Although the pair started Friday with a rebound, it turned out to be inconclusive, and the market quickly returned to the values it started with. This is largely due to the empty economic calendar. Today's calendar looks even emptier. However, tension in the market will only continue to build. The upcoming week is incredibly eventful. It's not just about the meeting of the Federal Open Market Committee. Don't forget about the preliminary estimate of inflation in the eurozone and the United States Department of Labor data. And although the most interesting events will only start from Wednesday, various rumors and speculations will have a significant impact, tossing the market from side to side. So, we might see unexpected and sharp jumps today. Both upwards and downwards. Everything will depend on the nature of the news. Primarily regarding the potential outcomes of the upcoming FOMC meeting. Despite all this, the likely outcome is that the market will continue to tread water. In general, it will likely stay in place until the Federal Reserve meeting.

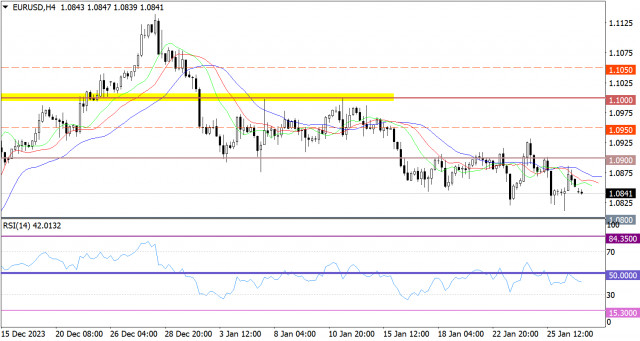

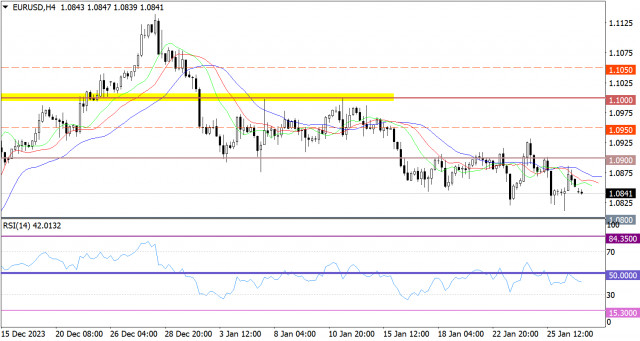

The EUR/USD pair is in the vicinity of the base of a corrective cycle, displaying speculative activity.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, confirming the increase in selling volumes.

On the same chart, the Alligator's MAs are headed downwards, corresponding to the current cycle.

Outlook

If the corrective phase persists, this suggests that bearish sentiment prevails among market participants. However, sellers are still facing the level of 1.0800, and in terms of technical analysis, this could exert pressure on short positions. Thus, the downward cycle is limited by this level, which makes it possible for the price to fluctuate above it. However, if the price settles below 1.0800 during the day, it would indicate a subsequent increase in the volume of short positions.

The complex indicator analysis points to a downtrend in the short-term and intraday periods.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T21Mht

Comments

Post a Comment