibex +2.63%

* Italy's FTSE MIB +2.46%

In the Asian-Pacific market:

* Hong Kong's Hang Seng index +1.36%

* China's Shanghai composite index +0.64%

* Australians S&P/ASX index +0.82%

In the US debt market, yields are sharply higher with the shorter end leading the way to the upside:

* two year yield 4.132% +20.9 basis points. Yesterday the two yield rose about 13.5 basis points

* five year yield 3.705% +13.3 basis points

* 10 year yield 3.563% +8.7 basis points. The 10 year yield rose about 8 basis points yesterday

* 30 year yield 3.720+5.9 basis points

In the European debt market, the benchmark 10 year yields are rising as well with the German 10 year leading the way that has some of the flows into the safety German debt instrument starts to unwind:

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/SlHCPz

http://dlvr.it/SlHCPz

- Get link

- X

- Other Apps

Comments

Post a Comment