- Get link

- X

- Other Apps

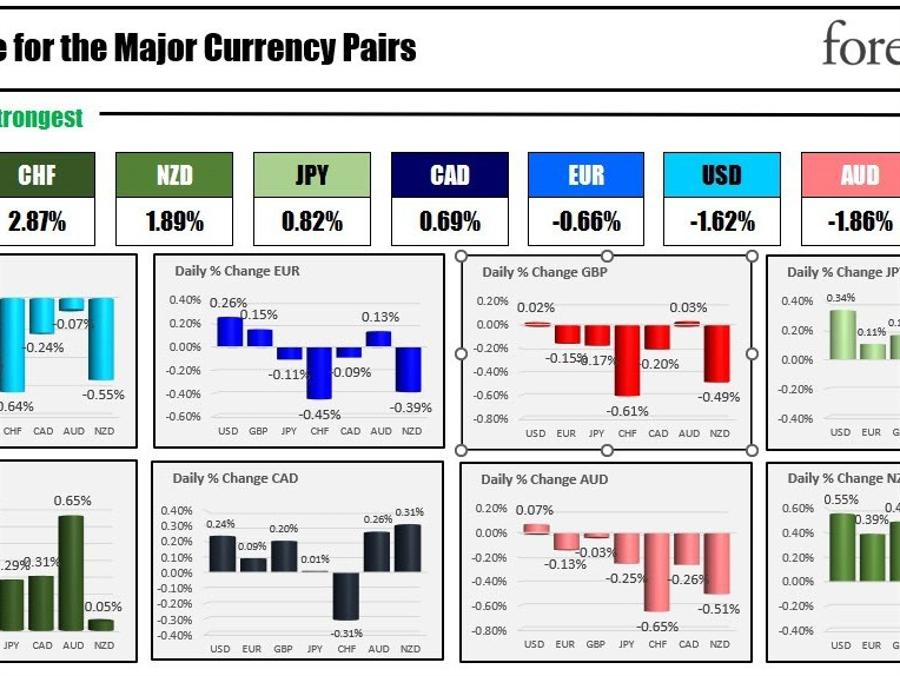

The CHF is the strongest and the GBP is the weakest as the NA session and the new trading week in North America begins. The USD is mostly lower with modest gains vs the GBP. The AUDUSD is unchanged. The USDCHF is the biggest mover as flows into the CHF (safety?) dominate the price action. Technically, the USDCHF is moving away from its near converges 100/200 hour MAs and looks to test the low from last week and the prior week near 0.8900 area (see chart below).

The market's response to the short-lived mutiny in Russia by the Wagner mercenaries, has been somewhat subdued. The conflict caused a temporary disruption, but Russian President Vladimir Putin maintained control and brokered a truce. Analysts suggested this unrest signals underlying weakness in Putin's rule but also highlighted the lack of high-level defections. The U.S. anticipates the situation could take months to resolve. Despite the past week's drop in crude oil prices due to concerns over interest rate hikes and a slower Chinese economic recovery, OPEC remains optimistic about the demand for oil in the coming decades. Oil prices are midrange, below $70 after reaching a high of $70.11.

US stocks are marginally lower to start the week after snapping 5 and 8-week up streaks last week (the Dow snapped a 3 week string). Last week, Federal Reserve Chair Jerome Powell hinted again at further interest rate hikes. Investors are awaiting updates on inflation and earnings reports from major companies such as Walgreens Boots Alliance and Nike.Meanwhile, Tesla is under scrutiny after receiving a downgrade from Goldman Sachs, a move mirroring those of Morgan Stanley and Barclays last week. Tesla shares are trading at $250.55 in pre-market trading after closing on Friday at $256.60.

US yields are lower. This week the US treasury will auction off 2, 5 and 7-year notes ($42, $43 and $35 billion).

In Europe today, IFO business confidence in Germany dipped for the second month in a row, with index falling to 88.5 vs 90.7 expected and down from 91.5 previously (lowest level since November - 2022 low was at 84.3). IFO's economist commented that the likelihood that Germany’s economy will shrink again in Q2 has increased with industry export expectations lower as a result of global rate hikes. The good news is that the number of companies that want to raise prices also decreased. This trend, coupled with disappointing PMI flash data from last week and a Q1 recession, signifies continued economic weakness. German inflation rates are also persistently higher than neighboring nations. Having said that, the Bundesbank Monthly Report concluded that the German economy has bottomed out with slight GDP growth expected in Q2 and expect inflation to slow further in the coming months. Go figure. The EURUSD is modestly higher on the day. The EUR is mixed/lower with declines vs the JPY, CHF, CAD and NZD and modest gains vs the USD, GBP, and AUD.

A snapshot of the markets currently shows:

* Crude oil is trading up $0.46 or 0.67% at $69.62

* Spot gold is trading up $11.18 or 0.59% at $1931.49 .

* Silver is up up $0.39 or 1.77% $22.80

* Bitcoin is trading steady at $30,326. The ranges this weekend reached a high of $34,047. The low today reached $29,993

In the premarket for US stocks, the major indices are trading lower in premarket trading

* Dow Industrial Average is trading down marginally (-2 point) after its -219.28 point decline on Friday

* S&P index is trading down -3 points after declining -33.58 points on Friday

* NASDAQ index is trading down -16 points after Friday's -138.09 point decline

In the European equity markets, the major indices are mixed

* German DAX down -0.19%

* France's CAC of 0.21%

* UK's FTSE 100 unchanged

* Spain's Ibex of 0.10%

* Italy's FTSE MIB down -0.17% (delayed)

In the Asian Pacific market today, Japan and Australia is indices fell. China was closed for holiday:

* Japan's Nikkei fell -0.25%

* Australia's S&P/ASX 200 index fell -0.29%

* China's Shanghai composite index fell -1.48%

* Hang Seng index fell -0.51%

In the US debt market yields are lower

* 2-year yield 4.7224-2.8 basis points

* 5-year yield 3.952% -4.1 basis points

* 10-year yield 3.699% -3.9 basis points

* 30-year yield 3.782% -3.7 basis points

In the European debt market, benchmark 10-year yields are lower as concerns about growth weigh on the yields

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/SrHll3

http://dlvr.it/SrHll3

- Get link

- X

- Other Apps

Comments

Post a Comment