How to get SNIPER ENTRIES on all forex pairs. 0. This forex indicator is built based on the trend following the price action strategy. Sniper ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/hn78Jrs

via IFTTT

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Saturday 30 September 2023

October TV Preview: 22 New Shows to Watch - IndieWire

... FX Networks. All rights reserve. 20. October 26: “FX's American Horror Stories” (Hulu). It's a double dose of American Horror Stories this fall while ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/SHr72JW

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/SHr72JW

via IFTTT

20 facts you might not know about 'Fargo' - Yardbarker

It takes place in the same universe and references Fargo and other Coens movies. Fargo has aired four seasons on FX thus far. 19 of 20. The movie does ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Nyf61bD

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Nyf61bD

via IFTTT

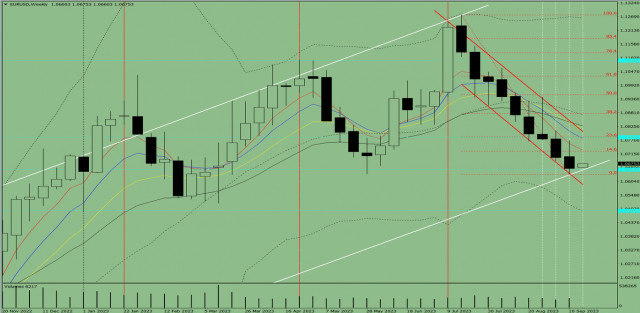

Euro vs US Dollar Live Forex Chart (EURUSD,D1) By David829 - Myfxbook.com

Analyze, discuss and view in real time EURUSD,D1 forex chart by David829 ... Loading... Loading... All Quotes x. AUDUSD, 0.6426, USDCHF, 0.9153. EURJPY ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/KpCUYjz

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/KpCUYjz

via IFTTT

Judge greenlights class action against Bausch Health on Cold-FX products - 660 News

... All. News. LocalCanadaWorldBusinessEntertainment. Watch. All. Watch. Latest ... Several Cold FX products are seen. COLD FX. By The Canadian Press.

from Google Alert - ALL ABOUT FOREX https://ift.tt/q5iWzhj

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/q5iWzhj

via IFTTT

Forex Today: Another positive week for the Dollar - FXStreet

However, it's important to note that if a government shutdown occurs, the release of the Nonfarm Payrolls report may be delayed or not occur at all.

from Google Alert - ALL ABOUT FOREX https://ift.tt/g59IljT

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/g59IljT

via IFTTT

Lecturers studying abroad on TETFund grants seek bailout amid forex fluctuations

... foreign exchange (forex). ... “Based on the foregoing, TETFund has been up to date in tuition payment to the training institutions of all affected ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/7kGydB0

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7kGydB0

via IFTTT

Ontario judge greenlights class action against Bausch Health on Cold-FX products - CP24

Coverage from across Toronto and beyond on all the stories that matter ... FX products. Advertisement. Filed in 2019, the suit notes that packaging and ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/eDkcKQU

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/eDkcKQU

via IFTTT

Nigeria: Naira Appreciates At Forex Markets - allAfrica.com

AllAfrica is a voice of, by and about Africa - aggregating, producing and distributing 500 news and information items daily from over 90 African news ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/JmRWqsb

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/JmRWqsb

via IFTTT

Friday 29 September 2023

CFTC Charges Eight Entities for Fraudulently Claiming CFTC Registration

... foreign exchange dealers (RFEDs). The entities, which all claim to be based in the Florida, are altux-fx-miner, AstroFXMinners, Avadigital-Miners ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/3MFRxLl

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/3MFRxLl

via IFTTT

How can I improve if I have all day : r/Forex - Reddit

I have all day to laser focus on becoming profitable, I've been trading for 2 years still not profitable due to sloppiness, switching strategies…

from Google Alert - ALL ABOUT FOREX https://ift.tt/mdP5nZD

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/mdP5nZD

via IFTTT

FX option expiries for 29 September 10am New York cut - Forexlive

You could lose some or all your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/4KDMW5Z

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/4KDMW5Z

via IFTTT

Best scalping ea free download. it's best to let the EA algo

All Currency Pairs; Unlimited Demo Licenses; Yes, you are free to use the Forex Scalping EA for trying to pass prop firm challenges provide the prop ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/OjR4zg6

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/OjR4zg6

via IFTTT

USD/JPY Forecast - US Dollar Recovers After Initial Selloff - FX Empire

All things being equal, this is a market that continues to move based on interest rate differential, which of course is quite wide between these 2 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/X5q2Thv

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/X5q2Thv

via IFTTT

29/09/2023 - USDCAD vulnerable to more downside - Markets Overview Videos - provided by XM

Forex Outlook. View All · 4 days ago. Weekly Technical Outlook: 25/09/2023 - USDJPY, EURUSD, AUDUSD · 1 week ago. Weekly Forex Outlook: 22/09/2023 - ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/IOgpaP8

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/IOgpaP8

via IFTTT

Thursday 28 September 2023

UK retail sales rose 0.4% in August, partly reversing July's sharp decline - TopBrokers.com

TopBrokers.com will not accept any liability for loss or damage as a result of reliance on the information on this site. Forex pairs, cryptocurrencies ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/fuBWRLe

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/fuBWRLe

via IFTTT

Pakistani central bank forex reserves fall 59 mln USD - Xinhua

Pakistani central bank forex reserves fall 59 mln USD ... Copyright©2000-2023XINHUANET.com All rights reserved.

from Google Alert - ALL ABOUT FOREX https://ift.tt/ejUIEtg

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ejUIEtg

via IFTTT

We 'll tackle forex shortage, Cardoso assures investors - Vanguard News

The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has assured that the institution would do all within its statutory ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/VWNSYDv

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/VWNSYDv

via IFTTT

FP Markets Wins 'Best Trading Conditions' and 'Most Trusted Broker' at the Ultimate Fintech ...

CNW/ -- FP Markets, a leading broker for Forex and CFDs, continued to set the standard at the Ultimate Fintech Awards Global 2023, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/B1dpvji

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/B1dpvji

via IFTTT

The Texas Chain Saw Massacre - Nicotero Leatherface Reveal Trailer - GameSpot

Designed by Special Makeup FX Artist and founder of KNB EFX Group ... All information these cookies collect is aggregated and therefore anonymous.

from Google Alert - ALL ABOUT FOREX https://ift.tt/HahjJlq

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/HahjJlq

via IFTTT

Have you ever met a know-it-all acting like they know everything about the market? : r/Forex

I was a bragging forex trader when i started and the market humbled me very fast. I also use to take signals till i understand that signals mean your ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Evb8VwX

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Evb8VwX

via IFTTT

How forex volatility affects cost of doing business at Nigerian ports - Tribune Online

With Nigeria not having a single ship to move goods all around the world, almost 100 percent of cargoes that come into Nigerian ports are moved by ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/zxJ2YMR

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/zxJ2YMR

via IFTTT

Wednesday 27 September 2023

We Will Maintain Price Stability, Promote Healthy Forex - CBN - YouTube

... forex, inflation and interest rate. During his screening with the Senate ... Why All Eyes Are On Zimbabwe's Lithium Industry. CNBC•941K views · 21:08.

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=MLVbyS8HC8Y

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=MLVbyS8HC8Y

via IFTTT

US Dollar Price Action: EUR/USD, Gold, GBP/USD, USD/CAD, USD/JPY - FOREX.com

I'll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It's free for all to register: Click here to register. The US ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/zG7sYxg

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/zG7sYxg

via IFTTT

Exclusive: My Forex Funds Claims CFTC “Mischaracterized” Its Tax Payments to Freeze Assets

That is what happened here, and the CFTC would have this Court believe that all of this is completely constitutional. It is not.”, the motion stated.

from Google Alert - ALL ABOUT FOREX https://ift.tt/Arjn1BZ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Arjn1BZ

via IFTTT

Forex Trading Secrets | JadeCapFx - Eightify

All Forex Trading summaries > · Our team · Contact us · Terms of use · Privacy Policy · All summaries · YC summaries · GPT summaries · Eightify ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/NWjZSJp

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NWjZSJp

via IFTTT

Afternoon update: ASX dips 0.29% with all sectors in the red - YouTube

Afternoon update: ASX dips 0.29% with all sectors in the red. 16 views · 6 ... FOREX vs STOCK Market! Which one is BETTER and WHY?! ForexSignals TV ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=6kY5guaMk2w

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=6kY5guaMk2w

via IFTTT

Understanding the Benefits of Having a Forex Mentor - Trade Brains

Forex trading is an exciting avenue to make money. Like all things, you must start somewhere. It is not ideal to figure it out yourself, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/TDrU4Ep

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/TDrU4Ep

via IFTTT

CP17/23 – Capitalisation of foreign exchange positions for market risk - Bank of England

Information provided in response to this consultation, including personal information, may be subject to publication or disclosure to other parties in ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/vUhQukY

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/vUhQukY

via IFTTT

Best Forex Brokers Malaysia Reviewed in 2023 - Outlook India

Most CFD traders use leverage, and this carried substantial risks for all traders. You should not trade any such instruments unless there is a local ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZPDCyR7

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZPDCyR7

via IFTTT

Watch TD Securities on FX Strategy - Bloomberg

You know, this this Chinese market equity or currency, you know, pick your asset class, you know, when things turn, this is all all gas and no brakes.

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vy9jYpR

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vy9jYpR

via IFTTT

Nigeria's central bank Governor Cardoso pledges to clear $7 billion forex backlog

... forex demand on the official market due to inadequate liquidity and ... All rights reserved. Stock quotes are provided by Factset, Morningstar ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/gSYVunb

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/gSYVunb

via IFTTT

Tuesday 26 September 2023

SPX, USD, Rates Price Action - EUR/USD, USD/JPY, USD/CAD - YouTube

In this webinar Sr. Strategist James Stanley goes over major FX and macro markets with a focus on price action. 00:00 - Introduction 02:19 - FOMC ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=JEkzQFp5400

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=JEkzQFp5400

via IFTTT

FOREX-Dollar hits 10-month high as US yields spike, yen slides - Nasdaq

All spots FX= Tokyo spots AFX= Europe spots EFX= Volatilities FXVOL= Tokyo Forex market info from BOJ TKYFX. World FX rates https://ift.tt/fio8Ft1.

from Google Alert - ALL ABOUT FOREX https://ift.tt/I8jDEdn

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/I8jDEdn

via IFTTT

The best forex trading Meta trader update of all times. The Bulk opera... - TikTok

Have tou ever wonder how to close all your trade in one go without closing them one by one? I have you covered on this short video How to learn forex ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/cr3OJPV

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/cr3OJPV

via IFTTT

Daman Securities Discover Forex News Group

Daman Securities Discover Forex News Group: the latest behind-the-scenes insight into all the FX executive moves, platform advancements, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/JDFXupY

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/JDFXupY

via IFTTT

GBPUSD marks its worst month of 2023 - Markets Overview Videos - provided by XM

Forex Outlook. View All · 4 days ago. Weekly Forex Outlook: 22/09/2023 - US core PCE and Eurozone flash CPIs eyed after rate pause signals · 1 week ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/M2NUm7Y

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/M2NUm7Y

via IFTTT

Markets Overview Videos - provided by XM

Market Comment: 26/09/2023 - Dollar at 10-month high as yields keep surging. Forex News. View All · 4 days ago. Market Comment: 22/09/2023 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/D56w0Uq

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/D56w0Uq

via IFTTT

FX Daily: US bond market sets the FX tone | Article | ING Think

Use all cookies. I accept all cookies (including marketing cookies) used by ING or third parties, such as social media platforms. Reject.

from Google Alert - ALL ABOUT FOREX https://ift.tt/8HG2rkX

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/8HG2rkX

via IFTTT

South Korea to Extend Forex Trading Hours Next Year - WSJ

... forex policy at the Ministry of Economy and Finance said Tuesday. The ... The 12-time Grammy Award winner took advantage of an invitation from the All ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/phoRjb4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/phoRjb4

via IFTTT

Unlock the Trading Secret: All Trades Are Equal! - Eightify

Summaries · Forex Trading Unlock the Trading Secret: All Trades Are Equal! This is a summary of a YouTube video "One Simple Trading Secret ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/RkLnEDH

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/RkLnEDH

via IFTTT

Monday 25 September 2023

Analyst Reviews Nigeria's FOREX Management History - YouTube

Analyst Reviews Nigeria's FOREX Management History. 571 views · 15 hours ago ... 'If You Fight With One, You Fight With All', TUC warns Lagos Govt.

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=e2sC9_9JrxQ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=e2sC9_9JrxQ

via IFTTT

10 Powerful Facts About Big Data | InformationWeek

Recent in ML & AI · See All · Business woman, AI and laptop with hologram, UX and networking for forex trading icon in office using virtual platform.

from Google Alert - ALL ABOUT FOREX https://ift.tt/MmVkpxW

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/MmVkpxW

via IFTTT

Enclave FX Takes Center Stage as Titanium Sponsor at Forex Expo Dubai 2023 ...

... forex market.For further information about Enclave FX and to explore their award-winning brokerage and trading platform, please visit Enclave FX ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/YXwjSpg

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/YXwjSpg

via IFTTT

Extra Income In Poland - Answers To All The Important Questions - Traders Union

Do you want to start trading Forex? Open an account on RoboForex! 58.42% of retail investor accounts lose money when trading CFDs with this provider.

from Google Alert - ALL ABOUT FOREX https://ift.tt/8gITtjl

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/8gITtjl

via IFTTT

Arbitrary detentions continue in Sudan, intelligence condemns RSF forex speculators

The El Omda Residents Gathering on Saturday issued a statement calling on the RSF to release all detainees who were abducted on Friday and taken to an ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vdmcx0X

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vdmcx0X

via IFTTT

India rupee ends weaker but fresh record low not in sight | Reuters

Global pressures all point to depreciation but "83.30 is likely to stay protected," said Sajal Gupta, head of forex and commodities at Nuvama Wealth ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/4yIk3GB

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/4yIk3GB

via IFTTT

Sunday 24 September 2023

US Home Home Sales - Economic Calendar - FX Leaders

... all the additional information you need to know about US Home Home Sales ... Forex StrategiesFundamental Forex StrategiesPopular Forex Strategies ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/73JW2Qf

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/73JW2Qf

via IFTTT

Planters' Association says unproductive rubber lands can be utilized for palm cultivation to save forex

“We must be able to formulate policy based on facts and data, not slogans and other propaganda.” Speaking further, the Planters' Association Chairman ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/uhC9zQp

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/uhC9zQp

via IFTTT

Commodity Currencies Feeling Good on Positive Signals from the Global Economy

Forex StrategiesFundamental Forex StrategiesPopular Forex StrategiesTechnical Forex StrategiesForex Strategies Articles ... View all comments. 6 H. 0.

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZTmUl6j

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZTmUl6j

via IFTTT

Weekly Forex Forecast – GBP/USD, USD/JPY, WTI Crude Oil, NASDAQ 100 Index, Sugar

Riskier currencies and commodities suffered much less, if at all. The other major event last week was the Bank of England's narrow vote to leave its ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ULbuRa1

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ULbuRa1

via IFTTT

Exploring the Global Market: How All Trading of Currencies on the Forex Takes Place

The foreign exchange market, also known as the forex market or FX market, is the largest and most liquid financial market in the world.

from Google Alert - ALL ABOUT FOREX https://ift.tt/jz8Cqsw

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/jz8Cqsw

via IFTTT

Crypto fear and greed index steady as Memeainator token sale nears - Invezz

Invest in forex How to trade forex Overall best forex brokers Best forex ... Olive oil, live cattle, orange juice, and cocoa have all surged to historic ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/38AwtbJ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/38AwtbJ

via IFTTT

ALL TREE SERVICE •MASTER TREE SERVICE• | Tree Service | brenhambanner.com

ALL TREE SERVICE•MASTER TREE SERVICE•27 Years Experience in TreeRemoval ... ForexForex More More. undefined. SPX500USD C. S&P 500. undefined. XLY0 C.

from Google Alert - ALL ABOUT FOREX https://ift.tt/aYUpr8v

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/aYUpr8v

via IFTTT

Forex, forex, Fx? - Trinidad Guardian

All commercial banks now have the authority and capacity to treat with customers' forex demands. They need only report for statistical purposes the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/HXNJfZz

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/HXNJfZz

via IFTTT

SIX, Capital.com, oneZero and More: Executive Moves of the Week

Established in 2013 with headquarters in London, Alchemy Prime delivers FX Prime Brokerage solutions with “direct access to all Tier-1 and Tier 2 FX ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/BZn0cG4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/BZn0cG4

via IFTTT

Cardoso and Tasks ahead in CBN - THISDAYLIVE

All three issues are more linked to fiscal policies than monetary at ... forex disbursements. He recalled such efforts were rebuffed. “But we never ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/KZRGDYE

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/KZRGDYE

via IFTTT

JPMorgan warns of a continued surge in oil prices to $150 - Invezz

Invest in forex How to trade forex Overall best forex brokers Best forex ... All Rights Reserved. Share via. Facebook. Twitter. LinkedIn. Mix. Pinterest.

from Google Alert - ALL ABOUT FOREX https://ift.tt/sh3y8SO

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/sh3y8SO

via IFTTT

Saturday 23 September 2023

Profitable Forex Indicator - Free Download in Description - Eightify

A currency that is consistently strong or weak across all time frames can provide even more confidence in trading decisions. The momentum meter ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/65hO3Qf

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/65hO3Qf

via IFTTT

The Forex Sniper Indicator - Product Information, Latest Updates, and Reviews 2023

Calling all experts and enthusiasts! Share your wisdom and leave a pro tip that will make a difference! Have you tried The Forex Sniper Indicator ?

from Google Alert - ALL ABOUT FOREX https://ift.tt/LsJzh3O

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/LsJzh3O

via IFTTT

Forex Trading Strategies

"The Real Solution FX Traders Want"

Foreign exchange (FX) trading is a dynamic and high-stakes endeavor, attracting traders from around the world. These traders are constantly seeking an edge in a market known for its volatility and unpredictability. In their quest for success, they are often in search of the real solution that will elevate their trading game and lead to consistent profits.

While there are countless strategies, tools, and platforms available to FX traders, the real solution they want transcends the traditional arsenal of trading techniques. It goes beyond simply finding the next hot trend or the perfect indicator. The real solution FX traders want encompasses a combination of factors that together create a holistic approach to trading success.

Education and Knowledge: The foundation of any successful trader's journey is a deep understanding of the FX market. This includes knowledge of macroeconomic factors, geopolitical events, and market psychology. FX traders want access to high-quality educational resources and courses that can help them continuously improve their skills and stay updated on market developments.

Risk Management: One of the most crucial aspects of FX trading is risk management. Traders want a solution that helps them protect their capital and limit potential losses. This involves setting stop-loss orders, proper position sizing, and maintaining a disciplined approach to trading.

Psychological Discipline: Emotional control is a significant challenge for many traders. They want strategies and tools that help them maintain discipline and avoid impulsive decisions driven by fear or greed. Mindfulness techniques and trading journals can be valuable in this regard.

Access to Reliable Information: Timely access to accurate and relevant information is vital in the FX market. Traders want access to news feeds, economic calendars, and analysis tools that can help them make informed decisions.

Technology and Tools: Traders require efficient and reliable trading platforms that offer a wide range of technical analysis tools, customizable charts, and order execution capabilities. They also want access to algorithmic trading systems and automation options to streamline their trading processes.

Community and Mentorship: Being part of a trading community or having access to experienced mentors can be invaluable. Traders want to learn from others, share insights, and receive guidance from those who have successfully navigated the challenges of FX trading.

Adaptability: The FX market is constantly evolving, and traders want solutions that allow them to adapt to changing market conditions. This may involve exploring new trading strategies or adjusting existing ones as market dynamics shift.

Regulatory Compliance: A trustworthy trading environment is essential for traders. They want to trade with brokers and platforms that adhere to robust regulatory standards to ensure the safety of their funds and transactions.

Continuous Improvement: FX traders are always striving to improve their skills and strategies. They want access to tools and resources that facilitate ongoing learning and development.

Realistic Expectations: Ultimately, traders want a solution that helps them set realistic expectations. Trading is not a guaranteed path to instant wealth, and traders need to understand and accept the risks involved while pursuing consistent, sustainable profits.

In the world of FX trading, there is no one-size-fits-all solution, as individual traders have unique goals and risk tolerances. However, the real solution FX traders want encompasses a combination of education, discipline, access to reliable information, and the right tools and resources to help them navigate the complex and ever-changing world of foreign exchange markets. Success in FX trading requires dedication, continuous learning, and a comprehensive approach to trading that addresses all these aspects.

Plug Power stock just formed a rare bullish pattern but risks remain - Invezz

Invest in forex How to trade forex Overall best forex brokers Best forex ... It has dropped by more than 90% from its all-time high, bringing its total ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/bzmuTpY

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/bzmuTpY

via IFTTT

The Fed Wrestles with Rate Expectations as USD Bulls Continue Push - FOREX.com

It's free for all to register: Click here to register. The US Dollar bullish theme has continued to run and the September FOMC rate decision seemed to ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/3fMFs4h

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/3fMFs4h

via IFTTT

All you see i got them with the help of forex trading.You can achieve - TikTok

TikTok video from TradewithRama (@ramafx_crypto): "All you see i got them with the help of forex trading.You can achieve in short time just ASK ME ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/8NWHS3R

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/8NWHS3R

via IFTTT

Mql4 dashboard

... forex trading pdf Forex Mt4 forex currency table Indicators . Smart FX ... Among all such forex currency strength indicator mt4 is one …The #1 MT4 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZpvkHDx

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZpvkHDx

via IFTTT

Euro vs Canadian Dollar Live Forex Chart (EURCAD,M30) By TOUREDJIGUIBA | Myfxbook

Loading... Loading... All Quotes x. AUDUSD, 1.0, USDCHF, 0.9. EURJPY, 158.08, EURCHF, 0.9665. EURGBP, 0.8709, GBPJPY, 181.49. EURUSD, 1.1, GBPUSD, 1.0.

from Google Alert - ALL ABOUT FOREX https://ift.tt/lrYc48R

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/lrYc48R

via IFTTT

Kenya shilling tipped to weaken further on low forex inflows - The East African

X could charge all users 'small monthly payment', Musk says · Kenya-born ... Kenya relies on forex inflows from diaspora remittances, exports ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/yQB97Em

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/yQB97Em

via IFTTT

Forex Update: India's Foreign Exchange Reserves Drop $867 Million to $593 Billion; Check Details

In October 2021, India's forex kitty had reached an all-time high of $645 billion. India's foreign exchange reserves declined $867 million to $593.037 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/NRx7crm

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NRx7crm

via IFTTT

Best Forex Trading Platform of 2023 Named by TradersUnion.com - Hindustan Times

All have been evaluated by the Traders Union Overall Score, a scoring system for brokers used by TU experts to evaluate companies. It ranges from ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/c03QO9x

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/c03QO9x

via IFTTT

CMA Directs Online Foreign Exchange Brokers to Enhance Disclosure Mechanisms

The information contained in this website is for general information purposes only. Read more.. Advertise with Us. Copyright 2023. The Kenyan Wall ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/QH2pDgB

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/QH2pDgB

via IFTTT

Friday 22 September 2023

Japan Will Not Rule Out Any Options Against Forex Volatility - PM Kishida - US News Money

See All Best Of Pages. Card Reviews. American Express · Capital One · Chase ... Japan Will Not Rule Out Any Options Against Forex Volatility - PM ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/6k5cKA9

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/6k5cKA9

via IFTTT

Stocks roll over as US yields climb to new highs - Markets Overview Videos - provided by XM

Forex Outlook. View All · 4 days ago. Weekly Technical Outlook: 18/09/2023 - EURUSD, GBPUSD, USDJPY · 1 week ago. Weekly Forex Outlook: 15/09/2023 - ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/yX2WrQi

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/yX2WrQi

via IFTTT

Forex Trading Profile of forexprofitsONEX - Myfxbook.com

View the profile of Forex Trader forexprofitsONEX - forex trading systems, strategies and forum posts ... all the aspects on how to win in the Forex ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/zDZ0tFC

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/zDZ0tFC

via IFTTT

Forex kitty drops USD 867 million to USD 593.037 billion | Zee Business

In October 2021, the country's reserves had touched an all-time high of USD 645 billion. The reserves took a hit as the central bank deployed the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/T97ZBNW

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/T97ZBNW

via IFTTT

FX Daily: Re-pricing for a world of higher US rates | Article - ING Think

It really has been the PMI releases that have hit the euro since the summer. Despite all this pessimism about the euro, however, the ECB's trade- ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/q2fiEj7

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/q2fiEj7

via IFTTT

Japan will not rule out any options against forex volatility, prime minister says | Reuters

The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. Checkpoint , opens new tab. The industry ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/yLDcvtr

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/yLDcvtr

via IFTTT

GBPJPY recovers some ground after BoE slump - Markets Overview Videos - provided by XM

... all eyes on the Fed meeting. Forex Outlook. View All · 4 days ago. Weekly Technical Outlook: 18/09/2023 - EURUSD, GBPUSD, USDJPY · 1 week ago. Weekly ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/gXahEs9

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/gXahEs9

via IFTTT

IC Markets Review 2023: The Best Forex Broker? - Outlook India

They operate on and offshore, allowing traders to capitalize on the increased leverage this brings, whilst staying compliant with regulations in all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/K70Q3tE

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/K70Q3tE

via IFTTT

The Cost of Learning: Evaluating the ROI of a Trading Course Forex | Forex Academy

While there is a wealth of information available online, many traders opt to enroll in trading courses to accelerate their learning process. However, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/FeSxls8

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/FeSxls8

via IFTTT

GBP/USD, DAX Forecast: Two Trades to Watch - FOREX.com

All opinions and information contained in this report are ... Forex trading involves significant risk of loss and is not suitable for all investors.

from Google Alert - ALL ABOUT FOREX https://ift.tt/2poAhf4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/2poAhf4

via IFTTT

Exploring India's Forex Market Timings With Insights From Experts - FinanceFeeds

Although the Forex market is accessible 24 hours, not all hours offer optimal trading conditions. Overlapping trading sessions, where major ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/1zUyaLo

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/1zUyaLo

via IFTTT

Hawkish Fed vs Dovish Others - Action Forex

It's hard to see how, with all these developments, the BoE won't be obliged to hike, again. The only way is a really bad economic performance. A ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/YdhmFUk

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/YdhmFUk

via IFTTT

MT4 Expert Advisor Forex Trading Robots For Passing Prop Firm Challenges

By gathering all of the relevant information quickly and with a high degree of accuracy and then placing trades automatically, the software offers ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/5RaltrZ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/5RaltrZ

via IFTTT

Critical point in Nigeria's FX management - Businessday NG

This week has finally pushed the Naira / Dollar exchange rate closer to N1000 to the Dollar. Most people who spoke to me this week all…

from Google Alert - ALL ABOUT FOREX https://ift.tt/ESdZAcq

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ESdZAcq

via IFTTT

No options excluded in tackling forex volatility: finance chief - Kyodo News

No options excluded in tackling forex volatility: finance chief. KYODO NEWS - 2 hours ago - 12:01 | All, Japan. Japan does not rule out ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/rzDbPWg

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/rzDbPWg

via IFTTT

URGENT: No options excluded in tackling forex volatility: finance chief | Nippon.com

Related articles · URGENT: Japan warns of excess currency volatility, says all options on table · URGENT: Every option on table to counter excess forex ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/7NMvyJ0

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/7NMvyJ0

via IFTTT

Sunset Market Commentary - Action Forex

A slew of central bank meetings kept markets busy all day. From the Turkish central bank (+500 bps to 30%) over the Riksbank & the Norges Bank (+25 ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/evnr9l8

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/evnr9l8

via IFTTT

USD/TRY: Higher Values with Tame Velocity and Correlations - DailyForex

... Forex market in many cases. The USD/TRY is trading near ... We work hard to offer you valuable information about all of the brokers that we review.

from Google Alert - ALL ABOUT FOREX https://ift.tt/2J8hTmD

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/2J8hTmD

via IFTTT

Thursday 21 September 2023

Japan will not rule out any options against forex volatility - PM Kishida | SaltWire

Japan will not rule out any options against forex volatility - PM Kishida ... All rights reserved. Privacy Policy Terms of Use Copyright Terms of ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/iXL2Bj4

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/iXL2Bj4

via IFTTT

FX reserves commonly invested in US Treasuries, bank deposits - Central Banking

All rights reserved. Published by Infopro Digital Services Limited, 133 Houndsditch, London, EC3A 7BX. Companies are registered in England and ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/aV1QWf5

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/aV1QWf5

via IFTTT

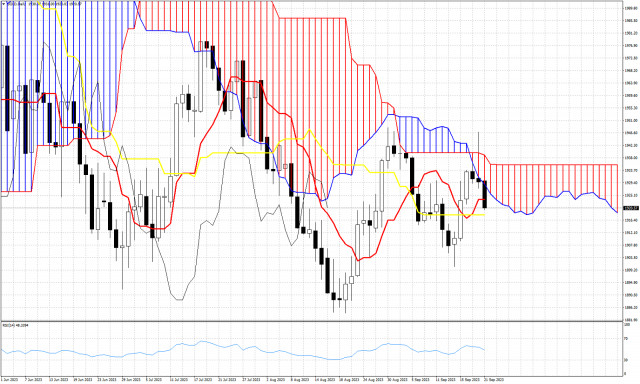

Ichimoku cloud indicator analysis on Gold for September 21st, 2023.

Gold price is trading around $1,920. Bulls failed to push price above the Kumo (cloud) resistance. Price is showing rejection signs in the daily chart as price is turning lower after testing the cloud resistance. Gold is trading below the tenkan-sen (red line indicator) and is now challenging the kijun-sen (yellow line indicator). A daily close below $1,918 would be a new sign of weakness. Trend according to the Ichimoku cloud indicator is still bearish as price remains below the Daily Kumo. The Chikou span (black line indicator) is above the candlestick pattern (bullish) but is turning lower. Price remains vulnerable to more downside.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwQwzg

http://dlvr.it/SwQwzg

RBI can spend USD 30 bn of forex reserves to defend rupee: Report - The Times of India

The rupee is currently close to its all-time high against the US dollar, and the RBI has been actively intervening in the forex market to manage ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/D3NV1hL

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/D3NV1hL

via IFTTT

RBI can spend $30 billion of forex reserves to defend rupee: Deutsche Bank | Mint

The German brokerage said the Indian rupee is trading close to around ₹83.30, its all-time high against the US dollar, and the Reserve Bank is ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/NlOiC6M

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/NlOiC6M

via IFTTT

The Informed Way To Navigate The Forex Landscape—Post-2023 Banking Crisis - Forbes

However, another group that has felt these tremors in a pronounced way is forex investors and traders. ... After all, the importance of learning from ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/9Za8Eil

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/9Za8Eil

via IFTTT

RBI can spend USD 30 billion of forex reserves to defend rupee: Report | Zee Business

The rupee is trading close to its all-time high against the US dollar at around Rs 83.30, and the Reserve Bank is actively intervening in the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/gaihzZP

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/gaihzZP

via IFTTT

Gold Forecast Video for 21.09.23 by Bruce Powers for FX Empire - YouTube

Know-it-all Knows it all New 5.6K views · 1:20 · Go to channel · Natural Gas Forecast for 21.09.23, by Bruce Powers for FXEmpire. FX Empire New 340 ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=wH-vCtj6zAU

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=wH-vCtj6zAU

via IFTTT

Forex Trading Profile of DESILVAGROUP - Myfxbook.com

To give customers/investors all the tools they require in order to generate the most profits and passive income possible, as well as to build a solid ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/6Uoiz8x

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/6Uoiz8x

via IFTTT

Message from FOMC Meeting: Higher for Longer - Action Forex

The decision to keep rates unchanged was unanimously supported by all twelve voting members of the Committee. The statement noted that job gains ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/2NLDRy1

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/2NLDRy1

via IFTTT

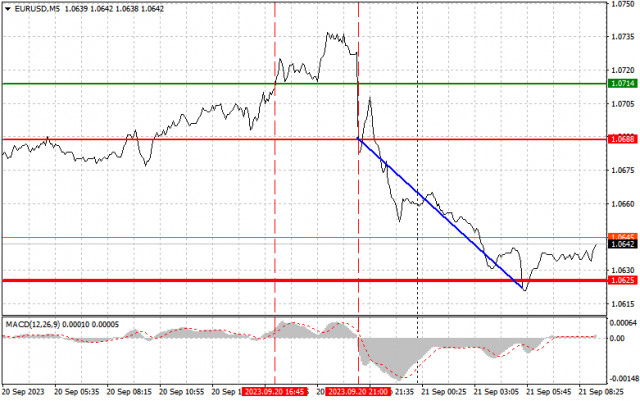

Analysis and trading tips for EUR/USD on September 21

Analysis of transactions and tips for trading EUR/USD

Further growth became limited because the test of 1.0714 on Wednesday afternoon coincided with the sharp rise of the MACD line from zero. Meanwhile, the decision of the Fed to reconsider its forecasts put pressure on the pair, leading to a test of 1.0688. This prompted a signal to sell, which resulted in a further price decrease of over 60 pips.

Euro rose briefly as ECB Board members Fabio Panetta and Isabel Schnabel said to be more cautious on future policy changes. However, in the quarterly economic forecasts of the Federal Reserve, 12 out of 19 representatives stated that they still expect another interest rate hike this year. This triggered a sell-off in EUR/USD. As for today, growth will be unlikely because nothing important will happen apart from the speech of ECB President Christine Lagarde and the eurozone's consumer confidence data.

For long positions:

Buy when euro hits 1.0668 (green line on the chart) and take profit at the price of 1.0705. Growth will occur as part of an upward correction. However, when buying, ensure that the MACD line lies above zero or just starts to rise from it.

Euro can also be bought after two consecutive price tests of 1.0632, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0668 and 1.0705.

For short positions:

Sell when euro reaches 1.0632 (red line on the chart) and take profit at the price of 1.0589. Pressure may return at any moment, especially after yesterday's Fed meeting. However, when selling, ensure that the MACD line lies below zero or drops down from it.

Euro can also be sold after two consecutive price tests of 1.0668, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0632 and 1.0589.

What's on the chart:

Thin green line - entry price at which you can buy EUR/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell EUR/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwQLf0

http://dlvr.it/SwQLf0

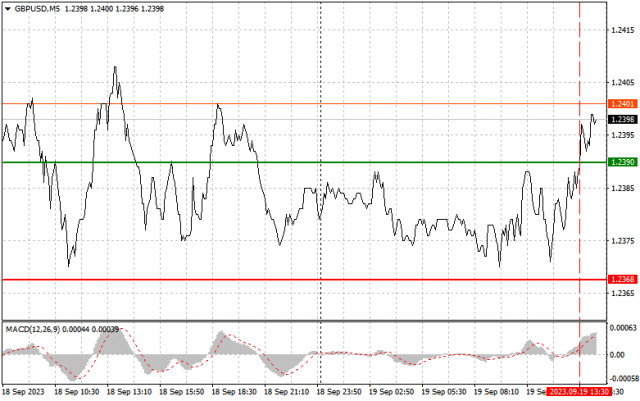

Tips for trading GBP/USD

Although the Federal Reserve kept the interest rate unchanged, dollar rose sharply, leading to the formation of a selling area in GBP/USD.

Looking at the three-wave pattern (ABC) where wave "A" represents today's momentum, traders could consider long positions with stop-loss placed at 1.23328 and take-profit set upon the breakdown of 1.24229.

This trading idea follows the framework of the "Price Action" and "Stop Hunting" strategies.

Good luck in trading and don't forget to control the risks! Have a nice day.

The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwQLZq

http://dlvr.it/SwQLZq

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Thursday, September 21 2023.

If we look closely at the daily chart of the USD/IDR exotic currency pair, it is very clear that the USD is still strengthening against the Garuda currency, where this can be seen in the USD/IDR price movement which is in the Bullish Pitchfork channel and is above the AI Supertrend indicator, so Based on these facts and data, USD/IDR in the next few days as long as it does not retrace below level 15227, there is a high probability of continuing its strengthening to level 15474.

(Disclaimer)The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwQLYR

http://dlvr.it/SwQLYR

Technical Analysis of Daily Price Movement of Nasdaq 100 Index, Thursday September 21, 2023.

With the CCI indicator successfully breaking below three important levels (100, 0, & -100) on its daily chart and the price movement being below the WMA (20), and the emergence of the Bearish 123 pattern which coincidentally intersects within the Bearish Fair Value Gap area level, then, in the next few days, as long as there is no upward correction past level 15640.6, #NDX will have the opportunity to continue its decline to level 14748.3 as its main target and level 14554.6 as its second target.

(Disclaimer)The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwQLXH

http://dlvr.it/SwQLXH

Wednesday 20 September 2023

Douglas Steenland - FX News Group

Douglas Steenland Discover Forex News Group: the latest behind-the-scenes insight into all the FX executive moves, platform advancements, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/QzK7cDP

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/QzK7cDP

via IFTTT

Technical Analysis: 20/09/2023 - EURUSD edges higher, all eyes on the Fed meeting - XM

Risk Warning: Forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our Risk ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/YsdAeip

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/YsdAeip

via IFTTT

Ichimoku cloud indicator analysis on EURUSD for September 20th, 2023.

EURUSD is bouncing towards 1.07 as price is trading above the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). In Ichimoku cloud terms, trend remains bearish in the 4 hour chart because price is still below the Kumo (cloud). With price trading above the kijun-sen there are increased chances of a bigger bounce towards the lower cloud boundary around 1.0735. Support is found at 1.0692-1.0696 and as long as price holds above this level, we could see a move higher towards the Kumo. The Chikou span (black line indicator) remains below the candlestick pattern (bearish). Price in the near term is making higher highs and higher lows, but no important resistance has been broken in order to call for a trend change.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwNm1K

http://dlvr.it/SwNm1K

what is an NDF - FX News Group

what is an NDF Discover Forex News Group: the latest behind-the-scenes insight into all the FX executive moves, platform advancements, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/24nyLcY

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/24nyLcY

via IFTTT

Outlook for GBP/USD on September 20. COT report. Get ready for the pound!

Analysis of GBP/USD 5M

On Tuesday, GBPUSD remained subdued. The chart above may make it seem like the price was moving fairly actively and with volatility, but it's just an illusion. It only covered 55 pips from the day's low to the high, which is quite meager for the pound. Therefore, it didn't make any sense for the pound to rise in the middle of the European trading session. Moreover, it wasn't triggered by any report or event, as the UK calendar was basically empty yesterday. Today, the UK will release important reports, but this doesn't guarantee increased movement and higher volatility.

Let's assume that inflation in the UK matches the forecasts; then, there will be nothing for the market to react to. Accordingly, until the Federal Reserve announces the results of its meeting, which are, for the most part, already known, the pair may continue to remain relatively muted. The same goes for the evening; if Fed Chair Jerome Powell doesn't announce anything significant, the pair will simply move up and down and return to its initial positions.

There were no trading signals, and that was a good thing because it would be difficult to expect any profits with just a 50-pip volatility. However, there could be many false signals. But yesterday, the price didn't touch any important lines or levels along its path.

COT report:

According to the latest COT report on GBP/USD, the Non-commercial group has 4,700 long positions and 4,900 short positions. Thus, the net position of non-commercial traders decreased by 200 contracts over the week. The net position indicator has been steadily increasing over the past 12 months and remains high, while the British pound is still not in a hurry to fall sharply. However, the pound sterling has started to fall in the last two months. If the pound had been rising for a year before, why should it start to fall rapidly now? Perhaps we are at the very beginning of a protracted downtrend.

The British currency has jumped by a total of 2,800 pips from its absolute lows reached last year. All in all, it has been a stunning rally without a strong downward correction. Thus, further growth would be utterly illogical. We're not against the upward trend. We just believe GBP/USD needs a good downward correction first and then assess the factors supporting the dollar and the pound. The Non-commercial group currently holds a total of 97,400 longs and 51,100 shorts. We remain skeptical about the long-term growth of the British currency, as we do not see any fundamental and macroeconomic reasons for it.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD continues its weak downward movement. The pound sterling is still poised to decline and can't correct upwards. It still has to go through the meetings of the Bank of England and the Federal Reserve this week. The British pound may very well sink even lower as the market is currently not interested in the uptrend for obvious reasons. This is entirely reasonable since the pound remains overbought and lacks a fundamental backdrop for a bullish move.

On September 20, traders should pay attention to the following key levels: 1.2188, 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2693, 1.2786, 1.2863. The Senkou Span B (1.2573) and Kijun-sen (1.2439) lines can also be sources of signals, e.g. rebounds and breakout of these levels and lines. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 20 pips. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits.

UK inflation data is due today, which could be quite influential and can directly influence the Bank of England's rate decision tomorrow. This report has the potential to move the market today. The main item on today's agenda is the results of the FOMC meeting and the press conference with Fed Chair Jerome Powell. However, this is in the late evening.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwMtvl

http://dlvr.it/SwMtvl

Trading plan for EUR/USD for September 20, 2023

Technical outlook:

EUR/USD rised through the 1.0720 highs on Tuesday before pulling back lower again. The single European currency is seen to be trading close to the 1.0680 mark as traders await the fundamental trigger of Fed interest rate decision to be out later at 02:30 PM EST. The charts are already suggesting a pullback rally towards at least 1.0800 .

EUR/USD has terminated the first leg of its larger degree corrective phase around the 1.0630 mark. Also note that fibonacci 0.382 of its larger degree upswing has been tested along with the price support at 1.0635. Ideally, prices should unfold the second leg of the corrective phase higher towards 1.0800 and potentially to 1.1000 levels respectively.

EUR/USD has already carved a lower degree upswing between 1.0630 and 1.0720 as seen on the H4 chart here. High probability remains for a corrective drop towards the 1.0630-50 zone before the rally resumes towards 1.0800 in the near term. Also note that trendline resistance is parring through 1.0800 and a break higher would encourage further strength.

Trading idea:

Potential rally towards 1.0950 might have resumed.

Good luck!The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwMtqq

http://dlvr.it/SwMtqq

NZDUSD H4 | Falling to support level?

The NZD/USD chart shows a mild bearish trend, with a potential decline to the 1st support at 0.5891 if it breaks the intermediate overlap support at 0.5933. The 2nd support is at 0.5859, termed as a pullback. Resistance levels stand at 0.5955, aligning with the 61.80% Fibonacci retracement, and 0.6001, a multi-swing-high resistance.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwMtp8

http://dlvr.it/SwMtp8

EURUSD, H4 | Potential bullish reversal?

The EUR/USD chart displays a bullish trend, driven partly by a break above a descending resistance. The price may bounce at the 1st support of 1.0673, aligned with the 61.80% Fibonacci Retracement, and then aim for the 1st resistance at 1.0705. The 2nd support stands at 1.0634, a multi-swing low, while resistances at 1.0705 and 1.0766 are emphasized as overlap resistances, with the former also associated with the 61.80% Fibonacci Retracement.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwMtmT

http://dlvr.it/SwMtmT

Tuesday 19 September 2023

Richard Acosta - FX News Group

Richard Acosta Discover Forex News Group: the latest behind-the-scenes insight into all the FX executive moves, platform advancements, ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/mZ2XtY3

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/mZ2XtY3

via IFTTT

The 5 Habits of Highly Successful Forex Traders

The foreign currency exchange, forex, or FX, markets are the most widely traded in the world. ... Still, something like one-half of all the forex ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/V7izR1J

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/V7izR1J

via IFTTT

China banks' forex purchase at 1.39T yuan | The Manila Times

... foreign exchange market. . All these factors are conducive to the stable future development of the country's forex market, Wang said. . . Comments ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/ma6y4Wj

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/ma6y4Wj

via IFTTT

AUD/USD Forex Signal: Weakly Bearish Consolidation - DailyForex

... all above the round number at $0.6400. brokers-we-recommend Forex Brokers We Recommend in Your Region. prev next. See full brokers list see-full ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/M8iur1F

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/M8iur1F

via IFTTT

Hawkish Pause? - Action Forex

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not speculate, invest or hedge ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Z8xbzaJ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Z8xbzaJ

via IFTTT

Markets Overview Videos - provided by XM

Forex Outlook. View All · 4 days ago. Weekly Forex Outlook: 15/09/2023 - Fed, BoE, and BoJ meetings to fuel FX volatility · 1 week ago. Weekly ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/UWOkPZA

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/UWOkPZA

via IFTTT

Price action all about central bank event risk positioning [Video] - FXStreet

It is not a place to slander, use unacceptable language or to promote LMAX Group or any other FX, Spread Betting and CFD provider and any such ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/0Gf7OZ6

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/0Gf7OZ6

via IFTTT

Dollar analysis: EUR/USD, DXY and Gold in focus - Technical Tuesday - Forex.com

That said, central banks in the UK, Switzerland, Sweden and Norway, as well as Turkey and Brazil, will all be making their own policy decisions this ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vyhn0LQ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vyhn0LQ

via IFTTT

New Zealand dollar rises despite soft Services PMI - MarketPulse

... forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/g42zHcF

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/g42zHcF

via IFTTT

Is OctaFX A Scam Broker? Everything You Need To Know About OctaFX In Malaysia

Last year, OctaFX, as well as most Forex brokers working in Malaysia, ended up in the Financial Consumer Alert List (FCA) of Bank Negara Malaysia (BNM) ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/XmI6tHc

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/XmI6tHc

via IFTTT

Prop Trading and My Forex Funds: A Regulatory Crossroads in the Wake of the Deel Scandal

The recent scandal involving the HR startup Deel and My Forex Funds ... All information these cookies collect is aggregated and therefore anonymous.

from Google Alert - ALL ABOUT FOREX https://ift.tt/8gidJsZ

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/8gidJsZ

via IFTTT

Best UK Forex Brokers for September 2023 Ranked by Traders Union | TheFestivals

The platform's main goal in evaluating Forex brokers' activities is to provide independent and unbiased information key to making investment endeavors ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/hlcnv90

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/hlcnv90

via IFTTT

Rupee Hits All-Time Low Again, Here's Why It's Falling Against The US Dollar

... Forex traders, as per the PTI report. At the interbank foreign exchange, the rupee opened at 83.09 against the dollar and traded in the range of ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/gVNO2jK

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/gVNO2jK

via IFTTT

All-in EV: fund focuses only on top makers - YouTube

Forex forecast 09/19/2023 on GBP/USD, GOLD, Crude Oil and Bitcoin from Petar Jacimovic. InstaForex ENG New 11 views · 31:01. Go to channel · Why AI ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=1R4wjBQkyMk

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=1R4wjBQkyMk

via IFTTT

Exploring the Different Types of Option Forex Trading

Binary Options: Binary options are a type of option where the payout is either a fixed amount of money or nothing at all. In forex trading, binary ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Qf7jE0I

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Qf7jE0I

via IFTTT

Best Tips to Deal with Trading Losses

You must make peace with trading losses because we all make mistakes. No one is perfect, and the same applies to forex trading. From a professional ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/g9qyp30

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/g9qyp30

via IFTTT

Analysis and trading tips for GBP/USD on September 19 (US session)

Analysis of transactions and trading tips on GBP/USD

Further growth became limited because the test of 1.2390 earlier in the day occurred when the MACD line rose sharply from zero.

Poor figures on the upcoming data for issued building permits and number of new housing starts in the US may further weaken dollar's position, leading to a larger upward surge of the pair towards the weekly highs. But if the data exceeds expectations, pressure may return, especially considering the current state of the US economy.

For long positions:

Buy when pound hits 1.2410 (green line on the chart) and take profit at the price of 1.2441 (thicker green line on the chart). Growth will occur after weak data from the US, within the context of a correction. However, when buying, ensure that the MACD line lies above zero or rises from it.

Pound can also be bought after two consecutive price tests of 1.2380, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2410 and 1.2441.

For short positions:

Sell when pound reaches 1.2380 (red line on the chart) and take profit at the price of 1.2347. Pressure may return in the case of very strong data on the US real estate market. However, when selling, make sure that the MACD line lies below zero or drops down from it.

Pound can also be sold after two consecutive price tests of 1.2410, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2381 and 1.2347.

What's on the chart:

Thin green line - entry price at which you can buy GBP/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell GBP/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwKw3H

http://dlvr.it/SwKw3H

Eurozone CPI finalized at 5.2% in Aug, core CPI at 5.3% - Action Forex

Eurozone CPI was finalized at 5.2% yoy in August, down from 5.3% yoy in July. CPI core (all-items ex-energy, food, alcohol & tobacco) was ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/bR1oqHW

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/bR1oqHW

via IFTTT

19/09/2023 - GBPUSD drops to fresh 3-month low - Markets Overview Videos - provided by XM

Forex News. View All · 4 days ago. Market Comment: 15/09/2023 - Euro skids ... For more information, please see our Cookie Policy. MODIFY PREFERENCES.

from Google Alert - ALL ABOUT FOREX https://ift.tt/pj2WDIu

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/pj2WDIu

via IFTTT

Why FX-LIST Is Your Go-To Platform When Looking for Forex Brokers - BusinessMole

It includes basic information such as the leverage of the broker, its location, spreads, minimum deposit, instruments, platforms, and payment options ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/3IP9kHx

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/3IP9kHx

via IFTTT

EUR/USD: Most likely a calm trading day as all eyes on Fed - FXStreet

Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/jViDrIU

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/jViDrIU

via IFTTT

Aud/Usd Forex Signal: All Eyes On The Federal Reserve | MENAFN.COM

Forex Brokers We Recommend in Your Region 1 Read full review Get Started Bearish view Sell the AUD/USD.

from Google Alert - ALL ABOUT FOREX https://ift.tt/hbmQq3F

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/hbmQq3F

via IFTTT

GBP/USD analysis for September 19, 2023 - Potential for the further drop

Technical

analysis:

GBP/USD

has been trading sideways

at the price of 1.2376 but I see potential for the downside breakout

of the consolidation.

Due

to the breakout of the bigger base in the background and potential

for the downside continuation, I see further downside movement

towards lower reference.

Downside

objective is set at the price of 1.2310

RSI

oscillator is showing bearish

divergence, which is good sign for the potential downside movement.

Key

resistance is set at the price of 1.2410The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwK0NK

http://dlvr.it/SwK0NK

USDCAD H4 | Neutral Momentum?

The USD/CAD chart displays a neutral trend, suggesting price may range between the 1st support and resistance. The 1st support at 1.3472 aligns with the 127.20% Fibonacci extension, while the 2nd support at 1.3435 coincides with multiple Fibonacci levels. On the upside, resistances are at 1.3497 (pullback resistance) and 1.3539, which is a swing-high resistance matched with the 78.60% Fibonacci retracement.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwK0M1

http://dlvr.it/SwK0M1

EURUSD, H4 | Falling to support level?

The EUR/USD chart displays a bearish trend, emphasized by its position below the bearish Ichimoku cloud. Price might react bearishly at the 1st resistance of 1.0692, then possibly decline to the 1st support at 1.0633, an overlap support. The 2nd support at 1.0593 is enhanced by the 161.80% Fibonacci Extension. Resistances at 1.0692 and 1.0766 are both overlap resistances, with the former aligned with the 38.20% Fibonacci Retracement. The overall outlook remains bearish.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwK0J8

http://dlvr.it/SwK0J8

XAUUSD H4 | Bullish Momentum?

The XAU/USD chart indicates a bullish trend, with potential for a brief decline to the 1st support at 1915.89 before rising to the 1st resistance at 1934.40. The 1st and 2nd supports, at 1915.89 and 1903.38 respectively, are both overlap supports, denoting their importance. In terms of resistance, both the 1st at 1934.40 and the 2nd at 1945.96 are overlap resistances, reinforcing their significance. The overall momentum remains bullish.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwK0Cq

http://dlvr.it/SwK0Cq

Monday 18 September 2023

USDCAD sellers are making a play with a break below 1.34923 - YouTube

I Ranked All Truck Brands from Worst to Best. Scotty Kilmer•2.4M views · 7 ... Kickstart your forex trading day with a technical look at EURUSD, GBPUSD ...

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=mWUZvMGSzoI

via IFTTT

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=mWUZvMGSzoI

via IFTTT

Unpacking Niyo Solutions' zero forex markup cards - Mint

“All the savings account functions that a customer can do with a bank can be done with Niyo as well. We, as a tech company, make the banking ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/WQry9wm

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/WQry9wm

via IFTTT

Technical Analysis: 18/09/2023 - Gold challenges crucial downward sloping trendline - XM

Forex News. View All · 3 days ago. Market Comment: 15/09/2023 - Euro skids ... For more information, please see our Cookie Policy. MODIFY PREFERENCES.

from Google Alert - ALL ABOUT FOREX https://ift.tt/YNmWOjr

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/YNmWOjr

via IFTTT

How $100 Oil Affects Stocks and Forex - Investing.com

... Forex. Learn how to use ... Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/f467RVr

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/f467RVr

via IFTTT

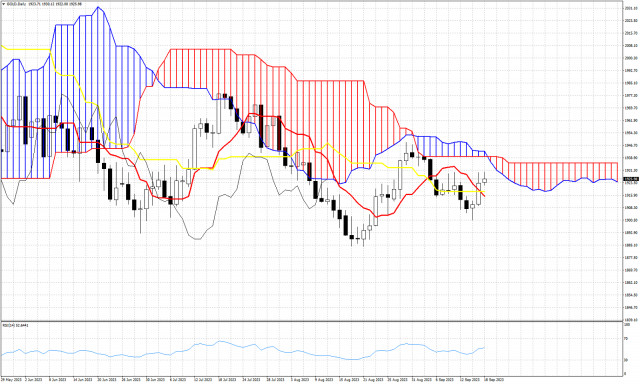

Ichimoku cloud indicator analysis on Gold for September 18th, 2023.

Gold price is trading around $1,925. In Ichimoku cloud terms ,trend remains bearish as price is still below the Kumo (cloud). Price is trading above the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). The Chikou span (black line indicator) is moving above the candlestick pattern (bullish). Some of the indicators in the daily chart give some hints of a possible trend reversal. However the most important obstacle is the Kumo (cloud) resistance at $1,943. A daily close above this level would be an important bullish sign. At $1,915-18 we find short-term support. Bulls do not want to see price make a daily close below this support area.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwH44n

http://dlvr.it/SwH44n

Naira weakens to all-time low of N960 - Businessday NG

At the Investors' and Exporters' (I&E) forex window, Nigeria's official FX market, the naira fell by 2.96 per cent as the dollar was quoted at ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/0znSIUk

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/0znSIUk

via IFTTT

Rupee hits all-time low of 83.29 against US dollar - Mint Genie

At the interbank foreign exchange, the domestic unit opened at 83.09 against the dollar and traded in the range of 83.09 to 83.30 against the ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/SsUtRjB

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/SsUtRjB

via IFTTT

FX caught in a bind as the waiting game continues - Forexlive

The dollar is sitting little changed overall with the ranges for the day leaving a lot to be desired. Currently, dollar pairs are all holding ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/1ZtGiB7

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/1ZtGiB7

via IFTTT

Intesa Sanpaolo Bank Albania implements Profile's Software's treasury platform

The platform covers all operations that go through treasury from forex (interbank and client operations) to money market, security deals ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/Wh8HRy3

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/Wh8HRy3

via IFTTT

EUR/USD Breaking Below 1.0633 Would Further Hurt the Technical Picture. - Action Forex

All this on Friday resulted in a 'logical' underperformance at the long end of the EMU/German curve with Bund yields adding 4.9 bps (2-y) to 9.0 bps ( ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/aZefH6j

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/aZefH6j

via IFTTT

Forex Trade Alerts: Season 23 - Business (722) - Nigeria - Nairaland Forum

All of you that are opening telegram group to give signal, attaching fx to your name, dump all this shit and go and learn. It is shocking when you ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/GEWQhq0

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/GEWQhq0

via IFTTT

FX Veteran Leaves INFINOX to Join Alchemy Prime as Institutional Sales Head

Founded in 2013 and headquartered in London, Alchemy Prime offers FX Prime Brokerage solutions with “direct access to all Tier-1 and Tier 2 FX ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/WeVY26H

via IFTTT

from Google Alert - ALL ABOUT FOREX https://ift.tt/WeVY26H

via IFTTT

Technical analysis of EUR/USD for September 18-23

Trend analysis

EUR/USD may move upward this week, starting from the level of 1.0656 (closing of the last weekly candle) to the 14.6% retracement level of 1.0725 (red dashed line). After reaching this price, the pair will climb towards the 23.6% retracement level of 1.0783 (red dashed line).

Fig. 1 (weekly chart)

Comprehensive analysis:

Indicator analysis - upward

Fibonacci levels - upward

Volumes - upward

Candlestick analysis - upward

Trend analysis - upward

Bollinger bands - downward

Monthly chart - upward

Conclusion: The indicators point to an upward movement in EUR/USD.

Overall conclusion: The pair will have a bullish trend, with no first lower shadow on the weekly white candle (Monday - upward) and no second upper shadow (Friday - upward).

So during the week, euro will rise from 1.0656 (closing of the last weekly candle) to the 14.6% retracement level of 1.0725 (red dashed line), and then move to the 23.6% retracement level of 1.0783 (red dashed line).

Alternatively, it could continue moving downwards from 1.0656 (closing of the last weekly candle) to the support line at 1.0592 (thick red line), followed by a rise to the 14.6% retracement level of 1.0725 (red dashed line).The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SwG8FT

http://dlvr.it/SwG8FT

Indicator analysis: Daily review of EUR/USD on September 18, 2023

Trend analysis (Fig. 1).

The EUR/USD currency pair may move upward from the level of 1.0656 (closing of Friday's daily candle) with a target of 1.0707, the historical resistance level (blue dotted line). In the case of testing this level, a continued upward movement is possible with a target of 1.0725, the 14.6% pullback level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

* Indicator analysis – up;

* Fibonacci levels – up;

* Volumes – up;

* Candlestick analysis – up;

* Trend analysis – up;

* Bollinger bands – down;

* Weekly chart – up.