Daily Pivots: (S1) 0.9919; (P) 0.9959; (R1) 1.0008; More… Intraday bias in EUR/USD stays neutral at this point. Upside of recovery should be limited by 1.0121 minor resistance to bring another fall. Break of 0.9899 will resume larger down trend to 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should […]

The post EUR/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SXGRzR

Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Friday 26 August 2022

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1753; (P) 1.1797; (R1) 1.1839; More… GBP/USD is staying in consolidation from 1.1716 and intraday bias remains neutral for the moment. Upside of recovery should be limited by 1.2002 support turned resistance to bring another fall. Break of 1.1716 will resume larger down trend to 1.1409 long term support. In the bigger […]

The post GBP/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SXGRvp

http://dlvr.it/SXGRvp

Thursday 25 August 2022

EUR/USD Daily Outlook

Daily Pivots: (S1) 0.9919; (P) 0.9959; (R1) 1.0008; More… Intraday bias in EUR/USD stays neutral as consolidation form 0.9899 is extending. Upside of recovery should be limited by 1.0121 minor resistance to bring another fall. Break of 0.9899 will resume larger down trend to 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm […]

The post EUR/USD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SXCHwq

http://dlvr.it/SXCHwq

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.1753; (P) 1.1797; (R1) 1.1839; More… Intraday bias in GBP/USD stays neutral and consolidation from 1.1716 is extending. Upside of recovery should be limited by 1.2002 support turned resistance to bring another fall. Break of 1.1716 will resume larger down trend to 1.1409 long term support. In the bigger picture, fall from […]

The post GBP/USD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SXCHv3

http://dlvr.it/SXCHv3

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9625; (P) 0.9656; (R1) 0.9705; More… Intraday bias in USD/CHF remains neutral and outlook is unchanged. Triangle correction from 1.0063 could have completed at 0.9369 already. Above 0.9691 will t target 0.9884 resistance next. Break there will argue that larger up trend is ready for resumption through 1.0063. On the downside, below […]

The post USD/CHF Daily Outlook appeared first on Action Forex.

http://dlvr.it/SXCHtF

http://dlvr.it/SXCHtF

USD/JPY Daily Outlook

Daily Pivots: (S1) 136.46; (P) 136.86; (R1) 137.53; More… Intraday bias in USD/JPY stays neutral for the moment. Overall, price actions from 139.37 are seen as a corrective pattern, with rise from 130.38 has the second leg. Above 137.70 will extend the rebound but upside should be limited by 139.37. On the downside, firm break […]

The post USD/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SXCHl1

http://dlvr.it/SXCHl1

AUD/USD Daily Report

Daily Pivots: (S1) 0.6881; (P) 0.6908; (R1) 0.6936; More… Intraday bias in AUD/USD remains neutral first. Corrective rebound from 0.6680 could have completed with three waves up to 0.7135. Below 0.6855 will target a retest on 0.6680 low. However, break of 0.7135 will invalidate this view and resume the rebound from 0.6680 instead. In the […]

The post AUD/USD Daily Report appeared first on Action Forex.

http://dlvr.it/SXCHgp

http://dlvr.it/SXCHgp

Wednesday 24 August 2022

Effort and sacrifice needed to brave through winter, says France's Macron

* It is the end of a certain "carefreeness" in the world

* We are going through a rather "big shift, a big change"

* "Freedom has a cost" (referring to the Russia-Ukraine conflict)

The warning delivered is to ministers but in general, he is cautioning that France needs effort and sacrifice to get through the current tough times - especially with a rather harsh winter approaching. As much as the foreshadowing has been well telegraphed, it still feels like Europe as a continent is not too prepared for the months ahead. And that will be a major worry for the euro and the ECB.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SX8RpN

http://dlvr.it/SX8RpN

Bend DAO Proposes Emergency Measures As Credit Crisis Escalates

NFT-collateralized crypto loans platform BendDAO initiated measures to course correct itself as a liquidity crisis over the weekend threatened to spiral out of control. The unfolding situation at Bend DAO highlighted the downsides in letting users borrow using their Bored Ape NFTs as collateral.

A Disastrous Liquidity Crisis

Bend DAO allows users to deposit money into the decentralized finance (DeFi) platform that loans the money out while depositors earn a cut from all the accumulating interest payments. However, the collateral is not what you’d expect, pictures of monkeys, pricey punks, and other expensive NFTs. Over the past week, depositors grew fearful that the lender was in a spot of bother, resulting in a bank run.

As depositors withdrew their assets, it led to Bend DAO’s reserves being completely drained. The liquidity crisis peaked as reserves dropped to a low of 5 ETH on Sunday, worth around $23,715 at the time, from over 10,000 ETH that the DAO held in reserve. The massive drop happened after dozens of Bend DAO’s loans slipped into the so-called “danger zone.” This meant that the NFTs held as collateral for these loans could be liquidated.

New Week Brings Relief

Monday saw some of the intense pressure building on the DAO abate as depositors returned to the platform while other borrowers repaid their NFT-backed loans. This relief allowed Bend DAO and its community to address the faulty liquidation mechanism that sparked the weekend crisis. The community is now set to approve a slew of changes to how Bend DAO functions to avoid a similar scenario in the future.

The Problematic Mechanism

Bend DAO shields itself from borrowers that default by auctioning off the NFTs they lock as collateral with the platform. According to Nikolai Yakovenko from DeepNFTValue, the protocol is hard coded to accept “only bids that make the DAO whole.” This ensures that the protocol is able to pay back depositors.

However, things get complicated when no one is willing to bid for the NFTs at prices set by Bend DAO. Dropping NFT prices and apprehension about tying assets into the protocol’s two-day auction window proved to be Bend DAO’s undoing over the weekend, as it was stuck with JPEGs instead of the ETH that it needed. Yakovenko explained the situation further, stating,

“They basically don’t allow the DAO to be leveraged in any way whatsoever. They don’t allow the DAO to take a loss on anything, which as a result makes them take a loss on everything.”

Corrective Measures

Bend DAO accepted that they had underestimated just how illiquid NFTs could potentially become during the bear market while setting the initial parameters. The team also proposed a proposal to change how the protocol operated and help build confidence among depositors. The changes would see the protocol lower the liquidity threshold from its current 95% to 70%. This change would occur gradually.

Additionally, the liquidation amnesty window would also be shortened from two days to four hours. Interest rates would also see an increase to incentivize ETH deposits and repayments further. Bend DAO’s liquidity amnesty program gave borrowers time to “rescue” their NFTs by paying a penalty along with the repayment. However, this worked against the protocol because no bidder wanted to lock their assets in an auction where the borrower could get their NFT back.

Crypto Insolvency Woes Continue

Bend DAO is the latest in a long line of protocols that have had a liquidity crunch in recent months. Crypto lending platform Celsius continues to struggle with liquidity issues and is trying everything to stay solvent. Meanwhile, Three Arrows Capital finally went into liquidation at the end of June.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

http://dlvr.it/SX8Dp4

http://dlvr.it/SX8Dp4

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9897; (P) 0.9972; (R1) 1.0018; More… Intraday bias in EUR/USD remains on the downside for the moment. Next target is 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. On the upside, above 1.0045 minor resistance will turn intraday […]

The post EUR/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SX87Jv

http://dlvr.it/SX87Jv

GBP/JPY Daily Outlook

Daily Pivots: (S1) 161.14; (P) 161.84; (R1) 162.50; More… Intraday bias in GBP/JPY remains neutral range trading continues. On the upside, break of 163.91 will bring stronger rise to 166.31 resistance. On the downside, below 160.07 will turn bias to the downside for 159.42 and below. In the bigger picture, up trend from 123.94 (2020 […]

The post GBP/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX87Gk

http://dlvr.it/SX87Gk

EUR/JPY Daily Outlook

Daily Pivots: (S1) 136.10; (P) 137.02; (R1) 137.65; More…. Intraday bias in EUR/JPY remains neutral as sideway trading continues. On the upside, break of 138.38 resistance will resume the rebound from 133.38 towards 142.31 resistance. On the downside, break of 134.93 will turn bias back to the downside for 133.38 support. Overall, corrective pattern from […]

The post EUR/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX87Dz

http://dlvr.it/SX87Dz

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8425; (P) 0.8460; (R1) 0.8484; More… Intraday bias in EUR/GBP is turned neutral at this point. On the downside, break of 0.8386 minor support will resume the choppy fall from 0.8720 through 0.8338. On the upside, above 0.8510 will resume the rebound to 0.8585 resistance next. In the bigger picture, medium term […]

The post EUR/GBP Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX874y

http://dlvr.it/SX874y

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.4388; (P) 1.4506; (R1) 1.4571; More… Range trading continues in EUR/AUD and intraday bias remains neutral. Further decline is expected as long as 1.4804 resistance holds. On the downside, firm break of 1.4318 low will resume larger down trend to medium term projection level at 1.3623. However, break of 1.4804 will delay […]

The post EUR/AUD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX86ty

http://dlvr.it/SX86ty

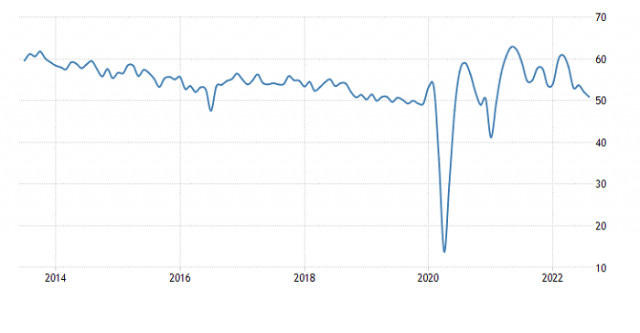

Hot forecast for GBP/USD on 24/08/2022

Preliminary data on business activity indices in the UK, in principle, remained unnoticed, although in fact they turned out to be worse than forecasts that were not even comforting. Only the index of business activity in the service sector turned out well, which decreased from 52.6 points to 52.5 points, with a forecast of 51.8 points. The manufacturing index, instead of decreasing from 52.1 points to 51.3 points, literally collapsed to 46.0 points. As a result, the composite index of business activity decreased from 52.1 points to 50.9 points, although it was expected to decline only to 51.3 points.

Composite PMI (UK):

The market revived only on the release of similar data on the United States, which also turned out to be noticeably worse than forecasts. Only the manufacturing index turned out to be better than them, which fell from 52.2 points to 51.3 points, while it was expected to fall to 51.1 points. But the index of business activity in the service sector fell from 47.3 points to 44.1 points. But they were waiting for its growth to 48.0 points. Because there is nothing surprising in the fact that the composite business activity index, instead of rising from 47.7 points to 49.0 points, fell to 45.0 points.

Composite PMI (United States):

Such weak data made it possible for the pound to rise above the 1.1800 mark, where it continues to be in. Given that the macroeconomic calendar is almost empty today, most likely the market will stagnate in anticipation of tomorrow, when the conference starts in Jackson Hall. Where Federal Reserve Chairman Jerome Powell will give his speech, from whom they are waiting for signals about the adjustment of the policy of the US central bank. Moreover, in the direction of lowering the growth rates of interest rates.

The GBPUSD currency pair, after a short stagnation within the support level of 1.1750, increased the volume of long positions. This resulted in forming a technical pullback in the market by about 120 points. Given the overheating of short positions in the pound for one and a half weeks, the current pullback is the least that could happen on the market.

The technical instrument RSI H4 left the oversold zone at the time when the rollback is formed.

The signal to buy was the critical oversold level of 17.65.

The MA moving lines on the Alligator H4 indicator are still pointing down as the retracement is relatively small compared to the down cycle.

Expectations and prospects

Despite the scale of the pullback, the pound is still oversold. For this reason, keeping the price above 1.1880 may push bulls to form a full-size correction in the market.

Also, in order to prolong the downward trend, the quote needs to stay below the level of 1.1750 in a four-hour period.

Comprehensive indicator analysis in the short-term and intraday periods indicates a long position due to a rollback. In the medium term, the indicators are oriented to sell, due to updating the local low of the downward trend.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SX85KJ

http://dlvr.it/SX85KJ

The X.LA Metaverse Revealed In Detail

Cologne, Germany, 23rd August, 2022, Chainwire

X.LA Foundation executive Aleksey Savchenko has revealed details of the eagerly anticipated X.LA Metaverse. Before an expectant crowd at Gamescom in Cologne, Germany, Savchenko promised an immersive experience, delineating a vision backed by technology that will shape the way people interact well into the next century.

The X.LA Metaverse is built on the promise of a virtual world that mirrors the physical one but is easier to navigate and full of untethered potential. As a visionary in this space, Savchenko brings over 25 years of video game and software development experience and is a major proponent of the metaverse.

“It’s not a product – it’s a paradigm shift,” the X.LA Foundation executive told the Gamescom crowd.

The X.LA Metaverse will be defined by a spirit of altruism, collaboration, and productivity that stimulates content creation. Outlining the community-driven approach to sharing within the X.LA Metaverse, Savchenko illustrated how these key assets will drive continued and enthusiastic engagement. Within a fully 3D photorealistic environment, the opportunities for crafting engaging, interactive experiences will be limitless.

The X.LA Metaverse will place the power firmly in the hands of the creators, and with this creation comes full ownership. This is facilitated through such provisions as the X.LA Revenue Share Contract (RSC) that underpins the contributions made by each creator. It encourages collaboration, safe in the knowledge that creators are fairly rewarded for their output.

As Aleksey Savchenko explained, the Metaverse is a single click away. There are no downloads, no clients to find and manage, no updates to await: just a single button that propels you straight into your virtual world. At the Gamescom event in Cologne, Savchenko highlighted the teaser video Metaverse Is Us which demonstrates various pieces of the Metasites(™) that will make up the X.LA Metaverse.

Watch the video here

About X.LA Metaverse

X.LA Metaverse helps creators ideate and build photorealistic 3D environments that users can experience in various metaverses. Developers, designers, and artists from all around the world can come together, contribute to metaverse digital environments in real-time, and ultimately receive a portion of the revenue these metaverses generate via the X.LA revenue-sharing smart contract.

About X.LA

X.LA is a decentralized protocol that allows content creators the ability to leverage their IP so that they can profitably participate in the metaverse economy by utilizing revenue-sharing smart contracts.

X.LA Foundation is a decentralized autonomous organization (DAO) that is changing how IP creators, owners, and holders generate and earn revenue.

Learn more: https://x.la/ ContactsTeam

* X.LA Foundation

* pr@x.la

http://dlvr.it/SX83R5

http://dlvr.it/SX83R5

Crypto Community Protests Arrest Of Tornado Cash Developer

The arrest of Tornado Cash developer Alexey Pertsev in the Netherlands has resulted in widespread protests in the community.

#FreeAlex Snowballs

Roughly a week earlier, Dutch law enforcement authorities arrested one of the developers of the infamous Tornado Cash app, Alexey Pertsev, on charges of fraud and asset confiscation. The Dutch Fiscal Information and Investigation Service (FIOD) arrested Pertsev in Amsterdam as they suspected him of being involved in hiding illicit funds and facilitating money laundering through the app that he created. However, the move has severely angered the community, which is now banding together to arrange for Pertsev’s release.

Protestors, especially in Amsterdam, have claimed that the arrest indicates that governments are fixating on restraining the entire open source software segment. The protests have now snowballed into online petitions and campaigns raising awareness on the matter to preserve the “fundamentals of cryptocurrency” and seeking the immediate release of Pertsev from custody. A Change.org petition to #FreeAlex currently crossed over 2000 signatures out of its quota of 2500 and is continuing to garner support from the community.

“Code Is Not A Crime”

One of the main points of arguments put forth by the protesters is that “code is not a crime.” In the United States, code is considered to be under the free speech protection of the First Amendment to the country’s constitution. In Europe, the matter is still not fully fleshed out. Responding to the claims of the protesters, the FIOD pointed out that individuals behind decentralized autonomous organizations (DAO) have profited largely from illicit money laundering incidents. However, they have not clarified if they suspected Pertsev to be involved in such an arrangement.

Hoskinson On Tornado Cash Ban

The arrest happened soon after the U.S. Treasury Department had announced a blanket sanction on the Tornado Cash app, which functions as a mixer tool to obfuscate the origin and transfer of crypto funds. In fact, according to a Treasury official, the mixer tool has been used explicitly by North Korean hacker group Lazarus and was responsible for siphoning away over $7 billion of digital assets since 2019.

More recently, Cardano founder and crypto expert Charles Hoskinson shared his two cents on the Tornado Cash matter, which is relevant to Pertsev’s arrest. According to Hoskinson, banning Tornado Cash sets a dangerous precedent as it sends the message that creators and developers have to be held responsible for the use of their code.

He said,

“When we write code, it’s an expression. As long as we don’t get involved in the running and use of that code for purposes, we’re just writing it, it’s like writing a book...Now in a free society, we generally allow people to do these types of things, and it’s deeply uncomfortable when they start saying no.”

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

http://dlvr.it/SX83PQ

http://dlvr.it/SX83PQ

Tuesday 23 August 2022

$ETH: ConsenSys Highlights 5 Misconceptions About Ethereum’s “Merge” Upgrade

On Monday (August 22), blockchain technology company ConsenSys said that there are still five common misconceptions about Ethereum’s upcoming “Merge” upgrade, which marks the transition from proof-of-work (PoW) to proof-of-stake (PoS). Here is how ConsenSys describes what it does: “ConsenSys is the leading Ethereum software company. We enable developers, enterprises, and people worldwide to build […]

http://dlvr.it/SX5HXF

http://dlvr.it/SX5HXF

Eurozone August flash services PMI 50.2 vs 50.5 expected

* Prior 51.2

* Manufacturing PMI 49.7 vs 49.0 expected

* Prior 49.8

* Composite PMI 49.2 vs 49.0 expected

* Prior 49.9

The manufacturing print beat estimates but still dropped to a 26-month low, while the services print continues to highlight a further decline in demand conditions - falling to a 17-month low. Meanwhile, the composite reading was slightly better than expected but still reflected a decline to a 18-month low. That signals a deeper contraction in the euro area economy in August than in July.

All in all, this points to a contraction in Q3 output and with services activity suffering already suffering ahead of the winter months, the outlook is rather bleak to say the least. S&P Global notes that:

“The latest PMI data for the eurozone point to an economy in contraction during the third quarter of the year. Cost of living pressures mean that the recovery in the service sector following the lifting of pandemic restrictions has ebbed away, while manufacturing remained mired in contraction in August, seeing another record accumulation of stocks of finished goods as firms were unable to shift products in a falling demand environment. This glut of inventories suggests little prospect of an improvement in manufacturing production any time soon.

“Declining output is now being seen across a range of sectors, from basic materials and autos firms through to tourism and real estate companies as economic weakness becomes more broad based in nature.

“The rebuilding of workforces following the pandemic is also losing steam, with firms increasingly reluctant to hire additional staff given falling new orders and relatively weak business sentiment.

“Businesses are at least continuing to see weaker rises in their costs, in turn increasing their selling prices at a softer pace. This should help to feed through to slower consumer price inflation later in the year, although it appears that any alleviation to the inflation situation is coming too late to provide any real support to demand. The remainder of 2022 is therefore looking to be one of struggle for firms across the eurozone.”

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SX54cW

http://dlvr.it/SX54cW

EUR/USD Daily Outlook

Daily Pivots: (S1) 0.9897; (P) 0.9972; (R1) 1.0018; More… EUR/USD’s break of 0.9951 support confirms down trend resumption. Intraday bias stays on the downside for 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. On the upside, above 1.0045 minor resistance will […]

The post EUR/USD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX4yzr

http://dlvr.it/SX4yzr

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9603; (P) 0.9637; (R1) 0.9660; More…. EUR/CHF’s down trend resumed by breaking through 0.9602 and intraday bias is back on the downside. Current down trend should now target 100% projection of 1.1149 to 0.9970 from 1.0513 at 0.9334. On the upside, break of 0.9698 resistance will indicate short term bottoming, and turn […]

The post EUR/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SX4yvB

http://dlvr.it/SX4yvB

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 136.02; (P) 136.62; (R1) 137.53; More… USD/JPY’s rally is still in progress and intraday bias remains on the upside for 139.37 high. Strong resistance could be seen from 139.37 high to bring another fall from to extend the corrective pattern from there. On the downside below 134.61 minor support will turn intraday […]

The post USD/JPY Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SX4ys6

http://dlvr.it/SX4ys6

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9559; (P) 0.9579; (R1) 0.9604; More… USD/CHF’s rise from 0.9369 is still in progress and intraday bias stays mildly on the upside for 0.9648 resistance. Firm break there will bring stronger rally back to 0.9884 resistance next. On the downside, below 0.9496 minor support will revive near term bearishness and bring retest […]

The post USD/CHF Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SX4yqk

http://dlvr.it/SX4yqk

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1765; (P) 1.1858; (R1) 1.1924; More… GBP/USD’s fall from 1.2292 is still in progress and intraday bias stays on the downside for retesting 1.1759 low. Firm break there will resume larger down trend to 1.1409 long term support. On the upside, above 1.1924 minor resistance will delay the bearish case and turn […]

The post GBP/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SX4ycy

http://dlvr.it/SX4ycy

GBP/USD trading plan for European session on August 23, 2022. COT report and overview of yesterday's trades. GBP tests new

Yesterday, several entry signals were formed. Let's take a look at the 5-minute chart and see what happened. In my morning forecast, I paid attention to the level of 1.1806 and recommended making decisions on entering the market from it. A false break in the 1.1806 area at the very beginning of the day gave a signal to buy the pound, which, to my regret, was never realized. I did not see any upward movement, after which the trading continued around 1.1806, completely crossing out the pair's upward potential even at the beginning of this week. In the afternoon, the bulls tried to return above 1.1825, but all that was done was to form a false breakout and a signal to sell the pound further along the trend, which resulted in the pair falling by more than 80 points.

For long positions on GBP/USD:Before analyzing the technical picture of the pound, let's look at what happened in the futures market. In the COT report (Commitment of Traders) for August 16, an increase in both short positions and long positions was recorded, however, these changes no longer reflect the real current picture. Serious pressure on the pair, which began in the middle of last week, continues now, and for sure those who want to buy the pound in the current difficult macroeconomic conditions will become less and less. Ahead of us is a meeting of American bankers in Jackson Hole, which may lead to even greater strengthening of the dollar against the pound. This will happen on the condition that Federal Reserve Chairman Jerome Powell announces the preservation of the committee's previous position regarding the active and tough increase in interest rates, counting on the further fight against inflation and bringing it back to normal. The latest COT report indicated that long non-commercial positions rose 1,865 to 44,084, while short non-commercial positions rose 506 to 77,193, further narrowing the negative non-commercial net position to -33 109 versus -34,468. The weekly closing price remained virtually unchanged at 1.2096 versus 1.2078.

Today we expect quite a large number of fundamental statistics for the UK. Everything will start with data on the index of business activity in the manufacturing sector, the services sector and data on the composite PMI index in the UK. All these indicators are unlikely to show growth, so do not expect anything good. In case of further decline in GBP/USD in the first half of the day, which is more likely, the best scenario for buying will be a false breakdown in the area of the nearest support at 1.1743, which was already tested for strength during yesterday's day. This will lead to a rebound upwards and a jerk to the 1.1782 area, where the average moving averages play on the side of the bears. Only after getting above 1.1782 it will be possible to talk about the prerequisites for building an upward correction for the pair. The breakdown of 1.1782, as well as the reverse downward test opens the way to 1.1820. A more distant target will be the area of 1.1865, where I recommend taking profits. If the GBP/USD falls and there are no buyers at 1.1743, the pressure on the pound will increase again, which will force the bulls to leave the market. If this happens, I recommend postponing long positions to 1.1707 - a major support, below which there is emptiness and new yearly lows. I advise you to buy there only on a false breakdown. You can open long positions on GBP/USD immediately for a rebound from 1.1643, or even lower - in the area of 1.1573 with the aim of correcting 30-35 points within the day.

For short positions on GBP/USD:

Protection of the nearest resistance 1.1782, where the moving averages, playing on the side of the sellers, are almost the most important task for today. Not only weak data on PMI will help in this, but also a negative report on the balance of industrial orders from the Confederation of British Industrialists. If the pair rises on the back of good activity reports in the UK, only the formation of a false break at 1.1782 will return pressure on the pound and form a sell signal with the aim of lowering to the nearest support at 1.1743. A break and back test from the bottom up of this range would provide a sell entry point with a fall towards 1.1707. A more distant target will be the area of 1.1643, where I recommend taking profits. With the GBP/USD growth option and no bears at 1.1782, buyers will have an excellent chance of a return to 1.1820, which will make life difficult for pound sellers. Only a false break around 1.1820 forms an entry point into short positions, counting on a new downward movement of the pair. If there is no activity there, there may be a surge up to the high of 1.1865. There, I advise you to sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within a day.

Indicator signals:

Moving Averages

Trading below the 30 and 50-day moving averages indicates that bears can still push the pair lower.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

A breakout of the lower band at 1.1740 will intensify the bearish pressure on the pair. In case the pair advances, the upper band at 1.1780 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.

The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SX4xBb

http://dlvr.it/SX4xBb

Dollar momentum grows as risk retreats further

EUR/USD is now trading down by 0.4% to near 0.9900 and that is even before we get to the PMI data in Europe later today. This comes as the dollar is seen pulling higher with GBP/USD also down 0.4% to 1.1720 and AUD/USD down 0.3% to 0.6857 on the day. The extension comes as equities are slipping further with S&P 500 futures down 20 points, or 0.5%, currently.

The other key tailwind for the dollar (and bad for risk trades) is the fact that the Chinese yuan is deteriorating rather sharply after having seen USD/CNY break above 6.80 since the end of last week:

With the pair targeting a push towards 7.00 next, that leaves some added scope for the dollar to gain further while risk trades may not see too much comfort if the pace of the decline in the yuan stays as it is.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SX4vQX

http://dlvr.it/SX4vQX

AUD/USD falls to fresh one-month lows as risk stays on the defensive

The pair is trading down to 0.6857 on the day currently, its lowest level in a month as sellers look to take out the 5 August low at 0.6869 on the daily chart. The 38.2 Fib retracement level sits nearby at 0.6855 next but it's tough to fight the momentum at the moment as risk stays on the defensive and the dollar continuing to pull ahead.

The next key test for the pair will be a look back towards 0.6700 potentially with the weekly chart underscoring technical support at a key trendline (white line) after the rejection of the 200-week moving average:

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SX4vPX

http://dlvr.it/SX4vPX

Monday 22 August 2022

REX Brings Traditional Certificates of Deposit Onto the BNB Chain

Important information: This is a sponsored story. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice. Tax rules can change and the value of any […]

http://dlvr.it/SX29m2

http://dlvr.it/SX29m2

The new crypto scam known as Pig butchering

Scammers are becoming far more patient and persistent and are spending weeks and months ‘fattening’ their prey as they gain their confidence. Then comes the ‘butchering’ as the unwary victim is finally coaxed into making an investment that disappears.

As ever more bad actors are drawn into the cryptocurrency space, the ways of relieving vulnerable or even sometimes quite savvy individuals of their wealth are multiplying and are becoming much harder to spot.

One of these types of scams has recently hit the headlines and has been coined ‘pig butchering’ due to the process of ‘fattening up’ the victim over sometimes what is quite a long period of time, before introducing the ‘butchering’ after the victim has been lulled into trusting their contact and finally invests a sizeable amount, which then disappears along with the contact.

Typically, the process would begin as the fraudster trawls through social media looking for that ‘chance’ encounter with a likely victim that they can develop into a relationship that grows slowly.

Often the relationship is a romance, where the con artist takes on the role of a young lady from Asia perhaps who just can’t seem to be lucky in love. Or perhaps it’s a handsome man who acts like a real gentleman and who never mentions money… until that one time when all the victim’s guards are down.

South East Asia is actually where this scam is said to have originated from, and the perpetrators have refined their art to a high degree.

After what can be a long and drawn out grooming process the scammer finally guides the victim into a conversation about cryptocurrencies and how certain investments can attract a decent return.

Often, the scammer will allow their prey to even start earning a small amount of return. This is in order to quell any last lingering doubts the victim might have. Then the final ‘butchering’ takes place as the victim is persuaded to invest a large amount into the website that the scammer has covert control over.

Once the pig has been butchered, all the money disappears, along with the romantic lover, and the next series of victims are earmarked.

According to a report by the Wall Street Journal, the number of complaints over this type of scam made to the Federal Trade Commission rose 70% from 2020 to 2021, resulting in around $547 million reportedly being lost by victims.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

http://dlvr.it/SX1zSX

http://dlvr.it/SX1zSX

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2896; (P) 1.2932; (R1) 1.2982; More… Intraday bias in USD/CAD remains mildly on the upside at this point. Corrective decline from 1.3222 should have completed with three waves down to 1.2726. Further rally would be seen back to retest 1.3222 high. On the downside, break of 1.2879 minor support will mix up […]

The post USD/CAD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX1t1v

http://dlvr.it/SX1t1v

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9603; (P) 0.9637; (R1) 0.9660; More…. Intraday bias in EUR/CHF remains neutral at this point. In case of another recovery, upside should be limited well below 0.9948 resistance to bring another fall. On the downside, break of 0.9602 will resume larger down trend to 100% projection of 1.1149 to 0.9970 from 1.0513 […]

The post EUR/CHF Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX1szP

http://dlvr.it/SX1szP

GBP/JPY Daily Outlook

Daily Pivots: (S1) 161.39; (P) 162.12; (R1) 162.59; More… Range trading continues as consolidation pattern from 168.67 is extending. Intraday bias remains neutral at this point. On the upside, break of 163.91 will bring stronger rise to 166.31 resistance. On the downside, below 160.07 will turn bias to the downside for 159.42 and below. In […]

The post GBP/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX1srv

http://dlvr.it/SX1srv

EUR/JPY Daily Outlook

Daily Pivots: (S1) 136.93; (P) 137.45; (R1) 137.94; More…. Range trading continues in EUR/JPY and intraday bias remains neutral first. On the upside, break of 138.38 resistance will resume the rebound from 133.38 towards 142.31 resistance. On the downside, break of 134.93 will turn bias back to the downside for 133.38 support. Overall, corrective pattern […]

The post EUR/JPY Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX1snh

http://dlvr.it/SX1snh

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8458; (P) 0.8485; (R1) 0.8517; More… Intraday bias in EUR/GBP remains mildly on the upside at this point. Current development argues that choppy fall from 0.8720 might be completed. Firm break of 100% projection of 0.8338 to 0.8491 from 0.8386 at 0.8539 will affirm this bullish case, and prompt upside acceleration to […]

The post EUR/GBP Daily Outlook appeared first on Action Forex.

http://dlvr.it/SX1skd

http://dlvr.it/SX1skd

Cryft Token Launches Crypto Cards So You Can Gift the Moon

Lake Geneva, Wisconsin, 21st August, 2022, Chainwire

Cryft, a BNB Chain project that’s part of the SafeMoon ecosystem, has launched its own gift cards. Cryft Cards enable anyone to give crypto in the form of a virtual card, providing an opportunity to “gift the moon” to friends, family and loved ones.

Crfyt’s creation of crypto gift cards is part of its team’s efforts to make digital assets more accessible to beginners, many of whom are unsure where to start. Cryft Cards can be acquired in stores and online, providing a convenient way of purchasing cryptocurrency with no complex onboarding. Each card contains a unique code that can be redeemed to claim the cryptocurrency assigned to it. After entering the code into the Cryft website at www.cryftcards.com, CRYFT tokens are instantly credited to the holder’s account.

Based out of Utah, Cryft LLC, the company behind the CRYFT token, comprises an experienced crew of blockchain pioneers. CEO and founder Chad Scully has a successful background in managing, manufacturing, and developing. His family's company operates in industries ranging from professional entertainment to contractor supply to consumer accessories.

Each of the seven team members has a specific role within Cryft LLC. Don Bailey handles all of the marketing, Leet oversees blockchain security, Stefanie manages social media and is responsible for content creation, Garrett advises on finances, Josh is Project Manager, and Branden is Chief Communications Officer.

In early July, the CRYFT token launched on SafeMoon Swap on BNB Chain. Since then the token has seen steady adoption and grown to a market cap of over $2 million. The Cryft v2 token contract imposes a 10% buy and sell tax, incentivizing long-term holding, and building a community around the simple yet appealing concept. The launch of Cryft Cards is expected to generate further interest in the CRYFT token and its growing ecosystem of products.

About Cryft

Cryft is a cryptocurrency and blockchain ecosystem that’s available on BNB Chain. Tradable on SafeMoon Swap, the CRYFT token forms a fun entry point to crypto with a welcoming community and consistent growth. Cryft Cards, the project’s latest product, enable anyone to gift cryptocurrency to an acquaintance in the form of a virtual card that can be redeemed at any time.

Learn more: www.cryftcards.comContactsCEO

* Chad Scully

* Cryft LLC

* help@cryftcards.com

http://dlvr.it/SX1rQM

http://dlvr.it/SX1rQM

Sunday 21 August 2022

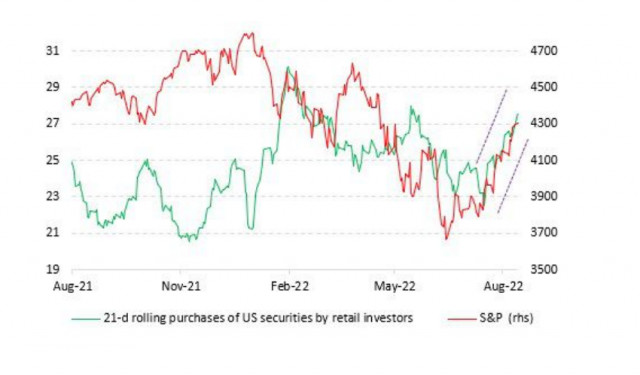

Retail traders saved markets by keeping trades open during tough times

After the spring fever, which ended with a global sell-off of all indices and a bearish reversal, many retail traders again tried to get back into the game. However, before the S&P 500 had time to accelerate, a new blow from the meme-stock market brought new losses to the bulls. However, the survey showed that traders are not ready to follow the bearish trend.

Retail traders saved markets by keeping trades open during tough times

According to analysts, this time it was a fairly large army of "mom-dad" investors that suffered, that is, traders with little trading experience and without a strong educational base.

Wall Street was talking about this type of investor when they tried to explain the July rise in cryptocurrencies. Now they are suspected of provoking the latest global surge in US indices.In my opinion, if this reflects the real state of affairs, then only partially.

Yes, one cannot but agree that the retail investor base has changed dramatically in recent years, especially after the COVID-19 pandemic. The rise of social media (hello Reddit) and online trading sites and apps has created younger and more market-savvy individuals who complement the more traditional older investors who make monthly contributions to their pension funds.

This army of traders, if it can be suspected of naivety, then after the last two extremely volatile years of trading, they have clearly gained experience and are in no hurry to part with their money.

Wall Street analysts paint us a portrait of a fickle, speculative day trader who just wants to make a quick buck, especially in the riskier and more complex parts of financial markets like cryptocurrencies.

To some extent this is true, let's not deny the obvious. This is also a direct consequence of the surge in liquidity in financial markets after the pandemic, which the Federal Reserve is now trying to reverse. Yet research shows that retail investors are not as easy-going as institutional investors might have thought.For example, a survey of 1,000 retail investors in the United States conducted by the social investment platform eToro in June, when the market was in a bearish peak, showed that 80% of them buy or sell assets monthly or less often.

At the time of the survey, about 65% of respondents were holding their investments, 29% were holding and buying more, and only 6% had sold. These numbers give us a completely different picture of what is happening in small trades.

According to the traditional school of investing, young investors are less likely to keep their investments. Yet 42% of investors aged 18 to 34 did just that, and 43% held and bought more. Sold only 15% of the total.

Typically, retail investors are late to the peak of profitable deals and exit them last and with the worst hangover. Many of them lost some headroom earlier this year, when the S&P 500 (.SPX) posted its worst first half performance in more than half a century.

Of course, one might think that retail investors are generally not the most sophisticated or nimble, and that they probably suffered huge losses as the market went against them for months on end. But if they had given up and sold them, the market crash could have been even worse.

And more importantly, according to this survey, they never really left. They kept their positions in the trades, not allowing the market to collapse even more. And it's impressive.

Therefore, the sharks of Wall Street immediately suspected these hurry-ups that it was they who were now pulling the markets up. Just this week, retail investors were again taken aback by the wild swings in shares of home improvement retailer Bed Bath & Beyond. Meme shares soared over 130% at the start of the week, but fell 20% on Thursday and 40% in early trading on Friday. It comes after billionaire Ryan Cohen suddenly sold his stake in troubled retailer Bed Bath & Beyond - just days after he went bullish on stock options.

For Cohen himself, the deal could bring in between $55 million and $60 million. But the traders, who hurried to invest in the newly popular funds, did not do well.

Not good for other meme companies. Retail favorites GameStop and AMC Entertainment continued their decline on Friday, leaving most of their weekly profits behind. GameStop and AMC Entertainment lost between 4% and 6%. E-commerce firm Vinco Ventures plunged 17%. Interestingly, Cohen also owns a stake in GameStop.

And yet, despite the current dip, BBBY and call option buying volumes by retail investors are up more than 70 times their all-time average, with current five-day net buying up to $188 million on Wednesday.

However, the market is still on a positive wave: step away from meme stocks and look towards the luminaries: the S&P 500 and Nasdaq Composite rebounded almost 20% and 25%, respectively, from their mid-June lows. This has certainly been helped by the strong growth in retail investor buying, which currently averages $1.36 billion per day, with a 21-day moving average of over $27 billion.

Moreover, the data shows that retail investors remained active buyers throughout the January-June market downturn. Yes, the 21-day moving average fell to $23 billion over the summer, but it's still well above last year's low of about $21 billion.

What does this tell us? That the markets don't want to accept the reality of a bearish downturn, preferring to hold positions and bet on the bulls as soon as there is the slightest opportunity for growth.

According to the technical data, the bearish decline is already in full swing. Thus, Citi analysts have identified 22 bear market rallies since the 1920s, lasting from two to 128 trading days and ranging in size from 11% to 47%. There were three such episodes from 2001 to 2002, four in the period 2008-2009, and two this year.

However, I want to caution you. The influence of retail traders on the markets is largely seasonal. It's August now, when liquidity is low and the big investment companies usually take their staff on vacation, so it's the off season... and an opportunity for the retail bulls, who have increased their influence due to this factor. In late August - early September, the market of large investors will revive, and the game will follow different rules.

The real economy is slow to recover, a recession is waving a red flag in China, the conflict in Ukraine is dragging on, and the coronavirus promises us a fresh strain this season. So there are not so many grounds for optimism. With this in mind, we can expect a rather difficult autumn-winter season, including for traders.The material has been provided by InstaForex Company - www.instaforex.com

http://dlvr.it/SX0D2M

http://dlvr.it/SX0D2M

Crypto Weekly Roundup: aUSD & HUSD Depeg, Do Kwon Speaks, Celsius

All the attention is on Ethereum right now due to its upcoming Merge upgrade. Certain platforms like Coinbase have even started preparing for it. Let’s find out more.

Bitcoin

On Friday, Bitcoin experienced a sharp fall with a 7.2% slide to the price of $21,500. Practically the entire crypto market has followed suit.

Ethereum

After a record-breaking performance in July, over 2 million domain names have been registered on the Ethereum Name Service (ENS).

The Coinbase platform has announced that it will pause all Ethereum transactions during The Merge as a precautionary measure.

DeFi

Layer-2 scaling solution Optimism came under heavy criticism after the platform made an unannounced movement of funds, causing significant panic among investors.

The Ronin development team recently announced in a blog post that they had increased the number of validators securing the chain from 14 to 17.

Altcoins

The aUSD stablecoin took a hit after a hack into the Acala Network resulted in a 99% drop in its value.

Huobi’s HUSD stablecoin has become the latest asset to de-peg from its dollar peg, as its price dropped to a low of $0.84.

Terra Founder, Do Kwon, who has been relatively quiet till now, has given the first interview since the crash of the Terra protocol following the depegging of the LUNA stablecoin.

Technology

The government of Colombia has confirmed its plans for a digital currency, based on blockchain technology, in partnership with the country's central bank.

Business

Ripple has partnered with Latin American bank Travelex to launch the first On-Demand Liquidity (ODL) service in Brazil.

In a new partnership with SBI Remit, Ripple Net has launched a remittance payment service for the Japan-Thailand corridor.

A report has claimed that CEO Alex Mashinsky had taken over control of trading strategies at Celsius in the months leading up to the firm’s widely publicized insolvency issues and eventual collapse.

Crypto.com has acquired the approval of the Ontario Securities Commission to become the first global cryptocurrency platform to be legally registered for operations in Canada.

Regulation

The US Federal Deposit Insurance Corporation issued warning letters to FTX and four other crypto firms.

The Russian national, who was extradited from the Netherlands, has been accused of money laundering in the Ryuk ransomware case.

KPMG Canada’s director and co-leader of crypto assets and blockchain, Kunal Bhasin, has said that he believes that the Howey Test might not be the right rule with which to decide whether a cryptocurrency is a security or not.

The European Union (EU) is considering the appointment of a new anti-money laundering (AML) body to oversee the crypto space.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

http://dlvr.it/SX0900

http://dlvr.it/SX0900

Raoul Pal on Ethereum ($ETH): “I Think Everybody’s Underweight the Merge Still”

During an interview on Thursday (August 18), former Goldman Sachs executive Raoul Pal talked about how he expects $ETH to perform (vs USD) both in the short term and in the medium/long term. Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London […]

http://dlvr.it/SWzv0k

http://dlvr.it/SWzv0k

The weekend Forex report for the week starting August 22, 2022

In this weekend video, I review and preview the fundamental influences in the market and then look at the technicals in the market that are defining the bias, and risk with the focus on the major currencies vs the USD.

If you like this video, please give a thumbs up on YouTube. If you don't like it give a thumbs down.

Your comments are also appreciated

Have a good weekend and new trading week.

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/SWzmDP

http://dlvr.it/SWzmDP

$ADA: Cardano-Powered Metaverse ‘Cardalonia’ Partners With ‘Ready Player Me’, Prepares for Land Presale

On Friday (August 19), Cardalonia ($LONIA), the Web3 startup that claims to be “building the biggest metaverse ecosystem on Cardano”, announced an interesting new partnership. On April 18, the Estonian crypto startup that is developing the upcoming Cardano-powered NFT-based play-to-earn (P2E) game Cardanlonia ($LONIA) announced that it had raised $420,000 in a pre-seed round. In […]

http://dlvr.it/SWzgVV

http://dlvr.it/SWzgVV

Saturday 20 August 2022

As $ETH Price Falls, Raoul Pal Says 2-Year Risk/Reward Is Getting ‘Really Attractive’

On Saturday (August 20), as the ETH-USD trades around the $1,600 level, having fallen from around $1,900 at the start of the week, some $ETH HODLers are using this dip to buy more $ETH. One of those is investors is former Goldman Sachs executive Raoul Pal. According to data by TradingView, on crypto exchange Bitstamp, […]

http://dlvr.it/SWy4Qj

http://dlvr.it/SWy4Qj

Bitcoin Price Drops Below Its 200-Week Moving Average, Peter Schiff Says ‘Still Time To Sell’

On Saturday (August 20), BTC-USD is trading below $22,927, which is the closely monitored 200-week moving average (200WMA). According to data by TradingView, on crypto exchange Bitstamp, currently (as of 10:10 a.m. UTC on August 20) BTC-USD is trading around $21,158, down 2.43% in the past 24-hour period. As you can see from the five-day […]

http://dlvr.it/SWxqDd

http://dlvr.it/SWxqDd

Uniglo (GLO), NEAR Protocol (NEAR), and Chainlink (LINK) Prepare for a Major Send-off in November

Before the year ends, many cryptocurrency project developers are looking forward to sending their cryptos on an upward journey. This impetus comes after the crypto world's major collapse in May, the effects of which most industry players have not properly reversed yet until now. But three crypto projects are preparing for a nice ending to this year. In this article, we look at how Uniglo (GLO), NEAR Protocol (NEAR), and Chainlink (LINK) are preparing for a major send-of in November.

Uniglo (GLO) sees a bright post-launch November

We see a busy November for Uniglo, as this new decentralized finance (DeFi) project is set for public launch in mid-October. After the project is launched, the GLO tokens purchased during the presale season will be deposited in the respective buyers' wallets, allowing buyers to use the tokens in any allowable manner.

The Uniglo project has been making headlines lately because of its multi-asset-backed social currency that is further boosted by a unique Ultra-Burn Mechanism. November will see many activities from Uniglo, which could include the creation of a liquidity pool on Uniswap, the release of public tokens into such liquidity pool, the first high-value asset purchase, and the first implementation of the Ultra-Deflationary Burn from fourth-quarter profits. As such, investors will see gains from their GLO tokens before the year ends.

NEAR Protocol (NEAR)

NEAR Protocol is also preparing for a major send-off in November. NEAR Protocol is a blockchain-based platform for the development of decentralized applications. This protocol is known for high-performance, enabling fast, secure, and infinitely scalable transactions. By operating with a Nightshade consensus protocol, NEAR Protocol can run approximately 100,000 transactions per second. Currently, the NEAR token is trading around $5, which is a good price at which major returns could be generated by three months’ time.

Chainlink (LINK)

Lastly, Chainlink is prepping for a November send-off. Chainlink is a commonly used oracle network that facilitates connections between blockchains and off-chain data sources. The network is preparing for Chainlink token staking, which is geared towards improving the crypto-economic security for data exchanges. Staking will require collateralizing, enabling the network to impose penalties on nodes that are acting dishonestly, This move will ideally boost the activity levels on Chainlink.

The bottom line

November could be an exciting time for cryptos, as things start to pick up and players prepare for a brand new year. August could be an ideal time to buy into tokens that are set for a send-off before 2022 ends.

Find Out More Here:

Join Presale: https://presale.uniglo.io/register

Website: https://uniglo.io

Telegram: https://t.me/GloFoundation

Discord: https://discord.gg/a38KRnjQvW

Twitter: https://twitter.com/GloFoundation1

Disclaimer: This is a sponsored press release, and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice

http://dlvr.it/SWxjFC

http://dlvr.it/SWxjFC

$ADA: Popular SPO Explains Why ‘It Is Impossible To Stop Cardano’

On Thursday (August 18), the highly popular and respected operators of the Cardanians $ADA stake pools explained why “it is impossible to stop Cardano.” Yesterday, they tweeted that the reason the Cardano network cannot be stopped is because it is so decentralized: On 17 February 2020, Cardanians published a blog post (titled “The Challenges of […]

http://dlvr.it/SWxbk5

http://dlvr.it/SWxbk5

EUR/AUD Weekly Outlook

EUR/AUD recovered ahead of 1.4318 low last week, but recovery is limited below 1.4804 resistance. Initial bias remains neutral this week first and further decline is expected. On the downside, firm break of 1.4318 low will resume larger down trend to medium term projection level at 1.3623. However, break of 1.4804 will delay the bearish […]

The post EUR/AUD Weekly Outlook appeared first on Action Forex.

http://dlvr.it/SWxXSf

http://dlvr.it/SWxXSf

US 10 year yields off highs but technical bias shifts to the upside

The US 10 year yield has been trying to stay below the 100 day MA (blue line) in August. Yes, there were little blips above the MA line (see blue line), but apart from one day, the yield has closed below that MA level.

Today, the yield has pushed through the MA with momentum.

That 100 day MA comes in at 2.905%. The high yield reached 2.998%. The current yield is at 2.978%.

Stay above the 100 day moving average and the bias for yields to the upside. Move below, and the bias shifts to the downside.

This article was written by Greg Michalowski at www.forexlive.com.

http://dlvr.it/SWxVJ2

http://dlvr.it/SWxVJ2

Friday 19 August 2022

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1876; (P) 1.1978; (R1) 1.2033; More… GBP/USD’s fall accelerates to as low as 1.1814 so far and intraday bias stays on the downside for retesting 1.1759 support. Firm break there will resume larger down trend Next target is 1.1409 low. On the upside, above 1.2002 support turned resistance will turn intraday bias […]

The post GBP/USD Mid-Day Outlook appeared first on Action Forex.

http://dlvr.it/SWvZg0

http://dlvr.it/SWvZg0

EUR/USD: Narrow range on the day but technical bias points lower

Despite the narrow range on the day, there is a lot to digest when it comes to looking at the EUR/USD chart at the moment. The most glaring detail is the break back below 1.0100 after the breakout above the range of 1.0100 to 1.0283 failed at the 61.8 Fib retracement level at 1.0361 highlighted earlier in the week here.

With the dollar seen firmer across the board and also making headway against the likes of the yen and pound, there is a strong argument for EUR/USD to head back towards parity in the sessions ahead.

So far, there is a lack of appetite for a strong move today but we'll see if there is any major extension to follow once US traders come into the fray. It will be important to see how price action develops from here as I fear another retest of parity will not be one where the euro fares too well this time around.

The outlook for the euro area remains bleak as recession risks are on the rise and today's record rise in German producer prices exemplifies the nature of which surging prices is taking a toll on the region. As much as euro area governments are playing down the risks, soarin energy prices ahead of winter is going to lead to a dark period for businesses and consumers.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SWtv9G

http://dlvr.it/SWtv9G

Stocks bleed lower in European morning trade

European indices are deepening losses across the board with US futures also slumping more heavily now on the day. S&P 500 futures are down 35 points, or 0.8%, as the drop extends:

Meanwhile, the DAX is down 0.9%, Eurostoxx down 0.9%, and CAC 40 down 0.7% currently. Regional indices aren't able to take much comfort after having seen German producer prices post a record increase in July here.

But a firmer dollar and higher yields are also weighing on sentiment, but one can also argue that it is all tied together. Looking at US equities in particular, the rejection of the S&P 500 at the 200-day moving average seems to be the momentum breaker this week.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SWtmC8

http://dlvr.it/SWtmC8

Top Blockchain Exchange Partners with Ukraine boxing legend Usyk

Europe is the second-biggest cryptocurrency market with over 38 million users, which can be attributed to the heavy presence of crypto trading platforms in the region. These European-based exchanges aim to dominate the crypto world by engaging other prominent industries like finance, media, health, sports and many more to attract more participants in the digital currency space.

Partnership With Ukrainian Boxing Icon

One of the leading crypto platforms that are ready to leverage on the European market is QMALL. The exchange recently announced a partnership with Ukrainian boxing champion and star athlete Oleksandr Usyk. The joint efforts and support of Ukraine by QMALL and Oleksandr Usyk will show the unification of the two leading brands to viewers worldwide.

With a common goal of pushing the Ukrainian market to the international arena, the champion will mount the fighting stage wearing QMALL branded merchandise before exchanging blows with former world boxing champion Anthony Joshua on August 20.

Interestingly, boxing is among the most-viewed sports worldwide, with over 2 million spectators, the majority of which are young people. Hence the partnership between QMALL and Usyk will promote the crypto brand and connect younger audiences in Europe and beyond.

Because of the success rate of collaborations between sports and crypto platforms, over $3 billion have gone into sports sponsorship in 2021 alone. Therefore, QMALL aims to break down the complications of crypto to an average European young trader who wants to know more about digital assets.

Why QMALL is the Next Level European Cryptocurrency Exchange

QMALL is an innovative crypto platform with a European license that allows it to explore other European markets, expand its geography and possibilities and start working with a new scope.

In addition, the licence will enable the European-based exchange to access more opportunities and reach more active audiences.

With its headquarters in Ukraine, the blockchain platform creates innovative acquiring products that make the process of payment and accounting for cash and non-cash payments simple and convenient. QMALL has also integrated Euro into its trading platforms, allowing users to trade with the European currency.

Users can trade:

* EUR/USDT

* BTC/EUR

* ETH/EUR

* QMALL/EUR

Additionally, QMALL has become one of the trustest crypto platforms in the European market. Over 300 thousand European traders continue to exchange their digital assets with cash and other cryptocurrencies safely and efficiently. Some of QMALL’s features include:

Low Transaction Fees: Users can enjoy trading commissions based on the trading pair, ranging from 0 to 0.5%. Depending on the currency, commissions for deposits and withdrawals can vary from 0 to 2%.

Security: Users do not have to worry about the safety of their assets because 98% of the funds are stored offline, preventing them from hackers. Furthermore, QMALL uses automatic DDoS protection, creates daily backups and enables 2FA for all users.

Exciting User Experience: QMALL breaks down complicated trading functions into simple steps for new and experienced users. The platform offers advanced charting features to enable Traders to visualise orders, positions and price alerts.

More Development for the Future

Founded by Mykola Udianskyi and Bohdan Prylepa, QMALL has grown rapidly in recent years.

QMALL plans to unveil QPad, the largest launch pad for new European cryptocurrency projects, in September. This launch pad will be available to crypto startups from different countries, and the project will appear in collaboration with the French counterpart of Silicon Valley, Sophia Antipolis.

Crypto startups can launch their projects to a community of 100,000 users who can create the hype and implement the project goals after its launch. In turn, users can buy project tokens at the unveiling and earn a high profit.

Additionally, this update will allow exchange users to invest with the native token of the platform, QMALL, which would provide rewards to holders and influence its value in the crypto market. Furthermore, the crypto platform is currently developing the first Ukrainian Crypto Bank, crypto cards and the world’s first meta crypto exchange.

To learn more about QMALL, click here.

Instagram

Twitter

Telegram

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

http://dlvr.it/SWtkrZ

http://dlvr.it/SWtkrZ

Eurozone June current account balance €4.2 billion vs -€4.5 billion prior

The non-seasonally adjusted figure also sees a return to surplus of €3.2 billion, from -€15.4 billion previously. It is a welcome development after higher energy and raw material prices led the current account to a deficit in the prior two months.

That said, the negative terms of trade shock isn't over just yet. The details from Germany this month showed that it recorded a deficit in terms of current account with China, its first since 2012. As such, it isn't just the impact from the Russia-Ukraine war that Europe needs to be wary about but also a slowdown in China.

This article was written by Justin Low at www.forexlive.com.

http://dlvr.it/SWtklx

http://dlvr.it/SWtklx

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.1876; (P) 1.1978; (R1) 1.2033; More… Intraday bias in GBP/USD stays on the downside as fall from 1.2292 is in progress for retesting 1.1759 support. Firm break there will resume larger down trend Next target is 1.1409 low. On the upside, above 1.2078 minor resistance will turn intraday bias neutral first. But […]

The post GBP/USD Daily Outlook appeared first on Action Forex.

http://dlvr.it/SWtg94

http://dlvr.it/SWtg94

Subscribe to:

Posts (Atom)

'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...