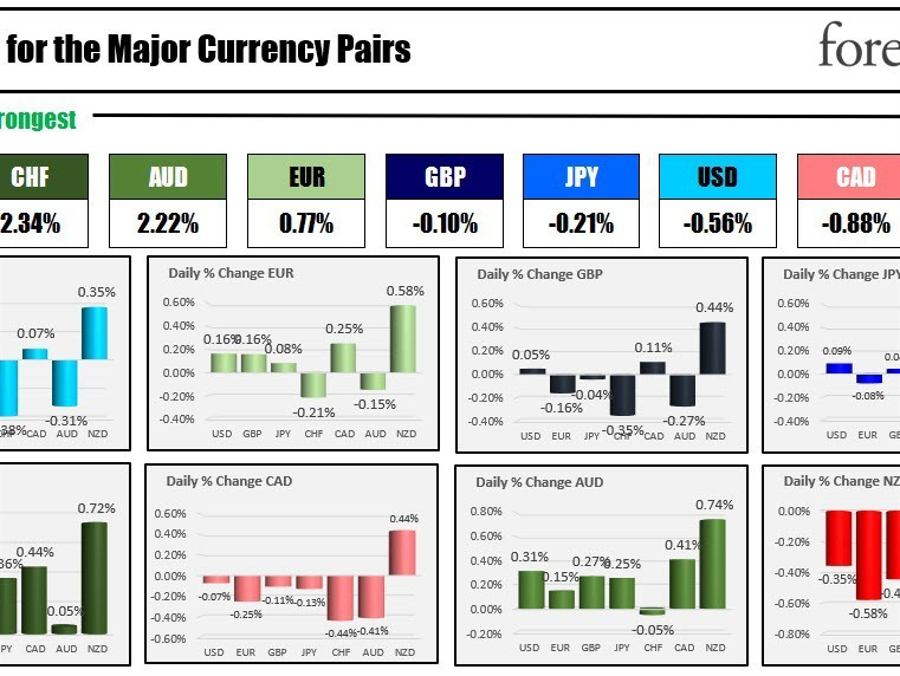

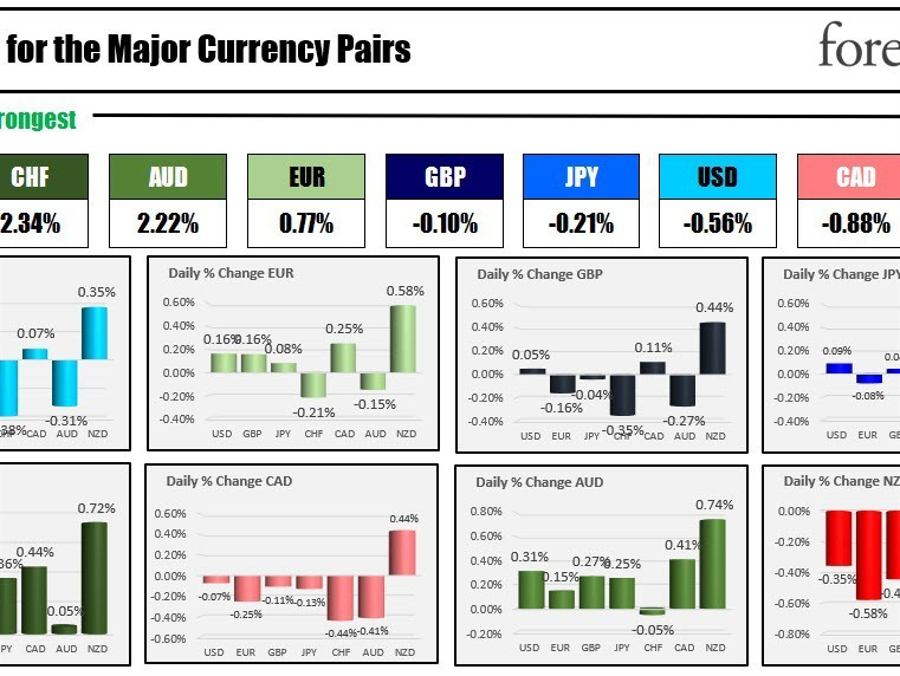

As the North American session begins, the CHF is the strongest and the NZD is the weakest. The USD is mostly lower but modestly lower as well with changes of 0.16% or less vs the EUR, GBP, JPY and CAD.

The greenback is up 0.35% versus the NZD, but down -0.38% versus the CHF and -0.31% versus the AUD. Today, US initial jobless claims will be released at 8:30 AM ET with expectations of 240K versus 239K last week. Job cuts continue to be announced and traders are focused on whether they start to show up in this data (to counteract the inflation fears that come and go). The Philly Fed business index for April will also be released at 8:30 AM with expectations of -19.2 versus -23.2 last month. On Tuesday, the Empire manufacturing index came in better at 10.8 versus -17.7 expected. At the 10 AM consumer confidence for April is expected to come in at -18.5 versus -19.2 last month, and existing home sales is expected to come in at 4.5 million versus 4.58 million.

Also today there is a number of fed speakers including Federal Reserve Gov. Waller who called for additional rate hikes on Friday. Atlanta fed Pres. Bostic (he called for 1 more hike earlier this week followed by a pause), and Cleveland Pres. Mester and Gov. Bowman will also speak. Of note is that the quiet period for Fed officials ahead of the FOMC meeting on May 2-3 will start at the close of business tomorrow. Overnight New York Fed President Williams said that inflation is still too high and the Fed will have to act. The expectations for a May fed hike is over 80%.

ECB minutes today said a very large majority agreed to raise rates by 50 basis points and if the inflation outlook embedded in projections were confirmed the ECB would have more ground to cover to adjust monetary policy to return inflation to the target. ECB's Knot said that they may need to hike in June and July in addition to May.

Looking at some of the earnings earnings from after the close yesterday:

* Tesla reported after the closing its shares are down in premarket trading (trading at $167.80 after closing at $180.59) as numbers missed Wall Street estimates with the firm posting its lowest quarterly gross margin 2 years.

* IBM also announce after the close and beat on expectations. The stock is up 1.53% in premarket trading

Earnings announced this morning included:

* American Express reported earnings of $2.40 versus $2.66 expected. Revenues over or better-than-expected $14.3 billion versus $14.03 billion. Shares are down -1.95% in premarket trading

* Philip Morris earnings came in at €2.53 versus $2.47 expected. Revenues were higher at $5.92 billion versus $5.87 billion. Shares are down -1.42%.

* DR Horton came in at $2.73 versus $1.93. Revenues came in at $7.97 billion versus $6.47 billion expected. Shares are up 4.64%

* AT&T earnings came in at $0.60 versus $0.59 expected. Revenues were $30.139 billion versus $30.26 billion expected. Shares down -4.67%

Overall US stocks are lower in premarket trading after yesterday's modest changes in the broader indexes for the 2nd consecutive day (the S&P and Nasdaq were near unchanged since Monday's close). US yields are lower. Oil prices are at the lowest level since the OPEC+ production cut decision at the beginning the month.

A snapshot of markets currently shows:

* spot gold is trading up $7.51 or 0.3% at $2001.93.

* Spot silver is up 1.8 cents or 0.07% at $25.29

* WTI crude oil is trading at its lows level since OPEC+ production cuts and trades down $1.31 and $77.93. The low price reached $77.50. The gap from the early April spike goes down to $75.70

* Bitcoin has continued its decline in trades at $28,648. Near 5 PM yesterday the price was trading near $29,256

Looking at the premarket for US stocks, stocks are down sharply:

* Dow industrial average down -200 points after yesterday's -79.62 point decline

* S&P index is down -33 point after yesterday's -0.35 point decline

* NASDAQ is down -133 points after yesterday's 3.81 point rise

In the European equity markets, the major indices also trading lower:

* German DAX -0.91%

* Frances CAC -0.50%

* UK's FTSE 100 -0.22%

* Spain's Ibex -0.68%

* Italy's FTSE MIB -1.1%

in the Asian-Pacific markets today:

* Japan's Nikkei index rose 0.18%

* Hang Seng index increased 0.14%

* Shanghai composite index fell -0.09%

* Australia's S&P/ASX index fell -0.04%

In the US debt market yields have moved back to the downside. The 2 year yield rose about 5.3 basis points yesterday while the thirty-year was unchanged. Today:

* 2 year yield 4.210% -5.7 basis points

* 5 year yield 3.664% -5.7 basis points

* 10 year yield 3.562% -4.0 basis points

* 30 year yield 3.763% -2.6 basis points

In the European debt market, yields in the benchmark 10 year yields are mostly lower after gains yesterday:

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/Smqyjd

Comments

Post a Comment