The major averages all finished the day in negative territory following the mixed performance on Tuesday, with the Dow closing lower for the third ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/wpI68mN

via IFTTT

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Thursday 29 February 2024

2024 Forex.com reviews

Forex.com is a regulated broker that can service all types of fx traders but its emphasis on fast, reliable execution makes it a good fit for the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/jMIPnmJ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/jMIPnmJ

via IFTTT

Is FX's Shōgun in English? - Escapist Magazine

FX's new historical drama, Shōgun, takes its audience all the way to feudal Japan. So, is FX's Shōgun in English?

from Google Alert - ALL ABOUT FOREX https://ift.tt/n5TMBim

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/n5TMBim

via IFTTT

Internet Down while trading forex - YouTube

... Forex VPS Here: https://ift.tt/3LaNXOf How To Beat The Markets: Step 1. Subscribe to MPG Forex and turn On All Notifications. Step 2 ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=6pMHElS3wNA

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=6pMHElS3wNA

via IFTTT

FOREX-Markets brace for US inflation reading, yen strengthens on BOJ comments

FOREX-Markets brace for US inflation reading, yen strengthens on BOJ comments ... All rights reserved.

from Google Alert - ALL ABOUT FOREX https://ift.tt/7lMGsYO

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7lMGsYO

via IFTTT

Blocking Binance P2P Not The Answer To FX Issues- Crypto Community - YouTube

Blocking Binance P2P Not The Answer To FX Issues- Crypto Community. 700 ... Did CBN really shut down all crypto websites? Techpoint Africa New 121 ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=iTpC6G8c2BY

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=iTpC6G8c2BY

via IFTTT

Dow Jones Forecast: DJIA rises after inflation cools - FOREX.com

Meanwhile, should the trendline support hold, buyers could look for a rise of 39240 for fresh all-time highs. FX markets – USD falls, USD/JPY drops.

from Google Alert - ALL ABOUT FOREX https://ift.tt/EagXcfI

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/EagXcfI

via IFTTT

Frequently Asked Questions | trueforexfunds.com

About True Forex Funds. What is True Forex Funds? · General Information. What Is the Funded Program? · Evaluation & Funding. What Is Phase 1? · Trading ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/T6kI5sc

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/T6kI5sc

via IFTTT

Belarusian Broker MTBankFX Announces End of Global Investment Operations

Dedicated Forex cloud solutions with stable and fast cross-border ... All information these cookies collect is aggregated and therefore anonymous.

from Google Alert - ALL ABOUT FOREX https://ift.tt/rHChyIw

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/rHChyIw

via IFTTT

Event Design Ideas From FX's Shōgun Premiere | BizBash

How This Jaw-Dropping Event Design Transported Guests Into the World of FX's Latest Series ... All rights reserved.

from Google Alert - ALL ABOUT FOREX https://ift.tt/8AnZrQg

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/8AnZrQg

via IFTTT

FOREX IS DEAD ! IT'S TIME TO MOVE ON... - YouTube

Forex has become a very sketchy industry with all of the nonsense going on. FTMO no longer accepting US clients, most well known brokers being ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=dWt4-_Ny_mQ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=dWt4-_Ny_mQ

via IFTTT

For all that think Forex is just noise

Ali Casey from the Youtube channel StatOasis stated that forex is just noise at this point and that futures are far better if you want to trade ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/b9BokgS

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/b9BokgS

via IFTTT

A four book box set for trading forex, with all you need t by Nuvvug - SoundCloud

Stream #% A Complete Forex Trading Library: A four book box set for trading forex, with all you need t by Nuvvug on desktop and mobile.

from Google Alert - ALL ABOUT FOREX https://ift.tt/7rIpD0f

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7rIpD0f

via IFTTT

Wednesday 28 February 2024

What would be the most profitable 10 minute trade of all time. : r/Forex - Reddit

he traded in his name and not a company so was on the hook for about 5m, last i heard he ended up selling his house and settled with the broker for a ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/dbPAu7C

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/dbPAu7C

via IFTTT

Forex Today: Inflation and rate cut bets come to the fore - FXStreet

On February 29, all the attention will be on the inflation gauged by the PCE, along with Personal Income, Personal Spending, Pending Home Sales and ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/94UycYN

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/94UycYN

via IFTTT

Toncoin is on its way to an all-time high amidst the Telegram advertising platform launch

Forex brokers in United States Forex brokers in United Kingdom Forex brokers in Australia Forex ... Toncoin is on its way to an all-time high amidst ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/i1UR2po

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/i1UR2po

via IFTTT

There's Been a Regime Change in FX, Says TD's McCormick - Bloomberg

In the context of the FX market, there's been a dramatic regime change,” said Mark McCormick, global ... Help©2024 Bloomberg L.P. All Rights Reserved.

from Google Alert - ALL ABOUT FOREX https://ift.tt/NHmt8Bz

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NHmt8Bz

via IFTTT

Bitcoin reaches new all-time high, inflation data outlook | IG International

Start trading forex today ... Trade the largest and most volatile financial market in the world. Spreads start at just 0.6 points on EUR/USD; Analyse ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/sRmTck9

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/sRmTck9

via IFTTT

Samsung Introduces Galaxy Ring To Track Health - Forex News by FX Leaders

“As a new addition to our wearables portfolio, Galaxy Ring will offer users an all-new way to simplify everyday wellness, empowering them with greater ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/k86hMpd

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/k86hMpd

via IFTTT

2024 Is foreign exchange trading profitable - Na Nadgarstek

In the past few years, forex trading has grown a lot, with more and more traders from all over the world getting involved and hoping to make a lot ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/GbJrZLy

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/GbJrZLy

via IFTTT

Can you trade forex in Africa?

Tax returns for the year must include information on all income, including gains from Forex trading, for South African residents. ... all out-of-pocket ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/nzegPH5

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/nzegPH5

via IFTTT

How China Is Tantalizing – And Maddening – FX Traders Everywhere - Forbes

Though all three dynamics have great impact, this last one is worth exploring as Asia's biggest economy stumbles. Suffice to say, China's year isn't ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/2kO1mMK

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/2kO1mMK

via IFTTT

Tuesday 27 February 2024

Forex Prop-Firms Force USA Traders Out! What's Next? (My Reaction) - YouTube

Watch More Interviews: Female Trader Explains How She Made It to $60000 Days in Forex ... This 22-Year-Old Kid Sacrificed EVERYTHING to Earn $12,000 ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=ylsZ2al_cTI

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=ylsZ2al_cTI

via IFTTT

Demo VS Live Forex Trading Facts ♂️ ♂️ #forextrading #forexmillionaire #patrexpro - YouTube

It's also advisable to use same amount you used in demo for live account...small amount you can increase a little at a time as you progress in ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=Hct3WK52bek

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=Hct3WK52bek

via IFTTT

Hays Travel to recruit forex cashiers ahead of peak summer period

... all its 470 branches have a dedicated cashier over the peak summer holiday period. Applicants aged 17 are sought for the flexible FX consultant roles.

from Google Alert - ALL ABOUT FOREX https://ift.tt/E2Y37fw

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/E2Y37fw

via IFTTT

American Horror Story: Stream and Scream FX's anthology horror series (and its spinoff!) on these ...

Where can I watch all American Horror Story seasons? Image credit: FX. As of this writing, there are 12 seasons of American Horror Story, the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/4h51DXM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/4h51DXM

via IFTTT

NYC professor and Wall Street widow donates $1 billion to Bronx medical school so that all ...

Forex Factory. View full page at forexfactory.com. NYC professor and Wall Street widow donates $1 billion to Bronx medical school so that all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/tNGHirV

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/tNGHirV

via IFTTT

Best Forex cards to use in Germany: Features, Types, Charges - Fly Finance

The bank offers multi-currency Forex cards to students going to Germany or any other country. The card supports all the major currencies including the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/3tYcI7s

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/3tYcI7s

via IFTTT

Why a Historian Is Looking Forward to the New Shōgun Series - Time

What kind of Shōgun will we see? All the clues suggest a break from the 1980 miniseries and a return to what made the book so special. Read More: FX's ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/tHk8hPX

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/tHk8hPX

via IFTTT

For all my brothers in the trenches.... : r/Forex - Reddit

Nobody's responded to this post yet. Add your thoughts and get the conversation going.

from Google Alert - ALL ABOUT FOREX https://ift.tt/EDIF3um

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/EDIF3um

via IFTTT

Standard Chartered Bank Forex Card: Check All Details Here - Fly Finance

Anybody who is an Indian citizen and has a savings account with StanChart Bank can get a Forex Card. In this blog, we will discuss all the major ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/8tVmORv

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/8tVmORv

via IFTTT

Popular currency pairs - Forex Client Sentiment

Forex Sentiment with contrarian indicators for the widely traded forex markets ... You can accept all or manage them individually. More options. Accept ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Qn4XkUq

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Qn4XkUq

via IFTTT

BitForex Plunges Offline amidst $57 Million Crypto Withdrawal Mystery - Finance Magnates

... Forex Education · Cryptocurrency Education · Fintech Education · Industry Terms ... All rights reserved.For more information, read our Terms, Cookies ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZTspym8

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZTspym8

via IFTTT

Monday 26 February 2024

FX's "Shogun" Scores Stunning Reviews - Dark Horizons

FX's “Shogun” Scores Stunning Reviews ... This adaptation handles it all adeptly without ever surrendering the forward momentum of its compelling plot.

from Google Alert - ALL ABOUT FOREX https://ift.tt/7PRd83W

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7PRd83W

via IFTTT

Click Bait or Cash Grab? Spotting Forex Trading Scams on Instagram - Auvoria Prime

Brag about Fake Riches: They show off expensive stuff, like fancy cars and trips, pretending they got it all from forex trading. Promise Easy ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/j9Ft2Xv

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/j9Ft2Xv

via IFTTT

What is Equity in Forex Trading? - PrimeXBT

Forex equity reflects all funds; real and unrealized in a Forex trader's account. This includes free margin, trading balance, the value of all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/QXa1LhA

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/QXa1LhA

via IFTTT

Sunday 25 February 2024

Razorpay Blog - All Things Payments | All Things Fintech

All About Forex & More · June 19, 2023 7 Mins Read. What is an Exchange Rate? An exchange rate is the rate at which one currency is exchanged for ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/5raAq3V

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/5raAq3V

via IFTTT

Forex crisis threatens modular refineries N25bn daily crude input - Punch Newspapers

Nigeria has 25 licenced modular refineries with a combined capacity of producing 200,000 barrels of crude oil daily. Although not all of the plants ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/wIVP0ih

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/wIVP0ih

via IFTTT

Yen Volatility Set to Fall as Dueling Forces Curb Trading Range | Forex Factory

The Services Producer Price Index (All items) rose 2.1 percent from the previous year. The Services ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/p6D1Zu3

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/p6D1Zu3

via IFTTT

All About Lois hiring Expert forex trader in Nigeria | LinkedIn

Posted 3:21:27 PM. Company Description We are a virtual career and tech hub specializing in recruitment, headhunting…See this and similar jobs on ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Bsb5Hcv

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Bsb5Hcv

via IFTTT

Week Ahead: What are markets watching this week? - FXStreet

All in all, it will be a busy week for the markets. US data in the ... USD/JPY forex trade review [Video]. By Zan K | Feb 22, 18:26 GMT. Wells Fargo ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/wXzvD2S

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/wXzvD2S

via IFTTT

US equity indices refresh record highs; Further upside? - FXStreet

Forex MAJORS. Cryptocurrencies. Signatures. ©2024 "FXStreet" All Rights ... Note: All information on this page is subject to change. The use of ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/owBd4Ag

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/owBd4Ag

via IFTTT

Supply And Demand Weekly Forex Forecast - All Major Forex Pairs - YouTube

forexforecast #fundamentalanalysis #forexanalysis Join the supply and demand technical and fundamental analysis Discord coaching group!

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=gMzz8k3yyf8

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=gMzz8k3yyf8

via IFTTT

Saturday 24 February 2024

Buffett's Berkshire posts record profit, quarterly results also rise - XM

... forex news, technical analysis, investment topics, daily outlook and daily videos ... For all of 2023, Berkshire posted a net profit of $96.2 billion ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/qrLaZOi

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/qrLaZOi

via IFTTT

Speculators, Unscrupulous Individuals Sabotaging Nigeria's Reform Efforts, Says ... - Arise News

The Minister of Information and National Orientation, Mohammad Idris, made the allegation on the fierce resistance the monetary system was facing in a ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/5w0SKxJ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/5w0SKxJ

via IFTTT

Trader Mike on X: "Have all forex prop firms banned us traders at this point?" / X

Have all forex prop firms banned us traders at this point? 2:55 PM · Feb 24, 2024. ·. 12.6K. Views. 3. Reposts · 71. Likes. 2. Bookmarks.

from Google Alert - ALL ABOUT FOREX https://twitter.com/tradermike1234/status/1761404523711537363

via IFTTT

from Google Alert - ALL ABOUT FOREX https://twitter.com/tradermike1234/status/1761404523711537363

via IFTTT

Actors Hiroyuki Sanada & Anna Sawai discuss authenticity of FX series 'Shōgun' - YouTube

Actors Hiroyuki Sanada & Anna Sawai discuss authenticity of FX series 'Shōgun' ... MAGA all in on Trump at CPAC: Michael Moore x Melber. MSNBC New 345K ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=jYx_ZlhxRQ4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=jYx_ZlhxRQ4

via IFTTT

Forex Update: India's Foreign Exchange Reserves Fall $5.24 Billion to $617.23 Billion

The Indian rupees is expected to move between 82.80 to 83.10 in the coming week again with inflows dominating and RBI in all probability buying the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/BLOk6KP

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/BLOk6KP

via IFTTT

CBN hikes BDC license to N2bn, issues new guidelines on FX transactions

Previously, a minimum capital requirement from N35 million was set for all BDCs. 2. Banks, NGOs, Government Agencies are barred from owning or ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/2rTxw8U

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/2rTxw8U

via IFTTT

Ryan Murphy Teases New Horror Series 'Grotesquerie' on FX - The Hollywood Reporter

We use vendors that may also process your information to help provide our services. // This site is protected by reCAPTCHA Enterprise and the Google ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/zGSF7Md

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/zGSF7Md

via IFTTT

US Equities at All Time Highs as Rate Cut Odds Getting Pared Back - ForexTV

View All Result. ForexTV. News. Top News · Market News · Lifestyle · Forex News · Forex Analysis · Crypto News · NFT News · Small Business · Digital ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/mCokVw5

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/mCokVw5

via IFTTT

CBN: Sellers of FX above $10,000 must declare source to BDCs - Thecable.ng

CBN also mandated the sellers to “comply with all AML/CFT/CPF regulations and foreign exchange laws and regulations”. Also, the CBN said customers ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/FwEVZYa

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/FwEVZYa

via IFTTT

Everything we know about Shōgun, FX's upcoming historical drama series with a perfect ...

Cosmo Jarvis in Shogun. FX. What is Shōgun about? Shōgun is the story of John Blackthrone, an English sailor who is shipwrecked in Japan ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/RoqYAgj

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/RoqYAgj

via IFTTT

FOREX-Dollar index on track for first weekly fall this year - Nasdaq

FOREX-Dollar index on track for first weekly fall this year. Credit: REUTERS ... All Cookies”, you agree to the storing of cookies on your device to ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/7ZY3zn2

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7ZY3zn2

via IFTTT

Friday 23 February 2024

All I need is capital : r/Forex - Reddit

I have spent two years developing a strategy with a 80% win rate..all I've traded on demo till now and it rarely fails me but I need capital to be ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/GNvP56f

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/GNvP56f

via IFTTT

Foreign Exchange doesn't have to be Foreign - Investing.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/vrLcf7U

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/vrLcf7U

via IFTTT

N2bn capital requirement, no FX credit to customers' — CBN sets guidelines for BDCs

“Customers may transfer foreign currencies from their individual domiciliary accounts with Nigerian banks to BDCs,” the apex bank said. “All digital/ ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/q9OfDwa

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/q9OfDwa

via IFTTT

Mastering Forex: 7 Years of Proven Trading Strategies - YouTube

... all of you is to never away from your vision. There will be times in ... Mastering Forex: 7 Years of Proven Trading Strategies. 1.4K views · 6 hours ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=3Cb6Z1xqIpM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=3Cb6Z1xqIpM

via IFTTT

S&P 500 tests new all-time high for the second day in a row - Forex News by FX Leaders

The S&P 500 tested new all-time highs today as various macro factors and headline news rekindled the bullish momentum for the last 3 trading days of ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Kciadh5

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Kciadh5

via IFTTT

Auto File: All electric by ... later - XM

Forex; Índices; Acciones; Criptomonedas; Materias primas. Reuters. Auto File: All electric by ... later. 23 Feb, 2024 a las 4:00 p. m. GMT. Feb 23 - ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/fycltZQ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/fycltZQ

via IFTTT

Thursday 22 February 2024

Why September? - Action Forex

Assessing the inflation outlook instead requires information about its drivers, including labour costs, productivity and the balance of demand and ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/M1HctR3

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/M1HctR3

via IFTTT

Credit Card Interest Rate Margins Reach All-time High - Forex News by FX Leaders

The Consumer Financial Protection Bureau on Thursday said that the interest credit card companies earn on their loans has hit an all-time high.

from Google Alert - ALL ABOUT FOREX https://ift.tt/YToBlh4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/YToBlh4

via IFTTT

Why do you lose money in trading? | Page 3 - Forex Factory

Cos' y'all don't know how a martingale works.. Joking aside it's because folks are 1. Lazy 2. Don't know how to add up and 3.

from Google Alert - ALL ABOUT FOREX https://ift.tt/z35KAma

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/z35KAma

via IFTTT

Gold analysis: Rising yields could send metal below $2,000 again - FOREX.com

But with US data remaining mostly positive, with existing homes sales, manufacturing PMI and jobless claims all topping expectations today, the dollar ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/4Nk5AnF

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/4Nk5AnF

via IFTTT

Pornstar Rocco Siffredi bares it all in new series 'Supersex' - XM

All News; Forex; Indices; Stocks; Cryptocurrencies; Commodities. Reuters. Pornstar Rocco Siffredi bares it all in new series 'Supersex'. Feb 22, 2024 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/NcXFCBk

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NcXFCBk

via IFTTT

EUR/USD analysis: Dollar weakness could be temporary - FOREX.com

The EUR/USD rose along with most other FX majors in early European session on Thursday. They were all boosted by weakness in US dollar, thanks to ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/HTpkntK

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/HTpkntK

via IFTTT

Foreign Exchange Market: BDC Operators Welcome Efforts To Stabilize Naira - YouTube

Comments1 · The Kenyan Cult Leader Paul Mackenzie · News At 10 | 21/02/2024 · Flag Off Ceremony: Construction, Rehabilitation Of Roads In All Six Areas ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=IxvxQ-D7scw

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=IxvxQ-D7scw

via IFTTT

Nvidia Poised for New All-Time High After Earnings Beat, S&P 500 Buoyed - DailyFX

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/XNeZWo7

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/XNeZWo7

via IFTTT

Wednesday 21 February 2024

Forex Today: Markets now shift the attention to PMIs - FXStreet

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/RjxPfmt

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/RjxPfmt

via IFTTT

Speculations Over Fed's Next Move Grow Increasingly Complex - Action Forex

A notable highlight from the trade data was Japan's trade surplus with the US, amounting to JPY 415B, as exports reached an all-time high for the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/q8Hu7Cy

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/q8Hu7Cy

via IFTTT

Exclusive-Brazil readies broad FX hedging program with $2 billion in derivatives for green ...

Brazil's Finance Ministry, the central bank and the IDB all declined to comment. Brazil's central bank is expected to sign a comprehensive derivatives ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/U0KWXcH

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/U0KWXcH

via IFTTT

FX's Shōgun on Hulu follows the complexity of James Clavell's novel, an exclusive chat ... - KTVB

All Rights Reserved. Company Logo. 'Do Not Sell or Share My Personal Information' Notice. Like many content publishers, we provide online ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/sEdrC0q

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/sEdrC0q

via IFTTT

Africa's largest economy is battling a currency crisis and soaring inflation - CNBC

The Nigerian naira hit a new all-time low against the U.S. dollar on both the official and parallel foreign exchange markets on Monday, sliding to ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/AL13aKI

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/AL13aKI

via IFTTT

Dollar steadies ahead of Fed minutes, pound shrugs off record surplus

Business NewsMarketsForexDollar steadies ahead of Fed minutes, pound shrugs off record surplus ... All information these cookies collect is aggregated ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/0bd56KN

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/0bd56KN

via IFTTT

EFCC Raids Kano Foreign Exchange Market, Arrests 7 - Arise News

“The WAPA Forex Market is licensed and there are no fewer than two hundred licensed individual outfits here in the market. All our operations are ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/7Zpdv2E

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7Zpdv2E

via IFTTT

Everything about XAUUSD today (FOMC) - 21.02.2024 : r/Forex - Reddit

My areas of interest for today are as follows: 2034, 2036 - 2018, 2020 for possible reversal and 2025, 2027.50 for bearish continuation. However, it ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/GvURPti

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/GvURPti

via IFTTT

AMP Global

Exchange-Traded Futures + Forex & CFDs · All-In-One Metatrader 5 Account! · Experience AMP Global Advantage ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/BU8HoNZ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/BU8HoNZ

via IFTTT

Bryant Named 2024 AAI Award Nominee - LSU Athletics

A native of Cornelius, North Carolina, Bryant is a 17 time All-American (5 VT, 3 UB, 2 BB, 3 FX, 4 AA) and three-time All-SEC member. The senior ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/pB6429k

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/pB6429k

via IFTTT

Tuesday 20 February 2024

U.S. Stocks May See Further Downside In Early Trading - Forex News by FX Leaders

The major averages all ended weak, with the downside of the tech-laden Nasdaq more pronounced. The Dow, which briefly emerged into positive territory ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/r1vcRnE

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/r1vcRnE

via IFTTT

CBI sells +$200 million in forex on Tuesday - Shafaq News

CBI sells +$200 million in forex on Tuesday. Economy CBI ... CBI sells +$241 million in forex on Tuesday. ShafaqMockup. Be the First to Get All the News.

from Google Alert - ALL ABOUT FOREX https://ift.tt/wxj9MB4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/wxj9MB4

via IFTTT

3 Technical Forex Setups With High Profit Probability: EUR/USD, USD/JPY, GBP/USD

All CFDs (stocks, indexes, futures) and Forex and cryptocurrency prices are not provided by exchanges but rather by market makers, and so prices ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/bt85swV

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/bt85swV

via IFTTT

To all my hater's out there please continue to do so, if your not hating I'm not doing ... - Reddit

364K subscribers in the Forex community. Welcome to FXGears.com's Reddit Forex Trading Community! Here you can converse about trading ideas…

from Google Alert - ALL ABOUT FOREX https://ift.tt/3BJY61e

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/3BJY61e

via IFTTT

Some Nigerians Profiting From Naira's FX Market Mess - Business Correspondent

africanews New 677 views · 17:35 · Go to channel · Naira Reaches All Time Low Of 1,534 Per Dollar. TVC News Nigeria•2.4K views · 1:01 · Go to channel ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=M1EGjwwrWYs

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=M1EGjwwrWYs

via IFTTT

Monday 19 February 2024

New rules for the tax treatment of foreign currency transactions - Grant Thornton Philippines

Hence, taxpayers using average weekly or monthly rates, or any rates other than the required spot rates by the RMC, will need to convert all foreign ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/tlpLKWA

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/tlpLKWA

via IFTTT

Brazil: The economy grew by 3% in 2023 - Forex News by FX Leaders

Trading forex, cryptocurrencies, indices, and commodities are potentially high risk and may not be suitable for all investors. The high level of ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ndEMiup

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ndEMiup

via IFTTT

2.0 ALL to KYD Forex Currency Exchange Rate Conversion.

2.0 ALL to KYD Forex Currency Exchange Rate. We Use Mid-Market Exchange Rates. Amount. From. 00 - 00 Token, 1INCH - 1inch, AAVE - Aave, ABT - Arcblock ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/pxyrfqh

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/pxyrfqh

via IFTTT

TopStep Prop Firm Review - Pros & Cons Revealed

... information we provide on all the top Forex / CFD brokerages featured here. Our research focuses heavily on the broker's custody of client ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/NIyuXAw

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NIyuXAw

via IFTTT

What is forex trading? - AOL.com

Businesses that operate in more than one country, financial traders and people looking to travel abroad all have reason to engage in forex trading.

from Google Alert - ALL ABOUT FOREX https://ift.tt/LBkUw62

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/LBkUw62

via IFTTT

Naira loses 69% of its value against dollar since FX reforms - Businessday NG

Naira loses 69% of its value against dollar since FX reforms. BusinessDay. February 19, 2024. BusinessDay NG. 7.42K ... All Rights Reserved.

from Google Alert - ALL ABOUT FOREX https://ift.tt/tNoW4aJ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/tNoW4aJ

via IFTTT

Natural Gas Daily Technical Analysis February 19, 2024, by Chris Lewis for FX Empire

... information about Forex and Commodities News: News: https://ift.tt/0CZcgN4 Technical Analysis: https://ift.tt/jqynKhg ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=KpDxc3Xw3hg

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=KpDxc3Xw3hg

via IFTTT

Sunday 18 February 2024

India's debt, forex markets closed on Feb 19

The XM Research Desk, manned by market expert professionals, provides live daily updates on all the major events of the global markets in the form ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/0ucbjSK

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/0ucbjSK

via IFTTT

Olam Group says no evidence its Nigeria unit was involved in alleged forex fraud

Traders and investors use our platform. #1. Top website in the world when it comes to all things investing. 1.5M+.

from Google Alert - ALL ABOUT FOREX https://ift.tt/xZkHl1q

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/xZkHl1q

via IFTTT

NextEra Energy increases quarterly dividend to $0.515 - TradingPedia

Trading forex, stocks and commodities on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/NfiBF3m

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NfiBF3m

via IFTTT

Coming off another week of muddled macro messages - FXStreet

Forex markets. FX Traders will be closely watching the minutes from the ... Note: All information on this page is subject to change. The use of ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/nScY5F0

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/nScY5F0

via IFTTT

FX weekly — EUR/USD and 14 currency pair levels and targets - FXStreet

All easy targes to achive and all severely overbought. GBP/USD updates for next months: 1.2454, 1.2603, 1.2630, 1.2797, 1.2826, 1.3149, 1.3542. The 5 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/MbYLfDi

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/MbYLfDi

via IFTTT

It all boils down to what else: Uncomfortably warm inflation data - FXStreet

SPI Asset Management provides forex, commodities, and global indices ... Note: All information on this page is subject to change. The use of this ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/AOSYsJT

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/AOSYsJT

via IFTTT

Tinubu's forex policy hurriedly put together without proper strategy – Atiku - TheCitizen

Secondly, operating a successful fixed-exchange rate system would require sufficient FX reserves to defend the domestic currency at all times. But as ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/qdvszlN

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/qdvszlN

via IFTTT

Tinubu's Forex Policy Was Hurriedly Put Together – Atiku - Channels Television

Secondly, operating a successful fixed-exchange rate system would require sufficient FX reserves to defend the domestic currency at all times. But ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/982vHC5

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/982vHC5

via IFTTT

FX week in review: HYCM acquired, Prop trading firms scramble, OANDA patent suit thrown out

Plaintiff OANDA Corporation and defendant StoneX Group, Inc. are both providers of online foreign currency trading and information services. OANDA has ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/O5VAnSM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/O5VAnSM

via IFTTT

What should I do and don't when self learning forex? - Reddit

No one makes money from books, they're often written by legit traders. Don't: ask online for opinions (you'll never get facts as the other guy ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/5RysaDM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/5RysaDM

via IFTTT

Monterrey And Santos Laguna Deliver - Forex Factory

The match showcased top-tier expertise, unimaginable targets, and nail-biting moments that left an enduring impression on all who had been fortunate ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/AlerYvB

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/AlerYvB

via IFTTT

Celsius Shares Could Be Ready to Break Out…Again - FX Empire

Celsius Holdings Price Prediction. The CELH rally isn't new at all. Big Money buying in the shares is signaling to take notice. Given the historical ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ehxsK0f

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ehxsK0f

via IFTTT

The Week Ahead: Forex Markets Brace for Volatility Amidst Monetary Policy Uncertainty

... All Cookies. Company Logo. Privacy Preference Center. When you visit any website, it may store or retrieve information on your browser, mostly in the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZvEDUBF

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZvEDUBF

via IFTTT

Saturday 17 February 2024

Nigeria's Headline Inflation Increases as Central Bank Intensifies Foreign Exchange Controls

The Nigerian currency, the naira, has been losing ground against major currencies and recently it plunged to an all-time low against the U.S. dollar.

from Google Alert - ALL ABOUT FOREX https://ift.tt/CpmAKNr

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/CpmAKNr

via IFTTT

Three White Soldiers pattern brings BTC to Fork in the road - FX Empire

Bitcoin would go into the 2024 bull run with all holders in profits already, this would likely cause the bull run to be a true parabolic form. Both ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ho3E5jd

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ho3E5jd

via IFTTT

LOVESAC DEADLINE ALERT: Bragar Eagel & Squire, P.C. Reminds Investors that a Class ...

Forex Trader Tools. Pivot Point Calculator · Currency Converter · Global ... all persons and entities who purchased or otherwise acquired Lovesac ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/1stO9QM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/1stO9QM

via IFTTT

Weekly outlook and setups VOL 229 (19-23.02.2024) | FOREX, Indices - YouTube

Trading the financial markets involves risk and is not suitable for all investors. Before deciding to invest in foreign exchange or another ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=5nyva0g3yQc

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=5nyva0g3yQc

via IFTTT

Peak TV is dead, says FX's John Landgraf. Long live peak TV? - KCRW

Plus, FX head John Landgraf says that peak TV is over. What does that really mean? Kim Masters and Matt Belloni investigate. A Mickey Mouse clapback?

from Google Alert - ALL ABOUT FOREX https://ift.tt/I3USonL

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/I3USonL

via IFTTT

Friday 16 February 2024

India's Forex Reserves Decline $5.2 Billion, RBI's Intervention to Defend Rupee

In October 2021, the country's foreign exchange reserves touched an all-time high of about $645 billion. Much of the decline, though marginal on a ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/QKUuRdA

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/QKUuRdA

via IFTTT

Forexlive Americas FX news wrap: The FX market was unconvinced by the PPI report

CPI and import/export prices were both surprisingly high and now PPI has joined in to complete the trio. Those are three different data sets but all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Ss9mgpV

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Ss9mgpV

via IFTTT

Don Novo & Son Recalls RTE Meat Products For Listeria Concern - Forex News by FX Leaders

shrink-wrapped packages containing “Don Novo MORTADELLA CUBANA CUBAN BRAND MORTADELA. All the impacted products come with an expiry date of 3/30/2024.

from Google Alert - ALL ABOUT FOREX https://ift.tt/Y5A7Tvp

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Y5A7Tvp

via IFTTT

All Major Actors & Cast List for FX's Shōgun - Escapist Magazine

The cast of the upcoming series Shogun is pretty impressive. Here are all the major actors and the cast list for FX's Shogun.

from Google Alert - ALL ABOUT FOREX https://ift.tt/6HfUdEQ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/6HfUdEQ

via IFTTT

Trade ideas for Gold, Silver, WTI Crude and Forex [Video] - FXStreet

EURUSD recovered almost all of Tuesday's steep losses on the weak retail sales number. We hit the sell level & just held below the stop. USDJPY ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/xocLjVk

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/xocLjVk

via IFTTT

Forex Trading: What You Need to Know | IG US

Find out everything you need to know about forex trading. Learn more about how forex markets work, the currency pairs available and the risk ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/mSwgeCd

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/mSwgeCd

via IFTTT

Nasdaq Rallies, USD Pulls Back After 'Flipped Out' Comment - FOREX.com

But this has also been met with a considerable number of dovish pushes from Fed members. That's not all too different than what started to show in ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/wydEPJa

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/wydEPJa

via IFTTT

Forex Reserves Fall By $5.24 Billion To $617.2 Billion, Says RBI - NDTV Profit

The country's forex kitty had reached an all-time high of $645 billion in October 2021. The reserves took a hit as the central bank deployed the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/X3Vk0e4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/X3Vk0e4

via IFTTT

FX Talking: Forecasts table | articles - ING Think

Stay up to date with all of ING's latest economic and financial analysis. ... ® 2024 ING Bank N.V.. All rights reserved.

from Google Alert - ALL ABOUT FOREX https://ift.tt/VlgKJIF

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/VlgKJIF

via IFTTT

Electrolux Recalls Fridge Due To Electrocution Hazards - Forex News by FX Leaders

Although no incidents or injuries have been reported, consumers are still advised to visit https://ift.tt/nRGs7MJinformation ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/qb9ZODf

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/qb9ZODf

via IFTTT

Thursday 15 February 2024

GBPUSD declines as UK slips into technical recession | FXCM Markets

All three sectors – services, production, and construction output – showed ... Forex News: Trading Strategies & Tools Forex Terms · What Is The ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Q0K9xRM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Q0K9xRM

via IFTTT

Gold Price Forecast - Gold Markets Continue Overall Recovery - FX Empire

If we can break above there, then it's likely that the market could go looking to the 50-day EMA. All things being equal, it is worth noting that we ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ITFacjm

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ITFacjm

via IFTTT

Forecast for GBP/USD on February 15, 2024

GBP/USD

Yesterday, the UK inflation data came out weaker than expected. The Core CPI edged higher by 5.1% YoY in January, missing estimates of 5.2%. On a monthly basis, core CPI slid to -0.9%, against expectations of -0.8%. Month-on-month, the headline CPI fell to -0.6% (forecast -0.3%), and on an annual basis, it also remained at 4.0% against forecasts of an increase to 4.1% YoY. Retail prices and housing prices declined. As a result, the pound fell by 27 pips.

Today, the UK will release several reports. GDP for the 4th quarter is expected to grow by only 0.1% YoY, compared to 0.3% YoY in the previous period, due to a contraction of GDP in the 4th quarter by 0.1%. The consensus estimate for December is expected to be -0.2% MoM. Industrial production for December is expected to contract by 0.1%, and the trade balance is expected to worsen from -14.2 billion pounds to -15.0 billion pounds.

In the US, industrial production for January is expected to increase by 0.2%. Market players expect mixed indicators for retail sales. Based on these preliminary data, we expect the pound to fall further.

Yesterday, the pound fell slightly short of the target support at 1.2524 and showed a corrective move with its weak growth. From a technical perspective, this helps us with confirming the main bearish scenario since the risk of forming convergence with the oscillator has been eliminated. At the same time, we see the price moving below the level of 1.2610 and below the MACD line (blue). Overcoming the support level of 1.2524 paves the way for the price to reach the target at 1.2373.

On the 4-hour chart, the price is moving below the balance and MACD indicator lines, with the Marlin oscillator in a downtrend territory. We are waiting for the price to consolidate below 1.2524 to reveal the main scenario. If the pound strengthens above the level of 1.2610, this will delay the main plan.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2mkhW

Yesterday, the UK inflation data came out weaker than expected. The Core CPI edged higher by 5.1% YoY in January, missing estimates of 5.2%. On a monthly basis, core CPI slid to -0.9%, against expectations of -0.8%. Month-on-month, the headline CPI fell to -0.6% (forecast -0.3%), and on an annual basis, it also remained at 4.0% against forecasts of an increase to 4.1% YoY. Retail prices and housing prices declined. As a result, the pound fell by 27 pips.

Today, the UK will release several reports. GDP for the 4th quarter is expected to grow by only 0.1% YoY, compared to 0.3% YoY in the previous period, due to a contraction of GDP in the 4th quarter by 0.1%. The consensus estimate for December is expected to be -0.2% MoM. Industrial production for December is expected to contract by 0.1%, and the trade balance is expected to worsen from -14.2 billion pounds to -15.0 billion pounds.

In the US, industrial production for January is expected to increase by 0.2%. Market players expect mixed indicators for retail sales. Based on these preliminary data, we expect the pound to fall further.

Yesterday, the pound fell slightly short of the target support at 1.2524 and showed a corrective move with its weak growth. From a technical perspective, this helps us with confirming the main bearish scenario since the risk of forming convergence with the oscillator has been eliminated. At the same time, we see the price moving below the level of 1.2610 and below the MACD line (blue). Overcoming the support level of 1.2524 paves the way for the price to reach the target at 1.2373.

On the 4-hour chart, the price is moving below the balance and MACD indicator lines, with the Marlin oscillator in a downtrend territory. We are waiting for the price to consolidate below 1.2524 to reveal the main scenario. If the pound strengthens above the level of 1.2610, this will delay the main plan.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2mkhW

Wednesday 14 February 2024

Watch Dow Jones, S&P 500, Nasdaq All Up - Beyond the Bell - Bloomberg

FX · Factor Investing · Alternative Investing · Economic Calendar · Markets ... Dow Jones, S&P 500, Nasdaq All Up - Beyond the Bell. Bloomberg Markets: ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/FNmGPv7

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/FNmGPv7

via IFTTT

Rapid Forex Fluctuations “Not Good” for Economy: MOF Official - The Japan News

By clicking “Accept all,” you will allow the use of these cookies. Accept all. Reject all. Users accessing this site from EEA countries and UK are ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/WjDKpcM

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/WjDKpcM

via IFTTT

Forex Today: Rate cuts and data remain in the spotlight - FXStreet

On February 15, GDP figures will grab all the attention in the domestic calendar along with the final Industrial Production results. AUD/USD regained ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/womq15T

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/womq15T

via IFTTT

Let's say the Fed doesn't cut at all this year... - Forexlive

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/PNAgT0z

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/PNAgT0z

via IFTTT

USDCHF breaks above the 200 day MA. Key break. Staying above keeps the buyers in control.

If you offered me all the bitcoin in the world for $25, I wouldn't take ... Kickstart your FX trading on Febrary 14 with a technical look at the 3 major ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=50vWeePLIYw

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=50vWeePLIYw

via IFTTT

Forex Today: UK Inflation Unchanged at 4.0% - DailyForex

As expected, this lower number saw US stock markets selloff, with the major equity indices the S&P 500 and the NASDAQ 100 and the Dow Jones 30 all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/lQbKWBH

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/lQbKWBH

via IFTTT

USD/JPY breaks 150 as bulls eye 152, AUD/USD seems on track for 64c - FOREX.com

US inflation data was broadly higher than expected, which triggered well defined moves in favour of the US dollar and to the detriment of all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/WjIt1R7

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/WjIt1R7

via IFTTT

GBP/USD trading plan for European session on February 14, 2024. COT report and overview of yesterday's trades. The pound

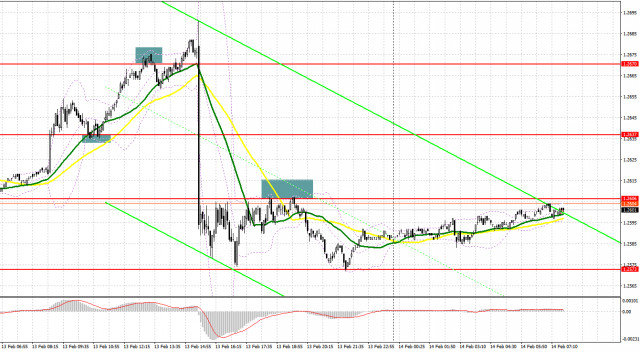

Yesterday, GBP/USD generated several signals to enter the market. Now let's look at the 5-minute chart and try to figure out what actually happened. In my morning forecast, I indicated the level of 1.2637 and planned to make decisions on entering the market from there. A breakout and upward retest of 1.2637 generated a buy signal, which sent the pair up by more than 35 pips. In the afternoon, a false breakout at 1.2670 produced a sell signal. As a result, the pair was down by more than 80 pips.

For long positions on GBP/USD:

Yesterday's UK labor market data reminds us that the Bank of England's rates need to be kept at current highs for as long as possible. This morning, the UK Consumer Price Index will be published. If inflation increases, the pound may quickly regain its position, which it lost yesterday after the US inflation data. But if inflation falls, GBP/USD will likely fall further.

I plan to look for buying opportunities on dips, ensuring that buyers are present around 1.2573. A false breakout of this level, similar to what I discussed above, would serve as a buy signal, aiming for a recovery towards 1.2651, where the moving averages are currently aligned in favor of sellers. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2652, which would be a strong correction for the pair. The ultimate target will be the 1.2690 high where I intend to take profit. In a scenario where GBP/USD falls and there are no buyers at 1.2573, we might see another pound sell-off, which will revive the bear market and cross out all the bulls' plans for further correction. In such a scenario, only a false breakout near the next support at 1.2543 would provide an entry signal. I would immediately go long on a bounce from the 1.2519 low, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers are in control of the market and their goal is to keep the pair below the nearest resistance at 1.2615. In case GBP/USD attempts to recover in the first half of the day, I plan to sell GBP/USD only after forming a false breakout, as this would confirm the presence of major sellers in the market, creating a sell signal that will give bears a chance to move the price down to the area of 1.2573 - yesterday's low. Only a breakout and a retest from below will deal a more serious blow to the buyers' positions, leading to the removal of stop orders and opening the way to 1.2543, where I anticipate big buyers to show up. The next target would be low of 1.2519, where I plan to take profits. If GBP/USD grows and there are no bears at 1.2615, and if we receive strong UK inflation data, the bulls will try to regain the market's favor in hopes of a correction. In such a case, I will postpone sales until the price performs a false breakout at 1.2652. If there is no downward movement there, I will sell GBP/USD on a bounce right from 1.2690, considering a downward correction of 30-35 pips within the day.

COT report:

In the COT report (Commitment of Traders) for February 6, we find an increase in both long and short positions. Although traders already have a clear view of the Bank of England's future policy, which intends to actively control inflation, the pound is not in a rush to show growth. Recent statements by BoE officials indicate a soft wait-and-see stance that can change at any moment – if, of course, the data allows. In the near future, we can look forward to UK reports on the labor market, wage growth, and inflation, which can significantly change the balance of power in the market. But don't forget to consider the Federal Reserve's wait-and-see position, so uncertainties are much greater now than before. The latest COT report said that long non-commercial positions rose by 6,437 to 83,936, while short non-commercial positions increased by 6,115 to 49,461. As a result, the spread between long and short positions decreased by 2,374.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower boundary near 1.2555 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2kTls

For long positions on GBP/USD:

Yesterday's UK labor market data reminds us that the Bank of England's rates need to be kept at current highs for as long as possible. This morning, the UK Consumer Price Index will be published. If inflation increases, the pound may quickly regain its position, which it lost yesterday after the US inflation data. But if inflation falls, GBP/USD will likely fall further.

I plan to look for buying opportunities on dips, ensuring that buyers are present around 1.2573. A false breakout of this level, similar to what I discussed above, would serve as a buy signal, aiming for a recovery towards 1.2651, where the moving averages are currently aligned in favor of sellers. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2652, which would be a strong correction for the pair. The ultimate target will be the 1.2690 high where I intend to take profit. In a scenario where GBP/USD falls and there are no buyers at 1.2573, we might see another pound sell-off, which will revive the bear market and cross out all the bulls' plans for further correction. In such a scenario, only a false breakout near the next support at 1.2543 would provide an entry signal. I would immediately go long on a bounce from the 1.2519 low, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers are in control of the market and their goal is to keep the pair below the nearest resistance at 1.2615. In case GBP/USD attempts to recover in the first half of the day, I plan to sell GBP/USD only after forming a false breakout, as this would confirm the presence of major sellers in the market, creating a sell signal that will give bears a chance to move the price down to the area of 1.2573 - yesterday's low. Only a breakout and a retest from below will deal a more serious blow to the buyers' positions, leading to the removal of stop orders and opening the way to 1.2543, where I anticipate big buyers to show up. The next target would be low of 1.2519, where I plan to take profits. If GBP/USD grows and there are no bears at 1.2615, and if we receive strong UK inflation data, the bulls will try to regain the market's favor in hopes of a correction. In such a case, I will postpone sales until the price performs a false breakout at 1.2652. If there is no downward movement there, I will sell GBP/USD on a bounce right from 1.2690, considering a downward correction of 30-35 pips within the day.

COT report:

In the COT report (Commitment of Traders) for February 6, we find an increase in both long and short positions. Although traders already have a clear view of the Bank of England's future policy, which intends to actively control inflation, the pound is not in a rush to show growth. Recent statements by BoE officials indicate a soft wait-and-see stance that can change at any moment – if, of course, the data allows. In the near future, we can look forward to UK reports on the labor market, wage growth, and inflation, which can significantly change the balance of power in the market. But don't forget to consider the Federal Reserve's wait-and-see position, so uncertainties are much greater now than before. The latest COT report said that long non-commercial positions rose by 6,437 to 83,936, while short non-commercial positions increased by 6,115 to 49,461. As a result, the spread between long and short positions decreased by 2,374.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower boundary near 1.2555 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2kTls

Inflationary explosion in the US: how do the dollar and bonds react?

The consequences of high inflation are felt across the financial market. Specifically, the main Wall Street indices reacted to this news with a decrease after the publication of data indicating a higher than expected rise in consumer prices. This event pressured the expectations regarding the imminent lowering of interest rates, which in turn led to an increase in the yield of US Treasury bonds.

Among other things, the Dow Jones Industrial Average recorded its most significant drop in almost 11 months after the US Department of Labor's report showed an unexpected increase in consumer prices in January, especially due to the rise in housing costs.

Against this backdrop, market indices, which were on the rise in anticipation that the Federal Reserve System (FRS) would begin to lower rates as early as May, showed negative dynamics. The S&P 500 index, for example, closed above the 5000 point mark for the first time, and the Dow Jones index traded near record-high values. However, the publication of inflation data revised expectations regarding the FRS's policy, increasing the likelihood that rate cuts may not occur until June.

Mega-cap companies sensitive to rates, such as Microsoft, Alphabet, Amazon.com, and Meta Platforms, showed a decrease in stock prices amid the rise in yields of US Treasury bonds to a two-month high. A similar situation was observed among chip manufacturers, including Micron Technology, Qualcomm, and Broadcom, which led to a 2% drop in the Philadelphia SE Semiconductor index.

The real estate, consumer discretionary, and utilities sectors faced the most significant losses among the 11 major industry indices of the S&P 500, especially real estate, which reached its lowest values in more than two months.

Small-cap companies also felt the pressure, with the Russell 2000 index showing the most significant daily drop since June 2022.

"Various statements by Federal Reserve System officials in recent weeks have indicated that the market-anticipated rate cuts in the first half of the year might have been premature. The latest consumer price index data certainly confirms this trend," commented Bob Elliott from Unlimited Funds.

The consumer inflation data followed a modest revision of inflation figures for the last quarter of 2023, giving investors temporary relief regarding inflation expectations.

The Cboe Volatility Index reached its highest level since November, highlighting the growing market concern. The S&P 500 and Nasdaq Composite indices lost 1.37% and 1.79% respectively, while the Dow Jones Industrial Average fell by 1.36%, marking its most significant decline since March 2023.

Among other developments, JetBlue Airways shares surged by 21.6% after Carl Icahn disclosed his stake in the company, calling the shares "undervalued." Arista Networks' shares declined by 5.5% following a gross profit forecast below expectations, and Marriott International lost value after forecasting annual earnings below analyst expectations.

Cadence Design Systems and toy manufacturer Hasbro also faced a drop in share value after publishing gloomy forecasts. Meanwhile, Tripadvisor shares jumped by 13.8% following the announcement of the creation of a special committee to review deal proposals.

The total trading volume on US exchanges reached 12.9 billion shares, comparable to the average of the last 20 sessions at 11.71 billion shares.

The US stock market continues to demonstrate record levels, supported by leading technology companies and expectations of Federal Reserve rate cuts. The global stock index MSCI and the Stoxx 600 European index also showed a decline amid current events.

The dollar index reached a three-month high, and bitcoin set a new record since December 2021, despite subsequent declines.

Data on US retail sales and the producer price report are expected shortly, which may further influence market sentiments.

The rise in oil prices continues amid tensions in the Middle East and Eastern Europe, with Brent crude futures and West Texas Intermediate showing significant increases. Meanwhile, gold prices fell below the key level of $2000 per ounce after the CPI data was released, reaching a two-month low.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2k7r3

Among other things, the Dow Jones Industrial Average recorded its most significant drop in almost 11 months after the US Department of Labor's report showed an unexpected increase in consumer prices in January, especially due to the rise in housing costs.

Against this backdrop, market indices, which were on the rise in anticipation that the Federal Reserve System (FRS) would begin to lower rates as early as May, showed negative dynamics. The S&P 500 index, for example, closed above the 5000 point mark for the first time, and the Dow Jones index traded near record-high values. However, the publication of inflation data revised expectations regarding the FRS's policy, increasing the likelihood that rate cuts may not occur until June.

Mega-cap companies sensitive to rates, such as Microsoft, Alphabet, Amazon.com, and Meta Platforms, showed a decrease in stock prices amid the rise in yields of US Treasury bonds to a two-month high. A similar situation was observed among chip manufacturers, including Micron Technology, Qualcomm, and Broadcom, which led to a 2% drop in the Philadelphia SE Semiconductor index.

The real estate, consumer discretionary, and utilities sectors faced the most significant losses among the 11 major industry indices of the S&P 500, especially real estate, which reached its lowest values in more than two months.

Small-cap companies also felt the pressure, with the Russell 2000 index showing the most significant daily drop since June 2022.

"Various statements by Federal Reserve System officials in recent weeks have indicated that the market-anticipated rate cuts in the first half of the year might have been premature. The latest consumer price index data certainly confirms this trend," commented Bob Elliott from Unlimited Funds.

The consumer inflation data followed a modest revision of inflation figures for the last quarter of 2023, giving investors temporary relief regarding inflation expectations.

The Cboe Volatility Index reached its highest level since November, highlighting the growing market concern. The S&P 500 and Nasdaq Composite indices lost 1.37% and 1.79% respectively, while the Dow Jones Industrial Average fell by 1.36%, marking its most significant decline since March 2023.

Among other developments, JetBlue Airways shares surged by 21.6% after Carl Icahn disclosed his stake in the company, calling the shares "undervalued." Arista Networks' shares declined by 5.5% following a gross profit forecast below expectations, and Marriott International lost value after forecasting annual earnings below analyst expectations.

Cadence Design Systems and toy manufacturer Hasbro also faced a drop in share value after publishing gloomy forecasts. Meanwhile, Tripadvisor shares jumped by 13.8% following the announcement of the creation of a special committee to review deal proposals.

The total trading volume on US exchanges reached 12.9 billion shares, comparable to the average of the last 20 sessions at 11.71 billion shares.

The US stock market continues to demonstrate record levels, supported by leading technology companies and expectations of Federal Reserve rate cuts. The global stock index MSCI and the Stoxx 600 European index also showed a decline amid current events.

The dollar index reached a three-month high, and bitcoin set a new record since December 2021, despite subsequent declines.

Data on US retail sales and the producer price report are expected shortly, which may further influence market sentiments.

The rise in oil prices continues amid tensions in the Middle East and Eastern Europe, with Brent crude futures and West Texas Intermediate showing significant increases. Meanwhile, gold prices fell below the key level of $2000 per ounce after the CPI data was released, reaching a two-month low.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2k7r3

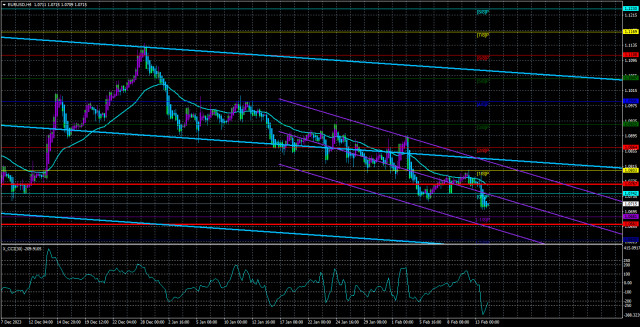

Overview of the EUR/USD pair. February 14th. US inflation disappoints the market again

The EUR/USD currency pair traded relatively calmly on Tuesday. Even the US inflation report did not significantly impact the movement of the currency pair. While we did see a surge of emotions in the market, it cannot be said that it had a radical effect on market sentiment and the technical picture. At this time, bears are in control. From our perspective, this is entirely logical, as the euro has been rising for too long, and the dollar has been falling for too long. Consequently, the euro remains overbought, implying a further decline.

The current technical disposition is more clearly visible in the 24-hour timeframe. It is evident that the pair began forming a downtrend last year, and the upward movement in the last 4 months (which has already concluded) is nothing more than a correction. Thus, from a technical standpoint, we expect only a decline. From a fundamental standpoint, there is no expectation other than a decline in the euro as well. The market had long believed that the Federal Reserve (Fed) would begin lowering rates in March, while the European Central Bank (ECB) would do so at some point. However, representatives of the Fed are now openly stating that March is too early, and there is no rush.

In ECB circles, the situation is the opposite. Many policymakers believe that the rate will start decreasing in 2024, while others insist that this process should begin in the summer. Even Christine Lagarde has stated twice that her department expects updated information by May, after which decisions on key rates can be made. Therefore, the fundamentals fully support further depreciation of the European currency since market expectations for the Fed rate were initially too low and for the ECB rate - too high.

As for the macroeconomic background, it has long been favoring only the dollar. Despite a series of weak reports (particularly on the labor market) in November and December of last year, the situation has since improved, and the latest Non-Farm Payrolls report undoubtedly pleased dollar buyers.

Only inflation raises some questions.

Yesterday's consumer price index report once again showed that inflation in America has been decreasing very slowly over the past 7-8 months or not decreasing at all. According to the latest published report, prices rose by 3.1% on an annual basis, while the market expected a slowdown to 2.9%. Core inflation remained at 3.9%, although the market expected it to decrease to 3.7%. Thus, we once again conclude that the Fed will not ease monetary policy in March. Moreover, the longer inflation refuses to slow down in line with the regulator's expectations, the longer the regulator will resist the easing cycle. This could provide significant support to the dollar against the euro, as the ECB may start lowering its rate by summer, which is 1% lower than the current rate in the United States.

The dollar rightly showed growth against the euro on Tuesday. The downtrend persists, and we fully support further pair declines. The issue for buyers lies not only in high American inflation but in numerous fundamental and macroeconomic reasons, which we have been discussing for several months.

The average volatility of the EUR/USD currency pair for the last 5 trading days as of February 14th is 53 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0661 and 1.0767 on Wednesday. A reversal of the Heiken Ashi indicator upwards will indicate a new phase of corrective movement.

Nearby support levels:

S1 – 1.0681

S2 – 1.0620

Nearby resistance levels:

R1 – 1.0742

R2 – 1.0803

R3 – 1.0864

Trading recommendations:

The EUR/USD pair continues to be below the moving average line. We continue to look towards short positions with targets at 1.0661 and 1.0620. The decline of the European currency is stable but slow. We see no reasons for a global rise in the euro, except for corrections. Formally, long positions can be considered with targets at 1.0864 and 1.0925 if the price consolidates above the moving average line. However, we see in the illustration that the last three consolidations above the moving average did not lead to a pair's rise. Therefore, caution is needed with buying.

Illustration explanations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for current trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel in which the pair will move over the next day, based on current volatility indicators.

CCI indicator - entering the oversold area (below -250) or overbought area (above +250) signals an upcoming trend reversal in the opposite direction.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T2k7bp