Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Wednesday 31 May 2023

Does Forex Factory Have An App. They openly talk about it and y

from Google Alert - ALL ABOUT FOREX https://ift.tt/cHEjmo2

via IFTTT

Forex Preview: 31/05/2023 - Dollar turns to US employment report for more fuel - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=lj17-w7rCzs

via IFTTT

How to Trade Forex - Investopedia

from Google Alert - ALL ABOUT FOREX https://ift.tt/5XJ7kdl

via IFTTT

Finding Opportunities to Trade Based on Common Forex Chart Patterns - Technology Org

from Google Alert - ALL ABOUT FOREX https://ift.tt/pCrmQwJ

via IFTTT

18 Forex Facts: Exploring the Global Currency Market - Facts.net

from Google Alert - ALL ABOUT FOREX https://ift.tt/cJoRO68

via IFTTT

DAX, USD/JPY outlook: Two trades to watch - FOREX.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/8fl1Ytp

via IFTTT

EURUSD Final Minor ABC Zigzag Underway!

http://dlvr.it/SpvX2c

Tuesday 30 May 2023

Unleashing the Forex Trader Within: Embracing Mindset and Motivation

FOREX-Yen stronger post-emergency meeting, dollar stays lower - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/LpQNkuD

via IFTTT

Japan's Top FX Diplomat Kanda: Closely watching forex moves, will respond appropriately if ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/PhFeVyM

via IFTTT

Debt ceiling deal and market breadth: What's next for forex? - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/UL5qpyH

via IFTTT

Best Forex Brokers in the MENA Region - Finance Magnates

from Google Alert - ALL ABOUT FOREX https://ift.tt/Cfz5vGA

via IFTTT

FOREX-Yen strengthens on policymaker meeting, dollar gives up early gains

from Google Alert - ALL ABOUT FOREX https://ift.tt/x6lMVLD

via IFTTT

All India Radio News on Twitter: "Forex market: #Rupee closes at 82 rupees and 72 paise against ...

from Google Alert - ALL ABOUT FOREX https://twitter.com/airnewsalerts/status/1663533840810508288

via IFTTT

Gold Technical Analysis

http://dlvr.it/SprWsL

Monday 29 May 2023

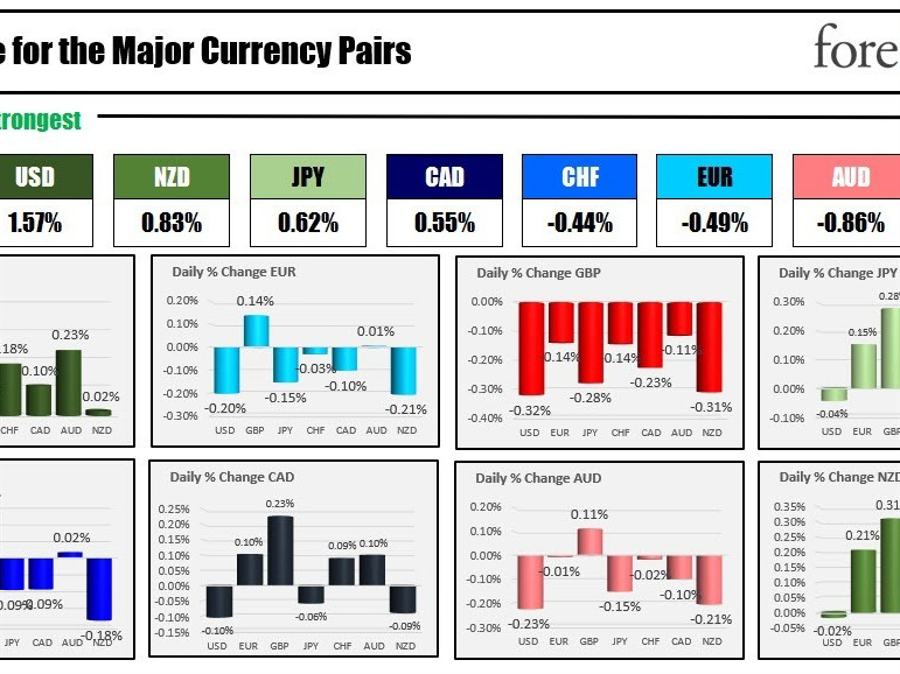

Turnaround time for the US dollar - Forexlive

from Google Alert - ALL ABOUT FOREX https://ift.tt/hCNcdQP

via IFTTT

EUR/USD, GBP/USD Eyeing Recovery on Low Liquidity Monday Following US Debt Deal

from Google Alert - ALL ABOUT FOREX https://ift.tt/8eYOHpk

via IFTTT

10 Best Forex VPS - Find Your Perfect Match HERE

from Google Alert - ALL ABOUT FOREX https://ift.tt/S4FG8c6

via IFTTT

XAUUSD good monday for all : r/Forex - Reddit

from Google Alert - ALL ABOUT FOREX https://ift.tt/admqRl1

via IFTTT

FLASHBACK: Desist from buying and selling foreign currency or face prosecution - BoG warns public

from Google Alert - ALL ABOUT FOREX https://ift.tt/QvVJM9D

via IFTTT

BTC/USD Forex Signal: Risk-On Sentiment Sets In - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/0LmnZc9

via IFTTT

S&P 500 Technical Analysis

http://dlvr.it/SppMpp

Sunday 28 May 2023

House Speaker Mccarthy Says "not At All" Worried About Losing Sp… - Stock market news

from Google Alert - ALL ABOUT FOREX https://ift.tt/jGdYlI1

via IFTTT

India's forex reserves decline to 593.48 bln USD in May | Macau Business

from Google Alert - ALL ABOUT FOREX https://ift.tt/3d95vxW

via IFTTT

Fxglobe Unveils Comprehensive New Fxglobe Academy | MENAFN.COM

from Google Alert - ALL ABOUT FOREX https://ift.tt/foiDjVQ

via IFTTT

Polygon (MATIC) and Tron (TRX) Price Prediction: TMS Network (TMSN) Price ... - Bitcoinist

from Google Alert - ALL ABOUT FOREX https://ift.tt/wzdDFgK

via IFTTT

India's forex reserves decline to 593.48 bln USD in May - Xinhua

from Google Alert - ALL ABOUT FOREX https://ift.tt/b6uigBD

via IFTTT

Saturday 27 May 2023

Why have Bitcoin and crypto lost 60% of their market cap since their all-time highs?

from Google Alert - ALL ABOUT FOREX https://ift.tt/dtxrKwh

via IFTTT

65. Gold hits downside target and BTC setup | Trading Opportunities (Forex, Commodities, Indices)

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=N054KiwvIQ4

via IFTTT

All eyes on Bank Negara | The Star

from Google Alert - ALL ABOUT FOREX https://ift.tt/4oFGc7B

via IFTTT

The 5 Best Forex Trading Courses and Academies for 2022 - 2023

from Google Alert - ALL ABOUT FOREX https://ift.tt/rwR7tvA

via IFTTT

META: Wave (iv) Found Buyers Within Blue Box Area - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/Fd8HQDu

via IFTTT

US Dollar Technical Analysis: USD Turn Gathers Steam - FOREX.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/STkeAon

via IFTTT

Friday 26 May 2023

India's Forex Reserves Drop By USD 6 Bn To USD 593.48 Bn - News18

from Google Alert - ALL ABOUT FOREX https://ift.tt/BybD3SF

via IFTTT

Terms and Conditions : Yonna Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/hyGdwcQ

via IFTTT

Forex News: 25/05/2023 - Dollar pauses for breath ahead of inflation data, tech rally eases

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=xifxzXmCXbE

via IFTTT

Forex Prop Industry Weekly Overview! What's new?

from Google Alert - ALL ABOUT FOREX https://ift.tt/KyREn1O

via IFTTT

Thursday's Forex Analytical Charts, May 25 | Kitco News

from Google Alert - ALL ABOUT FOREX https://ift.tt/YUWFKQ2

via IFTTT

GBP/USD Forecast: Market Volatility Prevails Amid Economic Concerns - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/xpDE2bq

via IFTTT

Thursday 25 May 2023

Forex Trading Xl Review: Evaluating The Features And Offerings Of Xl Trading | Trade Wise

from Google Alert - ALL ABOUT FOREX https://ift.tt/NDluewn

via IFTTT

Turkey cenbank's net forex reserves negative for first time since 2002 | SaltWire

from Google Alert - ALL ABOUT FOREX https://ift.tt/D6cyoMC

via IFTTT

Yuan Weakness Spooks China and Asia Ex-Japan Stock Markets - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/I3FC80e

via IFTTT

Nasdaq provides info on trading in MoneyGram International shares - FX News Group

from Google Alert - ALL ABOUT FOREX https://ift.tt/GATq9ZO

via IFTTT

Turkey Cenbank's Net Forex Reserves Negative for First Time Since 2002

from Google Alert - ALL ABOUT FOREX https://ift.tt/tUyqaoc

via IFTTT

Turkey cenbank's net forex reserves negative for first time since 2002 - SaltWire

from Google Alert - ALL ABOUT FOREX https://ift.tt/RXnTlsN

via IFTTT

Wednesday 24 May 2023

AUD/USD long sentiment grows below 0.6600 | IG US

from Google Alert - ALL ABOUT FOREX https://ift.tt/K6eYuXg

via IFTTT

EUR/USD forecast: Sentiment sours ahead of FOMC minutes - FOREX.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/m7yN8jx

via IFTTT

Gold Price Rangebound Below $1,984, All Eyes on FOMC - Forex Crunch

from Google Alert - ALL ABOUT FOREX https://ift.tt/LQYEqZ4

via IFTTT

FX option expiries for 24 May 10am New York cut - Forexlive

from Google Alert - ALL ABOUT FOREX https://ift.tt/Y5WQzwl

via IFTTT

Discover the Strongest Currency in the World: Top Rankings and Analysis - Capital.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/f1aC6Bn

via IFTTT

Ally Financial to present at the Morgan Stanley US Financials, Payments & CRE Conference

from Google Alert - ALL ABOUT FOREX https://ift.tt/u0fgoE7

via IFTTT

Tuesday 23 May 2023

GBP/USD drifting lower ahead of UK inflation - MarketPulse

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZMXpEB0

via IFTTT

Latest News and Analysis for Traders of All Levels - Mitrade

from Google Alert - ALL ABOUT FOREX https://ift.tt/sYCaQ03

via IFTTT

EURJPY regains traction, eyeing multi-year highs - Markets Overview Videos - provided by XM

from Google Alert - ALL ABOUT FOREX https://ift.tt/NFJ9Ymx

via IFTTT

GBP/USD Technical Analysis: Bearish Correction - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/pcdteLq

via IFTTT

Everything you need to know about the Alibaba IPOs and spin offs - FOREX.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/2N03xwJ

via IFTTT

Monday 22 May 2023

Offset Forex CFD trading losses as an individual (not business) - all transactions in same FY

from Google Alert - ALL ABOUT FOREX https://ift.tt/WrAFmZa

via IFTTT

Sunset Market Commentary - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/Mpuoqvt

via IFTTT

Institutional FX Solutions - LSEG

from Google Alert - ALL ABOUT FOREX https://ift.tt/t74lpoN

via IFTTT

Forex/Traders Meet & Greet, Wed, Jun 7, 2023, 7:00 PM | Meetup

from Google Alert - ALL ABOUT FOREX https://ift.tt/B6WcCxL

via IFTTT

MOEX Sees Strong Q1 Earnings despite FX Market Headwinds - Finance Magnates

from Google Alert - ALL ABOUT FOREX https://ift.tt/L1NbEkF

via IFTTT

Sunday 21 May 2023

Monday morning open levels - indicative forex prices - 22 May 2023 | Forexlive

from Google Alert - ALL ABOUT FOREX https://ift.tt/Gic5oEW

via IFTTT

Forex trading XL on Instagram: “Backtesting a lot will help you recognize better zones to trade from

from Google Alert - ALL ABOUT FOREX https://ift.tt/Kl7EOWo

via IFTTT

Biden says he won't agree to debt deal that protects crypto traders - Invezz

from Google Alert - ALL ABOUT FOREX https://ift.tt/u9AjqJK

via IFTTT

TMS Network (TMSN) Gains Huge Presale Appeal, Arbitrum (ARB) Reaches 200M ... - Bitcoinist

from Google Alert - ALL ABOUT FOREX https://ift.tt/IWXqJzY

via IFTTT

Newsquawk Week Ahead: Highlights include FOMC mins, US PCE, RBNZ, Flash PMIs

from Google Alert - ALL ABOUT FOREX https://ift.tt/4UOvtoe

via IFTTT

Tesla Stock Price Forecast: Technical Analysis and Trade Idea for Bulls (using Fib entry)

http://dlvr.it/SpMzvx

Saturday 20 May 2023

Elliott Wave Analysis of SP500 - May 22nd, 2023 - EWM Interactive

from Google Alert - ALL ABOUT FOREX https://ift.tt/8nzHYs2

via IFTTT

KOJO FOREX on Twitter: "All these cars are “vanity” but May you say it from your own experience ...

from Google Alert - ALL ABOUT FOREX https://mobile.twitter.com/KojoForex/status/1659875281136386048

via IFTTT

Twitter Share Price Drops, Tradecurve (TCRV) Presale Tokens Set To Rally 80%

from Google Alert - ALL ABOUT FOREX https://ift.tt/CVRleo4

via IFTTT

Artificial Intelligence Stocks Run Wild: NVDA, PLTR, AI, UPST, GOOGL, MSFT all gain this week

from Google Alert - ALL ABOUT FOREX https://ift.tt/rejcaU9

via IFTTT

Podcast - Stocks weaken as Debt-Limit Talks hit a Roadblock and on Fed Pause Hopes

from Google Alert - ALL ABOUT FOREX https://ift.tt/Pyxi2D6

via IFTTT

(TWE) TeamWithERVING ©️ – Telegram

from Google Alert - ALL ABOUT FOREX https://ift.tt/Bv32wAp

via IFTTT

BitForex: Charting a New Course in the Crypto Landscape with Joseon | News Alarms

from Google Alert - ALL ABOUT FOREX https://ift.tt/OjiSIbu

via IFTTT

Major US stock indices open higher but there is some pause

http://dlvr.it/SpKcfM

Friday 19 May 2023

Kenya's forex reserves plunge, worsening dollar crisis - Xinhua

from Google Alert - ALL ABOUT FOREX https://english.news.cn/20230520/28cee7a5a96344c590e9e9f0cd850503/c.html

via IFTTT

Smart Prop Trader 5% discount by Forex Prop Reviews!

from Google Alert - ALL ABOUT FOREX https://ift.tt/NQXyrZx

via IFTTT

USD/JPY analysis: Yen strengthens on hot inflation figures - FOREX.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/6Bfak0w

via IFTTT

2023 Testing Identifies the Lowest Forex Broker Raw Spread Account - PR Newswire

from Google Alert - ALL ABOUT FOREX https://ift.tt/pr3BVg5

via IFTTT

USD/JPY Eases from its 2023 Highs as Japan's Inflation Rose | FXCM Markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/4wYGdhu

via IFTTT

The USD is the strongest and the GBP is the weakest as the North American session begins

http://dlvr.it/SpGpfc

S&P 500 Technical Analysis

http://dlvr.it/SpGpN3

Thursday 18 May 2023

Mexico central bank leaves benchmark interest rate unchanged at 11.25% - Forexlive

from Google Alert - ALL ABOUT FOREX https://ift.tt/FbVrx8g

via IFTTT

How do i trade forex on thinkorswim?

from Google Alert - ALL ABOUT FOREX https://ift.tt/ElxsYV5

via IFTTT

Take your trading to new heights and achieve your goals with our top-notch program.

from Google Alert - ALL ABOUT FOREX https://ift.tt/4MOzesP

via IFTTT

Cardano Is Down By 80% From Its All-time High: Is It Good To Buy ADA Now? - FXLeaders

from Google Alert - ALL ABOUT FOREX https://ift.tt/UIpDLMT

via IFTTT

Indian carrier IndiGo plans to double capacity by end of decade - Reuters

from Google Alert - ALL ABOUT FOREX https://ift.tt/BjuKzbc

via IFTTT

British Pound Drifts Lower, Markets Eye Bailey Testimony - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/rO1UExW

via IFTTT

XAUUSD Technical Analysis

http://dlvr.it/SpCrN8

Wednesday 17 May 2023

Sunset Market Commentary - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/tNV8w2k

via IFTTT

USD/CAD goes on a 50-pip round trip. What's next. | Forexlive

from Google Alert - ALL ABOUT FOREX https://ift.tt/uaN1Hdx

via IFTTT

CAUTION: Bitcoin Is Following EVERY Previous Cycle. | They're All Wrong About The Markets!

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=fsgQqm2WhE0

via IFTTT

FOREX-Data and debt ceiling hoist dollar - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/AHl1zq5

via IFTTT

EURJPY Forex Analysis - Retest & Failure At 148.39 Monthly Resistance - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=ocQalRqSKx8

via IFTTT

USDCAD Technical Analysis - Rangebound

http://dlvr.it/Sp8rQp

Tuesday 16 May 2023

What are the risks of forex trading? Is it worth investing a small amount of money into it?

Leading Forex Signal Provider | Elliott Wave Forecast

from Google Alert - ALL ABOUT FOREX https://ift.tt/WRP18Ql

via IFTTT

Forex Prop Forum: Your Ultimate Resource for Trading Strategies!

from Google Alert - ALL ABOUT FOREX https://ift.tt/4WaPzAk

via IFTTT

Do you have to submit all of your taxes when you file forex taxes? - Forex Academy

from Google Alert - ALL ABOUT FOREX https://ift.tt/cIDeZ7E

via IFTTT

Forex Analysis - USDCAD, USDCHF, USDJPY, EURGBP, NZDJPY, and NZDUSD

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=RpdpEduniB8

via IFTTT

EUR/USD outlook: Long-term view remains bullish - FOREX.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/YzU4SZN

via IFTTT

What are the forex sessions?

from Google Alert - ALL ABOUT FOREX https://ift.tt/Y8X7xcB

via IFTTT

FOREX ANALYSIS 5/16/2023 part 4

SELL STOP EUR USD @ 1.08426

Sl. 1.11040

Tp. 1.06306

SELL STOP EUR CAD @ 1.46260

Sl. 1.50305

Tp. 1.44187

All on D1 TIMEFRAME.

SEE THE PAIR THAT WILL TREND NOW

Monday 15 May 2023

SIGNAL FOREX ANALYSIS FOR 5/16/2024 part 2

BUY AUD USD

TP. 0.67553

Sl. 0.66555

BUY NZD CHF

TP. 0.56328

Sl. 0.55435

SELL AUD NZD

TP. 1.06704

Sl. 1.07630

BUY NZD USD

TP. 0.63129

Sl. 0.62025

SELL GBP NZD

TP. 1.99576

Sl. 1.01550

SELL GBP JPY

TP. 168.622

Sl. 171.140

SEE THE FOREX PAIR THAT WILL MOVE NOW

SIGNAL ANALYSIS FOREX 5/16/2023

BUY AUD USD

TP. 0.67553

Sl. 0.66555

BUY NZD CHF

TP. 0.56328

Sl. 0.55435

SEE FOREX PAIR THAT WILL TREND NOWAUD/USD Forex Signal: False Breakout Points to More Downside - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/nbkspzw

via IFTTT

Alpha Capital New May Updates - All in One Place! - Forex Prop Reviews

from Google Alert - ALL ABOUT FOREX https://ift.tt/JbdItrE

via IFTTT

FXCM Market Talk - Your Trading & Finance Podcast (Ep. 77)

from Google Alert - ALL ABOUT FOREX https://ift.tt/JwRSnLs

via IFTTT

Promotion For Traders - Unifi Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/K4Nyi9t

via IFTTT

All India Radio News on Twitter: "In the forex market, the #rupee closed at 82 rupees and 30 paise ...

from Google Alert - ALL ABOUT FOREX https://twitter.com/airnewsalerts/status/1658078523293089797

via IFTTT

Forex : A dead cat bounce? - Stock market news | MarketScreener

from Google Alert - ALL ABOUT FOREX https://ift.tt/KOdZUCt

via IFTTT

Dow Jones Technical Analysis

http://dlvr.it/Sp3Ln1

Sunday 14 May 2023

Wall Street Turns More Bullish on WalMart's Upcoming Earnings - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/IF8gjwO

via IFTTT

Forex blog: News and market reviews by PaxForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/BboO4c3

via IFTTT

Argentina plans new rate hike, more FX intervention as inflation soars - Stock market news

from Google Alert - ALL ABOUT FOREX https://ift.tt/LTks0eo

via IFTTT

Master Forex Fundamentals - Bkforex - Found Course

from Google Alert - ALL ABOUT FOREX https://ift.tt/Amy2LYD

via IFTTT

How many forex startegies have you had?

from Google Alert - ALL ABOUT FOREX https://ift.tt/vQbHuK3

via IFTTT

Saturday 13 May 2023

Can you make $500 a day from Forex?

While it is possible to make money from Forex trading, consistently making $500 per day is not a guaranteed outcome, and it largely depends on several factors such as your trading strategy, capital investment, risk management, market conditions, and your skills as a trader.

Forex trading involves the buying and selling of currencies in the foreign exchange market. Traders aim to profit from the fluctuations in exchange rates between currency pairs. However, the Forex market is highly volatile, and it can be unpredictable at times. Profits and losses are part of the trading process, and it's important to have a realistic understanding of the risks involved.

To make $500 per day from Forex trading, you would need to achieve a consistent profit of $500 each trading day. While some professional and experienced traders may achieve such returns, it requires a significant amount of capital, knowledge, skill, and experience. Many traders experience losses or earn smaller profits, especially when starting out.

It's important to note that Forex trading involves substantial risk, and there are no guarantees of making a specific amount of money. It is recommended to approach Forex trading with caution, educate yourself, practice with demo accounts, and consider seeking guidance from experienced traders or financial professionals. Additionally, it's important to manage your risk effectively by using appropriate position sizing and stop-loss orders to protect your capital.

India's forex reserves rose to $595.976bn during week ending May 5: RBI - Sarkaritel.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/NVgySL6

via IFTTT

Liberty All-Star Equity Fund April 2023 Monthly Update - Benzinga

from Google Alert - ALL ABOUT FOREX https://ift.tt/PnjMGSp

via IFTTT

Mitrade's Excellence Says It All: Wins Two Broker Awards, Debuts New iPad App

from Google Alert - ALL ABOUT FOREX https://ift.tt/D2lqtEm

via IFTTT

Forex Brokerage Scam - Melmac Solutions Limited

from Google Alert - ALL ABOUT FOREX https://ift.tt/MyBYalf

via IFTTT

SW Financial - FX News Group

from Google Alert - ALL ABOUT FOREX https://ift.tt/tV0Bepo

via IFTTT

India's forex reserves jump by $7.2 billion to $595.98 billion - Millennium Post

from Google Alert - ALL ABOUT FOREX https://ift.tt/kHfQqnC

via IFTTT

Nasdaq Composite Technical Analysis

http://dlvr.it/Snyync

Friday 12 May 2023

Forex Trendy Review

Forex trading has always been an attractive option to many but its complexities act as a deterrent. If you are looking at trading in the Forex market, you would need some tools, some indicators, and a good trading platform to help you along. Here I’ve reviewed a popular ClickBank product – Forex Trendy. Let’s take an in-depth view into what this is!

Forex Trendy is a software-based Forex trading tool that does not require any downloads for use. It does an automatic study of 34 currency pairs across nine primary time zones (that’s 306 charts) and presents easy, actionable data for you. Forex trading, is an international trading process, is working around the clock. The currency pairs selected by the program are the more popular ones and include gold, silver, and oil. It helps detect the soundest trending ones.

You can purchase a three-month membership to begin, giving you access to a member’s area to which you can log in from any device and place. There are no downloads to be done at all! The member’s area contains live charts of trending currency pairs and automated analysis of "Triangles, Flags, Wedges and Trend Lines on 34 currency pairs and all time frames” as a bonus, states the website. This gives you an overview of trading setups with high probability ratios. There is also an automated pattern-finding tool included that analyses various charts and shows up emerging patterns saving you precious time and energy poring over complex charts, trying to figure out a pattern for yourself! I loved this feature!

An important point to note here is that Forex Trendy does not include a trading platform. You will require your own account at a Forex trading platform like MetaTrader or NinjaTrader or any other.

The Creators

Not much is known about who is actually behind the product. The product designer has successfully kept his identity a secret, so with even a bit of in-depth research, I could not locate a name that I could associate with the product. All we have is the name of the service – Forex Trendy, a company name. This product can be purchase online only and is a ClickBank associate.

Positives

Forex Trendy has a lot that’s going well for it. Here are some of the pros of the product:

- The alert system can be set up to be visual, audio as well as via emails or to your phone via an SMS. You can choose whatever suits you best.

- You do not have to deal with CDs or any downloads to your machine.

- You can choose to increase or decrease the trade frequency as per your individual requirement.

- The chart patterns are displayed in easy-to-understand visuals.

- You can opt for any trade platform to work with the actual trading. It does not restrict or recommend any one specific platform unlike most other products out there.

- You get a free ebook called “Understanding the Myths of Market Trends and Patterns” which is a plus and makes for informative reading material.

- With its wide range of currency pairs and chart analysis, it can bring to attention trends that even seasoned traders may miss at times!

- Priced at $37 for a three-month membership, it is one of the most reasonably-priced items in the Forex trading tools niche.

Negatives

Forex trading is never easy, and no product is perfect – you just need to know how to correctly use the tool you have to get what you want. Here are some areas where I found Forex Trendy to be lacking and could do with some face-lifting:

- A service like this should have a live chat option or someone who you can speak to in real-time. I would like to know that if I have an issue now, I can just reach out to someone to sort it out immediately – after all, the markets are live!

- It’s a targeted service better suited to manual trading. It does not get into automatic trades for you. So you are looking for software to run on auto-pilot while you sit back, this is not for you.

- This is not for complete beginners. You need a little know-how about the Forex market, be able to make your trades, and so on. If you’ve been in the Forex trading market even briefly, only then will you find this product helpful?

- The customer support could do better. The emails are answered fairly, and they are timely, but sometimes you just need more prompt actionable advice.

My Verdict

Overall, Forex Trendy has been around for years, and it has a lot of satisfied members so obviously, it is doing something right! I have seen a lot of 90% accuracy claims from actual users on forums. This builds my trust. Also, the charts inside the member’s area make sense to me; they are updated in real-time and have had reliable results. It’s not a scam, and that’s for sure! The 60-day money-back guarantee and low tie-in of a three-monthly membership plan make it a product you can definitely try out!

Overall, Forex Trendy has been around for years, and it has a lot of satisfied members so obviously, it is doing something right! I have seen a lot of 90% accuracy claims from actual users on forums. This builds my trust. Also, the charts inside the member’s area make sense to me; they are updated in real-time and have had reliable results. It’s not a scam, and that’s for sure! The 60-day money-back guarantee and low tie-in of a three-monthly membership plan make it a product you can definitely try out!

My advice is this: first learn all you can about Forex trading, try it a little on your own and then venture ahead with Forex Trendy- it will then surely guide you well.

'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...

.jpg)

.jpg)