The EUR/USD currency pair traded relatively calmly on Tuesday. Even the US inflation report did not significantly impact the movement of the currency pair. While we did see a surge of emotions in the market, it cannot be said that it had a radical effect on market sentiment and the technical picture. At this time, bears are in control. From our perspective, this is entirely logical, as the euro has been rising for too long, and the dollar has been falling for too long. Consequently, the euro remains overbought, implying a further decline.

The current technical disposition is more clearly visible in the 24-hour timeframe. It is evident that the pair began forming a downtrend last year, and the upward movement in the last 4 months (which has already concluded) is nothing more than a correction. Thus, from a technical standpoint, we expect only a decline. From a fundamental standpoint, there is no expectation other than a decline in the euro as well. The market had long believed that the Federal Reserve (Fed) would begin lowering rates in March, while the European Central Bank (ECB) would do so at some point. However, representatives of the Fed are now openly stating that March is too early, and there is no rush.

In ECB circles, the situation is the opposite. Many policymakers believe that the rate will start decreasing in 2024, while others insist that this process should begin in the summer. Even Christine Lagarde has stated twice that her department expects updated information by May, after which decisions on key rates can be made. Therefore, the fundamentals fully support further depreciation of the European currency since market expectations for the Fed rate were initially too low and for the ECB rate - too high.

As for the macroeconomic background, it has long been favoring only the dollar. Despite a series of weak reports (particularly on the labor market) in November and December of last year, the situation has since improved, and the latest Non-Farm Payrolls report undoubtedly pleased dollar buyers.

Only inflation raises some questions.

Yesterday's consumer price index report once again showed that inflation in America has been decreasing very slowly over the past 7-8 months or not decreasing at all. According to the latest published report, prices rose by 3.1% on an annual basis, while the market expected a slowdown to 2.9%. Core inflation remained at 3.9%, although the market expected it to decrease to 3.7%. Thus, we once again conclude that the Fed will not ease monetary policy in March. Moreover, the longer inflation refuses to slow down in line with the regulator's expectations, the longer the regulator will resist the easing cycle. This could provide significant support to the dollar against the euro, as the ECB may start lowering its rate by summer, which is 1% lower than the current rate in the United States.

The dollar rightly showed growth against the euro on Tuesday. The downtrend persists, and we fully support further pair declines. The issue for buyers lies not only in high American inflation but in numerous fundamental and macroeconomic reasons, which we have been discussing for several months.

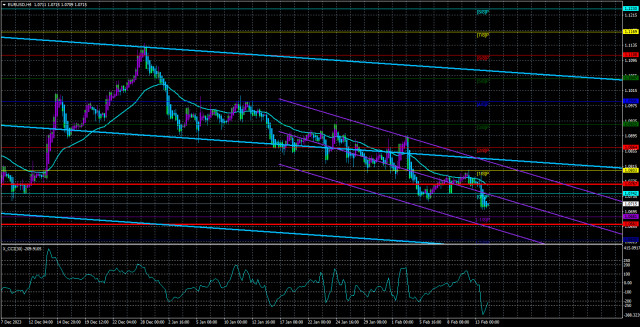

The average volatility of the EUR/USD currency pair for the last 5 trading days as of February 14th is 53 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0661 and 1.0767 on Wednesday. A reversal of the Heiken Ashi indicator upwards will indicate a new phase of corrective movement.

Nearby support levels:

S1 – 1.0681

S2 – 1.0620

Nearby resistance levels:

R1 – 1.0742

R2 – 1.0803

R3 – 1.0864

Trading recommendations:

The EUR/USD pair continues to be below the moving average line. We continue to look towards short positions with targets at 1.0661 and 1.0620. The decline of the European currency is stable but slow. We see no reasons for a global rise in the euro, except for corrections. Formally, long positions can be considered with targets at 1.0864 and 1.0925 if the price consolidates above the moving average line. However, we see in the illustration that the last three consolidations above the moving average did not lead to a pair's rise. Therefore, caution is needed with buying.

Illustration explanations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for current trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel in which the pair will move over the next day, based on current volatility indicators.

CCI indicator - entering the oversold area (below -250) or overbought area (above +250) signals an upcoming trend reversal in the opposite direction.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2k7bp

Comments

Post a Comment