The EUR/USD currency pair showed slightly higher volatility on Wednesday evening and throughout Thursday than on ordinary days. Of course, there was a spike in market activity, but we cannot say that we witnessed any discouraging movement that would affect the current technical picture. To be more precise, the technical picture has stayed the same. The downward trend persists, and the movement of the European currency down remains equally gradual.

Thus, we are left to deal with the fundamental events, many of which are in the second half of this week. As we mentioned in yesterday's article, we deliberately did not consider the results of the Fed meeting because at least 12 hours had to pass since their announcement for the market to settle. In principle, the market's calmness did not have to wait long. As we predicted, the Fed rates remained unchanged, but Jerome Powell's speech once again left more new questions than it provided answers to existing ones.

Powell's most significant statement is, "The key rate is unlikely to be lowered in March." On the one hand, this statement ends the question of the first easing of monetary policy. We have repeatedly mentioned that March is too early. But, on the other hand, Powell made several other statements of a more "dovish" nature. In particular, the head of the Fed stated that an unexpected weakening of the labor market could be a reason for a faster move to rate cuts. Thus, now everything depends not only on inflation but also on the labor market.

Currently, the Fed has no issues with the labor market. New jobs are consistently being created, and the number of vacancies stays the same every month. However, reports on unemployment and nonfarm payrolls will be released today. What if these two indicators start deteriorating sharply?

Regarding inflation, Powell stated that progress is evident, but its preservation in the future is not guaranteed. If inflation stops decreasing, the Federal Reserve will be ready to keep the rate at its current level for longer. However, what if inflation stops decreasing and the labor market starts slowing down? Powell also added that monetary policy should begin to ease this year, but the market understood that without a special statement from the head of the Fed.

In summary, Powell's rhetoric can be interpreted in different ways. Some may see "dovish" hints of a possible rate cut in March due to labor market weakness. Others may see "hawkish" hints that inflation is decreasing slowly and a more prolonged impact is required with a "tight" monetary policy. That may be why the US dollar barely rose at the end of the day. After the Fed meeting, its growth was undeniable, but it noticeably declined across the market in the first half of the day.

By the way, the first two reports on the US labor market needed to be more consistent. The ADP report was worse if the JOLT report was better than expected. Yesterday, business activity indices in the manufacturing sector and inflation in the European Union for January were also released. However, these reports could not transform the current movement into more trending and volatile. In the end, we witnessed various events and publications, but the overall situation of the EUR/USD pair did not change. It's a relief that the euro is at least falling, corresponding to our forecasts.

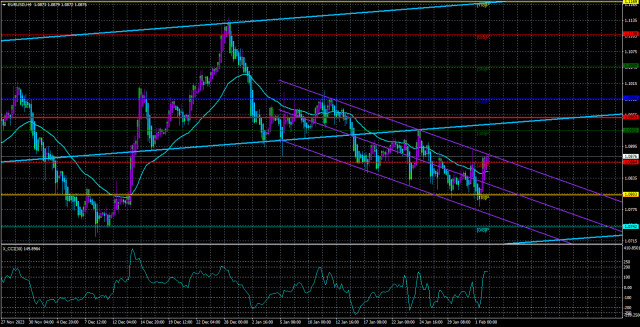

The average volatility of the EUR/USD currency pair for the last five trading days as of February 2nd is 74 points and is characterized as "average." Thus, we expect movement between the levels of 1.0802 and 1.0950 on Friday. The reversal of the Heiken Ashi indicator back down will indicate a resumption of the downward movement.

Nearby support levels:

S1 - 1.0864

S2 - 1.0803

S3 - 1.0742

Nearby resistance levels:

R1 - 1.0925

R2 - 1.0986

R3 - 1.1047

Trading recommendations:

The EUR/USD pair has consolidated above the moving average line, but this consolidation does not mean much for now. We continue looking towards short positions with a target of 1.0742, but a consolidation below the moving average is required. The downward trend is currently weak, and this week's strong macroeconomic background could contribute to a new rise in the pair. Formally, long positions can now be considered with targets at 1.0925 and 1.0950, but today - important statistics from across the ocean could well support the dollar. It is not excluded that the pair will quickly return to the level of 1.0803.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2CMBv

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Subscribe to:

Post Comments (Atom)

1 in 7 prop firms closed in 2024: Brokeree Solutions shares insights - FX News Group

Using publicly available data, Brokeree collected and analyzed information about: Country of registration;; Trading platforms utilized;; Fe...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

http://dlvr.it/TF2Sfb

No comments:

Post a Comment