Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Friday 31 March 2023

Forex Today: NASDAQ 100 Index Starts a Bull Market - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/QEDMXZu

via IFTTT

Thursday 30 March 2023

FOREX-Dollar steadies in uneasy market calm - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/Ed1jZAo

via IFTTT

Wednesday 29 March 2023

forex is rigged reddit. 34 within the final 24 hours, Jim Cramer cla - Opt-potolok.ru

from Google Alert - ALL ABOUT FOREX https://ift.tt/Yna4jFK

via IFTTT

Gold Technical Analysis: Testing Historical Top of $2000 - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/8W1N0nd

via IFTTT

Monday 27 March 2023

Trading, It's All That Matters Stocks, Business Matters,Investor Stock Forex Market Currency ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/EmHpgxR

via IFTTT

Sunday 26 March 2023

Saturday 25 March 2023

Thursday 23 March 2023

Why not all forex brokers works in usa?

from Google Alert - ALL ABOUT FOREX https://ift.tt/JX9WEjN

via IFTTT

Court Upholds XTB's 2018 Differential Slippage Penalty

from Google Alert - ALL ABOUT FOREX https://ift.tt/jmCW2pv

via IFTTT

NZD/USD Technical Analysis

http://dlvr.it/SlLD08

Wednesday 22 March 2023

Owatonna native part of Oscar-winning FX team for 'Avatar 2: The Way of Water' - KEYC

from Google Alert - ALL ABOUT FOREX https://ift.tt/fE2YcaM

via IFTTT

What forex pairs are moving right now?

Forex trading has always been an attractive option to many but its complexities act as a deterrent. If you are looking at trading in the Forex market, you would need some tools, some indicators, and a good trading platform to help you along. Here I’ve reviewed a popular ClickBank product – Forex Trendy. Let’s take an in-depth view into what this is!

Forex Trendy is a software-based Forex trading tool that does not require any downloads for use. It does an automatic study of 34 currency pairs across nine primary time zones (that’s 306 charts) and presents easy, actionable data for you. Forex trading, is an international trading process, is working around the clock. The currency pairs selected by the program are the more popular ones and include gold, silver, and oil. It helps detect the soundest trending ones.

You can purchase a three-month membership to begin, giving you access to a member’s area to which you can log in from any device and place. There are no downloads to be done at all! The member’s area contains live charts of trending currency pairs and automated analysis of "Triangles, Flags, Wedges and Trend Lines on 34 currency pairs and all time frames” as a bonus, states the website. This gives you an overview of trading setups with high probability ratios. There is also an automated pattern-finding tool included that analyses various charts and shows up emerging patterns saving you precious time and energy poring over complex charts, trying to figure out a pattern for yourself! I loved this feature!

An important point to note here is that Forex Trendy does not include a trading platform. You will require your own account at a Forex trading platform like MetaTrader or NinjaTrader or any other.

The Creators

Not much is known about who is actually behind the product. The product designer has successfully kept his identity a secret, so with even a bit of in-depth research, I could not locate a name that I could associate with the product. All we have is the name of the service – Forex Trendy, a company name. This product can be purchase online only and is a ClickBank associate.

Positives

Forex Trendy has a lot that’s going well for it. Here are some of the pros of the product:

- The alert system can be set up to be visual, audio as well as via emails or to your phone via an SMS. You can choose whatever suits you best.

- You do not have to deal with CDs or any downloads to your machine.

- You can choose to increase or decrease the trade frequency as per your individual requirement.

- The chart patterns are displayed in easy-to-understand visuals.

- You can opt for any trade platform to work with the actual trading. It does not restrict or recommend any one specific platform unlike most other products out there.

- You get a free ebook called “Understanding the Myths of Market Trends and Patterns” which is a plus and makes for informative reading material.

- With its wide range of currency pairs and chart analysis, it can bring to attention trends that even seasoned traders may miss at times!

- Priced at $37 for a three-month membership, it is one of the most reasonably-priced items in the Forex trading tools niche.

Negatives

Forex trading is never easy, and no product is perfect – you just need to know how to correctly use the tool you have to get what you want. Here are some areas where I found Forex Trendy to be lacking and could do with some face-lifting:

- A service like this should have a live chat option or someone who you can speak to in real-time. I would like to know that if I have an issue now, I can just reach out to someone to sort it out immediately – after all, the markets are live!

- It’s a targeted service better suited to manual trading. It does not get into automatic trades for you. So you are looking for software to run on auto-pilot while you sit back, this is not for you.

- This is not for complete beginners. You need a little know-how about the Forex market, be able to make your trades, and so on. If you’ve been in the Forex trading market even briefly, only then will you find this product helpful?

- The customer support could do better. The emails are answered fairly, and they are timely, but sometimes you just need more prompt actionable advice.

My Verdict

Overall, Forex Trendy has been around for years, and it has a lot of satisfied members so obviously, it is doing something right! I have seen a lot of 90% accuracy claims from actual users on forums. This builds my trust. Also, the charts inside the member’s area make sense to me; they are updated in real-time and have had reliable results. It’s not a scam, and that’s for sure! The 60-day money-back guarantee and low tie-in of a three-monthly membership plan make it a product you can definitely try out!

Overall, Forex Trendy has been around for years, and it has a lot of satisfied members so obviously, it is doing something right! I have seen a lot of 90% accuracy claims from actual users on forums. This builds my trust. Also, the charts inside the member’s area make sense to me; they are updated in real-time and have had reliable results. It’s not a scam, and that’s for sure! The 60-day money-back guarantee and low tie-in of a three-monthly membership plan make it a product you can definitely try out!

My advice is this: first learn all you can about Forex trading, try it a little on your own and then venture ahead with Forex Trendy- it will then surely guide you well.

Forex Trendy

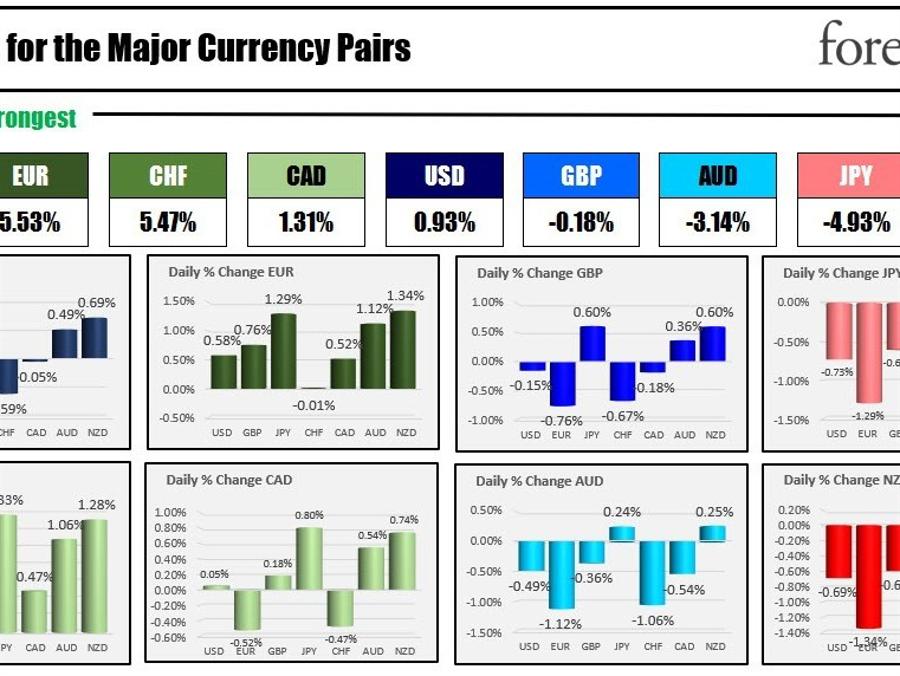

The EUR is the strongest and the NZD is the weakest as the North American session begins

http://dlvr.it/SlHCPz

Tuesday 21 March 2023

UBS Buys Credit Suisse to End Stress - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/9EIDkGl

via IFTTT

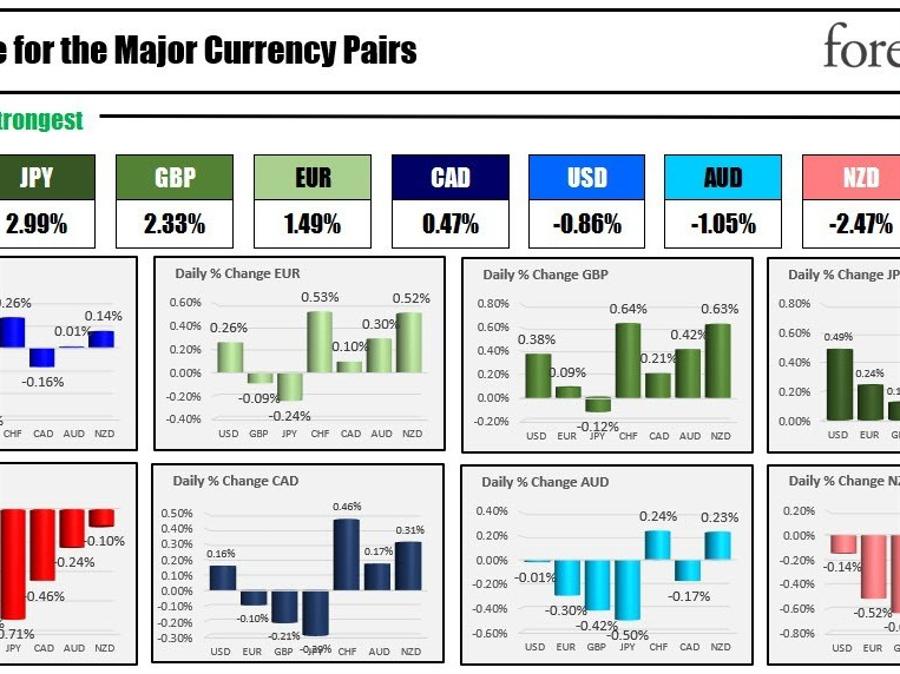

The JPY is the strongest and the CHF is the weakest as the North American session begins

http://dlvr.it/SlD8Mt

Monday 20 March 2023

Forex trading in the UK: regulation and legalities | Business Law Donut

from Google Alert - ALL ABOUT FOREX https://ift.tt/MksOSr3

via IFTTT

EURUSD,M1 Real Time Forex Chart nektar Analysis Page 1 - Myfxbook.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/YqHEKAo

via IFTTT

Sunday 19 March 2023

Closing an Anxious Week With Risk Assets Looking Increasingly Bearish - FXLeaders

from Google Alert - ALL ABOUT FOREX https://ift.tt/zKH6rfD

via IFTTT

The quiet Fed is ready to speak

http://dlvr.it/Sl8k45

my forex funds trade disabled. html>idxnln

from Google Alert - ALL ABOUT FOREX https://ift.tt/ayGBuhi

via IFTTT

Where does most bank forex trade happen?

from Google Alert - ALL ABOUT FOREX https://ift.tt/GNtwzQ9

via IFTTT

AUD/USD Price Analysis: Bulls eye a break into the 0.67s - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/e3YwJF7

via IFTTT

All UK phones to get emergency alert system to warn of life-threatening events - PTI

from Google Alert - ALL ABOUT FOREX https://ift.tt/tFX4yo1

via IFTTT

Fed interest rate decision with technical analysis and forecast

http://dlvr.it/Sl7wLN

Saturday 18 March 2023

Press Trust of India: Forex kitty down by USD 2.39 bn to USD 560 bn - PTI

from Google Alert - ALL ABOUT FOREX https://ift.tt/snMFATi

via IFTTT

Week Ahead – More Turmoil to Come? - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/NKsGfko

via IFTTT

US Industrial Production Remains Unchanged in February - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/XL1fUiK

via IFTTT

USD/JPY Technical Analysis

http://dlvr.it/Sl4sVj

Friday 17 March 2023

Weekly Forex Outlook: 17/03/2023 - Fed decision to fuel volatility in nervous market

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=-vA7FNOiNRA

via IFTTT

U.S. dollar closes lower on Taipei forex market - Focus Taiwan

from Google Alert - ALL ABOUT FOREX https://ift.tt/0sF9PxQ

via IFTTT

Nasdaq Composite Technical Analysis

http://dlvr.it/Sl2P8r

Forex Today: SNB Bails Out Credit Suisse - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/oHSnr1y

via IFTTT

Thursday 16 March 2023

FREE FALL BANKS? Post Market Report 15-Mar-23 Banking Stocks went for free fall due to Global banks Turmoil. ▻ Open account with Delta Exchange and get 10% off on trading ... #15mar

FREE FALL BANKS? Post Market Report 15-Mar-23 Banking Stocks went for free fall due to Global banks Turmoil. ▻ Open account with Delta Exchange and get 10% off on trading ... #15mar

All the balls are in the air now. Yields move lower. Stocks lower. USD higher...mostly - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=BNm0mmVQoTk

via IFTTT

Wednesday 15 March 2023

Vidsensation Demo Review | With a special bonus You MUST WATCH this

there is a much better,easier way to generate 100,000sof free visitors to your offers, pages & links working just 15 min/day..

EUR/USD Mid-Day Outlook

http://dlvr.it/SkvvQS

Tuesday 14 March 2023

Dealing with multi-currency inventory risk in foreign exchange cash markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/1ILsmHc

via IFTTT

forex strategy reddit. SMC theory. analysis, scalping is predicated u - INCH Housing

from Google Alert - ALL ABOUT FOREX https://ift.tt/KDCkrAQ

via IFTTT

FOREX-Dollar gains after tepid U.S. consumer prices report - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/Cq2JoxO

via IFTTT

AUD/USD Forex Signal: Waits for US Inflation Data - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/JRmvp3A

via IFTTT

Everything You Need to Know about Decentralized Forex Trading - BrokerXplorer

from Google Alert - ALL ABOUT FOREX https://ift.tt/07KljLV

via IFTTT

TRY/USD Forecast: Continues to Record Losses Against the US dollar - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/Kp18EIW

via IFTTT

GBP/USD Mid-Day Outlook

http://dlvr.it/Skrr81

Monday 13 March 2023

Forex Today: US Introduces New Bank Backstop Protecting All Deposits - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/NKP65Zv

via IFTTT

Search results for: 'Forex Club福瑞斯金融✔️推荐外汇天眼➡️wikifx123.com ... - Suvasa

from Google Alert - ALL ABOUT FOREX https://ift.tt/L7XtnAc

via IFTTT

Weekly Forex Forecast –S&P 500 Index, AUD/CHF, 2-Year Treasury Yield - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/6FN9wIi

via IFTTT

EUR/USD Daily Outlook

http://dlvr.it/SknsNp

Sunday 12 March 2023

Forex decline | Nepali Times

from Google Alert - ALL ABOUT FOREX https://ift.tt/kBzu76s

via IFTTT

EUR/AUD Weekly Outlook

http://dlvr.it/SklqGD

Saturday 11 March 2023

free online forex screener. 08:00 - 17:00; London time +44 (0)20 38

from Google Alert - ALL ABOUT FOREX https://ift.tt/aAef1Wg

via IFTTT

All the Forex Live Trading accounts are fake. The original one is bann... - TikTok

from Google Alert - ALL ABOUT FOREX https://ift.tt/02BXn5C

via IFTTT

UOB One: The One To Rule Them All

from Google Alert - ALL ABOUT FOREX https://ift.tt/X91Im3V

via IFTTT

What are all of the forex exotic currency pairs?

from Google Alert - ALL ABOUT FOREX https://ift.tt/oZLhK8C

via IFTTT

The benefits of adding forex trading to an investment portfolio - Business Review

from Google Alert - ALL ABOUT FOREX https://ift.tt/dMyLOr3

via IFTTT

Forex Reserves Rise For First Time In Five Weeks To $562.40 Billion - ABP LIVE

from Google Alert - ALL ABOUT FOREX https://ift.tt/rTDfRS1

via IFTTT

With Hundreds of Platforms Around, Information Gives FX Traders an Edge

from Google Alert - ALL ABOUT FOREX https://ift.tt/XSkdRgp

via IFTTT

USD/CHF Mid-Day Outlook

http://dlvr.it/Skjlbp

Friday 10 March 2023

TSX Stumbles to Conclude Negative Week - Baystreet.ca

from Google Alert - ALL ABOUT FOREX https://www.baystreet.ca/articles/marketupdates/85678/031023

via IFTTT

FOREX-Dollar weakens after U.S. payroll data suggests slowing inflation - Nasdaq

from Google Alert - ALL ABOUT FOREX https://ift.tt/HRXuESG

via IFTTT

Forex Customer Service Jobs - 2023 | Indeed.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/mK4QpB5

via IFTTT

USD/CHF Daily Outlook

http://dlvr.it/Skfwyp

USD/JPY Daily Outlook

http://dlvr.it/Skfwty

AUD/USD Daily Report

http://dlvr.it/Skfwqg

Thursday 9 March 2023

Forex Today: Bank of Canada Dovish on Inflation - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/HLc8KCb

via IFTTT

USD/MXN Forecast: USD Continues to Drift Lower - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/OsgTmJz

via IFTTT

A bullish case for the Nasdaq 100 - Forex.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/RV6ZNfG

via IFTTT

support and resistance videos by forex strategy factory

Secret to double your forex account

in a day.

#الشباب_الفيحاء#BirleşeBirleşeBaşaracağız#KCORPWIN#SPOARS#النصر_الاتحاد

GBP/USD Forex Signal: Bears Prevail as Crosses Key Support - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/KDPEUqt

via IFTTT

You deserve all the flowers in the world... 08.03.2023 - InstaForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/vOsPhR5

via IFTTT

USD/CHF Mid-Day Outlook

http://dlvr.it/SkbwVf

Wednesday 8 March 2023

Impact of News-Worthy Events on the Forex Market - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/tThUaRC

via IFTTT

FOREX-Dollar hits 3-mth high as Powell flags higher rates - Nasdaq

from Google Alert - ALL ABOUT FOREX https://ift.tt/25wz9CJ

via IFTTT

How Does Forex Trading Through ECN Work? - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/FDBXrHJ

via IFTTT

MechForex robot forex system review

MechForex Trading Robot Is The First 100% A.I Forex Robot With Proven Performance!

Now fast forward to modern times to a Forex trading robot. This is a everyday term for algorithmic trading which is based on a set of Forex market signals that helps determine whether to buy or sell a currency pair at a given point in time. These systems are often fully mechanical and integrate with online Forex brokers or exchange platforms. And newly launched is a leading trading robot – and one that’s the latest hot news having taken the market by storm. MechForex Trading Robot.

Not only is MechForex Trading Robot the leading trading robot in the world – it is THE ONLY ONE of its kind.

This unique robot can make money without the intervention of monetary management methods such as martingale. MechForex Trading Robot cleverly susses out market trends and monitors all business news and knows instantly when to stay in or out and ahead of the money market.

This unique trading robot has a staggering 30 different algorithms built into its distinctive structure, therefore allowing it to instantly adapt to all fluctuating market conditions.

MechForex Trading Robot has an over 97% success rate and all results can be verified on MyFxBook.

Volatile Week Ahead as Risk Events Eyed - Action Forex

from Google Alert - ALL ABOUT FOREX https://www.actionforex.com/contributors/fundamental-analysis/489749-volatile-week-ahead-as-risk-events-eyed/

via IFTTT

China's Forex Reserves Fell in February - Stock market news - MarketScreener

from Google Alert - ALL ABOUT FOREX https://ift.tt/SHiK6RW

via IFTTT

EUR/USD Mid-Day Outlook

http://dlvr.it/SkXv7K

Tuesday 7 March 2023

FOREX-Powell's warning on higher U.S. rates pushes dollar to 3-mth high - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/2BdOK8Z

via IFTTT

HIBOR Plunge Gives Wings to Carry Trades, Sustainability in Question - Finance Magnates

from Google Alert - ALL ABOUT FOREX https://ift.tt/qBhreAz

via IFTTT

China's forex regulator says offshore remittance policy remains unchanged as it plays down ... - MSN

from Google Alert - ALL ABOUT FOREX https://ift.tt/9nezIkS

via IFTTT

Page 35 of 35 - All about Forex trading - DadForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/69x1IBA

via IFTTT

EUR/GBP Daily Outlook

http://dlvr.it/SkTpd0

Monday 6 March 2023

Kenyan Forex Crisis: Central Bank Orders Financial Institutions to Ration Dollars

from Google Alert - ALL ABOUT FOREX https://ift.tt/cFbjxDC

via IFTTT

USD/CAD Daily Outlook

http://dlvr.it/SkQpJL

AUD/USD Daily Report

http://dlvr.it/SkQpDF

EUR/USD Daily Outlook

http://dlvr.it/SkQp8W

GBP/USD Daily Outlook

http://dlvr.it/SkQp5b

USD/CHF Daily Outlook

http://dlvr.it/SkQp0c

Saxo Bank's February FX Volume Sinks despite a Stronger ADV

from Google Alert - ALL ABOUT FOREX https://ift.tt/qWYdgkf

via IFTTT

Sunday 5 March 2023

Forex Expert Breaks Down INR Movement, Dots Critical Levels & Key Indicators

from Google Alert - ALL ABOUT FOREX https://ift.tt/LbPKJg1

via IFTTT

RBA Expected to Hike by 25bp Tomorrow - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/QwNByAk

via IFTTT

International forex trading Group | Best Forex Signal Provider - Facebook

from Google Alert - ALL ABOUT FOREX https://ift.tt/7QSW0lk

via IFTTT

6ixBuzzTV on Twitter: "What happened to all the forex traders?" / Twitter

from Google Alert - ALL ABOUT FOREX https://twitter.com/6ixbuzztv/status/1631100849874141186

via IFTTT

Warning: Misleading App Uses ForexLive Brand to Target Traders - Finance Magnates

from Google Alert - ALL ABOUT FOREX https://ift.tt/h6C0Wp2

via IFTTT

Saturday 4 March 2023

China comes to rescue again: SBP receives $500m loan from Chinese bank

from Google Alert - ALL ABOUT FOREX https://ift.tt/P8hT37j

via IFTTT

Pakistani Central Bank Forex Reserves Rise 556 Mln USD | MENAFN.COM

from Google Alert - ALL ABOUT FOREX https://ift.tt/sl3CdLa

via IFTTT

Forex Reserves Drops $325 Mn To $561 Bn - BW Businessworld

from Google Alert - ALL ABOUT FOREX https://ift.tt/lsbJAEf

via IFTTT

Forex Investor Group | Facebook

from Google Alert - ALL ABOUT FOREX https://ift.tt/zSxDnJ3

via IFTTT

USD/CAD Weekly Outlook

http://dlvr.it/SkLXMz

GBP/JPY Weekly Outlook

http://dlvr.it/SkLX9g

EUR/JPY Weekly Outlook

http://dlvr.it/SkLX8P

'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...