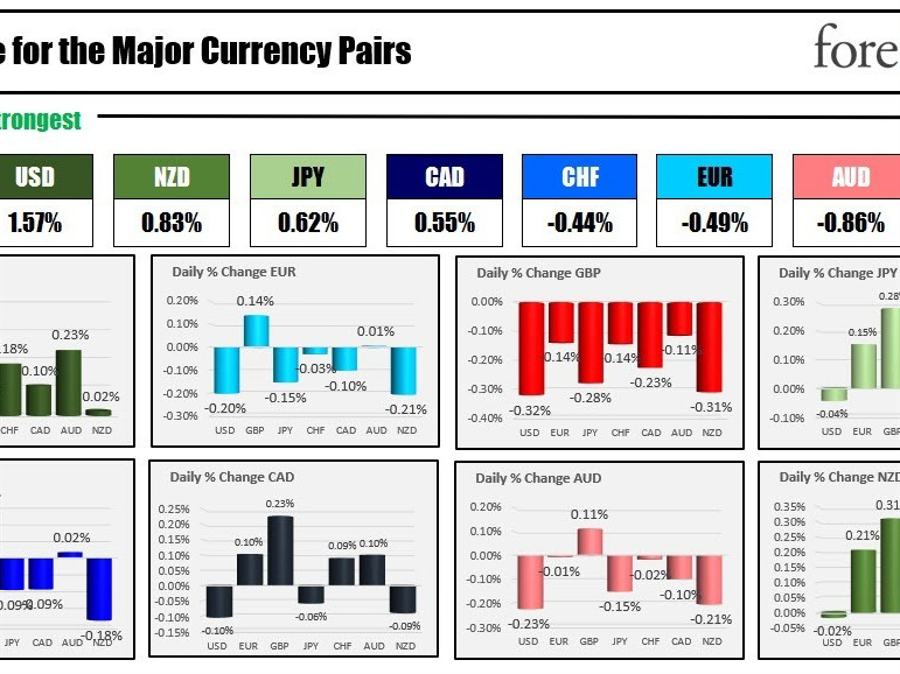

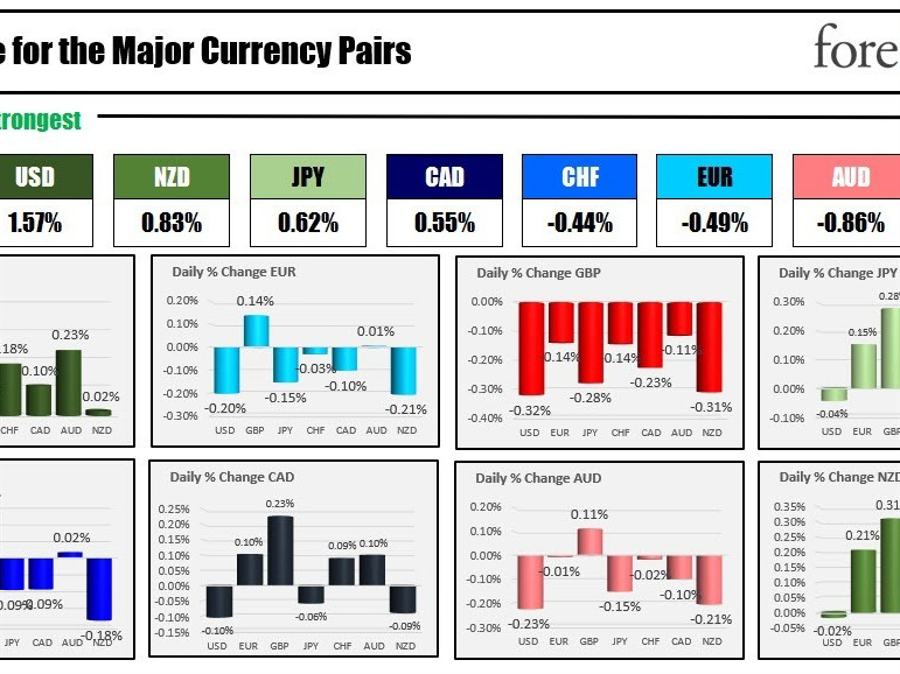

The USD is the strongest and the GBP is the weakest as the NA session begins. It is a holiday in most European countries in observance of Ascension Day (banks are closed). US yields are higher. US stocks are modestly higher. Walmart reported better earnings this morning with EPS coming in at $1.47 versus $1.32 expected. Revenues were higher at $152.3 billion versus $148.76 billion expected. Sales ex-gasoline were up 7.3% versus 5.1%. Walmart shares are trading at $151.81 versus $149.53 at the close yesterday. Oil prices have slightly dropped, awaiting the outcome of the debt limit talks. A successful agreement could bolster the prices. Yesterday, the inventory data showed a sharp build of 5.0 million barrels vs an expected draw of -1.2M barrels expected. The price moved higher by 2.78% (go figure).

U.S. President Joe Biden is in Japan for the G7 meeting discussing key global issues, while the spotlight stays on the resolution of the debt ceiling talks back home. The President has expressed optimism, emphasizing that the U.S. "will not default" and citing ongoing negotiations with top Congress members. He is expected to return to Washington on Sunday to aid in reaching an agreement, which Republican leader Kevin McCarthy believes is feasible by the weekend. Despite guarded optimism, no formal resolution has been reached, and a potential government default looms as early as June 1.

The day's economic agenda commences at 8:30 am with the release of the Canadian New Housing Price Index (NHPI) data. The forecast suggests a slight dip of -0.1%, compared to the previously recorded 0.0%. In the US at the same time, Unemployment Claims are expected to decrease to 254K from the previous count of 264K (the 4-week average was the highest since November 2021). The Philadelphia Fed Manufacturing Index is also set to be unveiled with an anticipated improvement to -19.8 from a previous -31.3. Recall, the Empire manufacturing index fell sharply on Monday (to -31.8 from 10.8 in the previous month). At 9:05 am, remarks from FOMC Member Jefferson are scheduled, followed by FOMC Member Barr at 9:30 am. Their commentary could provide valuable insights into the Federal Reserve's perspective on the state of the economy and monetary policy.

At 10:00 am, the release of US Existing Home Sales data, is forecasted to decline to 4.30 million from the previous figure of 4.44 million. Additionally, the Conference Board Leading Index on a month-on-month basis is expected to report a smaller decrease of -0.6%, an improvement from the previous -1.2%. FOMC Member Logan is also slated to speak during this hour. The sharp decline is forecasting a recession in the US going forward (nothing new).

A tentative release of the Bank of Canada's (BOC) Financial System Review is on the docket, with no specific time provided. At 11:00 am, remarks from the Bank of Canada's Governor Macklem are scheduled, potentially shedding light on Canada's monetary policy direction.

Overnight, in the Asian Pacific session disappointing labor market data for April was released. Jobs in the economy shrunk while the unemployment rate jumped higher (however, the unemployment remains near record lows so it is not all bad). Nevertheless, the data today in addition to the subdued wages data published yesterday, along with other indications showing some steam coming out from the Australian economy should give the Reserve Bank of Australia reason enough to pause at its upcoming June 6 meeting. New Zealand PPI was lower than expectations.

In other news, Montana is the first US state to ban TicTok. The decision is expected to be challenged in the courts. If the ban is maintained it will go into effect in January and will raise tensions between the US and China.

A look around the markets is showing.

* WTI crude oil is down $0.05 or -0.07% at $72.78

* Gold is down $5.70 or -0.29% at $1975.77

* Silver is down $0.18 or -0.84% at $23.54

* Bitcoin is back about the $27,000 level at $27,377. The price low reached $26,550.

In the premarket for US stocks, the major indices are marginally higher after yesterday's gains:

* Dow industrial average is up 14.23 points after yesterday's sharp 408.63-point rebound

* NASDAQ index is up 37 points after yesterday's 157.51-point rise

* S&P index is up 8.25 points after yesterday's 48.89-point rise

Although it is a banking holiday in Europe, stocks continue to trade:

* German DAX +1.64%. The price is near record highs at 16290.

* Frances CAC +0.92%

* UK's FTSE 100 +0.49%

* Spain Ibex +0.64%

in the US debt market, yields are higher:

* 2-year yield 4.186% +3.0 basis points

* 5-year yield 3.617% +2.6 basis points

* 10-year yield 3.602% +2.1 basis points

* 30-year yield 3.89% +1.1 basis points

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/SpGpfc

Comments

Post a Comment