Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Wednesday 31 January 2024

All eyes are on Fed, as the IMF signal increases the chance of soft landing | IG International

from Google Alert - ALL ABOUT FOREX https://ift.tt/LhZJlS3

via IFTTT

'Feud: Capote vs. the Swans' Review: Cold Blooded - The New York Times

from Google Alert - ALL ABOUT FOREX https://ift.tt/mpEYysj

via IFTTT

Betrayal spotlighted in FX's 'Feud: Capote vs the Swans' - ABC11

from Google Alert - ALL ABOUT FOREX https://ift.tt/EkxYtV1

via IFTTT

Naira falls to all-time low at parallel market, trades at N1,530 - Thecable.ng

from Google Alert - ALL ABOUT FOREX https://ift.tt/DrjwZ83

via IFTTT

Silver Price Forecast - Silver Continues to See Buyers on Dips - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/8m6Lbs9

via IFTTT

CBN, foreign airlines clash over $700m trapped funds - Businessday NG

from Google Alert - ALL ABOUT FOREX https://ift.tt/n1CNRGc

via IFTTT

All Airlines' Forex Debts Cleared By CBN - The Street Journal

from Google Alert - ALL ABOUT FOREX https://ift.tt/9Od0b4i

via IFTTT

The Evolution and Prospects of FX Clearing - Finextra Research

from Google Alert - ALL ABOUT FOREX https://ift.tt/nIrWLp4

via IFTTT

Airlines differ as CBN claims forex backlog cleared with $64m - Daily Trust

from Google Alert - ALL ABOUT FOREX https://ift.tt/349kqYG

via IFTTT

Risking it all... Day in the Life of a Forex Trader in Australia - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=tAd9yM-oqbQ

via IFTTT

CBN Moves To Stop Forex Speculation, Hoarding By Banks - Leadership News

from Google Alert - ALL ABOUT FOREX https://ift.tt/oH5UGZR

via IFTTT

Economy: How CBN clears all backlog of airlines' Forex claims –Official - ConsumerConnect

from Google Alert - ALL ABOUT FOREX https://ift.tt/EMtf5i2

via IFTTT

Nigeria's Central Bank Completes Payment Of 'All Verified FX Claims' Due To Airlines

from Google Alert - ALL ABOUT FOREX https://ift.tt/qIkmWrB

via IFTTT

Dada Olusegun on Instagram: "STILL ON FOREX

from Google Alert - ALL ABOUT FOREX https://ift.tt/lqdJeGc

via IFTTT

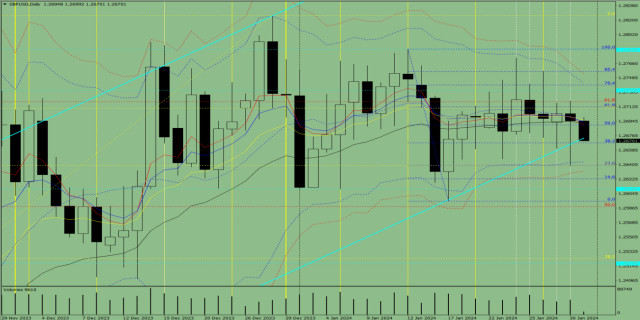

Indicator Analysis of GBP/USD on January 31, 2024

Trend analysis (Fig. 1).

On Wednesday, the market may move downward from the level of 1.2695 (closing of yesterday's daily candle) to 1.2667, the 38.2% pullback level (blue dotted line). In the case of testing this level, an upward movement is possible with a target of 1.2690, the 50% pullback level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

* Indicator analysis – down;

* Fibonacci levels – down;

* Volumes – down;

* Candlestick analysis – down;

* Trend analysis – down;

* Weekly chart – down;

* Bollinger bands – down.

General conclusion: Today, the price may move downward from the level of 1.2695 (closing of yesterday's daily candle) to 1.2667, the 38.2% pullback level (blue dotted line). In the case of testing this level, an upward movement is possible with a target of 1.2690, the 50% pullback level (blue dotted line).

Alternatively, the price may move downward from the level of 1.2695 (closing of yesterday's daily candle) to 1.2667, the 38.2% pullback level (blue dotted line). In the case of testing this level, a continued downward movement is possible with a target of 1.2639, the 23.6% pullback level (yellow dotted line). From this level, the price may move up.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T26kL3

Overview of the EUR/USD pair. January 31st. De Guindos, Centeno, Kazimir, and Vujicic did not clarify the situation with

In the current circumstances, however, even such a movement is considered fortunate. The problem is that the market needs clarification about what to expect from the ECB and the Fed in the first half of 2024. This is not the fault of officials from the Fed or the ECB. They follow inflation and are ready to adjust monetary policy parameters based only on the consumer price index.

Since inflation reports come out once a month, the rhetoric of Fed officials must stay the same. It has stayed the same but has a fairly vague appearance. In other words, FOMC officials are still determining when to start lowering the key rate. The same is true for the ECB.

The new week began with several speeches by ECB representatives and the publication of GDP reports in the European Union. It seemed like five events, each of which could be called "important." This is, of course, not non-farm payrolls or a central bank meeting, but still significant events. What information did we get? The rhetoric of ECB representatives differed from each other in content and nature. De Guindos did not consider it necessary to forecast when the rate could start decreasing. Mario Centeno stated that starting sooner rather than later is better, while Peter Kazimir believes starting a little later than sooner is better. And what conclusions can we draw about ECB rates in the first half of 2024 if regulator officials say opposite things?

In addition to the first three conflicting statements, Boris Vujicic stated yesterday that there is no difference in lowering rates in April or June. The main thing is maintaining a smooth easing to avoid shocking the markets and consumers. Vujicic believes the ECB should occasionally pause when the monetary policy easing cycle is launched. Another speech by a European official needed to clarify the current situation. Therefore, the European currency is trading very sluggishly. We observe constant pullbacks, corrections, but the downward trend persists.

Also, yesterday, the GDP report for the European Union in the fourth quarter was published, showing zero economic growth. Such a value even exceeded the forecast values, which looks somewhat comical. The economy of the European Union has been showing more or less zero growth every quarter for over a year. It is hardly possible to consider such indicator values positive. But we should remember that almost everything depends on how quickly central banks will start lowering rates and how much they will lower them in 2024. Since there is no reasoned and accurate forecast, the market will act "on the fly." We still believe that the EUR/USD pair should continue to decline, so we expect a test, at least, of the Murray level "0/8"-1.0742. We do not believe in a new upward trend and do not know what should happen with the ECB and the Fed rates in 2024 for the euro to show a powerful upward movement again.

However, if the Fed lowers the rate much stronger and faster than the ECB, this could be a significant reason for the market to consider new euro purchases rather than dollars.

The average volatility of the euro/dollar currency pair for the last five trading days as of January 31 is 67 points and is characterized as "average." Thus, we expect movement of the pair between the levels of 1.0776 and 1.0910 on Wednesday. A downward reversal of the Heiken Ashi indicator will indicate a resumption of the downward movement.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair remains below the moving average line. Therefore, we consider short positions with targets at 1.0776 and 1.0742. The downward movement is currently quite weak, and a strong fundamental and macroeconomic background this week may push the pair back up. But until consolidation is above the moving average, we consider only selling. We plan to return to long positions by consolidating the price above the moving average with a target of 1.0925. In case of consolidation above the moving average, it will be necessary to see after which event this happened. It is not excluded that the pair will quickly return down.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T26Ngr

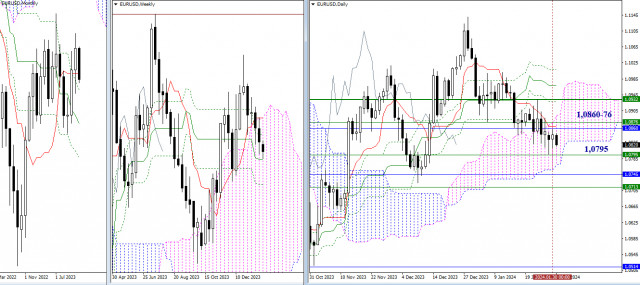

EUR/USD and GBP/USD: Technical analysis for January 31

Higher Timeframes

The pair continues to trade within the resistance range of 1.0860 – 1.0876, where several levels of different timeframes converge. In the event of a sustained move above this range, bullish players may formulate new plans, such as a return to the bullish zone relative to the weekly cloud (1.0932) and the elimination of the death cross of the daily Ichimoku cloud (1.0928 – 1.0969 – 1.1009). If, however, bearish players demonstrate activity and effectiveness, then after breaking through the support of the weekly medium-term trend (1.0795), they will need to exit the daily cloud (1.0769) and attempt to break beyond the limits of the weekly (1.0713) and monthly (1.0747) Fibonacci Kijun levels.

H4 – H1

Yesterday, the weekly long-term trend on lower timeframes successfully defended the interests of bearish players. To further restore their positions, the bears must update the low (1.0797) today. In the development of a downward trend within the day, the support levels of the classic pivot point (1.0792 – 1.0773) may come into play. If the market returns to the idea of breaking key levels, currently located at 1.0838-52 (central pivot point of the day + weekly long-term trend), a reliable consolidation above and a reversal of the moving average will open up new prospects for bullish players. Further targets for the upward movement can be marked at 1.0865 – 1.0884 – 1.0911 (resistances of classic pivot points).

***

GBP/USD

Higher Timeframes

Yesterday's test of the weekly short-term trend (1.2661) ended again with a long lower shadow of the daily candle. The market is not ready to break this support yet. Nevertheless, tension in the consolidation is increasing, and things can change quickly. A break of 1.2661 will send players towards various support levels on different timeframes, with the nearest ones waiting at 1.2612 – 1.2588 (monthly short-term trend + upper boundary of the weekly cloud). On the other hand, a rebound from 1.2661 should free the pair from the attraction of Ichimoku's daily cross levels (1.2684 – 1.2711 – 1.2738), after which attention will be focused on the recovery of the upward trend (1.2826) and progress towards the monthly Ichimoku cloud (1.2893).

H4 – H1

On lower timeframes, bearish players maintain an advantage, but they struggle to develop a downward trend. Instead, they repeatedly return to testing key levels. Today, these key levels are at 1.2685 (central pivot point) and 1.2706 (weekly long-term trend). A breakthrough and a reliable consolidation above these levels can change the current balance of power. Additional targets for intraday movement are provided by classic pivot points, currently located at 1.2649 – 1.2604 – 1.2568 (supports) and 1.2730 – 1.2766 – 1.2811 (resistances).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T26NPg

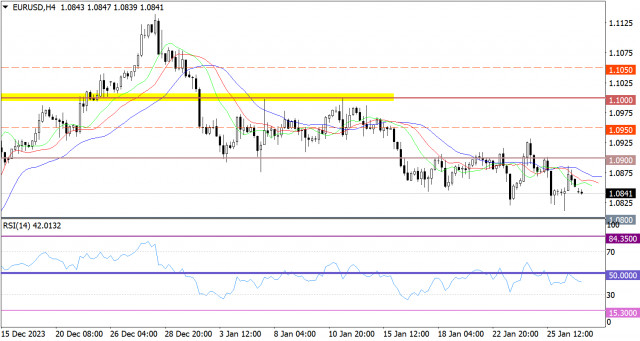

Outlook for GBP/USD on January 31. JOLTs report helped the dollar, but not too much

GBP/USD showed a decent downward movement on Tuesday, which, however, quickly ended, and the pair bounced back up. Therefore, the same judgment applies to both the euro and the pound. The pair is slowly sliding with frequent rebounds to the lower boundary of the sideways channel at 1.2611-1.2787. Since the flat phase persisted for a month and a half, we can't draw new technical conclusions at the moment. The Ichimoku indicator lines are weak, and strong signals are not forming around them.

Yesterday, there were no interesting events in the UK, and in the US, the JOLTs report on job openings in December was published. Its value exceeded the forecast by 0.25 million, so the dollar strengthened for a short period. However, in general, the technical picture did not change. The dollar rose yesterday, and today the pound may rise. The flat persists.

Tonight and tomorrow (as well as on Friday during the US session), we can expect increased volatility and the pair may even leave the sideways channel. However, for this to happen, all the remaining fundamental and macroeconomic events (or at least the majority) must unequivocally support the dollar. And only then will we be able to expect a breakthrough of the 1.2605-1.2620 area, as well as further downward movement.

There were only two trading signals on Tuesday, and both were formed around weak Kijun-sen and Senkou Span B lines at this time. Traders could open short positions during the European session, but closing them at a profit was quite difficult, as the pair did not reach the nearest target level by the evening and returned to the Senkou Span B line. The profit could only be small if traders manually closed the deals.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has been changing quite frequently in recent months. The red and green lines, representing the net positions of commercial and non-commercial traders, often intersect and, in most cases, are close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 6,300 buy contracts and 5,800 short ones. As a result, the net position of non-commercial traders increased by 500 contracts in a week. The fundamental backdrop still does not provide a basis for long-term purchases on the pound.

The non-commercial group currently has a total of 72,600 buy contracts and 41,100 sell contracts. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we need to pay close attention to the technical picture and economic reports. However, even these types of analysis are currently secondary because, despite everything, the market still maintains a bullish bias towards the pound, and the price has been in a flat range for the second month. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement (but there are no clear sell signals yet), and for a long time now, the economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD continues to trade within the sideways channel of 1.2611-1.2787. The price has been unable to leave it for a month and a half. Therefore, it would not be surprising if the British pound continues to stay within the flat today.

On Wednesday, the pair has a higher chance of rising than falling, but it is considered impractical to open positions at the moment. The price continues to be located precisely in the middle of the sideways channel, and there is no point in expecting strong signals near the Senkou Span B and Kijun-sen lines.

As of January 31, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2513, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B lines (1.2684) and Kijun-sen (1.2698) lines can also serve as sources of signals. Don't forget to set a breakeven Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

Today, there are no significant events lined up in the UK. The US economic docket features the release of the ADP report on private-sector employment. The results of the FOMC meeting will be announced in the evening, and Federal Reserve Chair Jerome Powell will speak. After these events, volatility may sharply increase, but the GBP/USD pair needs a clear and strong decline to have a chance of breaking out of the sideways channel.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T26N6Y

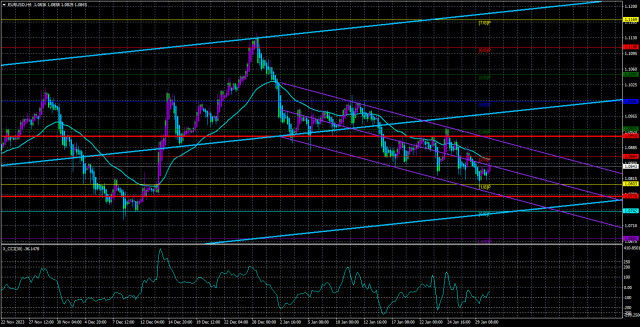

Outlook for EUR/USD on January 31. Euro continues to slide down

On Tuesday, EUR/USD once again showed very weak movements with a bearish bias. The best way to describe it is "the price is gradually sliding down." It is "sliding" because volatility remains very weak. The market seems to be unsure of its actions or openly waiting for something. And what can these events change in the lives of the euro and the dollar?

On Tuesday, the price once again broke through the level of 1.0823, but we did not see a pronounced decline. The flat phase seems to have ended, but what does it matter if the price's decline isn't enough? Therefore, we can say the following. The downtrend undoubtedly persists, but one needs to be in the trade for at least a few days to expect to make a profit.

Yesterday, GDP reports for Germany and the eurozone were released. They had no impact on the pair's movement. Traders reacted to the reports but it wasn't anything noteworthy. Both reports showed very weak values. In the United States, the JOLTs report on the number of job vacancies was published, which supported the dollar, as it exceeded forecast values. However, the dollar's rise was weak and short-lived.

There were few trading signals on Tuesday. The first sell signal turned out to be a false signal, as the price failed to break the level of 1.0823. Then a stronger buy signal followed near the same level, and traders could earn about 10-15 pips. The volatility of the day was only 46 pips, so such a profit looks decent.

COT report:

The latest COT report is dated January 23. As seen in the charts above, it is clear that the net position of non-commercial traders has been bullish for quite some time. To put it simply, the number of long positions is much higher than the number of short positions. This should support the euro, but we still do not see fundamental factors for the euro to strengthen further. In recent months, both the euro and the net position have been rising. However, over the past few weeks, big players have started to reduce their long positions, and we believe that this process will continue.

We have previously pointed out that the red and green lines have moved apart from each other, which often precedes the end of a trend. At the moment, these lines are still far apart. Therefore, we support the scenario in which the euro should fall and the uptrend must end. During the last reporting week, the number of long positions for the non-commercial group decreased by 9,100, while the number of short positions increased by 6,600. Accordingly, the net position fell by 15,700. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 89,000 (it was 104,000). The gap is quite large, and even without COT reports, it is clear that the euro should continue to fall.

Analysis of EUR/USD 1H

On the 1-hour chart, EUR/USD has already breached the level of 1.0823 three times, so we can expect the downtrend to resume after two weeks of a flat phase. The price is below the Kijun-sen and Senkou Span B lines. However, this week, we can look forward to a lot of important reports and events, so you should be cautious when opening any trades.

Today, we believe that the price will continue to "draw fences" with a minimal downward slope. We will consider new short positions with 1.0757 as the target if the price bounces again from the critical line or confidently breaches the level of 1.0823. You may consider longs if the price consolidates above the Kijun-sen with Senkou Span B as the target.

On January 31, we highlight the following levels for trading: 1.0658-1.0669, 1.0757, 1.0823, 1,0889, 1.0935, 1.1006, 1.1092, 1.1137, 1.1185, 1.1234, 1.1274, as well as the Senkou Span B line (1.0906) and Kijun-sen (1.0850) lines. The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a breakeven Stop Loss if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Wednesday, inflation, unemployment, and retail sales reports will be published in Germany, but the market is focused on the Federal Reserve meeting, the results of which will be announced in the evening.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T26Mqg

Tuesday 30 January 2024

FX Backlog: CBN Concludes Payment of All Verified Claims By Airlines

from Google Alert - ALL ABOUT FOREX https://ift.tt/XHP0V2U

via IFTTT

Forex Today: S&P 500 Index Makes New Record High Price - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZJ3wjac

via IFTTT

News Segment: CBN Clears Another $500m FX Backlog - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=WYwGPvb73vc

via IFTTT

Outlook for EUR/USD on January 30. The euro started the week by falling

On Monday, EUR/USD once again showed movements that were far from ideal. In the European session and half of the US session, the pair was trading lower and broke through the level of 1.0823, which it had bounced off several times before. However, in the middle of the US session, it turned upwards and started an equally strong upward movement. The pair closed the day above the level of 1.0823, and on higher timeframes, the breakout of 1.0823 can be considered a false signal.

Nevertheless, a breakout of this level did occur, which could be a good sign for maintaining the downtrend. There were no important reports on Monday, but three representatives of the European Central Bank spoke. Luis de Guindos was the least specific and said that the "ECB will cut interest rates when we are sure that inflation meets our 2% goal." His colleagues Centeno and Kazimir were more specific, but their comments were openly contradictory. One stated that it is better to start lowering the rate before June, the other said that rate cuts should not begin before June. Therefore, there is no more clarity in the ECB rate situation.

The weak downtrend persists, and this week we can expect strong movements. We hope that they will lead to a trend rather than another flat.

The trading signals on Monday left much to be desired. Despite the strength of the level of 1.0823, during the day, the price managed to overcome it four times. Therefore, it was not possible to make a profit – all four signals turned out to be false. Only the first two could be worked out.

COT report:

The latest COT report is dated January 23. As seen in the charts above, it is clear that the net position of non-commercial traders has been bullish for quite some time. To put it simply, the number of long positions is much higher than the number of short positions. This should support the euro, but we still do not see fundamental factors for the euro to strengthen further. In recent months, both the euro and the net position have been rising. However, over the past few weeks, big players have started to reduce their long positions, and we believe that this process will continue.

We have previously pointed out that the red and green lines have moved apart from each other, which often precedes the end of a trend. At the moment, these lines are still far apart. Therefore, we support the scenario in which the euro should fall and the uptrend must end. During the last reporting week, the number of long positions for the non-commercial group decreased by 9,100, while the number of short positions increased by 6,600. Accordingly, the net position fell by 15,700. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 89,000 (it was 104,000). The gap is quite large, and even without COT reports, it is clear that the euro should continue to fall.

Analysis of EUR/USD 1H

On the 1-hour chart, EUR/USD has broken the level of 1.0823, so we can expect the downtrend to resume after two weeks of consolidation. The price is below the Kijun-sen and Senkou Span B lines. However, this week, we can look forward to a lot of important reports and events, so you should be cautious when opening any trades.

Today, we believe that the price may simply return to the critical line once again. If the price bounces from it, we will consider new short positions with 1.0823 and 1.0757 as the targets. You may consider long positions if the price has settles above the Kijun-sen and we can use Senkou Span B as the target.

On January 30, we highlight the following levels for trading: 1.0658-1.0669, 1.0757, 1.0823, 1.0889, 1.0935, 1.1006, 1.1092, 1.1137, 1.1185, 1.1234, 1.1274, as well as the Senkou Span B (1.0906) and Kijun-sen (1.0865) lines. The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a breakeven Stop Loss if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Tuesday, the eurozone will publish the GDP report for the fourth quarter, and the US will release the JOLTs Job Openings report. Both reports are quite important, so the market may react to them.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T23vvC

Monday 29 January 2024

Tips for trading EUR/USD

Looking at this, market players could consider short positions with a pullback towards the breakdown area. Set the stop loss at 1.08508 and take profit upon the breakout at 1.08135.

The trading plan follows the framework of the "Price Action" and "Stop Hunting" strategies.

Good luck in trading and don't forget to control the risks! Have a nice day.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T23bx3

How to use forex trendy to know which trade is going to be profitable

Forex Trendy is a software application designed for traders in the foreign exchange (forex) market. It is important to note that as of my last knowledge update in January 2022, Forex Trendy was a product available in the market. However, please be aware that the specifics of the product and its features may have evolved since then.

Here is a general overview of Forex Trendy based on information available up to my last update:

Purpose:

Forex Trendy is primarily designed to help traders identify the best trends in the forex market. It aims to assist traders in making informed decisions by analyzing market trends and providing information on potentially profitable trading opportunities.

Features:

Trend Analysis: Forex Trendy uses advanced algorithms to analyze currency pairs and identify the prevailing trends in the market.

Pattern Recognition: The software may have the capability to recognize common chart patterns, such as triangles, flags, and wedges, which can be used by traders to predict potential price movements.

Chart Patterns and Timeframes: It might provide insights into various chart patterns across different timeframes, allowing traders to adjust their strategies based on their preferred trading timeframes.

User Interface:

Forex Trendy typically comes with a user-friendly interface that allows traders to access the necessary information and analysis easily.

The interface may include charts, trend indicators, and other tools to help traders make decisions.

Subscription Model:

Forex Trendy may operate on a subscription-based model where traders pay a fee to access the software and its features.

The subscription fee structure might vary, offering different plans depending on the duration of access and the features provided.

Alerts and Notifications:

The software might offer alert features to notify traders when certain market conditions or trends meet predefined criteria.

Notifications could be sent via email, SMS, or within the software platform.

Risk Management:

Some versions of Forex Trendy may include risk management tools to help traders assess and manage the risk associated with their trades.

Broker Compatibility:

Forex Trendy may be compatible with various forex brokers, allowing users to integrate the software with their trading platforms.

It's crucial to conduct thorough research and, if possible, access recent reviews and feedback from users before considering any trading software or tool. Additionally, be aware that the forex market is dynamic, and trading always involves risk. Always use caution and consider consulting with financial professionals before making trading decisions

CBN injects additional $500m to clear FX backlog - Premium Times Nigeria

from Google Alert - ALL ABOUT FOREX https://ift.tt/8M07qPm

via IFTTT

Nigeria Central Bank Vows to Clear Forex Backlog 'Within a Short Time' - Bloomberg

from Google Alert - ALL ABOUT FOREX https://ift.tt/2C4qMDG

via IFTTT

S&P 500 Price Forecast - S&P 500 Continues to Grind - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/UoQxA4k

via IFTTT

Volatility in Gold, After Mixed News on All Fronts Today - Forex News by FX Leaders

from Google Alert - ALL ABOUT FOREX https://ift.tt/wT04PHG

via IFTTT

Fitch Affirms JPMCC 2020-NNN; All Outlooks Revised to Negative

from Google Alert - ALL ABOUT FOREX https://ift.tt/nw6JbKM

via IFTTT

How to Trade Multiple Forex Accounts - Trading Effectively - PIP Penguin

from Google Alert - ALL ABOUT FOREX https://ift.tt/EXuao5z

via IFTTT

CBN releases $500m to clear verified Forex backlog - Punch Newspapers

from Google Alert - ALL ABOUT FOREX https://ift.tt/RHk4UWF

via IFTTT

CBN Releases $500m To Clear More Verified FX Liabilities Backlog - Channels Television

from Google Alert - ALL ABOUT FOREX https://ift.tt/qjN8vYA

via IFTTT

Again, CBN disburses $500m to clear 'verified' FX backlog - Thecable.ng

from Google Alert - ALL ABOUT FOREX https://ift.tt/6rMQcI2

via IFTTT

Nigeria's Central Bank Injects $500Million Into Forex Market, Vows To Clear Backlog Soon

from Google Alert - ALL ABOUT FOREX https://ift.tt/PkC3GFI

via IFTTT

EUR/USD Forecast: Firm Dollar Casting Shadows Ahead of FOMC - Forex Crunch

from Google Alert - ALL ABOUT FOREX https://ift.tt/cp5E8G6

via IFTTT

Analysis and trading tips for EUR/USD on January 29

Further decline became limited because the test of 1.0856 occurred during the sharp downward move of the MACD line from zero.

Data on Germany's consumer climate, M3 money supply aggregate in the eurozone, and private sector lending volume provoked a rise in euro in the morning. However, news indicating an increase in US spending fueled dollar demand, leading to a decline in the pair. Today, apart from the speech of ECB Vice President Luis de Guindos, no other interesting news will come out, although the statement may not have much impact on market direction.

For long positions:

Buy when euro hits 1.0858 (green line on the chart) and take profit at the price of 1.0886. Growth may not occur, so the pair will stay within the horizontal channel.

When buying, make sure that the MACD line lies above zero or rises from it. Euro can also be bought after two consecutive price tests of 1.0835, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0858 and 1.0886.

For short positions:

Sell when euro reaches 1.0835 (red line on the chart) and take profit at the price of 1.0810. However, be cautious as bears may refrain from active actions after updating the daily low due to the low market volatility.

When selling, make sure that the MACD line lies under zero or drops down from it. Euro can also be sold after two consecutive price tests of 1.0858, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0835 and 1.0810.

What's on the chart:

Thin green line - entry price at which you can buy EUR/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell EUR/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T21MwL

Hot forecast for EUR/USD on January 29, 2024

The EUR/USD pair is in the vicinity of the base of a corrective cycle, displaying speculative activity.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, confirming the increase in selling volumes.

On the same chart, the Alligator's MAs are headed downwards, corresponding to the current cycle.

Outlook

If the corrective phase persists, this suggests that bearish sentiment prevails among market participants. However, sellers are still facing the level of 1.0800, and in terms of technical analysis, this could exert pressure on short positions. Thus, the downward cycle is limited by this level, which makes it possible for the price to fluctuate above it. However, if the price settles below 1.0800 during the day, it would indicate a subsequent increase in the volume of short positions.

The complex indicator analysis points to a downtrend in the short-term and intraday periods.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T21Mht

Outlook for GBP/USD on January 29. The pound approaches the two central bank meetings in a great mood

GBP/USD traded chaotically and moved in different directions throughout Friday. However, there is nothing surprising about it, considering that the price has been stuck between the levels of 1.2610 and 1.2786 for the past month and a half. The flat persists, and movements within the flat have always been highly unpredictable, defying technical analysis.

Nevertheless, an uptrend has even formed within the sideways channel in recent weeks, as shown by the trendline on the hourly timeframe. Therefore, as long as the price does not firmly close below this trendline, we can still expect movement towards the upper boundary of the sideways channel – the level of 1.2786. Currently, the price is in between the Senkou Span B and Kijun-sen lines, as well as near the trendline. There's a high probability of a bullish reversal, but it is important to remember that this is still a flat, and movements within a flat can be entirely random.

It is also important not to forget that this week, we will see a significant number of important fundamental and macroeconomic events that are likely to have a strong impact on market sentiment. Therefore, this week might be a serious contender for the end of the flat. However, as usual, everything will depend on the nature of these events. If the British support the pound and the Americans support the dollar, and, technically, there's still a possibility that nothing will change. The pair may still remain within the bounds of the sideways channel.

Several trading signals were generated on Friday, as the price was in an area where two lines and one level converged. The first sell signal near the Senkou Span B line turned out to be false, resulting in a small loss. Subsequently, a buy signal was formed near the same line, after which the price crossed the Kijun-sen and the level of 1.2726. Traders had ample time to close long positions at a decent profit. Two more sell signals were formed by the end of the day, but there was no point in executing them as they were generated too late.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has been changing quite frequently in recent months. The red and green lines, representing the net positions of commercial and non-commercial traders, often intersect and, in most cases, are close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 6,300 buy contracts and 5,800 short ones. As a result, the net position of non-commercial traders increased by 500 contracts in a week. The fundamental backdrop still does not provide a basis for long-term purchases on the pound.

The non-commercial group currently has a total of 72,600 buy contracts and 41,100 sell contracts. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we need to pay closer attention to the technical picture and economic reports. However, even these types of analysis are currently secondary because, despite everything, the market maintains a bullish bias towards the pound, and the price has been in a flat range for the second month. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement (but there are no clear sell signals yet), and for a long time now, the economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD continues to move higher after bouncing from the 1.2605-1.2620 area. The wide sideways channel is still relevant, and the price has been unable to break out of it for a month and a half. Therefore, it wouldn't be surprising if the pound continues to rise within the flat today.

On Monday, the pair has a higher chance of rising than falling. The price is in the middle of the sideways channel, and the trendline is currently supporting its upward movement. Therefore, we believe that you may consider long positions with 1.2786 as the target, but we should remember that we are dealing with a flat market, and movements could turn out to be random so the price can move in any direction. The Ichimoku indicator lines are currently weak.

As of January 29, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2513, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2690) and Kijun-sen (1.2710) lines can also serve as sources of signals. Don't forget to set a breakeven Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

On Monday, there are no important events lined up in the UK and the US. Therefore, it is unlikely for the flat to end today, or volatility to be high.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T21MMV

Sunday 28 January 2024

Forecast for EUR/USD on January 29, 2024

At the end of the past week, during which the central banks of Japan, Canada, and the eurozone held meetings, the euro fell by only 44 pips. This indicates that investors are waiting for the outcomes of the Federal Reserve's decisions, and until then, significant market movements are not expected. Although the price settled below the MACD line on the daily chart, there is a small chance that the price will settle below the support level of 1.9825 since the bearish gap from the opening of the session has not yet been closed, and settling below the MACD line ahead of the Fed meeting may turn out to be a false signal.

Overcoming the MACD line (1.0862)will certainly eliminate the existing danger of a significant drop below 1.0825. However, this will not be a sign of a rise above 1.0905. Of course, we are waiting for the Fed's decision on monetary policy and the market's reaction to it. We expect the euro to fall below 1.0450 if the US stock market falls. Perhaps this will happen in February for political reasons.

On the 4-hour chart, an unclosed gap is clearly visible. The price adheres to the MACD line. The downtrend is restrained by a double convergence with the Marlin oscillator. We await the Fed meeting on Wednesday.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/T213d9

Explainer: What is naira's fair value? - Businessday NG

from Google Alert - ALL ABOUT FOREX https://ift.tt/bJXkEcf

via IFTTT

Forex trading mentor - Reddit

from Google Alert - ALL ABOUT FOREX https://ift.tt/Fm8BeYP

via IFTTT

Eventide's H90 Harmonizer has an all-new polyphonic synth algorithm + Bluetooth support

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=JcU44ESR-Vo

via IFTTT

2024 How to begin forex trading ideas. example. - tivekhsenlali.online

from Google Alert - ALL ABOUT FOREX https://ift.tt/hqGBEzY

via IFTTT

List Of All Upcoming Forex Events In Houston - AllEvents.in

from Google Alert - ALL ABOUT FOREX https://ift.tt/J1M96SZ

via IFTTT

Memeinator outlook after Joe Lonsdale's bullish remarks on AI - Invezz

from Google Alert - ALL ABOUT FOREX https://ift.tt/mb6GiAH

via IFTTT

Is Polygon (MATIC) Poised To Rally by 600%, Option2Trade (O2T) Attracts Forex Investors

from Google Alert - ALL ABOUT FOREX https://ift.tt/nkU2OWX

via IFTTT

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/lgUCFOi

via IFTTT

Forex Account for $100: Where to Open & Simulate Before Going Live - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=-kFLgEyISFI

via IFTTT

Cross Rate - What it is in Forex & What's its Purpose - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/p4kTx8W

via IFTTT

Saturday 27 January 2024

Weekly Forex Analysis & Trades Review! | EURUSD... - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=5LrqjnyTW7I

via IFTTT

US dollar slips after inflation data, Fed meeting looms next week - The Economic Times

from Google Alert - ALL ABOUT FOREX https://ift.tt/j3SrdVs

via IFTTT

What is interest and how do central banks affect it? - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=kv1mu5MXi-4

via IFTTT

Forecasting the Coming Week: Enter… the Fed! - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/ciIxW2L

via IFTTT

2024 Forex trading class cover on - cisbelaarh.online

from Google Alert - ALL ABOUT FOREX https://ift.tt/P2tS64d

via IFTTT

What is MACD Divergence? | FOREX.com - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=XBrrWblCWek

via IFTTT

Friday 26 January 2024

True Forex Funds Addresses MT5 Issues & Transition to cTrader

from Google Alert - ALL ABOUT FOREX https://ift.tt/m2f4pRD

via IFTTT

The Forex Funder on X: "Hey traders, wishing you all a fantastic weekend filled with joy and ...

from Google Alert - ALL ABOUT FOREX https://twitter.com/TheForexFunder/status/1750994943131205739

via IFTTT

Forex: J$156.40 to one US dollar - All Woman - Jamaica Observer

from Google Alert - ALL ABOUT FOREX https://ift.tt/oMhrut7

via IFTTT

CORRECTED-FOREX-Dollar firm ahead of price data; euro down on ECB rate cut hopes

from Google Alert - ALL ABOUT FOREX https://ift.tt/kHf0xLI

via IFTTT

Market Outlook | LIVE Trading 1/26/2024 | Forex, NAS100 | Stream # 180 - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=V2YiFATkDoo

via IFTTT

China's forex market turnover tops 20 trln yuan in December 2023 - Xinhua

from Google Alert - ALL ABOUT FOREX https://ift.tt/ctbMNsr

via IFTTT

Natural Gas Remains Subdued Despite the Freezing January in the US - Forex News by FX Leaders

from Google Alert - ALL ABOUT FOREX https://ift.tt/7QLPuBa

via IFTTT

What Is PATREX PRO BEST FOREX ROBOT ? Everything you need to know - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=PVEz5eTckpY

via IFTTT

Forex Reserves Fall By $2.8 Billion To $616.1 Billion, Says RBI - NDTV Profit

from Google Alert - ALL ABOUT FOREX https://ift.tt/frKc0hE

via IFTTT

Citi appoints new global head of FX product amid MD cuts - FX Markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/cnLNhtW

via IFTTT

Fitch Publishes Volkswagen Financial Services AG's 'A-' IDR; Outlook Stable

from Google Alert - ALL ABOUT FOREX https://ift.tt/59LeVNo

via IFTTT

India's forex reserves fall $2.79 bn to $616.14 bn as of Jan 19 - The Economic Times

from Google Alert - ALL ABOUT FOREX https://ift.tt/o5PpZkq

via IFTTT

One-on-one Forex training with a farmer, who came all the way from Free State to learn how ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/GugaTjt

via IFTTT

PrimeXBT Trading: Trade Forex on the App Store

from Google Alert - ALL ABOUT FOREX https://ift.tt/9wN8PJK

via IFTTT

Forex Trading Course - FX Learning | The Binary Destroyer

from Google Alert - ALL ABOUT FOREX https://ift.tt/XjR9OPT

via IFTTT

Thursday 25 January 2024

FOREX-US dollar gains after GDP data; euro falls to six-week low after dovish ECB, Lagarde

from Google Alert - ALL ABOUT FOREX https://ift.tt/8rUz35V

via IFTTT

Long-Time Trader Founds University of Options, Inaugurating Fail-Safe Trading Strategies

from Google Alert - ALL ABOUT FOREX https://ift.tt/jiSHDqI

via IFTTT

FOREX TRADING Why Exchange Forex? | by Lakiis Tech | Jan, 2024 | Medium

from Google Alert - ALL ABOUT FOREX https://ift.tt/y5hc804

via IFTTT

Pakistan's central bank forex reserves rise by 243 min USD - Xinhua

from Google Alert - ALL ABOUT FOREX https://ift.tt/vzINmoE

via IFTTT

CBN to gradually clear all FX obligations from FG, NNPC intervention — Report

from Google Alert - ALL ABOUT FOREX https://ift.tt/cDxF20K

via IFTTT

Forex is real, its not a conspiracy - Reddit

from Google Alert - ALL ABOUT FOREX https://ift.tt/CFpbwDL

via IFTTT

New trading platform costs weigh on FX dealers - FX Markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/NO4RGLK

via IFTTT

Australia's Top Lender Teams Up with Travelex to Revive FX Cash Services

from Google Alert - ALL ABOUT FOREX https://ift.tt/am4SsIB

via IFTTT

Wednesday 24 January 2024

Forex: J$156.87 to one US dollar - All Woman - Jamaica Observer

from Google Alert - ALL ABOUT FOREX https://ift.tt/wIhXZ3Y

via IFTTT

Common Misconceptions about Forex Robots Debunked - Medium

from Google Alert - ALL ABOUT FOREX https://ift.tt/gluUD0G

via IFTTT

Taylor Wimpey Shares Up 1.5% As Stock Markets Test All-Time Highs - FXLeaders

from Google Alert - ALL ABOUT FOREX https://ift.tt/aqGNVAM

via IFTTT

Forex Today: Bank of Canada Expected to Hold Rates at 5% - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/k9qXF1V

via IFTTT

Kuskus Starlight as a Confirmation Indicator - Stonehill Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/7hkULgH

via IFTTT

The Stars of 'Feud: Capote vs. The Swans' All Wore Black and White to the Premiere

from Google Alert - ALL ABOUT FOREX https://ift.tt/xTmHf6A

via IFTTT

Tuesday 23 January 2024

Forexlive Americas FX news wrap: US dollar flexes its muscles

from Google Alert - ALL ABOUT FOREX https://ift.tt/wk9Gn0K

via IFTTT

BOJ's Ueda: No requirement for all smes to increase wages significantly for policy change

from Google Alert - ALL ABOUT FOREX https://ift.tt/2ebE8CI

via IFTTT

Natural Gas Price Forecast - Natural Gas Markets Continue to Drift Lower - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/hD2tRQ1

via IFTTT

EUR/USD Mid-Day Outlook - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/w4UiLAd

via IFTTT

A Crunch Week For Central Banks: Policy Statements May Surprise The Market - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZuiKBEs

via IFTTT

FOREX-Yen firms on hints policy change may come; China market rescue talk lifts yuan, Aussie

from Google Alert - ALL ABOUT FOREX https://ift.tt/cZs5TFM

via IFTTT

Forex Exchange - album by Insignia 2020 - TikTok Music

from Google Alert - ALL ABOUT FOREX https://ift.tt/Qbu0HCW

via IFTTT

Mastering Forex Trading Pattern Recognition: A Comprehensive Guide for All Traders

from Google Alert - ALL ABOUT FOREX https://ift.tt/H8LieUq

via IFTTT

Jason Kelce Fx The Bear All Eposodes Streaming 6.22 Hulu Shirt - Eletees

from Google Alert - ALL ABOUT FOREX https://ift.tt/gDjZ74y

via IFTTT

Intro To Forex (Foreign Exchange), Mon, Jan 29, 2024, 7:30 PM | Meetup

from Google Alert - ALL ABOUT FOREX https://ift.tt/IepobDH

via IFTTT

Monday 22 January 2024

Is it Easy to Learn Forex? - IronFX

from Google Alert - ALL ABOUT FOREX https://ift.tt/2yxAeqT

via IFTTT

How does Traders Union help you choose a Forex broker and protect yourself against scam?

from Google Alert - ALL ABOUT FOREX https://ift.tt/uX6RIrG

via IFTTT

Exclusive: William Klippel rejoins Forex.com to head Partnerships and Alliances

from Google Alert - ALL ABOUT FOREX https://ift.tt/ukhbyro

via IFTTT

Caught this move last night y'all saw? : r/Forex - Reddit

from Google Alert - ALL ABOUT FOREX https://ift.tt/iL39Vxe

via IFTTT

Kickstart your FX trading with a technical look at the 3 major currencies - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=9qBkTM2Vaxw

via IFTTT

Oil Technical Analysis for January 23, 2024 by Chris Lewis for FX Empire - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=iUkjOrKBdOo

via IFTTT

Pakistan all set to launch online forex trading platform - ARY News

from Google Alert - ALL ABOUT FOREX https://ift.tt/HCuKXE5

via IFTTT

EUR/USD Mid-Day Outlook - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/jtuQFyB

via IFTTT

24 Exchange Sets Record Daily FX NDF Trade Volume of Over $4 Billion - PR Newswire

from Google Alert - ALL ABOUT FOREX https://ift.tt/mYThNUz

via IFTTT

NAS100 Hits Record Highs Ahead of Netflix & Tesla | FXCM UK

from Google Alert - ALL ABOUT FOREX https://ift.tt/K7ikp9S

via IFTTT

Y'all in any trades for the night? I had to close & catch a better entry. : r/Forex - Reddit

from Google Alert - ALL ABOUT FOREX https://ift.tt/Of3L4xa

via IFTTT

A Week in the Market: All Eyes on Central Banks (22-26 January) - Blog RoboForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/vsGqH40

via IFTTT

SMC Foundational Concepts is all you need for profitability #forextips #forextradingeducation #forex

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=2C-55HwWX7s

via IFTTT

All chart patterns for trading - Pinterest

from Google Alert - ALL ABOUT FOREX https://ift.tt/QOczrHP

via IFTTT

S&P 500 Price Forecast - Stock Markets Continue to Soar - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/3rXao06

via IFTTT

AUD/USD Forecast - Australian Dollar Continues to Consolidate - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/yzHjnOZ

via IFTTT

Sunday 21 January 2024

2024 Signal forex for a - haniodgf.online

from Google Alert - ALL ABOUT FOREX https://ift.tt/r3mFUEt

via IFTTT

2024 Most trusted forex brokers Investors. by - burcukim.online

from Google Alert - ALL ABOUT FOREX https://ift.tt/VguZnD5

via IFTTT

How to minimize losses and maximize trading profits [Video] - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/g9MQud5

via IFTTT

The Side Of Forex Trading Not Spoken About: Alb Weekly EP8. - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=WllDbiV-h6o

via IFTTT

Banks' forex holding drops in December - New Age

from Google Alert - ALL ABOUT FOREX https://ift.tt/icbILRM

via IFTTT

Weekly Forex Forecast For January 22-26, 2024

from Google Alert - ALL ABOUT FOREX https://ift.tt/tbo6OUg

via IFTTT

Haley targets Trump's affinity for dictators during final sprint in New Hampshire - XM

from Google Alert - ALL ABOUT FOREX https://ift.tt/Qq4msCN

via IFTTT

Saturday 20 January 2024

January 20, 2024 - The ICIR

from Google Alert - ALL ABOUT FOREX https://ift.tt/u7PanQ2

via IFTTT

The S&P 500's wild ride to an all-time high - XM

from Google Alert - ALL ABOUT FOREX https://ift.tt/ieP5thx

via IFTTT

Nifty Before and After. All market move the same guys. I started trading these indian stock ... - Reddit

from Google Alert - ALL ABOUT FOREX https://ift.tt/hVxUpZ8

via IFTTT

Weekly Forex Forecast For January 22-26, 2024 - Daily Price Action

from Google Alert - ALL ABOUT FOREX https://ift.tt/h3bQEtS

via IFTTT

AI a Jack-of-All-Trades, From Disease Prediction to Advancing Accessibility for the Disabled

from Google Alert - ALL ABOUT FOREX https://ift.tt/JEFwTgi

via IFTTT

Now Citi cut MDs from its US FX team - eFinancialCareers

from Google Alert - ALL ABOUT FOREX https://ift.tt/YXmQZti

via IFTTT

the harsh reality of forex trading - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=HUkmUbTlc98

via IFTTT

Friday 19 January 2024

Unveiling the Secrets to Effortlessly Make Money Online: The Cliqly Advantage

Unveiling the Secrets to Effortlessly Make Money Online: The Cliqly Advantage

Introduction:

In today's fast-paced world, many individuals find themselves juggling multiple responsibilities, including a full-time job and the desire to make extra income online. The struggle to find the time and effective methods to generate money online while working a busy job can be overwhelming. Hours spent clicking, posting on social media, and trying various strategies often lead to frustration and minimal results. This article aims to address these challenges and introduce a unique solution that claims to offer a way to add an extra $293 to your bank account every morning. Welcome to the world of Cliqly – the hidden secret that the pros might not want you to know.

The Frustration of Traditional Methods:

For many individuals, the pursuit of online income can feel like an endless loop of effort without significant returns. Clicking for hours, sharing content on social media platforms, and experimenting with different approaches often yield minimal attention from potential customers. The frustration builds as one wonders why the invested time and energy aren't translating into tangible financial gains. It's a common tale of confusion and disappointment, leaving many to question the viability of making money online.

The Need for a Change:

Amidst the sea of failed attempts and discouragement, the desire for a genuine solution becomes paramount. What if there was a way to not only break the cycle of frustration but also consistently add $293 to your bank account every morning? This article explores Cliqly, a purportedly unique solution that claims to revolutionize the way individuals make money online. Beyond the promises of financial gains, Cliqly also asserts its ability to pay off debts, facilitate savings for the future, and provide the freedom to live life on one's own terms.

Understanding Cliqly:

Cliqly is positioned as a game-changer in the realm of online income generation. Unlike conventional methods that often lead to disappointment, Cliqly promises a fresh approach to making money online. To comprehend the true essence of Cliqly, it's essential to delve into its features, benefits, and the reasons it stands out from other solutions in the market.

- The Hidden Secrets Pros Don't Want You to Know:

The marketing pitch for Cliqly suggests that it holds hidden secrets that professionals might not want you to discover. This claim raises curiosity and skepticism simultaneously. What are these secrets, and why would professionals conceal them? The article explores the unique aspects of Cliqly that allegedly set it apart from other online income solutions.

- Effortlessly Adding $293 to Your Bank Account Every Morning:

Cliqly's bold promise of adding $293 to your bank account daily is a significant attention-grabber. How does Cliqly achieve this, and is it a realistic expectation? This section investigates the mechanics behind Cliqly's purported daily financial gains and assesses its feasibility.

- Paying Off Debts: A Realistic Goal with Cliqly?

One of the asserted benefits of Cliqly is its potential to help users pay off debts. For many individuals, debt can be a significant source of stress and financial burden. Can Cliqly truly make a difference in this aspect, and what strategies does it employ to assist users in achieving debt-free status?

- Saving for the Future: Cliqly's Long-Term Financial Planning

Beyond immediate financial gains, Cliqly claims to provide a platform for users to save for the future. This section explores the mechanisms Cliqly employs for long-term financial planning, considering the importance of saving for goals such as education, homeownership, or retirement.

- Living Life on Your Terms: The Freedom Cliqly Promises

The desire for financial freedom is a common motivator for individuals seeking online income opportunities. Cliqly positions itself as a means to help users live life on their own terms. What does this freedom entail, and how does Cliqly empower its users to take control of their lives?

The article concludes by encouraging readers to take action and join Cliqly. A critical analysis of the provided link is undertaken, considering the potential risks and benefits of becoming a Cliqly user.

Conclusion:

In the pursuit of making money online while managing a busy job, individuals often encounter frustration and disappointment. Cliqly emerges as a potential solution, claiming to unveil hidden secrets, provide a daily income boost, help in paying off debts, support long-term financial planning, and empower users to live life on their own terms. This article critically examines these claims, aiming to provide readers with insights into the efficacy and feasibility of Cliqly as a transformative online income solution. As with any endeavor, thorough research and careful consideration are essential before taking the plunge into the world of Cliqly

'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...