Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Wednesday 30 June 2021

Tuesday 29 June 2021

Monday 28 June 2021

Sunday 27 June 2021

Tesla - Chinese authorities have ordered a fix be done on more than 280K cars in the country

http://dlvr.it/S2ZnFz

Weekend - UK financial regulator bans some Binance (a cryptocurrency exchange platform) operations

http://dlvr.it/S2Zlrk

ETH/USD at Risk of Testing 1155? Sally Ho's Technical Analysis 28 June 2021 ETH

http://dlvr.it/S2ZN4p

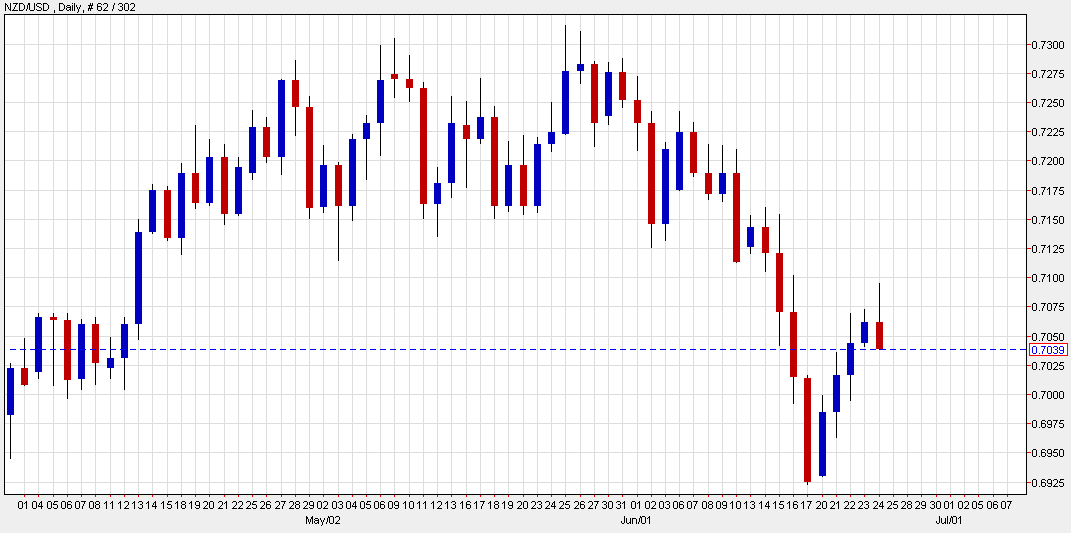

MUFG trade of the coming week: Buy NZD/USD

http://dlvr.it/S2Z6HH

Federal Reserve Official Calls Tether A 'Challenge' To Financial Stability

http://dlvr.it/S2YSPM

Saturday 26 June 2021

Bitcoin’s Taproot Upgrade Set To Improve Privacy, Introduce Smart Contracts

http://dlvr.it/S2X7sF

Central bank overview for June part 2

http://dlvr.it/S2X69X

ETH/USD Orbiting the 1868 Level: Sally Ho's Technical Analysis 27 June 2021 ETH

http://dlvr.it/S2Wlsm

BTC/USD Prints Below 30250: Sally Ho's Technical Analysis 27 June 2021 BTC

http://dlvr.it/S2WT9k

Fed Admits Problem of Massive Deficits, Claims No Risk!

http://dlvr.it/S2VpPf

Friday 25 June 2021

HOW TO MAKE MONEY IN FX I have spent countless daysand nights just watching charts and price action move up and down on the exchange ratesof currency pairs. I have defined proper entry price, take profit and stop loss. Risk and Reward has to be good before any trade is taken. #forexhttps://https://ift.tt/3dFikcT

BTC/USD Succumbing to Lower Highs: Sally Ho's Technical Analysis 26 June 2021 BTC

http://dlvr.it/S2SZn6

Bitcoin extends decline to nearly 7%, breaks yesterday's low

http://dlvr.it/S2SQvY

Gemini Partners With Climate Vault To Launch Gemini Green

http://dlvr.it/S2S7ys

First Chinese Crypto Exchange Quits Trading Amidst Countrywide Crackdown

http://dlvr.it/S2RfsJ

SushiSwap integrates with Harmony Protocol

http://dlvr.it/S2RVdK

Thursday 24 June 2021

Does Google’s recent crypto-ad ban reversal indicate the crypto market’s continued maturity?

http://dlvr.it/S2Ns0q

Bubbles Galore

http://dlvr.it/S2Nh2Q

Last Chance To Jump Onboard The Lightning Train With Solanax Private Sales

http://dlvr.it/S2NMc8

Big slate of economic data coming up

http://dlvr.it/S2MtKw

SEC Ordered to Produce Documents On Its Internal Digital Asset And Cryptocurrency Activities

http://dlvr.it/S2MhtM

Wednesday 23 June 2021

levelator pro trading system

Secret To Trading Forex Profitably!

Mechanical Cash Builder - Levelator PRO Review

The Forex trading market has always been extremely appealing. Investors who know their way around the market stand to profit heavily from this. Of course, the main barrier is here is technical knowledge. It’s a sea of complicated terms and an information overload everywhere.

As a result of the Forex market's profit-generating capacity, several forex trading tools and courses have sprung up like crazy all over the place. Most such tools claim to teach you how to make money with Forex trading, but in reality, they are all just luring you to buy their product.

The ClickBank Marketplace has a number of Forex trading sites listed that claim to get you rich quick! Some are definitely legitimate while others are, let's just say they end up teaching you only what any free Youtube video will be able to.

The big question then is – How to select the right Forex trading site? Here I have reviewed Russ Horn’s Levelator Pro for you. Let’s dive in!

What is the Levelator Pro?

Levelator Pro is an online Forex trading program that gives you insights and tips on when to trade and what to trade in.

Levelator Pro is an online Forex trading program that gives you insights and tips on when to trade and what to trade in.

This trading program analyses the Forex market 24/7 and prepares real-time charts for you. You need not really study the market or wonder which currency pairs to work with. Being an international market, forex is always at work in some parts of the world. Hence, it is essential to have round the clock monitoring done to actually be able to make money from the Forex market.

The name Levelator comes from the fact that the results are shown to you in the form of charts with levels clearly demarcated. You need to just follow the trade indicators at these levels.

The Levelator pro indicator works on all timeframes and across all currency pairs. It also works for non-forex markets like oil and gold, so it's quite diverse in this respect.

The alerts are sent both for BUY and SELL options. It also indicates the TakeProfit and StopLoss values so that you are aware of all risk parameters before the actual trade. The signal alerts are sent both via email as well as phone. A push notification is sent to your phone, and an email alert is also simultaneously sent. This just ensures that you do not miss any critical alerts.

How the analysis algorithm works is, of course, Russ's trade secret, and not much information is given on how the data is analyzed and charts created. This is standard practice for any similar site and hence did not raise any eyebrows. I was not expecting any revealing information about the mechanics anyway!

Who is the Levelator Pro for?

The Levelator pro program is aimed at the most basic audience – people with zero knowledge of the Forex market can work with it and trade. Needless to say, you will need to open your own trading account. It seems to be compatible with all trading platforms as the site does not display any information about compatibility with only a specific trading platform.

The Plus Side

There are a lot of features that work in the Levelator’s favor. Here are some of the highlights of this Forex software:

- The instruction manual is detailed and comprehensive. You will need to spend some time understanding how to read the Levelator chart, but it is all color-coded and explained very well. Russ has used all teaching tools like diagrams, charts, color coding, etc. to describe the concepts so clearly that even a complete newbie will get the hang of it.

- In his manual, Russ has clearly defined the entry and exit points, so if you follow the rules, chances are that you will not go wrong.

- The alerts are given out for Forex currency pairs, oil and gold, hence not just limited to the Forex market. It has a broader perspective and thus gives you a more extensive playground.

- In addition to the primary member's area access with the Levelator Pro, you also get invited to the Live webinars regularly hosted by Russ Horn. You can even speak to other traders on his platform and bounce out ideas and queries. Its almost like a community that is willing to help each other out.

- There are several alerts generated daily, so you are never at a loss for trading tips. The Levelator covers both short trades and long trades.

- The support system for the site is simply outstanding. Russ Horn himself takes personal care to ensure that your queries about the software are answered thoroughly. So, when you raise a question, you can be sure that it will be solved promptly and mostly to your satisfaction.

The Down Side

As is the case with all trading apps, the Levelator pro also has its disadvantages, although to be fair, they are few and far between.

- In his manual, Russ clearly states: “it has about a 60% win ratio if you are trading with the direction of the trend as determined by the 2ColorMA.” I actually did not know if I should take this as a pro or a con for the Levelator. The fact that Russ comes clean about the win ratio is a big plus for me. However, I'm not sure that knowing the chances are 60% for a win, I would actually work with this indicator.

- This program has only a digital online version. There are no CDs or books delivered to you.

Final Verdict

The Levelator Pro delivers a wide range of features and proves to be a reliable Forex indicator to work with. Clearly explained concepts and the flexibility to work with various markets all work in its favor.

Of course, as with any trading app, the standard disclaimer is mandatory – there is an amount of risk involved, and there are no guarantees. If you do not like it at all, the usual 60-day money-back guarantee is always an option. My suggestion is to start slowly and learn as you go along. Consistency will surely take you places!

Mechanical Cash Builder - Levelator PRO

Mechanical Cash Builder - Levelator PRO is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Mechanical Cash Builder - Levelator PRO , you can request a refund by sending an email to the ClickBank email address given inside the product and ClickBank® will immediately refund your entire purchase price, with no questions asked.

Mechanical Cash Builder - Levelator PRO is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Mechanical Cash Builder - Levelator PRO , you can request a refund by sending an email to the ClickBank email address given inside the product and ClickBank® will immediately refund your entire purchase price, with no questions asked.RELATED PRODUCT REVIEWS

1000PIP Climber Forex System - Worth Trying? Here is The Fact!

By admin 7/15/2020The 1000pip Climber System seems to be a reliable robot Forex analyzer. What was surprising to me was the lack of negative reviews online for this product. I did not see ...Secret To Trading Forex Profitably! - Does it really work?

By admin 11/27/2020The Levelator Pro delivers a wide range of features and proves to be a reliable Forex indicator to work with. Clearly explained concepts and the flexibility to work with ...

RELATED PRODUCTS

YOU MIGHT ALSO LIKE

FX's Alien Series Adds Wheel Of Time Star - GameSpot

FX's Alien Series Adds Wheel Of Time Star ... FX's upcoming Alien series ... All information these cookies collect is aggregated ...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...