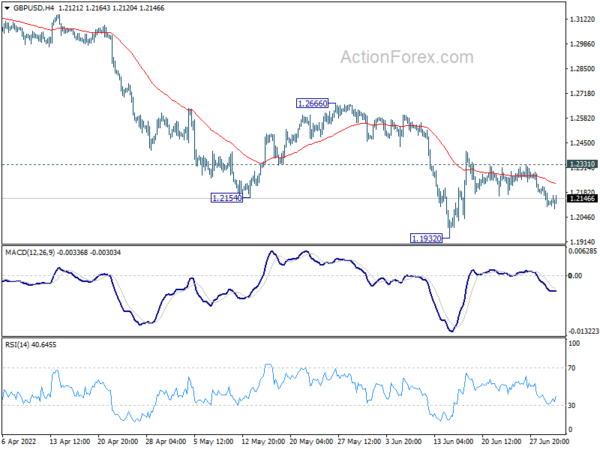

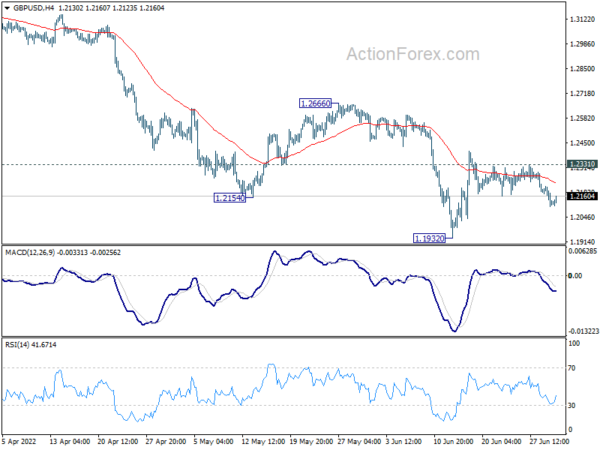

Daily Pivots: (S1) 1.2081; (P) 1.2147; (R1) 1.2188; More… No change in GBP/USD’s outlook and intraday bias remains neutral. Further fall is in favor as long as 1.2331 minor resistance holds. Firm break of 1.1932 will resume larger down trend from 1.4248. On the upside, above 1.2331 will resume the rebound from 1.1932 to 1.2666 […]

The post GBP/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST6p1w

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Thursday 30 June 2022

EUR/USD Mid-Day Outlook

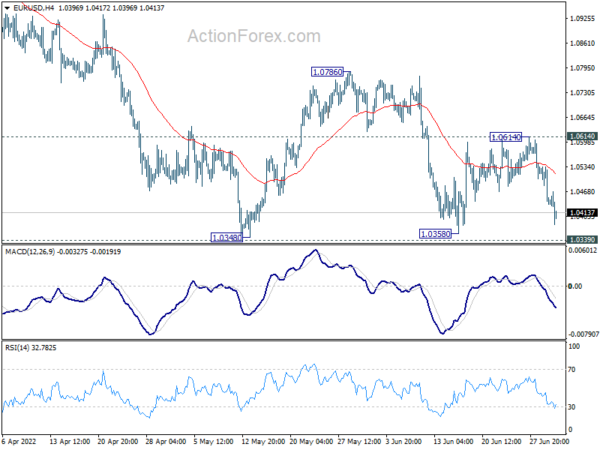

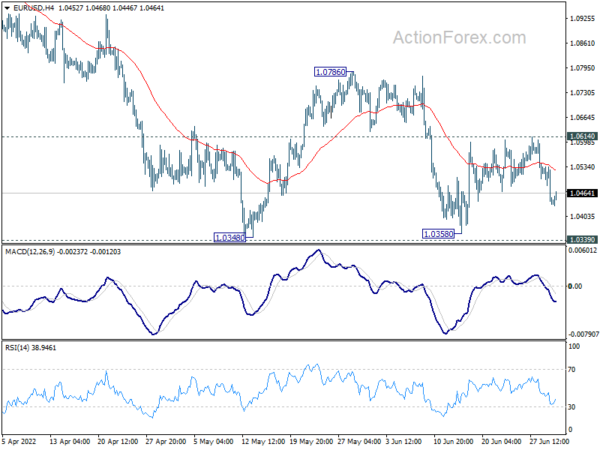

Daily Pivots: (S1) 1.0406; (P) 1.0471 (R1) 1.0506; More… EUR/USD is still staying above 1.0339/58 support zone with today’s decline. Intraday bias stays neutral first. Further fall is in favor with 1.0614 minor resistance intact. On the downside, sustained break of 1.0339/48 will resume larger down trend. Next target is long term projection level at […]

The post EUR/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST6kty

http://dlvr.it/ST6kty

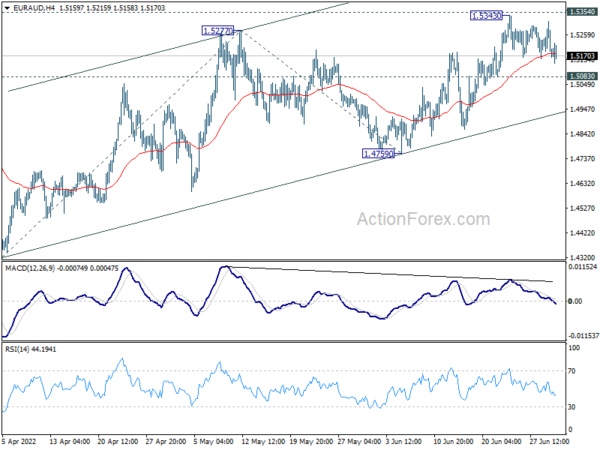

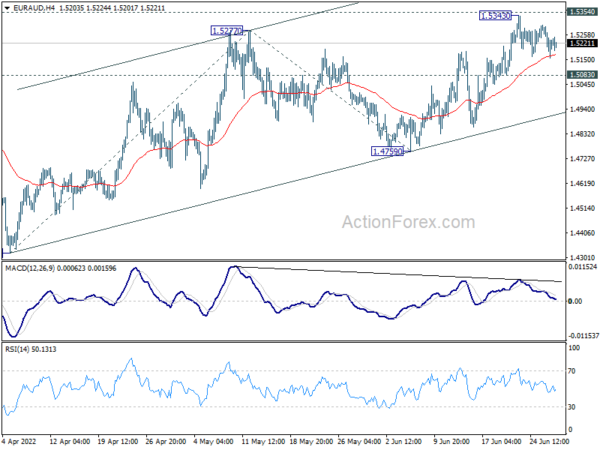

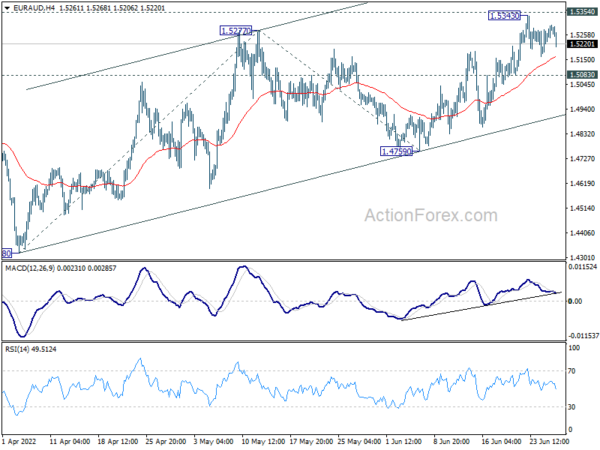

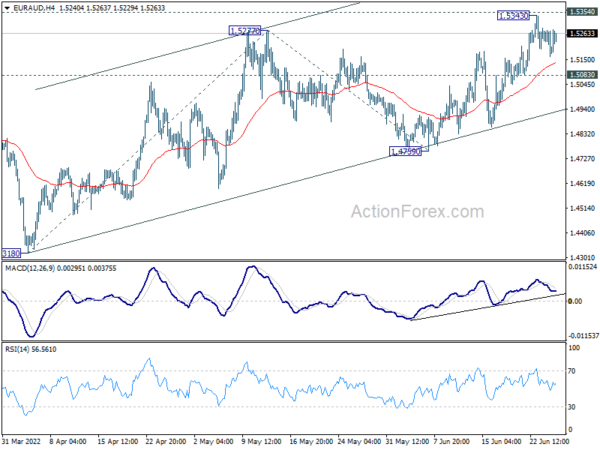

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5124; (P) 1.5221; (R1) 1.5276; More… Intraday bias in EUR/AUD remains neutral as range trading continues. On the upside, sustained break of 1.5354 support turned resistance will indicate medium term bottoming at 1.4318. Stronger rally would be seen back to 100% projection of 1.4318 to 1.5277 from 1.4759 at 1.5718. On the […]

The post EUR/AUD Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST65dd

http://dlvr.it/ST65dd

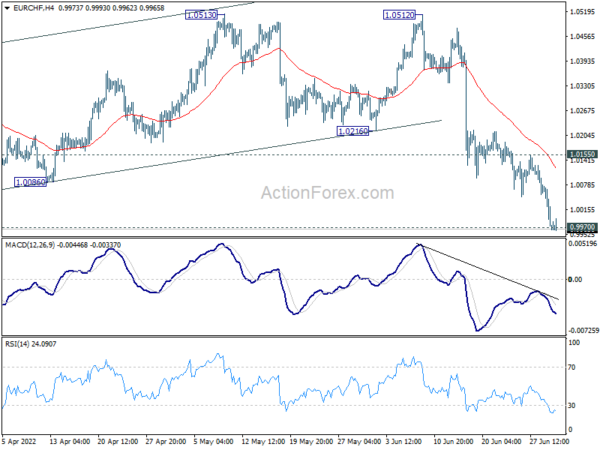

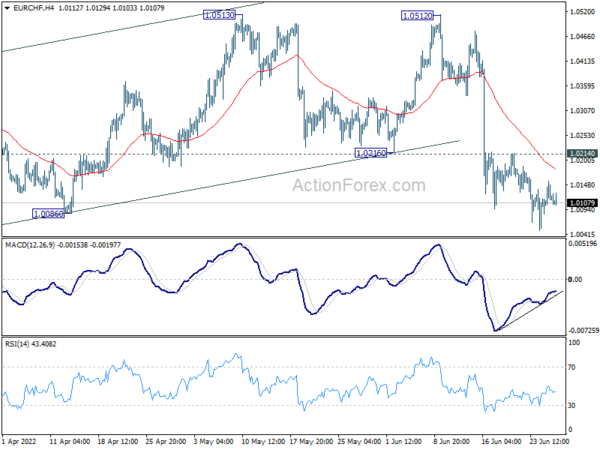

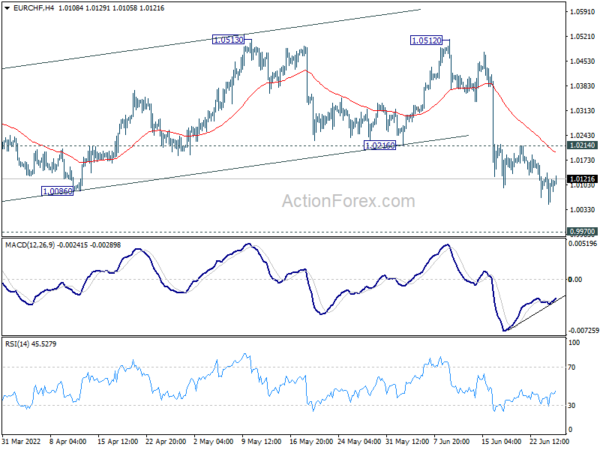

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9931; (P) 1.0004; (R1) 1.0041; More…. Intraday bias in EUR/CHF stays on the downside at this point. Sustained break of 0.9970 low will resume larger down trend. Next target is 0.9650 long term projection level. On the upside, however, above 1.0214 minor resistance will delay the bearish case, and turn bias back […]

The post EUR/CHF Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST65ZS

http://dlvr.it/ST65ZS

Germany June unemployment change +133k vs -6k expected

* Prior -4k

* Unemployment rate 5.3% vs 5.0% expected

* Prior 5.0%

The German jobless rate unexpectedly climbed in June but the jump owes to a bit of a caveat, with Ukrainian refugees registering with the labour office in search of work. That saw the number of people out of work growing by 133,000 to 2.417 million.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST5pzV

http://dlvr.it/ST5pzV

Risk on the defensive to start the session

With equities in a struggling spot, we are seeing a bit more of a risk-off push in markets to start European trading.

Treasury yields are more bid, with 10-year yields down 2.6 bps to 3.066% and 2-year yields down by a little over 5 bps to just below 3% again - the first time in about a week:

The 3% mark was what put off bond buyers last week but with risk on the defensive now, that may keep the pressure on for today. There's also month-end and quarter-end flows to contend with, so that might make things a bit messier as well.

But looking at the bond market as a whole, there will be questions asked as to whether or not we are seeing a peak in yields. Breakevens have started sliding and Fed terminal rate pricing has also come down considerably over the past few weeks. It is perhaps a sign that inflation fears are abating.

In FX, the bid in bonds today is helping the yen out with USD/JPY briefly touching below 136.00 on the day and is still down 0.3% to 136.15 at the moment.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST5lm1

http://dlvr.it/ST5lm1

France June preliminary CPI +5.8% vs +5.7% y/y expected

* Prior +5.2%

* HICP +6.5% vs +6.3% y/y expected

* Prior +5.8%

French inflation continues to soar, rising to near 6% now with little signs of letting up. The monthly number shows a 0.7% increase in inflation, so that won't provide much comfort. Meanwhile, the details show that the jump is broad-based (still led by energy though) with food inflation picking up again in June.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST5k7X

http://dlvr.it/ST5k7X

Risk appetite sapped as the session gets underway

It's not a good look for risk as we look towards the start of European morning trade, with S&P 500 futures now down 0.9%:

That has also weighed on European futures as mentioned here and bond yields are also pulled a little lower to start the session. 10-year Treasury yields are down 1.7 bps to 3.076% currently.

There isn't much of a catalyst for the dribble lower in the past hour but just be wary that month-end and quarter-end flows will be part and parcel of the picture today. That won't make it easy to read into sudden moves in the market.

In FX, the dollar is holding slightly lower despite the softer risk mood with USD/JPY down 0.3% to 136.20 and EUR/USD up 0.2% on teh day to 1.0463 at the moment.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST5k7K

http://dlvr.it/ST5k7K

Eurostoxx futures -1.4% in early European trading

* German DAX futures -1.3%

* UK FTSE futures -1.3%

Risk is on the retreat as we look towards European morning trade as equities are getting the short end of the stick going into month-end and quarter-end. US futures have also dropped lower in the past hour with S&P 500 futures now down 0.9% on the day:

Nasdaq futures are down 1.0% and Dow futures also down 0.8% at the moment.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST5k56

http://dlvr.it/ST5k56

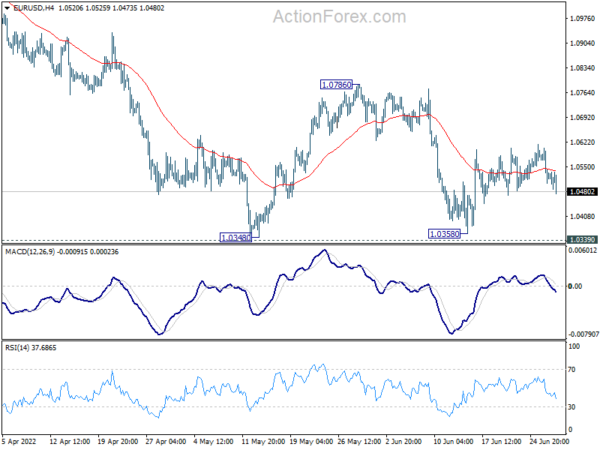

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0406; (P) 1.0471 (R1) 1.0506; More… Range trading continues in EUR/USD and intraday bias remains neutral first. Further decline is in favor with 1.0614 minor resistance intact. On the downside, sustained break of 1.0339/48 will resume larger down trend. Next target is long term projection level at 1.0090. On the upside, above […]

The post EUR/USD Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST5k50

http://dlvr.it/ST5k50

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2081; (P) 1.2147; (R1) 1.2188; More… GBP/USD is still bounded in range above 1.1932 and intraday bias remains neutral. Further fall is in favor as long as 1.2331 minor resistance holds. Firm break of 1.1932 will resume larger down trend from 1.4248. On the upside, above 1.2331 will resume the rebound from […]

The post GBP/USD Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST5dPK

http://dlvr.it/ST5dPK

Wednesday 29 June 2022

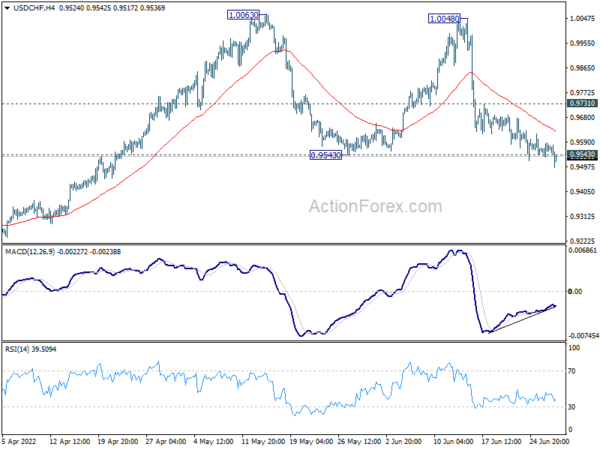

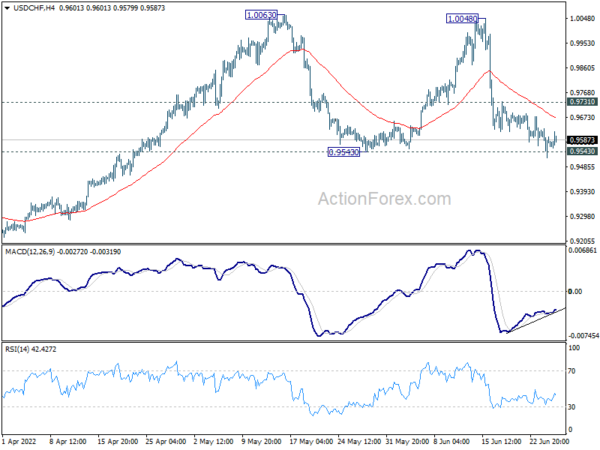

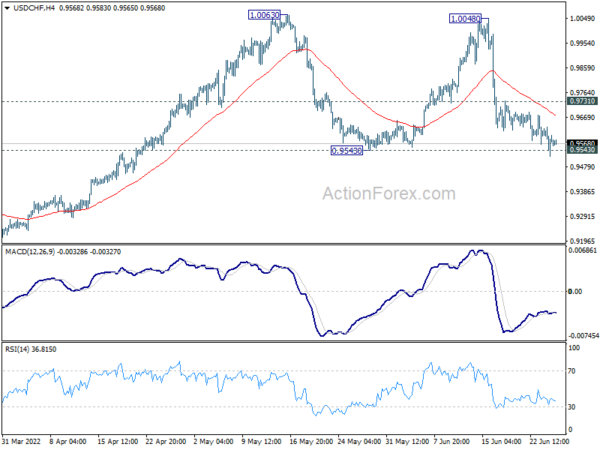

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9544; (P) 0.9565; (R1) 0.9597; More… Intraday bias in USD/CHF stays neutral as it continues to lose downside momentum as seen in 4 hour MACD. Fall from 1.0048 is still seen as the third leg of the consolidation pattern from 1.0063. Strong support should be seen around 0.9543 to bring rebound. On […]

The post USD/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST3qvL

http://dlvr.it/ST3qvL

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 1.0042; (P) 1.0086; (R1) 1.0117; More…. EUR/CHF’s fall continues today and breaches parity to as low as 0.9990 so far. Intraday bias stays on the downside for retesting 0.9970 low. Decisive break there will resume larger down trend. Next target is 0.9650 long term projection level. On the upside, however, above 1.0214 […]

The post EUR/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST3qtF

http://dlvr.it/ST3qtF

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0481; (P) 1.0543 (R1) 1.0584; More… No change in EUR/USD’s outlook as range trading continues. Intraday bias remains neutral. Further fall is in favor with 1.0786 resistance intact. On the downside, sustained break of 1.0339/48 will resume larger down trend. Next target is long term projection level at 1.0090. In the bigger […]

The post EUR/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST3R0Z

http://dlvr.it/ST3R0Z

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9544; (P) 0.9565; (R1) 0.9597; More… Intraday bias in USD/CHF stays neutral as it continues to lose downside momentum as seen in 4 hour MACD. Fall from 1.0048 is still seen as the third leg of the consolidation pattern from 1.0063. Strong support should be seen around 0.9543 to bring rebound. On […]

The post USD/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST3QyP

http://dlvr.it/ST3QyP

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 1.0042; (P) 1.0086; (R1) 1.0117; More…. EUR/CHF’s fall continues today and breaches parity to as low as 0.9990 so far. Intraday bias stays on the downside for retesting 0.9970 low. Decisive break there will resume larger down trend. Next target is 0.9650 long term projection level. On the upside, however, above 1.0214 […]

The post EUR/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST3J7H

http://dlvr.it/ST3J7H

Hesse June CPI +8.1% vs +8.4% y/y prior

* Brandenburg CPI +8.0% y/y

* Prior +8.5%

The German state readings reaffirm that we are seeing softer annual inflation with the monthly figures for Hesse and Brandenburg coming in flat. The only positive news is that we're not seeing a big climb down in the details that really matter. As per the North Rhine Westphalia data earlier, food inflation and gas, electricity inflation remains elevated and that will be of little comfort to households.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST2RHL

http://dlvr.it/ST2RHL

Fed's Mester: Right now I would advocate for 75 bps rate hike

* Debate in July is between 50 bps and 75 bps rate hike

* We want to see US rates above 4% next year

* Rate hikes are very necessary to get inflation down

Mester is talking up inflation risks and saying that US inflation could rise further from current levels. As such, she is pushing a more hawkish narrative going into next month's meeting. That said, Fed fund futures have already priced in ~84% probability of a 75 bps rate hike, so there's that.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST2Mlv

http://dlvr.it/ST2Mlv

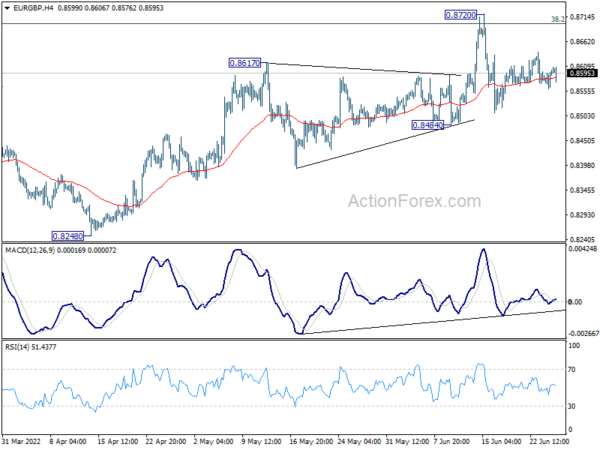

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8615; (P) 0.8631; (R1) 0.8650; More… Intraday bias in EUR/GBP remains neutral as sideway trading continues. Further rally is expected with 0.8484 support intact. On the upside, break of 0.8720 and sustained trading above 0.8697 medium term fibonacci level will carry larger bullish implication. Next target is 0.9003 fibonacci level. However, break […]

The post EUR/GBP Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST2LXM

http://dlvr.it/ST2LXM

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5166; (P) 1.5230; (R1) 1.5299; More… EUR/AUD is staying in range below 1.5343 and intraday bias remains neutral. On the upside, sustained break of 1.5354 support turned resistance will indicate medium term bottoming at 1.4318. Stronger rally would be seen back to 100% projection of 1.4318 to 1.5277 from 1.4759 at 1.5718. […]

The post EUR/AUD Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST2L5P

http://dlvr.it/ST2L5P

ECB reportedly weighing up whether to announce size, duration of bond-buying scheme

'QE but not QE'. That is the path the ECB is going to take in battling fragmentation.

Reuters is reporting that the central bank is set to announce the new tool on 21 July, alongside its first rate hike in more than a decade. But policymakers are said to be considering whether to announce the size and duration of the upcoming bond-buying scheme. There are said to be different options presented by ECB staff on the matter, so it may be that policymakers will not feel too comfortable in making it public this early on.

The sources say that one of the pros of announcing a large envelope would at least reaffirm the ECB's commitment to fighting fragmentation but if the size is deemed as "too small" by bond traders, it could backfire instead. Keeping things vague might help to avoid the latter but at the same time, it could leave a lot of questions unanswered - which also isn't a good thing.

As mentioned here yesterday, the ECB will bring back bond-buying alongside 'sterilisation' to try and convince markets of its goals. But again, whether or not this will work in practice is certainly going to be interesting to watch. Essentially, the ECB is going to backstop Italy at the expense of others so that will definitely stir up some controversy.

EUR

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST2LKB

http://dlvr.it/ST2LKB

Japan June consumer confidence index 32.1 vs 34.1 prior

* Prior 34.1

Household confidence slumps further in Japan and that continues to dampen economic sentiment even as the BOJ looks to maintain easy policy to aid with the recovery process. Price expectations continue to stay elevated and that is arguably a key reason for the softer sentiment overall.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST2LJj

http://dlvr.it/ST2LJj

ICYMI: Citi month-end flow model points to dollar buying

There was already a hint of that in trading yesterday but there's still today and tomorrow to go, so just be wary that month-end flows could make things a little muddy in the sessions ahead.

Citi's model hints at a stronger USD buying signal than the historical average. From yesterday:

* Flow models point to US dollar strength into month end

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/ST2Kpb

http://dlvr.it/ST2Kpb

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8615; (P) 0.8631; (R1) 0.8650; More… Intraday bias in EUR/GBP remains neutral as sideway trading continues. Further rally is expected with 0.8484 support intact. On the upside, break of 0.8720 and sustained trading above 0.8697 medium term fibonacci level will carry larger bullish implication. Next target is 0.9003 fibonacci level. However, break […]

The post EUR/GBP Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST2KmB

http://dlvr.it/ST2KmB

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5166; (P) 1.5230; (R1) 1.5299; More… EUR/AUD is staying in range below 1.5343 and intraday bias remains neutral. On the upside, sustained break of 1.5354 support turned resistance will indicate medium term bottoming at 1.4318. Stronger rally would be seen back to 100% projection of 1.4318 to 1.5277 from 1.4759 at 1.5718. […]

The post EUR/AUD Daily Outlook appeared first on Action Forex.

http://dlvr.it/ST2GJs

http://dlvr.it/ST2GJs

Tuesday 28 June 2022

risk reward ratio day trading

Suggestions On Risk Reward And Also Finance In Forex Trading

Forex is the brand-new gold rush for the net age. Trillions of bucks exchange hands daily, as well as every brand-new investor from Caracas to The golden state is persuaded that there's gold in them there hills.

Your broker in Forex is an important factor that you require to consider. That can only end in an extremely not successful business relationship as well as most likely cost you some money.

Stay away from the software application that declare that they can aid you forecast what the market is going to do. There are none that are shown to be precise and also if you invest your hard made money on them, you are bound to lose that cash along with the money that you put on the market.

To avoid investing greater than you intended or can afford, establish a spending plan or limitation for your forex costs. While you do not have to fret about charges, the temptation to invest more than your means permit may be strong, so a precise spending plan will enable you to reach your objectives while appreciating your limitations.

To keep yourself from a margin contact the Foreign exchange market, never placed greater than 1% to 2% of your account on a solitary profession. Manage your setting so that if the cost violates you, you will not lose more than that amount. This will help keep your losses to a minimum.

Open a demo account at two different Forex trading business. Each Foreign exchange trading business has a various trading system and coming to be acquainted with several trading platforms permits you to select a firm with a platform that is most instinctive for you. A system that is awkward for you leads to less victories.

To find the excellent minute to invest, pay attention to both the place price and also the forward price. The forward price suggests the provided value of a money at a specific factor of time, regardless of its spot rate. The place price shows the current variation and enables you to guess the upcoming fad.

Financial information can drastically influence Forex markets. In order to do well in Foreign exchange, you will certainly consequently require to be able to comprehend the news which implies having a standard expertise of international business economics.

Never hurry also rapidly for the gold around. Unlike San Francisco in the mid 1800s, the wealth on Forex isn't mosting likely to run out. It is necessary to be individual and also to learn more about the marketplace before you try to make a profit. Being ready to capitalize on opportunity with a knowledgeable hand is how you earn money in this market.

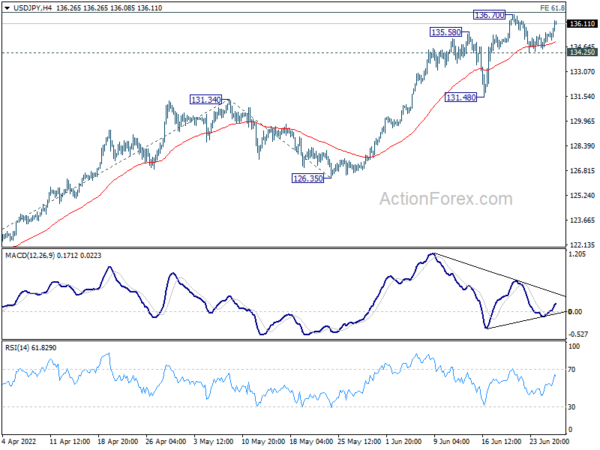

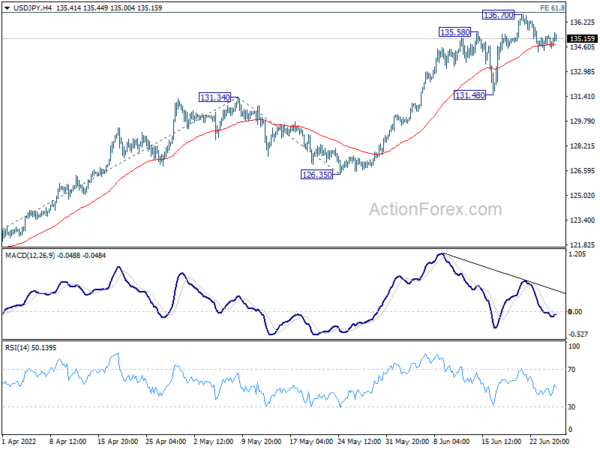

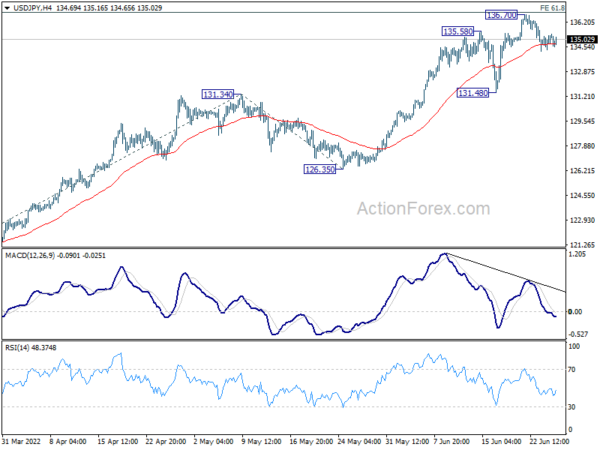

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 134.82; (P) 135.18; (R1) 135.85; More… USD/JPY rebounds notably today but stays below 136.70 resistance. Intraday bias stay neutral first. On the upside, decisive break of break of 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81 will extend larger uptrend. Next target is 100% projection at 143.29. On the downside, […]

The post USD/JPY Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/ST0Qs6

http://dlvr.it/ST0Qs6

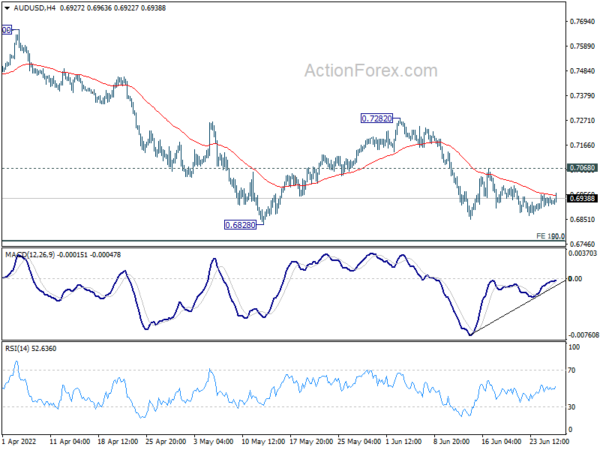

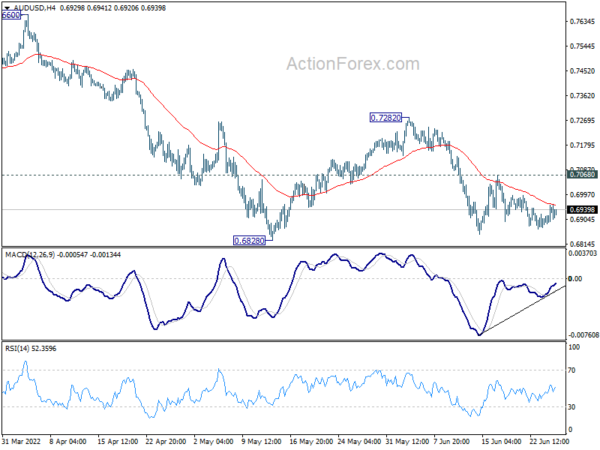

AUD/USD Daily Report

Daily Pivots: (S1) 0.6902; (P) 0.6930; (R1) 0.6953; More… Intraday bias in AUD/USD remains neutral as sideway consolidation continues. On the downside, firm break of 0.6828 support will resume larger fall from 0.8006. Next target is 0.6756/60 cluster support. On the upside, above 0.7068 minor resistance will bring stronger rebound to 0.7282 resistance first. Firm […]

The post AUD/USD Daily Report appeared first on Action Forex.

http://dlvr.it/SSzJx7

http://dlvr.it/SSzJx7

FX option expiries for 28 June 10am New York cut

There isn't anything significant to take note of in terms of expiries for today.

That will keep the focus on risk sentiment and the technicals once again as we settle into the new week. Month-end flows will also be a factor to consider in the days ahead so just be wary of that.

For more information on how to use this data, you may refer to this post here.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SSz227

http://dlvr.it/SSz227

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5215; (P) 1.5257; (R1) 1.5330; More… Intraday bias in EUR/AUD stays neutral for the moment. On the upside, sustained break of 1.5354 support turned resistance will indicate medium term bottoming at 1.4318. Stronger rally would be seen back to 100% projection of 1.4318 to 1.5277 from 1.4759 at 1.5718. On the downside, […]

The post EUR/AUD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSz14k

http://dlvr.it/SSz14k

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.0092; (P) 1.0125; (R1) 1.0153; More…. EUR/CHF is losing some downside momentum. But further decline is still expected with 1.0214 resistance intact. Further fall would be seen to retest 0.9970 low. Decisive break there will resume larger down trend. On the upside, however, above 1.0214 minor resistance will delay the bearish case, […]

The post EUR/CHF Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSz141

http://dlvr.it/SSz141

AUD/USD Daily Report

Daily Pivots: (S1) 0.6902; (P) 0.6930; (R1) 0.6953; More… Intraday bias in AUD/USD remains neutral as sideway consolidation continues. On the downside, firm break of 0.6828 support will resume larger fall from 0.8006. Next target is 0.6756/60 cluster support. On the upside, above 0.7068 minor resistance will bring stronger rebound to 0.7282 resistance first. Firm […]

The post AUD/USD Daily Report appeared first on Action Forex.

http://dlvr.it/SSyz1R

http://dlvr.it/SSyz1R

Has the Chinese Stock Market Bottomed? See This Technical Analysis of CSI 300.

* Today, China cut the time inbound visitors have to stay in quarantine from 3 weeks to 10 days. This sign of easing is positive for the Chinese stock market

* The CSI 300 index is one of China's most watched stock market indices. It follows 300 large and medium-sized stocks in Shanghai and Shenzhen

* The chinese stock market index was down nearly 37% from its all-time-high (ATH) on Feb 2021 to its recent low on April 2022, and is now just over 24% down from the ATH

* The CSI 300 chart shows strong and persistent buying pressure in the last 5 trading weeks, supporting the notion that the Chinese stock market bottomed on 27 April, which is a good candidate for the low of the year

* The following video presents a bullish technical analysis of the Chinese stock market as represented by the CSI 300 index

Trade CSI 300 or any other Chinese stock at your own risk.

This article was written by ForexLive at www.forexlive.com.

http://dlvr.it/SSyyHX

http://dlvr.it/SSyyHX

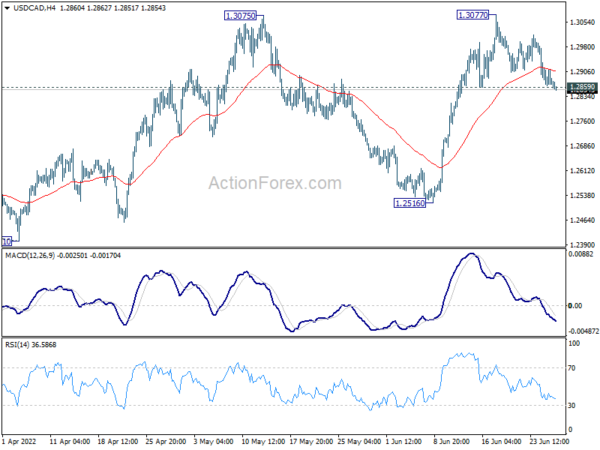

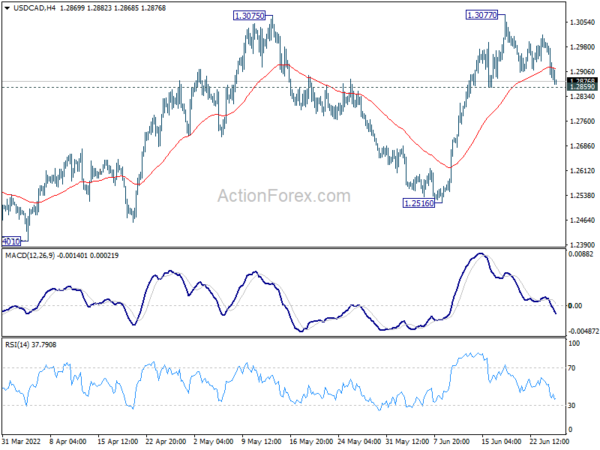

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2854; (P) 1.2885; (R1) 1.2906; More… Break of 1.2859 minor support suggest that deeper correction is underway in USD/CAD. Intraday bias is back on the downside for 55 day EMA (now at 1.2789. Sustained break there will target 1.2516 support next. On the upside, break of 1.3077 and sustained trading above 1.3022 […]

The post USD/CAD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSysSX

http://dlvr.it/SSysSX

Heads up: ECB speakers coming up later today

Here is the agenda:

0800 GMT - ECB president Lagarde delivers introductory speech0830 GMT - ECB chief economist Lane chairs panel discussions*1100 GMT - ECB executive board member Panetta chairs discussion on digital currencies, digital euro

*first session will be on globalisation and labour markets, second session will be on energy price volatility in Europe

Given the details, I don't think we will be getting much on ECB policy as the topics don't cover the key areas that markets are scrutinising at the moment. The policy panel discussion tomorrow (involving Lagarde, Powell, Bailey) will be the main highlight this week.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SSywnQ

http://dlvr.it/SSywnQ

Trading plan for Bitcoin Cash on June 28, 2022

Technical outlook:

Bitcoin Cash dropped through the $107.00 lows in the early hours on Tuesday, inching closer to interim support at around the $106.00 levels. The crypto is seen to be trading close to $111.00 at this point in writing and is expected to resume its rally soon towards the $210 initial resistance marked on the daily chart. The bottom line is that prices should stay above $106.00.

Bitcoin Cash has also cropped between $1,650 and $106, carving a meaningful larger degree downswing. The drop looks like a corrective zigzag (5-3-5) pattern and might be complete at 106.00. A break lower could drag further towards $63.00 before finding support again. As long as 106.00 is in place, bulls can come back strong from current levels.

Bitcoin Cash has carved a lower degree upswing between $106.00 and $125.00 recently. Prices seem to have retraced from the above upswing and bulls might be preparing to resume higher towards $210. Traders might remain inclined to hold long positions for now against the $106.00 interim support.

Trading plan:

Potential rally through $210 against $106

Good luck!The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SSywBL

http://dlvr.it/SSywBL

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 134.59; (P) 134.99; (R1) 135.63; More… Intraday bias in USD/JPY remains neutral for consolidation below 136.70. Deeper retreat could be seen, but downside should be contained above 131.48 support to bring rebound. On the upside, break of 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81 will target 100% projection at […]

The post USD/JPY Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SSywTz

http://dlvr.it/SSywTz

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9523; (P) 0.9578; (R1) 0.9634; More… Intraday bias in USD/CHF is neutral for the moment. Fall from 1.0048 is still seen as the third leg of the consolidation pattern from 1.0063. Strong support should be seen around 0.9543 to bring rebound. On the upside, above 0.9731 minor resistance will turn bias back […]

The post USD/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SSywRH

http://dlvr.it/SSywRH

Trading plan for Ripple on June 28, 2022

Technical outlook:

Ripple dropped through the $0.33900 lows during the early Asian session on Monday after reaching the $0.38700 highs over the weekend. The crypto is seen to be trading close to $0.34500 at this point in writing and is expected to resume its rally soon towards $0.41000 initial resistance as marked up on the daily chart.

Ripple has carved a meaningful larger degree downswing between $1.91600 and $0.28700 in the past several months. The drop looks corrective (Standard Flat) and might be complete at around $0.28700. If the above-proposed structure holds well, prices should rally straight towards $0.41000 from here confirming a potential bottom in place around $0.28700.

Ripple has potentially carved a lower degree upswing between $0.28700 and $0.38700 in the past few trading sessions. Prices are retracing at the moment but bulls are expected to come back in control soon and extend the rally through $0.41000 in the near term. Traders might be preparing for another leg higher through $0.41000 against $0.28700.

Trading plan:

Potential rally through $0.41000 against $0.28700

Good luck!The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SSyvW8

http://dlvr.it/SSyvW8

Monday 27 June 2022

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9523; (P) 0.9578; (R1) 0.9634; More… No change in the view that fall from 1.0048 is still seen as the third leg of the consolidation pattern from 1.0063. Strong support should be seen around 0.9543 to bring rebound. On the upside, above 0.9731 minor resistance will turn bias back to the upside […]

The post USD/CHF Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSw1wD

http://dlvr.it/SSw1wD

USD/JPY Daily Outlook

Daily Pivots: (S1) 134.59; (P) 134.99; (R1) 135.63; More… Intraday bias in USD/JPY remains neutral for consolidation below 136.70. Deeper retreat could be seen, but downside should be contained above 131.48 support to bring rebound. On the upside, break of 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81 will target 100% projection at […]

The post USD/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSw1KH

http://dlvr.it/SSw1KH

AUD/USD Daily Report

Daily Pivots: (S1) 0.6902; (P) 0.6930; (R1) 0.6972; More… Sideway trading continues in AUD/USD and intraday bias remains neutral. On the downside, firm break of 0.6828 support will resume larger fall from 0.8006. Next target is 0.6756/60 cluster support. On the upside, above 0.7068 minor resistance will bring stronger rebound to 0.7282 resistance first. Firm […]

The post AUD/USD Daily Report appeared first on Action Forex.

http://dlvr.it/SSw1Gd

http://dlvr.it/SSw1Gd

Central bank speakers in focus this week

The ECB will be hosting a forum on central banking this week and that is scheduled for 27 to 29 June. Today's agenda will feature welcome remarks by Lagarde at 1730 GMT but we will get more interesting lineups in the days ahead.

The big one will be a policy panel discussion on Wednesday at 1300 GMT, featuring Lagarde, Powell, and Bailey. That will last for about 1.5 hours, so one can expect there to be some good mix of policy remarks. The full agenda can be found here.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SSvhgN

http://dlvr.it/SSvhgN

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8557; (P) 0.8599; (R1) 0.8624; More… Intraday bias in EUR/GBP remains neutral for the moment, as range trading continues. Further rally is expected with 0.8484 support intact. On the upside, break of 0.8720 and sustained trading above 0.8697 medium term fibonacci level will carry larger bullish implication. Next target is 0.9003 fibonacci […]

The post EUR/GBP Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSvgWC

http://dlvr.it/SSvgWC

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5153; (P) 1.5217; (R1) 1.5265; More… Intraday bias in EUR/AUD remains neutral at this point. On the upside, sustained break of 1.5354 support turned resistance will indicate medium term bottoming at 1.4318. Stronger rally would be seen back to 100% projection of 1.4318 to 1.5277 from 1.4759 at 1.5718. On the downside, […]

The post EUR/AUD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSvgR9

http://dlvr.it/SSvgR9

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.0066; (P) 1.0102; (R1) 1.0154; More…. With 1.0214 resistance intact, further decline is expected in EUR/CHF to retest 0.9970 low. Decisive break there will resume larger down trend. On the upside, however, above 1.0214 minor resistance will delay the bearish case, and turn bias back to the upside for stronger rebound. In […]

The post EUR/CHF Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSvdMD

http://dlvr.it/SSvdMD

Fedex Stock (FDX) Technical Analysis

* Get the Technical Analysis for FedEx Stock (FDX) in 2 minutes

* FDX is inside a potential bull flag. Bullish flag formations are effective continuation patterns in strong uptrends. The "pole" of the flag arises from a stock's vertical increase; the "flag" is from consolidation (when the stock trades in a range, typically sideways to slightly down, when applied to flags of a bull flag)

* More upside for FedEx stock and a reasonable time to scale in, meaning to buy shares as the price cools down. Best is to set your buy order ahead of time and wait for the order to fill.

* 1st entry price for FDX: $ 240.35

* 2nd entry price for FDX: $ 231.29

* 3rd entry price for FDX: $ 225.70

* Average entry price, if and when all of the above buy orders get filled, would be: $ 233.41

* Stop Loss (sell and exit the entire position): $ 193.95

* Take Profit (partial or all, where you would exit the position with a profit): $ 312.16

* Watch the FDX stock technical analysis video below!

Buy or trade FDX at your own risk only. Visit ForexLive.com for upcoming stock technical analyses!

This article was written by ForexLive at www.forexlive.com.

http://dlvr.it/SSvch8

http://dlvr.it/SSvch8

USD/JPY Daily Outlook

Daily Pivots: (S1) 134.59; (P) 134.99; (R1) 135.63; More… Intraday bias in USD/JPY remains neutral for consolidation below 136.70. Deeper retreat could be seen, but downside should be contained above 131.48 support to bring rebound. On the upside, break of 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81 will target 100% projection at […]

The post USD/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSvb9n

http://dlvr.it/SSvb9n

AUD/USD Daily Report

Daily Pivots: (S1) 0.6902; (P) 0.6930; (R1) 0.6972; More… Sideway trading continues in AUD/USD and intraday bias remains neutral. On the downside, firm break of 0.6828 support will resume larger fall from 0.8006. Next target is 0.6756/60 cluster support. On the upside, above 0.7068 minor resistance will bring stronger rebound to 0.7282 resistance first. Firm […]

The post AUD/USD Daily Report appeared first on Action Forex.

http://dlvr.it/SSvb8W

http://dlvr.it/SSvb8W

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2855; (P) 1.2931; (R1) 1.2973; More… Intraday bias in USD/CAD remains neutral at this point, further rally is mildly in favor with 1.2859 support intact. On the upside, break of 1.3077 and sustained trading above 1.3022 fibonacci level will carry larger bullish implications. Next target is 100% projection of 1.2005 to 1.2947 […]

The post USD/CAD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SSvZGH

http://dlvr.it/SSvZGH

Sunday 26 June 2022

Five EU countries seek to delay the EU ban on petroleum-powered cars

European energy policy today is a clash of idealism with reality.

The energy crisis last winter with another one set to come this year is a sign of a political class that's experienced in sloganeering and little else.

Some countries are now trying to plan more-constructively for the next phase, which is the transition from gasoline and diesel-powered automobiles. Italy, Portugal, Slovakia, Bulgaria and Romania want to push back the effective ban of fuel-powered cars to 2040 from 2035.

More here.

This article was written by Adam Button at www.forexlive.com.

http://dlvr.it/SSskgZ

http://dlvr.it/SSskgZ

Subscribe to:

Posts (Atom)

Federal Court Orders Unregistered Pool Operator and its President to Pay Over $11 Million ...

... forex ) and forex futures contracts. Instead of trading pool participants' funds, Robinson and QYUHI misappropriated all of the po...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...