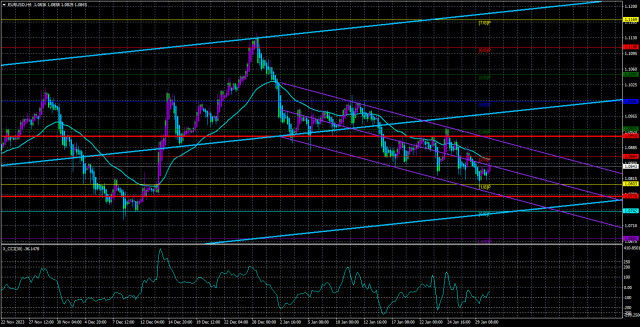

The currency pair EUR/USD continues to be weak, gradually declining. The level of 1.0823, which the price could not overcome in recent weeks, was broken, but a clear continuation of the decline after that is still not observed. Thus, the unequivocal downward trend persists, and the micro-flat is completed. However, volatility remains quite low, and the strength of movements is also weak.

In the current circumstances, however, even such a movement is considered fortunate. The problem is that the market needs clarification about what to expect from the ECB and the Fed in the first half of 2024. This is not the fault of officials from the Fed or the ECB. They follow inflation and are ready to adjust monetary policy parameters based only on the consumer price index.

Since inflation reports come out once a month, the rhetoric of Fed officials must stay the same. It has stayed the same but has a fairly vague appearance. In other words, FOMC officials are still determining when to start lowering the key rate. The same is true for the ECB.

The new week began with several speeches by ECB representatives and the publication of GDP reports in the European Union. It seemed like five events, each of which could be called "important." This is, of course, not non-farm payrolls or a central bank meeting, but still significant events. What information did we get? The rhetoric of ECB representatives differed from each other in content and nature. De Guindos did not consider it necessary to forecast when the rate could start decreasing. Mario Centeno stated that starting sooner rather than later is better, while Peter Kazimir believes starting a little later than sooner is better. And what conclusions can we draw about ECB rates in the first half of 2024 if regulator officials say opposite things?

In addition to the first three conflicting statements, Boris Vujicic stated yesterday that there is no difference in lowering rates in April or June. The main thing is maintaining a smooth easing to avoid shocking the markets and consumers. Vujicic believes the ECB should occasionally pause when the monetary policy easing cycle is launched. Another speech by a European official needed to clarify the current situation. Therefore, the European currency is trading very sluggishly. We observe constant pullbacks, corrections, but the downward trend persists.

Also, yesterday, the GDP report for the European Union in the fourth quarter was published, showing zero economic growth. Such a value even exceeded the forecast values, which looks somewhat comical. The economy of the European Union has been showing more or less zero growth every quarter for over a year. It is hardly possible to consider such indicator values positive. But we should remember that almost everything depends on how quickly central banks will start lowering rates and how much they will lower them in 2024. Since there is no reasoned and accurate forecast, the market will act "on the fly." We still believe that the EUR/USD pair should continue to decline, so we expect a test, at least, of the Murray level "0/8"-1.0742. We do not believe in a new upward trend and do not know what should happen with the ECB and the Fed rates in 2024 for the euro to show a powerful upward movement again.

However, if the Fed lowers the rate much stronger and faster than the ECB, this could be a significant reason for the market to consider new euro purchases rather than dollars.

The average volatility of the euro/dollar currency pair for the last five trading days as of January 31 is 67 points and is characterized as "average." Thus, we expect movement of the pair between the levels of 1.0776 and 1.0910 on Wednesday. A downward reversal of the Heiken Ashi indicator will indicate a resumption of the downward movement.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair remains below the moving average line. Therefore, we consider short positions with targets at 1.0776 and 1.0742. The downward movement is currently quite weak, and a strong fundamental and macroeconomic background this week may push the pair back up. But until consolidation is above the moving average, we consider only selling. We plan to return to long positions by consolidating the price above the moving average with a target of 1.0925. In case of consolidation above the moving average, it will be necessary to see after which event this happened. It is not excluded that the pair will quickly return down.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T26Ngr

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Subscribe to:

Post Comments (Atom)

Forex - Cfd's (All Contries) - Facebook

Forex trading worker · Ali Asghar Ali profile picture · Ali Asghar Ali▻ Forex - Cfd's ( All Contries). Just now. · Ali Asghar ...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

http://dlvr.it/TF2Sfb

No comments:

Post a Comment