Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Friday 30 June 2023

Stocks making the biggest premarket moves: Nike, Apple, Dominion Energy, Carnival and more

Canceled, delayed flights are likely over July 4 holiday weekend. What to know about your rights

DRC gets $203m IMF loan to boost dwindling forex reserves - The East African

from Google Alert - ALL ABOUT FOREX https://ift.tt/mLVsJ0x

via IFTTT

RBI upgrades info management system, launches next generation data warehouse CIMS

The Reserve Bank of India has introduced the Centralised Information Management System (CIMS), a next generation data warehouse, to strengthen regulatory supervision, monitoring, and enforcement. The system will improve monetary policymaking through refined economic analysis and the management of big data flow. RBI Governor Shaktikanta Das said the CIMS will lead to a paradigm shift in economic analysis and supervision, as well as reduce the regulatory compliance burden.

The Reserve Bank of India has introduced the Centralised Information Management System (CIMS), a next generation data warehouse, to strengthen regulatory supervision, monitoring, and enforcement. The system will improve monetary policymaking through refined economic analysis and the management of big data flow. RBI Governor Shaktikanta Das said the CIMS will lead to a paradigm shift in economic analysis and supervision, as well as reduce the regulatory compliance burden.

Nasdaq Composite Technical Analysis

http://dlvr.it/SrSBDx

Thursday 29 June 2023

Stocks making the biggest moves midday: Occidental Petroleum, Wells Fargo, Micron, Joby and more

Timing is Everything: How to Determine the Best Time to Forex Trade for Maximum Profit

from Google Alert - ALL ABOUT FOREX https://ift.tt/Q9xC7fB

via IFTTT

3 reasons it can be smarter to rent, even if you can afford to buy

Germany Joins Anti-Binance Sentiment, BaFin Rejects License Application

After the United States declared open war on cryptocurrency exchange Binance, Europe is also becoming an increasingly unfriendly ground for the digital asset market giant. Owned by Changpeng Zhao (CZ), the platform had hoped that Germany would become one of its new hubs on the Old Continent. However, recent reports suggest that the local financial market regulator BaFin has not looked favorably on Binance's application.

BaFin Rejects Binance's Bid in Germany

According to information published by the German Finance Forward today (Thursday), insiders claim that BaFin is unwilling to grant Binance a crypto custody license. Binance's press spokesperson has not confirmed these reports but commented to CoinDesk that the exchange is continuously working to meet all the requirements set by BaFin. He acknowledged that it is a complicated and lengthy process, but the platform is still hopeful for a positive conclusion.

If Binance fails to obtain a license in Germany, its business development in Europe may be in question. This is especially true given that the exchange has significantly limited its local presence due to regulatory changes.

Finance Magnates reported two weeks ago that Binance is exiting Cyprus and the Netherlands. Since then, the platform has also come under scrutiny from the French prosecutor's office for operating an 'illegal' exchange, withdrew its license in the United Kingdom, and was forced to leave Belgium.

The challenges in Europe are further exacerbated by the fact that Paysafe Solution, Binance's euro banking partner, is suspending support for further payments from the end of September 2023.

⚠️ Binance #Crypto Custody License Application Denied by 🇩🇪 German Regulator BaFin ‼️😬Several blows to #Binance in 🇪🇺 EU 👀#CryptoNews #Cryptocurency #BNBhttps://t.co/OnebGzBdTA

— Ajay Kashyap (@EverythingAjay) June 29, 2023

Binance Shifts Focus to Asia and the Middle East

Although Binance does not claim to be withdrawing from Europe, but rather adjusting its local strategy to comply with new regional cryptocurrency regulations (MiCA), it is faring considerably better on other fronts.

A week ago, Binance entered the Central Asian market by launching local services in Kazakhstan. The new platform will allow users to trade and store digital assets, make fiat deposits and withdrawals, and avail of conversion services.

A representative from the exchange also hinted earlier this week that, faced with regulatory pressure in the US and the EU, the Middle East might become Binance's primary target. These words came from Alex Chehade, the General Manager of Binance Dubai. According to Chehade, the United Arab Emirates (UAE) have favorable and transparent regulations regarding digital assets.

At a time when the EU is implementing MiCA and the United States is clashing with crypto exchanges, the giants of 'traditional finance' are seeking their place at the growing cryptocurrency table. Over the past two weeks, more companies have joined the collection of applications for the establishment of a spot Bitcoin ETF, initiated by BlackRock. ARK Invest, BitWise, and Invesco also want to offer a similar instrument.

Although US regulators have rejected such applications in the past, Wall Street giants are hoping that the current 'negative PR' around crypto exchanges will increase the chance of launching fully regulated instruments.

This article was written by Damian Chmiel at www.financemagnates.com.Bitcoin Technical Analysis

http://dlvr.it/SrPQ1g

Wednesday 28 June 2023

Stocks making the biggest moves midday: Pinterest, Carnival, General Mills, Netflix and more

Myanmar Economy Stymied by Forex Import Curbs World Bank Says - Bloomberg Tax

from Google Alert - ALL ABOUT FOREX https://ift.tt/9qSYg0b

via IFTTT

Powell says more 'restriction' is coming, including possibility of hikes at consecutive meetings

Stocks making the biggest moves before the bell: General Mills, Nvidia, AMD and more

USDJPY Technical Analysis

http://dlvr.it/SrLcbr

Tuesday 27 June 2023

Stocks making the biggest premarket moves: Walgreens, Kellogg, Eli Lilly, Delta and more

A U.S. recession is coming this year, HSBC warns — with Europe to follow in 2024

Adani Group clarifies over US probe speculation says 'not aware of SEC scrutiny'

from Google Alert - ALL ABOUT FOREX https://ift.tt/pvb31WO

via IFTTT

London England: The World's Capital for Foreign Exchange Adds Cryptocurrencies to Its Ledger

from Google Alert - ALL ABOUT FOREX https://ift.tt/dEvBlMu

via IFTTT

Gold Trading at Make or Break Level - Key levels to watch on the shinny metal - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=EnXGCsTmxTw

via IFTTT

Eleni Pastou - FX News Group

from Google Alert - ALL ABOUT FOREX https://ift.tt/9RNrdpH

via IFTTT

Currency Strength and Weakness for Tuesday 27th June 2023 | Forex Peace Army

from Google Alert - ALL ABOUT FOREX https://ift.tt/7VTYohl

via IFTTT

Wise shares spike 18% as higher interest rates help fintech triple profits

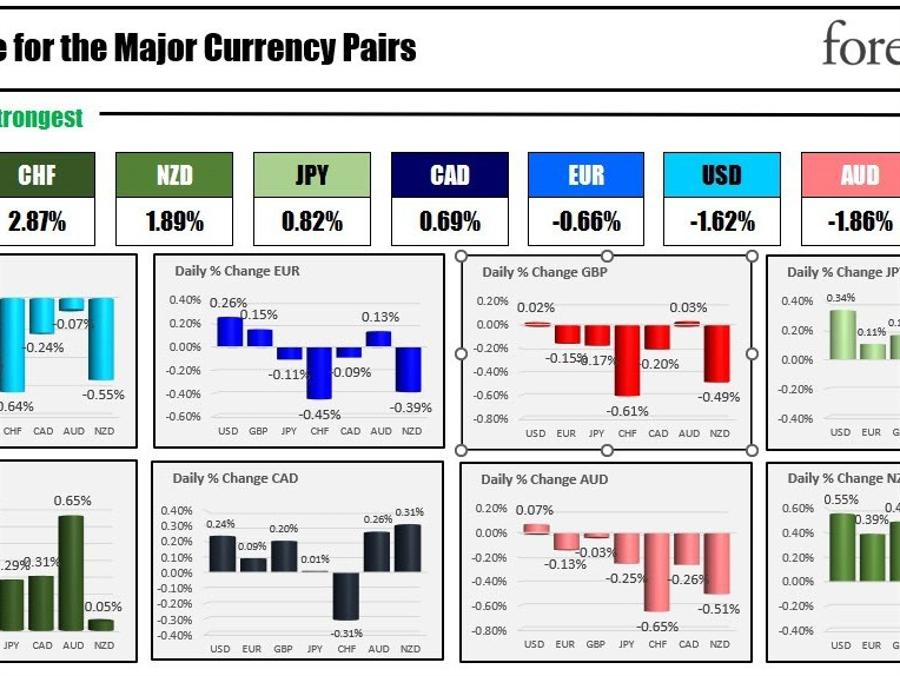

The CHF is the strongest and the GBP is the weakest as the NA session begins

http://dlvr.it/SrHll3

Monday 26 June 2023

Publishers Clearing House to refund customers $18.5 million in FTC settlement for 'deceptive' practices

6 Forex Trading Strategies for Beginners | Vantage

from Google Alert - ALL ABOUT FOREX https://ift.tt/pqUKSOX

via IFTTT

FP Markets Awarded 'Best Trade Execution' and 'Most Transparent Broker' at the Ultimate ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/WLhbkB8

via IFTTT

Top 5 Richest Forex Traders of All Time: Their Success Stories and Trading Strategies

from Google Alert - ALL ABOUT FOREX https://ift.tt/hvp1Sa8

via IFTTT

HSBC Reportedly Becomes First Bank in Hong Kong to Permit Crypto ETFs

HSBC, the largest bank in Hong Kong, has reportedly made Bitcoin and Ether-based exchange-traded funds (ETFs) listed on the Hong Kong Exchange (HKEX) available to its customers. The move, according to local journalist Colin Wu, is targeted at expanding local users’ exposure to digital assets.

SCOOP: HSBC, the largest bank in Hong Kong, today allows its customers to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong exchange, and is also the first bank in Hong Kong to allow it. The move will expand local users’ exposure to cryptocurrencies in Hong Kong. pic.twitter.com/vH0LieSVGw

— Wu Blockchain (@WuBlockchain) June 26, 2023

HSBC Facilitates Crypto ETF Trading

Currently, crypto ETFs listed on HKEX include CSOP Asset Management’s CSOP Bitcoin Futures ETF and CSOP Ethereum Futures ETF. A sub-subsidiary of Samsung’s investment arm offers the Samsung Bitcoin Futures Active ETF, on the exchange.

By providing access to the ETFs, HSBC becomes the first bank in the special Chinese administrative region to enable local investors to buy and sell crypto ETFs. The revelation comes days after reports emerged that Hong Kong’s central bank is pushing HSBC, Standard Chartered and the Bank of China, to accept crypto firms as clients.

In the past few days, the global cryptocurrency industry has seen renewed interest in spot Bitcoin ETF among stakeholders. The surge in new applications for the ETF came after BlackRock, the world’s largest asset manager, also made the same application with the US Securities and Exchange Commission.

Hong Kongs’ New Crypto Regime

Meanwhile, the launch of HSBC's new crypto ETF services follows a new crypto regime that has taken effect in Hong Kong since the beginning of this month. As part of the new crypto rules, crypto exchanges operating in the jurisdiction are now required to get licensed to offer their services to retail traders.

As reported by Finance Magnates, the new rules include a provision that requires exchanges to protect investors by assessing their knowledge of cryptocurrencies before they are onboarded. Exchanges are also required to limit retail investors’ risk exposure by confining them to cryptocurrencies with large market capitalization.

According to Wu, HSBC, in addition to providing its customers with access to crypto ETFs, launched the Virtual Asset Investor Education Centre. Customers are required to read and confirm the education materials and risk disclosure in the centre before investing in any crypto-related products on HSBC’s mobile apps: HSBC HK Easy Invest and HSB CHK Mobile Banking app as well as on the lender's online banking platform.

This article was written by Solomon Oladipupo at www.financemagnates.com.Stocks making the biggest premarket moves: Tesla, Moderna, Alphabet, PacWest and more

Sunday 25 June 2023

Russell 2000 futures technical analysis in 60 seconds, 26 June 2023

http://dlvr.it/SrDqBq

Crypto Custody Provider BitGo Ditches Plan to Acquire Rival Prime Trust

Digital asset custodian BitGo has shelved its planned acquisition of one of its rivals Prime Trust, despite a preliminary agreement reached earlier in the month. The initial takeover agreement transpired amid speculation that Prime Trust was facing bankruptcy.

BitGo Shuns Prime Trust Takeover

“After considerable effort and work to find a path forward with Prime Trust, BitGo has made the hard decision to terminate its acquisition of Prime Trust,” the California-based firm said in a Twitter post published today (Thursday). “This decision was not made lightly and BitGo remains committed to our mission to deliver trust in digital assets.”

After considerable effort and work to find a path forward with Prime Trust, BitGo has made the hard decision to terminate its acquisition of Prime Trust. This decision was not made lightly and BitGo remains committed to our mission to deliver trust in digital assets.

— BitGo (@BitGo) June 22, 2023

The speculation about Prime Trust’s health was fueled by recent developments at the Nevada-based firm. In January, the firm quit service provision in Texas after previously withdrawing its application for a Texas Money Transmitter License (MTL). In the same month, the crypto custodian shredded one-third of its workforce, which were mostly staff members in the communication and compliance departments, according to CoinDesk.

Last week, Banq, a mobile software solutions provider and a subsidiary of Prime Trust, filed for bankruptcy in a US court in Nevada, declaring $17.72 million in assets and $5.4 million in liabilities. Prime Trust itself was initially primed for acquisition for the sum of $1.2 billion by Galaxy Digital by late 2021. However, the deal fell apart in August last year, with Prime Trust’s claim of $100 million in damages that was later dismissed by a court in Delaware.

Prime Trust Stops Deposits

Meanwhile, Prime Trust has ceased all deposits of fiat and crypto assets for custody, according to Stably, a company that provides stablecoins and fiat-to-crypto on-ramps. The move is in line with an order by the Nevada Financial Institution Division.

Cryptocurrency exchange Coinmetro also made a similar move, saying it “is currently unable to process new USD transactions."

⚠️ Important announcement: unexpected disruption in USD transactions. We regret to inform you that our partner for USD payments PrimeTrust has temporarily suspended USD deposits and withdrawals. This means that Coinmetro is currently unable to process new USD transactions.While…

— Coinmetro (@CoinMetro) June 22, 2023

New exchange on TradingView; HKEX in New York; read today's news nuggets.

This article was written by Solomon Oladipupo at www.financemagnates.com.Governance: God has given Tinubu opportunity to write his name in gold Ibediro ex-APC ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/WQuAP1V

via IFTTT

Bvi forex - cocktails1.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/FBz8aeU

via IFTTT

Page 219 of 498 - Free Forex Education and Reviews - The Forex Geek

from Google Alert - ALL ABOUT FOREX https://ift.tt/8pJ6HNU

via IFTTT

Regulatory Orders Says Prime Trust Has 'Shortfall of Customer Funds'

Prime Trust is the latest crypto custody platform to be in trouble, as it received a cease-and-desist order from the Nevada Department of Business and Industry for a "shortfall in customer funds" and not being able to handle customers' withdrawal requests.

Troubled Prime Trust

The regulatory order was published publicly on Thursday, hours after BitGo, another digital asset custody provider, terminated its deal to acquire Prime Trust. Although, a spokesperson from the Nevada regulator confirmed to the media that the order was issued on June 21.

According to the Nevada regulator's Financial Institutions Division (FID), Prime Trust's "overall financial condition ... has considerably deteriorated to a critically deficient level," and thus, the company has been ordered to cease all activities. The regulator further highlighted that the crypto custodian might be on the brink of liquidation.

"On or about June 21, 2023, Respondent was unable to honor customer withdrawals due to a shortfall of customer funds caused by a significant liability on the Respondent's balance sheet owed to customers," the regulatory order stated. "Additionally, Respondent failed to safeguard assets under its custody and is unable to meet all customer withdrawals."

TrueUSD printed a billion stablecoins out of thin air, just a few days before the suspension of Prime Trusts services.In March of 2017, Tether also lost banking access and suspiciously started printing billions of Tethers that could not be redeemed.TrueUSD is now doing the… pic.twitter.com/BZoLn7Z8LV

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) June 23, 2023

Halted Deposits

Prime Trust has already halted all deposits of fiat and crypto assets on Thursday, which was confirmed by several companies.

Additionally, the regulatory order highlighted that Prime Trust had more than a negative amount of $12 million in stockholders' equity position at the end of March 2023, which signifies the company is "operating at a substantial deficit."

Based in Nevada, Prime Trust has been in business difficulties for a while now. It quit its service provision in Texas in January after previously withdrawing its application for a Texas Money Transmitter License (MTL), Finance Magnates recently highlighted. Further, Banq, a mobile software solutions provider and a subsidiary of Prime Trust, filed for bankruptcy last week in a US court in Nevada, declaring $17.72 million in assets and $5.4 million in liabilities.

This article was written by Arnab Shome at www.financemagnates.com.At 23 pc spend, Andhra Pradesh leads laggards in state capex in FY23; Karnataka, Bihar cross 100 pc

Saturday 24 June 2023

Why has India’s corporate tax mop-up failed to match the pace of personal income-tax collection?

India's corporate tax collection has struggled to keep pace with personal income tax in recent years due to factors such as better compliance, digitisation and wage rises in select service sectors. Since the COVID-19 pandemic began, the formalisation of the economy, better TDS compliance on salaries and a simplified tax regime have all contributed to higher personal tax collection.

India's corporate tax collection has struggled to keep pace with personal income tax in recent years due to factors such as better compliance, digitisation and wage rises in select service sectors. Since the COVID-19 pandemic began, the formalisation of the economy, better TDS compliance on salaries and a simplified tax regime have all contributed to higher personal tax collection.

Cramer says 'do not sell' CarMax stock after its Q1 earnings

from Google Alert - ALL ABOUT FOREX https://ift.tt/h2RjpAK

via IFTTT

Stocks fall dollar up as investors weigh more rate hikes | Forex News

from Google Alert - ALL ABOUT FOREX https://ift.tt/S2IV7Gf

via IFTTT

How many credit cards should you have? The answer isn’t zero, say experts

Blockchain Technology: Revolutionizing Industries Beyond Finance

Blockchain technology, which is most usually linked with cryptocurrencies, has emerged as a transformational force that goes far beyond banking. Blockchain has the potential to change a variety of industries, including healthcare, supply chain management, and voting systems, due to its decentralized and transparent nature.

In this article, we will look at how blockchain technology is altering various industries, opening up new avenues for efficiency, transparency, and trust.

Blockchain Technology in Healthcare

The incorporation of blockchain technology has the potential to dramatically enhance the healthcare business. Here's how it's done:

- Secure Data Management: By offering a secure and immutable ledger for healthcare records, blockchain has the potential to transform data management. Patient data kept on a blockchain can be secured, giving patients ownership over their information while also providing healthcare practitioners with a complete and accurate medical history. This decentralized strategy lowers the danger of data breaches while maintaining the integrity and privacy of sensitive health information.

- Interoperability and Data sharing: Interoperability is a fundamental barrier to the seamless sharing of patient data across different systems and providers in healthcare. Blockchain-based solutions can enable secure and standardized data transmission, guaranteeing that patient data is accurate, up to date, and accessible throughout the healthcare ecosystem. This interoperability improves patient outcomes by improving care coordination and reducing medical mistakes.

- Clinical Trials and Research: Blockchain technology has the potential to transform the way clinical trials are carried out and research data is managed. Researchers can ensure the transparency, integrity, and traceability of the entire process by securely capturing trial data on a blockchain. Transparency can reduce fraud, improve patient safety, and hasten the discovery of new treatments and cures.

Supply Chain Management with Blockchain

Lack of transparency, counterfeiting, and inefficiency are all problems in the supply chain business. Blockchain technology has the potential to address these concerns in the following ways:

- Improved Traceability: Blockchain enables end-to-end product traceability throughout the supply chain. Stakeholders may verify the authenticity and origin of products by recording each transaction and movement on a blockchain, assuring ethical sourcing and lowering the risk of counterfeit goods. This transparency also allows for the speedier detection and resolution of concerns like recalls, which improves customer safety.

- Streamlined Logistics: By automating and digitizing manual procedures, blockchain can optimize supply chain logistics. Smart contracts, which are self-executing agreements written in blockchain code, can simplify contract management, automate payments, and enforce compliance. These efficiencies cut costs, increase operational speed, and improve supply chain management overall.

- Sustainability and Fair Trade: By giving clear information about a product's environmental and social impact, blockchain technology can enable customers to make educated decisions. Consumers can support businesses that share their beliefs by tracking and confirming sustainability certifications and fair trade practices on a blockchain. Transparency encourages responsible behavior throughout the supply chain.

The Use of Blockchain in Voting Systems

Voting systems are critical to democratic processes, and blockchain technology provides multiple benefits:

- Immutable and visible Records: Because blockchain records are immutable and visible, they are very resistant to manipulation and fraud. The integrity of the voting process can be maintained by recording votes on a blockchain, ensuring that votes are reliably counted, and the results are transparently verifiable.

- Improved Voter Trust: The decentralized nature of blockchain-based voting systems increases voter trust. It eliminates the need for middlemen to count votes, such as electoral commissions, lowering the possibility of manipulation. Voters can independently verify their votes and engage in the democratic process directly.

- Accessibility and Efficiency: Blockchain-based voting systems can make voting more accessible to remote or international voters. Blockchain technology eliminates geographical obstacles, increases voter turnout, and lowers administrative expenses associated with traditional voting techniques by enabling secure and verified online voting.

Blockchain's Expansion into New Industries: Mitigating the Risks of a Single Point of Failure

Blockchain technology has emerged as a transformative force, revolutionizing various industries with its decentralized and transparent nature. However, as blockchain reaches new frontiers and finds applications beyond its initial use cases, it brings with it a potential risk: the creation of a single point of failure.

Recognizing and addressing this risk is essential to maintain the decentralized and transparent nature of blockchain. With careful planning and implementation, blockchain technology can continue to revolutionize industries while safeguarding against single points of failure.

The Single Point of Failure Dilemma

Traditionally, centralized systems have been susceptible to single points of failure, where a single component or entity can disrupt or compromise the entire system. Blockchain, with its decentralized architecture, aims to address this vulnerability by distributing control and authority among multiple participants. However, as blockchain expands into new industries, the risk of inadvertently creating a single point of failure becomes more apparent.

When blockchain technology is adopted within a specific industry or ecosystem, it often involves the establishment of consortiums or networks where a limited number of participants control the majority of nodes or resources. In such cases, if a dominant participant or a small group of participants experiences a technical failure, malicious attack, or unethical behavior, it can potentially undermine the entire network's integrity and reliability. This scenario defeats the purpose of blockchain's resilience and transparency.

Mitigating the Risk: Strategies and Best Practices

To mitigate the risk of a single point of failure, it is crucial to promote decentralization and diversity among network participants. Encouraging a broad range of stakeholders, including individuals, organizations, and even competing entities, to join the network helps distribute control and reduce the influence of any single participant. This approach enhances system robustness and makes it less susceptible to the negative impact of a single failure.

Moreover, implementing robust and secure consensus mechanisms is vital to blockchain networks. Consensus algorithms such as proof-of-work (PoW), proof-of-stake (PoS), or delegated proof-of-stake (DPoS) ensure agreement and validation of transactions across the network. By diversifying consensus mechanisms or adopting hybrid approaches, the network becomes more resilient against a single point of failure in any specific algorithm.

Building redundancy and backup systems into the blockchain infrastructure can also help mitigate the risks associated with a single point of failure. Multiple nodes distributed across different geographical locations ensure that if one node or a group of nodes fails, the network can continue to operate without disruption. This redundancy ensures data availability, integrity, and system functionality even in the face of technical failures or malicious attacks.

Regular monitoring and auditing of the blockchain network are crucial to detect potential vulnerabilities or signs of a single point of failure. Network administrators and participants should actively monitor the system's health, security, and performance to identify and address any weaknesses promptly. Transparent and independent audits can provide assurance to all stakeholders and help identify areas that require improvement or mitigation.

Lastly, promoting open standards and interoperability among blockchain networks can help mitigate the risks associated with a single point of failure. Interconnected networks enable the seamless transfer of data and assets, reducing reliance on a single network or consortium. By fostering interoperability, blockchain technology can achieve its full potential by promoting collaboration, innovation, and resilience across various industries.

Conclusion

Beyond banking, blockchain technology has the potential to alter industries by providing transparency, security, and efficiency to areas such as healthcare, supply chain management, and voting systems. These industries may open new opportunities for trust, traceability, and collaboration by exploiting blockchain's decentralized and transparent nature.

As blockchain technology evolves, stakeholders must accept it, handle scalability issues, and create collaboration in order to realize its potential for generating positive change across industries.

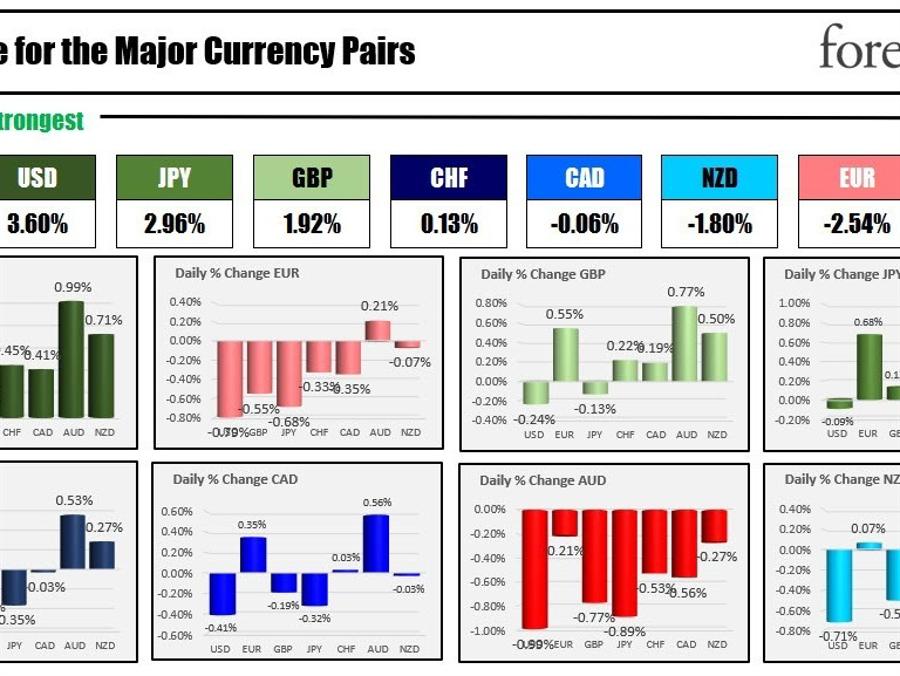

This article was written by FM Contributors at www.financemagnates.com.The USD is the strongest and the AUD is the weakest as the North American session begins

http://dlvr.it/Sr8nZ6

Friday 23 June 2023

Companies without direct A.I. link try to ride the Wall Street craze

India's Forex Reserves Jump $2.35 Billion To $596 Billion: RBI - ABP LIVE

from Google Alert - ALL ABOUT FOREX https://ift.tt/pc6e4S9

via IFTTT

FOREX-Dollar up on risk aversion; sterling Swiss franc slip despite rate hikes

from Google Alert - ALL ABOUT FOREX https://ift.tt/CsQ4Umw

via IFTTT

Goldman Sachs faces big writedown on CEO David Solomon’s ill-fated GreenSky deal

Stocks making the biggest moves before the bell: Starbucks, CarMax, Virgin Galactic and more

AUDUSD buyers and sellers battle it out between technical support and resistance

http://dlvr.it/Sr67y9

Thursday 22 June 2023

Warren Buffett's charitable giving exceeds $50 billion, more than his entire net worth in 2006

FedEx's Attempts to Trim Expenses May Be Too Little Too Late for Investors - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/4K05Sr7

via IFTTT

Watch Fed Chair Jerome Powell speak live to Senate banking panel

Bank of England surprises with 50 basis point rate hike to tackle persistent inflation

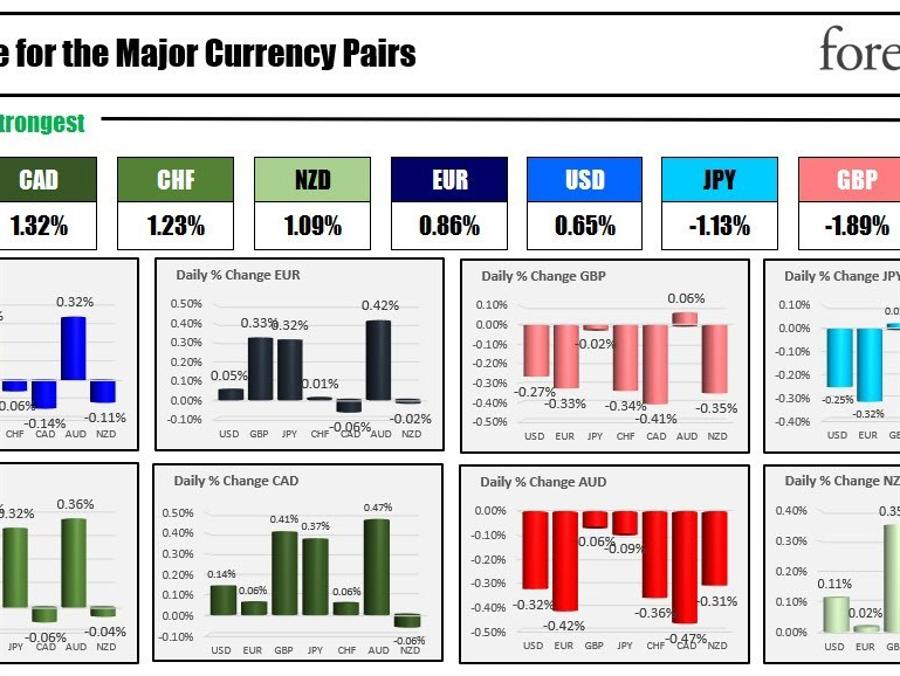

The CAD is the strongest and the AUD is the weakest as the NA session begins

http://dlvr.it/Sr3FP1

Wednesday 21 June 2023

Watch Fed Chair Powell speak live on rate hikes and more to a House panel

Exchange rate converges at N756 after FX reforms - Businessday NG

from Google Alert - ALL ABOUT FOREX https://ift.tt/JD9fqUz

via IFTTT

BoT warns on use of forex in payments - Daily News

from Google Alert - ALL ABOUT FOREX https://ift.tt/Ag3rsu8

via IFTTT

Experts shared valuable information about Forex trading in Nigeria - Newswire.net

from Google Alert - ALL ABOUT FOREX https://ift.tt/cMrtnhz

via IFTTT

AUDJPY Forex Analysis - Retest & Hold At 95.73 Weekly Support - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=pI8xMro8WFc

via IFTTT

FOREX-Dollar firm ahead of Powell testimony sterling up on hot inflation | Nasdaq

from Google Alert - ALL ABOUT FOREX https://ift.tt/vOT7zVE

via IFTTT

Treasury - Forex Management - Noida - EXL - 5 to 10 years of experience - Naukri.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/lq14Z2m

via IFTTT

Powell expects more Fed rate hikes ahead as inflation fight 'has a long way to go'

Stocks making the biggest moves premarket: Spotify, FedEx, Tesla, Coinbase and more

USDJPY Technical Analysis

http://dlvr.it/Sr0LPs

Tuesday 20 June 2023

Wall Street Giants Propel EDX Markets into Digital Asset Trading Scene

EDX Markets, a new digital asset marketplace, has announced the successful initiation of its trading operations, backed by a consortium of major financial institutions. Among the mentioned companies are several Wall Street giants, including Charles Schwab, Fidelity Investments, and Citadel Securities.

The company has also completed a new funding round that brought additional strategic investors on board. In a future plan to optimize the market, the platform aims to introduce a clearinghouse, EDX Clearing, later this year.

EDX Markets Starts Operations Supported by Wall Street's Giants

The EDX Markets platform began trading recently and claims that it stands out from the competition thanks to its liquidity, competitive quotes, and unique non-custodial model. EDX Markets aims to lessen potential conflicts of interest. EDX also brought a retail-only quote to the crypto markets, which resulted in improved pricing for retail-originated orders.

The platform supports the trading of the most popular digital assets such as Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH) and Litecoin (LTC).

"EDX's ability to attract new investors and partners in the face of sector headwinds demonstrates the strength of our platform and the demand for a safe and compliant cryptocurrency market," Jamil Nazarali, the CEO of EDX, commented.

"We are committed to bringing the best of traditional finance to cryptocurrency markets, with an infrastructure built by market experts to embed key institutional best practices.

In line with its launch, the platform closed a new funding round. This round introduced new strategic investors like DV Crypto, GTS and Miami International Holdings. These firms joined the original coalition of investors, including Wall Street giants mentioned before, like Charles Schwab, Citadel Securities, Fidelity Digital, Sequoia Capital and Virtu Financial.

The funds acquired will aid in the platform's continued development and reinforcement of its market leadership.

JUST IN: Citadel, Fidelity, and Charles Schwab launch new #crypto exchange platform, EDX Markets.

— Watcher.Guru (@WatcherGuru) June 20, 2023

EDX Markets to Launch EDX Clearing

A new development on the horizon for EDX Markets is the launch of EDX Clearing. This clearinghouse will settle trades matched on EDX Markets, acting as a central counterparty.

"Looking ahead, EDX Clearing will be a major differentiator for EDX - and resolve an unmet need in the market - by enhancing competition and creating unparalleled operational efficiency through a single settlement process," Nazarali added.

The investment firm BlackRock has also decided to venture into cryptocurrencies. Last week, it proposed establishing its first Bitcoin ETF in the United States. This new instrument will provide investors with secure and regulated access to the BTC market if approved.

These moves come at a time when there is increasing pressure from regulators on digital asset companies in the United States. The Securities and Exchange Commission (SEC) has filed lawsuits against the two largest exchanges in the country, Coinbase and Binance. This has made the crypto landscape more challenging but also illustrates the growing importance of digital assets in the financial ecosystem.

This article was written by Damian Chmiel at www.financemagnates.com.KOJO FOREX on Twitter: "My Tiktok is getting the relevant attention it needs. Straight Facts and ...

from Google Alert - ALL ABOUT FOREX https://mobile.twitter.com/KojoForex/status/1671061729487331332

via IFTTT

Unraveling the Latest Developments in Crypto Regulations Around the World

Over the last decade, the world of cryptocurrencies has seen amazing development and innovation. Governments and regulatory bodies are attempting to build comprehensive frameworks to oversee the usage of digital assets as they gain popularity and general acceptance.

This article goes into the most recent developments in global crypto legislation, giving light on the changing landscape and its ramifications for businesses, investors, and individuals.

Accepting Regulatory Clarity

Governments all around the world are recognizing the significance of creating clear regulations in order to support responsible and secure crypto ecosystems. While regulatory measures differ among jurisdictions, the overarching goal is to achieve a balance between promoting innovation and protecting against hazards like as fraud, money laundering, and market manipulation. Governments hope to boost investor confidence and the expansion of the cryptocurrency business by giving regulatory clarity.

Different Regulation Approaches

The United States

The United States has been actively establishing a cryptocurrency regulatory framework. The Securities and Exchange Commission (SEC) has increased its investigation of initial coin offerings (ICOs) and determined that many tokens are securities that must be regulated under existing securities regulations. Furthermore, the Office of the Comptroller of the Currency (OCC) has authorized national banks to provide cryptocurrency custody services. However, regulatory clarity is still a work in progress, with continuous conversations about digital asset classification and monitoring.

European Union

The European Union (EU) has taken attempts to standardize cryptocurrency rules among its member countries. The Fifth Anti-Money Laundering Directive (AMLD5) of the European Union compels cryptocurrency exchanges and custodian wallet providers to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. Furthermore, the proposed Markets in Crypto-Assets Regulation (MiCA) seeks to provide a complete regulatory framework for crypto-assets, with the goal of enhancing investor protection and market integrity.

Asia

With varying approaches to regulation, Asia has emerged as a hub for crypto activity. Countries such as Japan and Singapore have put in place regulatory structures that encourage innovation while protecting consumers.

China, on the other hand, has enforced severe cryptocurrency regulations, including bans on ICOs and cryptocurrency exchanges, but continuing to investigate the possibility of central bank digital currencies (CBDCs). Asia's changing landscape reflects the region's various perspectives about digital assets.

CBDCs (Central Bank Digital Currencies)

CBDCs are being extensively researched by central banks all over the world. These centrally supported digital currencies promise to provide efficiency, transparency, and financial inclusivity.

China, Sweden, and the Bahamas have made great progress in piloting CBDCs, while the United States and the European Union are doing research and feasibility studies. CBDCs have the ability to change the monetary system and the interaction between governments, central banks, and digital currencies.

Can CBDCs be a potential point of convergence for governments worldwide?

As the world continues to embrace digital transformation, governments are exploring the concept of Central CBDCs as a means to modernize their financial systems.

CBDCs, digital representations of a country's fiat currency, have the inherent potential to become a point of convergence between governments worldwide as they present a transformative opportunity for governments worldwide to collaborate, and build a more inclusive and efficient global financial ecosystem.

As governments explore the implementation of CBDCs, international collaboration and coordination will be crucial. Through open dialogue, shared standards, and cooperative efforts, governments can establish a foundation for a globally interconnected financial system that benefits individuals, businesses, and economies around the world. The convergence of CBDCs holds promise for a future where financial transactions are seamless, inclusive, and truly borderless.

Streamlining Cross-Border Transactions

One of the significant challenges in cross-border transactions is the complexity and cost associated with traditional banking systems. CBDCs can facilitate faster, more secure, and cost-effective cross-border transactions by leveraging blockchain or distributed ledger technology. With CBDCs, transactions can be executed in real-time, reducing the need for intermediaries and minimizing transaction costs.

By embracing digital currencies, governments can simplify cross-border payments, enabling businesses and individuals to transact seamlessly across borders. This streamlined process has the potential to boost international trade and commerce, promoting economic growth and cooperation between nations.

Enhanced Financial Inclusion

A key advantage of CBDCs is their potential to improve financial inclusion. Traditional banking systems may not reach certain segments of the population, particularly those in remote or underserved areas. CBDCs can provide a digital payment infrastructure that is accessible to anyone with a mobile phone or internet connection, regardless of their geographic location.

By providing a secure and inclusive digital payment solution, CBDCs can empower individuals who were previously excluded from formal financial services. This enhanced financial inclusion has the potential to stimulate economic activity and improve livelihoods across different regions, ultimately fostering socio-economic development.

Interoperability and Standardization

The development and implementation of CBDCs require international collaboration and coordination. Governments worldwide have a shared interest in establishing interoperability and common standards to ensure seamless integration between different CBDCs. This convergence can facilitate cross-border transactions and promote international trade by eliminating the complexities of multiple currency conversions and settlement processes.

Through international agreements and cooperation, governments can establish protocols for interoperability, enabling the efficient exchange of value between different CBDC ecosystems. Such standardization efforts can foster trust, transparency, and interoperability, creating a foundation for a global financial system that transcends national borders.

Strengthening Regulatory Frameworks

The introduction of CBDCs necessitates the development of robust regulatory frameworks that ensure financial stability, consumer protection, and privacy. As governments work together to define regulations and guidelines for CBDCs, it presents an opportunity for convergence and harmonization of regulatory practices.

International collaboration can lead to the exchange of best practices, the establishment of common regulatory principles, and the development of frameworks that address potential risks and challenges associated with CBDC implementation. By aligning regulatory approaches, governments can foster trust and confidence in CBDCs, attracting global adoption and promoting cross-border financial integration.

Addressing Economic Disparities

CBDCs have the potential to address economic disparities by providing governments with enhanced tools for monetary policy and economic stimulus. Governments can use them to distribute targeted welfare payments, subsidies, or grants directly to individuals or businesses in need, bypassing traditional intermediaries and reducing administrative costs.

Moreover, CBDCs can enable more efficient and transparent tax collection processes, combating tax evasion and promoting fiscal discipline. By leveraging them as a tool for economic empowerment and social welfare, governments can work together to bridge the gap between developed and developing economies, fostering global economic stability and sustainable growth.

The Effect on Businesses and Investors

Crypto regulations that are clear and well-defined have a significant impact on businesses and investors. Investor confidence is boosted by regulatory stability, which attracts institutional players and traditional financial institutions to the crypto arena.

This infusion of capital and knowledge has the potential to stimulate innovation, liquidity, and market maturation. Businesses in the cryptocurrency business may better negotiate legal regulations, develop compliance procedures, and build trust with their clients.

Consumer Safety and Security

Regulations are critical to protecting consumers and maintaining the security of cryptocurrency transactions. KYC and AML standards aid in the prevention of illegal activity, while investor protection measures safeguard against scams and fraud. Users get peace of mind knowing that their monies are secure and their rights are protected when they use well-regulated exchanges and custodial services.

Striking the correct balance between regulation and inhibiting innovation, on the other hand, remains a challenge, necessitating continual coordination among regulators, firms, and industry stakeholders.

International Standards and Cooperation

As the crypto sector crosses borders, international cooperation and the development of common standards become more crucial. Financial Action Task Force (FATF) and International Organization of Securities Commissions (IOSCO) are trying to produce consistent rules for crypto legislation. Harmonized standards can help cross-border transactions by reducing regulatory arbitrage and promoting global interoperability.

Conclusion

The changing regulatory landscape for cryptocurrencies reflects a maturing business seeking responsible growth and widespread adoption. Governments and regulatory agencies throughout the world are increasingly building clear frameworks to control cryptocurrencies in order to foster investor confidence, protect consumers, and mitigate risks.

As organizations and consumers deal with digital assets, it is critical to stay current on crypto rules and maintain compliance with applicable laws. Countries can unlock the revolutionary potential of cryptocurrencies while protecting against possible hazards by implementing a balanced regulatory approach, allowing the crypto industry to continue to expand and innovate on a global scale.

This article was written by FM Contributors at www.financemagnates.com.Stocks making the biggest premarket moves: Alibaba, Dice Therapeutics, Avis and more

Gold Technical Analysis

http://dlvr.it/SqxNR3

Monday 19 June 2023

Terraform Labs’ Do Kwon Sentenced to 4 Months in Jail over Document Forgery

A court in Montenegro has sentenced Do Kwon, the Co-Founder of Terraform Labs, to four months in jail for possessing forged passports and travel documents. Han Chong-Joon, former Chief Financial Officer at the Singapore-based blockchain company, was also found guilty of the same crime by the Basic Court in Podgorica, Bloomberg reported on Monday. Han also received the same sentence.

Court Sentences Do Kwon to Jail

Kwon and Han were arrested in March in Montenegro while they were attempting to travel to Dubai through a private jet. The court said Costan Rican and Belgian passports and identity cards belonging to the executives were confiscated.

The sentencing came weeks after the court granted a €400,000 bail each to Kwon and Han. An initial bail granted in May was voided by an upper court following an appeal by the prosecutor that the executive’s property had not been properly assessed.

According to Bloomberg, the time the Terraform Labs executives had spent in detention will be factored into the sentence. The court also said they had the option of appealing the verdict in a higher court.

Kwon last week told the court that he obtained the travel documents from an agency in Singapore recommended by his friend. The Terraform Labs CEO denied knowing that the documents were forged.

Do Kwon Faces Extradition

As the CEO of TerraLabs, Kwon helped in creating the algorithmic stablecoin TerraUSD and the native cryptocurrency of the Terra blockchain, LUNA. However, the digital assets collapsed in May last year, wiping out over $40 billion from the crypto market.

In February, US securities regulator charged Kwon with securities fraud, with federal prosecutors following this up with fraud charges, both over the failure of the cryptocurrency projects. South Korea also issued an arrest warrant against the Terraform Labs Founder last year.

Despite being granted bail last week, the Podgorica High Court confirmed to the media that it is keeping Kwon in ‘extradition custody’ for six months to consider an extradition request by South Korea. The United States also asked for the former CEO to be extradited.

Beeks' new contract; ex-Scope Markets' exec at Titan FX; read today's news nuggets.

This article was written by Solomon Oladipupo at www.financemagnates.com.GBP/JPY Forecast - British Pound Continues to Look to the Upside - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/JkAr9QM

via IFTTT

Court Approves Deal between SEC and Binance.US to Avoid Asset Freeze

The Securities and Exchange Commission (SEC) has reached a deal with Binance and Binance.US to circumvent the need for an asset freeze, limiting access to US customers' funds only to Binance.US employees. Additionally, the United States district court Judge Amy Berman Jackson approved the agreement on Saturday.

SEC and Binance Reached a Deal

Under the agreement, the US affiliate of Binance has to ensure that none of the officials from Binance Holdings, the global exchange, have access to private keys for wallets or hardware wallets. Binance.US needs to create new crypto wallets to which they only have access and move US customers' funds to them.

Further, none of the Binance Holdings officials can have root access to Binance.US's Amazon Web Services tools. In the meantime, US customers will be allowed to withdraw their funds.

Binance's CEO, Zhao tweeted that agreements were reached on "mutually acceptable terms."

Although we maintain that the SEC's request for emergency relief was entirely unwarranted, we are pleased that the disagreement over this request was resolved on mutually acceptable terms. User funds have been and always will be safe and secure on all Binance-affiliated…

— CZ 🔶 Binance (@cz_binance) June 17, 2023

Binance.US Avoids Asset Freeze

These restrictions came as the SEC alleged that Binance.com and its CEO, Changpeng Zhao controlled the US operations despite not holding any executive role in the country. Zhao is also the majority owner of Binance.US.

In addition to the limitation of access, the US-based crypto exchange must share detailed information about its business expenses with the regulator.

The SEC sued Binance, its two US affiliates, and Changpeng Zhao earlier this month over allegations of operating illegal trading platforms, offering unregistered crypto asset securities, and commingling customers' funds.

On top of that, the regulator filed a motion in the court seeking an asset freeze of BAM Management US Holdings and BAM Trading Services, the holding and operating firms for Binance.US, concerning that the exchange can move its customer funds to offshore wallets. However, the exchange said that such an order would mean a "death penalty" for its operations.

The representatives of the SEC and the Binance entities sat down at the table as a judge rejected a temporary asset freeze last Tuesday and forced them to negotiate a way out of it.

We want to provide an update on the current battle https://t.co/AZwoBOh0gq finds itself in with the SEC. We are pleased to inform you that the Court did not grant the SEC’s request for a TRO and freeze of assets on our platform which was clearly unjustified by both the facts and…

— Binance.US 🇺🇸 (@BinanceUS) June 17, 2023

Meanwhile, Binance is facing troubles outside the US. Its regulated French unit reportedly faces a probe over the 'illegal' provision of crypto services and money laundering.

This article was written by Arnab Shome at www.financemagnates.com.'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...