Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Sunday 30 April 2023

Do you need an expert to help you with all forex , binary options , crypto scam investment cases ?

from Google Alert - ALL ABOUT FOREX https://ift.tt/ksBQfXl

via IFTTT

After Raids Over Alleged Forex Law Violations, Byju's CEO Reassures Company's Compliance

from Google Alert - ALL ABOUT FOREX https://ift.tt/dpD7kaC

via IFTTT

Crypto Fx - Lawine Energy

from Google Alert - ALL ABOUT FOREX https://ift.tt/3Ea1nCI

via IFTTT

HBAR price prediction as Hedera Hashgraph coin jumps | Invezz

from Google Alert - ALL ABOUT FOREX https://ift.tt/qDd07pF

via IFTTT

Nasdaq futures technical analysis and price forecast: Key levels to watch (13500 target)

http://dlvr.it/SnKNYs

Trading in Forex App - Nagare Design Studio.

from Google Alert - ALL ABOUT FOREX https://ift.tt/hidjV3D

via IFTTT

UBS looks to bring Naratil back and mulls Swiss bank spin-off - NZZ - The Economic Times

from Google Alert - ALL ABOUT FOREX https://ift.tt/GRUhjDz

via IFTTT

Saturday 29 April 2023

EUR/USD Weekly Forecast: Investors Await Fed, ECB Rate Hikes - Forex Crunch

from Google Alert - ALL ABOUT FOREX https://ift.tt/JtbaKGr

via IFTTT

All-in bets on FAANG stock boom pay out in week of big earnings - The Economic Times

from Google Alert - ALL ABOUT FOREX https://ift.tt/IQWfvsP

via IFTTT

Naira falls amid marginal rise in FX turnover - Businessday NG

from Google Alert - ALL ABOUT FOREX https://ift.tt/J8mGSeu

via IFTTT

61. SPX at deciding level | Trading Opportunities (Forex, Commodities, Indices and Crypto)

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=m-LimKFA5oM

via IFTTT

Natural Gas Forecast: Continues to See Downward Pressures - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/24p3t6d

via IFTTT

EURUSD Technical Analysis

http://dlvr.it/SnG0Gs

Friday 28 April 2023

Forex vs. Stocks vs. Crypto: What Trading Option Is Best for Me? - 10News.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/EYz4HQv

via IFTTT

Vip Forex Signals. Check out what we have to offer and make your tr

from Google Alert - ALL ABOUT FOREX https://ift.tt/DWu2gFj

via IFTTT

S&P 500 stays near term bullish after biggest rally since Jan - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/5RuVx0T

via IFTTT

USDCHF trades higher with help from yields

http://dlvr.it/SnC7Wq

Thursday 27 April 2023

Forex Today: Market sentiment improves; Ueda's first BOJ meeting - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/Fp5V2uB

via IFTTT

Federal Court Orders South African CEO to Pay Over $3.4 Billion for Forex Fraud | CFTC

from Google Alert - ALL ABOUT FOREX https://ift.tt/wYSdUyO

via IFTTT

FCF Markets Review: The Forex Markets to Grow Further (fcfmarkets.com)

from Google Alert - ALL ABOUT FOREX https://ift.tt/ts4Mdhr

via IFTTT

Problem - Bitecfinance.com | Forex Peace Army - Your Forex Trading Forum

from Google Alert - ALL ABOUT FOREX https://ift.tt/QPOmJHN

via IFTTT

Forex Today: All eyes on US first-quarter GDP report - OctaFX

from Google Alert - ALL ABOUT FOREX https://ift.tt/fLhNjBW

via IFTTT

XAUUSD Technical Analysis

http://dlvr.it/Sn84Zk

Wednesday 26 April 2023

Forex News: 26/04/2023 - Dollar gains amid renewed recession fears - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=npNZDmKLyik

via IFTTT

We Were Victims of Financial Scams: Here Are Our Stories - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/r7qbPyQ

via IFTTT

What is the best book to learn forex?

from Google Alert - ALL ABOUT FOREX https://ift.tt/9sWRCrg

via IFTTT

What Is a Forex Trading Robot? | The Motley Fool

from Google Alert - ALL ABOUT FOREX https://ift.tt/4PbcDj6

via IFTTT

Big Banks Battle To Keep £1B Forex Rigging Case Opt-In - Law360

from Google Alert - ALL ABOUT FOREX https://ift.tt/3at8hlg

via IFTTT

HUNTER GOLD on Instagram: "Contact me via telegram t.me/TradeWithMyF1 This system can help ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/PaBknMo

via IFTTT

USD/CAD Technical Analysis - Shift in Sentiment?

http://dlvr.it/Sn50Rr

Tuesday 25 April 2023

Class Reps Fight For 2nd Chance To Bring £1B Forex Action - Law360

from Google Alert - ALL ABOUT FOREX https://ift.tt/IL3seCJ

via IFTTT

When is the most active forex time?

from Google Alert - ALL ABOUT FOREX https://ift.tt/jctsFzG

via IFTTT

Forex: J$154.12 to one US dollar - Jamaica Observer

from Google Alert - ALL ABOUT FOREX https://ift.tt/LVFhKc5

via IFTTT

Conotoxia's 2022 FX Turnover Soars 5% to $8.29 Billion, Record User Base

from Google Alert - ALL ABOUT FOREX https://ift.tt/OaUXe6C

via IFTTT

Profiforex Reviews and Comments - Forex-Ratings.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/yOapWNU

via IFTTT

EURUSD shows resilience: Key support levels in focus

http://dlvr.it/Sn1zrl

Monday 24 April 2023

New Ally survey reveals "Bucket Lists" and affordability top-of-mind for Americans

from Google Alert - ALL ABOUT FOREX https://ift.tt/Vdm1QuZ

via IFTTT

Forex Market Times. EST on Sunday to 4 p. XX. Trading is av - SK Event

from Google Alert - ALL ABOUT FOREX https://ift.tt/SAIWawz

via IFTTT

Evelyn Charlotte on Instagram: “Beautiful ❤️❤️ forex is everything, all I have to hear is ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/8A2qLg7

via IFTTT

ForexLive European FX news wrap: Mixed dollar amid mixed markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/m6VYwHE

via IFTTT

FOREX-Strong Euro nears nine-year high versus Japanese yen - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/mvLFp5O

via IFTTT

What line on tax form for forex irc?

from Google Alert - ALL ABOUT FOREX https://ift.tt/XeEsidK

via IFTTT

Sunday 23 April 2023

FOREX TRENDY TRADING ENGLISH REVIEW FOREX TRENDY FOREX SIGNAL REVIEW BY LAUGHTV22

http://dlvr.it/SmyYkk

EUR/USD Weekly Forecast - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/KWih7vA

via IFTTT

Forex analysis: AUD/JPY, AUD/USD, EUR/JPY, EUR/USD, GBP/JPY and GBP/USD [Video]

from Google Alert - ALL ABOUT FOREX https://ift.tt/qmZi78K

via IFTTT

Set yourself up for the new trading week by understanding the key levels in play

http://dlvr.it/Smy6r2

ROSEN, A GLOBAL AND LEADING LAW FIRM, Encourages Fidelity National Information ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/FwkRmcq

via IFTTT

Lifestyle on Instagram: "Shoutout to all the forex traders for your comments on all my holiday posts "

from Google Alert - ALL ABOUT FOREX https://ift.tt/3jCRQBr

via IFTTT

The man who bought Dogecoin (DOGE) till he maxed out everything and then cashed ... - Bitcoinist

from Google Alert - ALL ABOUT FOREX https://ift.tt/jquU2Vd

via IFTTT

Saturday 22 April 2023

Chile's central bank to gradually reduce forex forward operations - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/nIxRQEw

via IFTTT

Elliott Wave Analysis of SP500 - April 24th, 2023 - EWM Interactive

from Google Alert - ALL ABOUT FOREX https://ift.tt/XEkGs2Q

via IFTTT

Major US indices close little changed.Low to high trading ranges are the lowest since 2021

from Google Alert - ALL ABOUT FOREX https://ift.tt/40YHUpt

via IFTTT

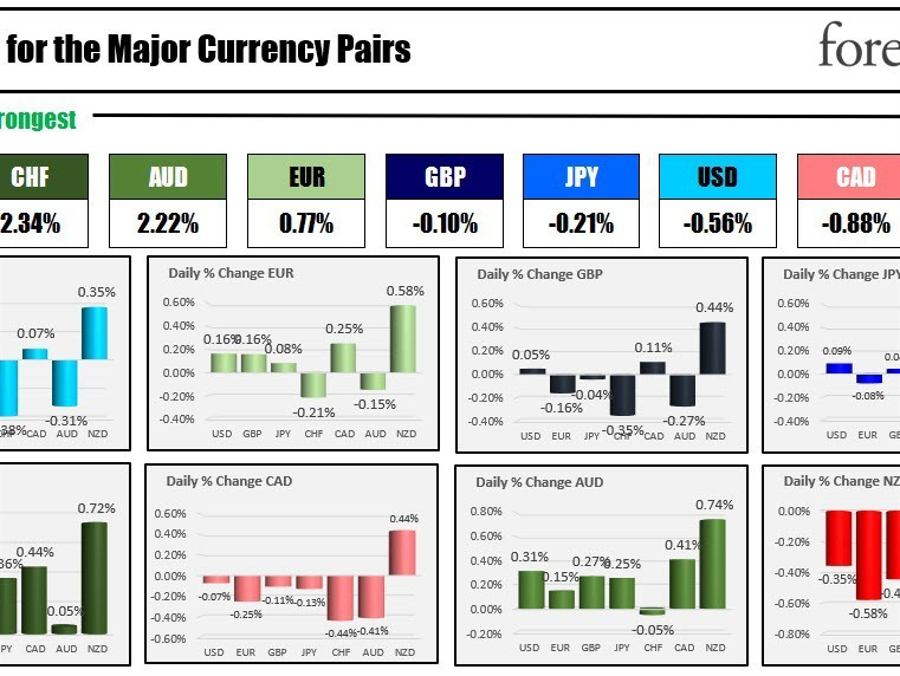

Live currency strength meter

from Google Alert - ALL ABOUT FOREX https://ift.tt/V8e4xBd

via IFTTT

China's foreign exchange market off to good start - Xinhua

from Google Alert - ALL ABOUT FOREX https://ift.tt/AwyvOVZ

via IFTTT

FOREX-US dollar flat to modestly higher as upbeat data backs May rate hike

from Google Alert - ALL ABOUT FOREX https://ift.tt/01WVONL

via IFTTT

Nasdaq Composite Technical Analysis

http://dlvr.it/Smtp37

Russell 2000 Technical Analysis

http://dlvr.it/Smtnfz

Friday 21 April 2023

Stocks Muted Ahead of PMIs - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/QzA6Hnp

via IFTTT

U.S. dollar 'death' won't happen for 'decades', these are the biggest risks in 2023 - Adam Button

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=nb-3Q8g0qNc

via IFTTT

S&P 500 Forecast: Continues to Trade in a Well-defined Range - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/6nPvrai

via IFTTT

Deriv Review and Information 2023 - Forex-Ratings.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/wMlHJOn

via IFTTT

Is Forex Taxable in The Philippines? - BOSS Magazine

from Google Alert - ALL ABOUT FOREX https://ift.tt/D4Q6i05

via IFTTT

US dollar takes a jump higher

http://dlvr.it/SmqzCh

The CHF is the strongest and the NZD is the weakest as the NA session begins

http://dlvr.it/Smqyjd

Thursday 20 April 2023

mdhossenalloe | Forex Peace Army - Your Forex Trading Forum

from Google Alert - ALL ABOUT FOREX https://ift.tt/mb85VNA

via IFTTT

Gold Technical Analysis: Gold is Selling Off - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/d157MVi

via IFTTT

USD/JPY Technical Analysis: General Trend is Still Bullish - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/Y0kAqnG

via IFTTT

Forex $150 No Deposit Bonus – UNFXB

from Google Alert - ALL ABOUT FOREX https://ift.tt/nubH3YL

via IFTTT

How to report forex trades on turbotax?

from Google Alert - ALL ABOUT FOREX https://ift.tt/yakStIP

via IFTTT

Velocity Trade Reviews and Comments - Forex-Ratings.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/03mE74s

via IFTTT

One Financial Markets Reviews and Comments - Forex-Ratings.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/j2fUvZV

via IFTTT

Gold outlook: Above $2K again as dollar eases - Forex.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/O0hVbIq

via IFTTT

USDCHF Technical Analysis

http://dlvr.it/SmmvjQ

Wednesday 19 April 2023

Forex Preview: 19/04/2023 - Eurozone PMIs eyed as ECB ponders size of next rate hike

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=uEHJTAt7Qyk

via IFTTT

All India Radio News on Twitter: "Forex Market: Rupee closes at 82 rupees & 23 paise against ...

from Google Alert - ALL ABOUT FOREX https://twitter.com/airnewsalerts/status/1648657888624394240

via IFTTT

Kenya shilling weakens due to dollar demand from oil retailers, manufacturers | Reuters

from Google Alert - ALL ABOUT FOREX https://ift.tt/h9v6b0X

via IFTTT

Bitcoin analysis: BTC dips but long-term outlook remains bullish - Forex.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/e4lWHwX

via IFTTT

Prop Trading Reviews. At Forex Prop Reviews, we believe in providing traders with ... - airobolab.ru

from Google Alert - ALL ABOUT FOREX https://ift.tt/skzp9xo

via IFTTT

What market is open now for forex?

from Google Alert - ALL ABOUT FOREX https://ift.tt/jsZ3BRu

via IFTTT

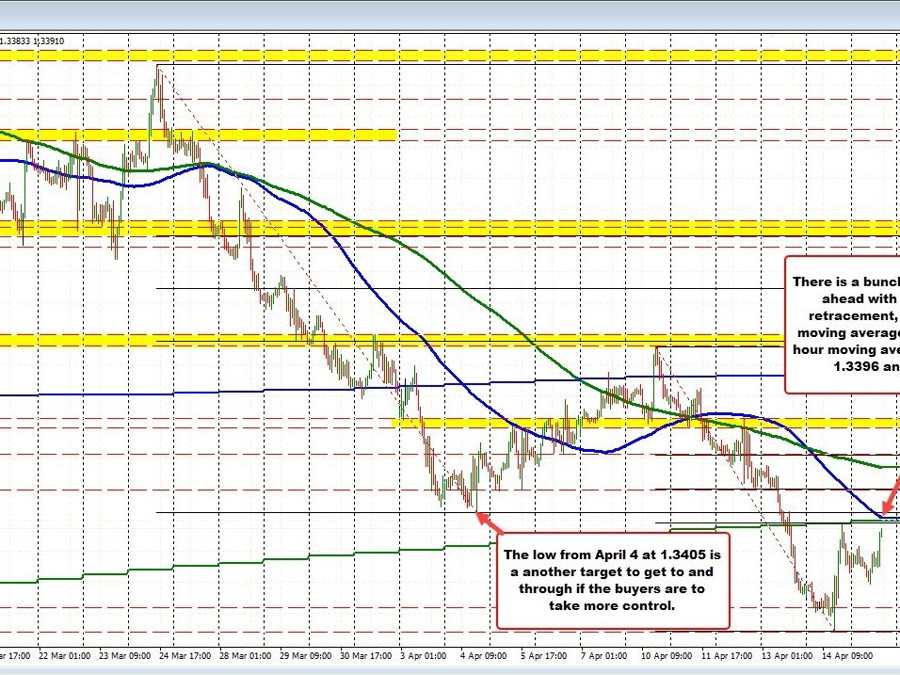

USDCAD Technical Analysis - Bearish Trend Returns

http://dlvr.it/SmjqBm

Tuesday 18 April 2023

How gang in Delhi emptied customer accounts via forex card details - Times of India

from Google Alert - ALL ABOUT FOREX https://ift.tt/bvyaQ7Y

via IFTTT

Potential tailwind for Asian equities as major downtrend on the US dollar remains intact

from Google Alert - ALL ABOUT FOREX https://ift.tt/MPjncfO

via IFTTT

Southwest Airlines briefly paused all flights today: sell the stock? - Invezz

from Google Alert - ALL ABOUT FOREX https://ift.tt/0459JWO

via IFTTT

Japanese Yen forecast: USD/JPY breakout towards 135, fresh monthly highs - Forex.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/pLKPTXs

via IFTTT

Forex Signs Burundi - Trading at Forex Signs for Abarundi

from Google Alert - ALL ABOUT FOREX https://ift.tt/7Ks8BMc

via IFTTT

USDCAD approaches Key levels as it reaches a new session high

http://dlvr.it/SmfmK6

Monday 17 April 2023

GO Markets named the Best Global Forex Broker 2023 - Mauritius for all-inclusive ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/L21ZFlX

via IFTTT

PBoC has 'by and large' ended FX intervention, says governor - Central Banking

from Google Alert - ALL ABOUT FOREX https://ift.tt/eDZIQKs

via IFTTT

FreshForex News - LabWrench

from Google Alert - ALL ABOUT FOREX https://ift.tt/clYSk36

via IFTTT

S&P 500 Technical Analysis

http://dlvr.it/SmcgQK

Dow Jones Technical Analysis

http://dlvr.it/SmcCq2

Russell 2000 Technical Analysis

http://dlvr.it/SmcCny

Sunday 16 April 2023

Forex and Cryptocurrency Forecast

from Google Alert - ALL ABOUT FOREX https://ift.tt/3Bbe58D

via IFTTT

THE TOP 5 STREAMING DEVICES FOR GAMERS IN INDIA OF ALL TIME - PhonesWiki

from Google Alert - ALL ABOUT FOREX https://ift.tt/8xJySiz

via IFTTT

Netflix to Kickstart FAANG Earnings: Here's What All Markets Will Look Out For

from Google Alert - ALL ABOUT FOREX https://ift.tt/zD5IGwS

via IFTTT

Rainbow FX Education - Can you become a millionaire by trading forex? There are two answers

from Google Alert - ALL ABOUT FOREX https://ift.tt/Ij6FOb5

via IFTTT

New push on US-run free electronic tax-filing system for all | MarketScreener

from Google Alert - ALL ABOUT FOREX https://ift.tt/Xd3K2Ra

via IFTTT

Cybersecurity Firm Warns Of Uniswap Phishing Scam Spreading False Exploit Information

from Google Alert - ALL ABOUT FOREX https://ift.tt/QIEOd6C

via IFTTT

UnitedHealth stock slides despite raised guidance: buy the dip? - Invezz

from Google Alert - ALL ABOUT FOREX https://ift.tt/DGxdW7b

via IFTTT

S&P 500 technical analysis: Understanding the recent sell-off and forecasting future price

http://dlvr.it/SmYhQ1

Saturday 15 April 2023

USD/JPY Weekly Outlook - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/idlVC1o

via IFTTT

All China March New Home Prices +0.5% M/m - Reuters Calculations… - Stock market news

from Google Alert - ALL ABOUT FOREX https://ift.tt/F76aNCY

via IFTTT

Warren Bowie & Smith: Reviews & Opinions 2023 - EconoTimes

from Google Alert - ALL ABOUT FOREX https://ift.tt/XhZTGWM

via IFTTT

Orlando Dreamers Announces the Completion of Economic and Fiscal Impact Study for New ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/xndYavI

via IFTTT

Surprise decline in US PPI spurs risk-on: DJIA, Straits Times Index, US dollar - IG

from Google Alert - ALL ABOUT FOREX https://ift.tt/onjNDTF

via IFTTT

AUDUSD downside momentum grows as key levels break

http://dlvr.it/SmWc2G

Friday 14 April 2023

India's Forex Reserves Jump to 9-Month High

from Google Alert - ALL ABOUT FOREX https://ift.tt/SEJPG4O

via IFTTT

Wedbush Names New Compliance Chief as It Enters FX Prime Brokerage

from Google Alert - ALL ABOUT FOREX https://ift.tt/106EtAe

via IFTTT

The USD moves higher and retraces some of the week's declines

http://dlvr.it/SmV1Fj

What is the Fibonacci retracement level, and why do people use it when trading Forex? Does it work, and if yes, how does it work?

The Fibonacci retracement is a technical analysis tool used to identify potential levels of support and resistance in a financial market. It is based on the idea that prices tend to retrace a predictable portion of a move, after which they continue in the direction of the original trend.

The Fibonacci retracement levels are derived from the Fibonacci sequence, a series of numbers in which each number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, and so on. The ratios between the numbers in the sequence become the basis for the Fibonacci retracement levels, which are expressed as percentages: 23.6%, 38.2%, 50%, 61.8%, and 100%.

In Forex trading, traders use the Fibonacci retracement tool to identify potential levels of support and resistance in a market. They draw a trendline between two extreme points in the market, such as a high and a low, and then use the Fibonacci retracement levels to identify potential levels where the market may retrace.

The theory behind the Fibonacci retracement is that these levels act as potential areas of support and resistance because many traders use them, and therefore, the market tends to react at these levels. As a result, traders can use these levels to identify potential entry and exit points for their trades.

The effectiveness of the Fibonacci retracement levels depends on how many traders are using them and how much weight they give them in their trading decisions. The levels may not work all the time, but they can be a useful tool when used in conjunction with other technical analysis tools and fundamental analysis.

EUR/USD and gold outlook: USD continues fall ahead of key US data - Forex.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/btCYqpi

via IFTTT

AUDUSD Forex Analysis - Retest and Failure at 0.6716 Daily Resistance - YouTube

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=tkGnC8E1dfs

via IFTTT

Thursday 13 April 2023

Bad news is good news for stocks, Mixed Earnings from Delta and Fastenal - MarketPulse

from Google Alert - ALL ABOUT FOREX https://ift.tt/skAjSwq

via IFTTT

BBC India Probed Again, This Time For Alleged Forex Violations: Sources | NDTV 24x7 Live TV

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=CBTamE9wpnY

via IFTTT

BTC/USD Forex Signal: US Inflation and Fed Minutes are Supportive - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/ZhFCl4j

via IFTTT

Turkey urges banks to avoid creating forex demand | AGBI

from Google Alert - ALL ABOUT FOREX https://ift.tt/M8fEJcb

via IFTTT

Wednesday 12 April 2023

Dollar and Yen forex pairs likely to be stuck in sideways trends through the summer [Video]

from Google Alert - ALL ABOUT FOREX https://ift.tt/nNirbkD

via IFTTT

Fed's Kashkari cautions against potential economic downturn and recession - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/ASI3W9D

via IFTTT

Elliott Wave Update of SP500 - April 12th, 2023 - EWM Interactive

from Google Alert - ALL ABOUT FOREX https://ift.tt/UoRzJi9

via IFTTT

GBP/USD Forex Signal: Bearish Outlook Ahead of US CPI, Fed Minutes - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/kEdh7FG

via IFTTT

Oil supported after EIA lifts its forecasts | FXCM Markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/vWTag9C

via IFTTT

Tuesday 11 April 2023

Right Time to Trade or Invest in Forex Market on 2023 | December is a ch...

S&P 500 Forecast - Stock Markets Continue to Consolidate - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/lLEws0I

via IFTTT

Trade ideas thread - Tuesday, 11 April 2023 | Forexlive

from Google Alert - ALL ABOUT FOREX https://ift.tt/lbjYFku

via IFTTT

How does a moving average indicator work on MetaTrader4 (forex)?

Euro slips on fallout from strong US nonfarm payrolls - MarketPulse

from Google Alert - ALL ABOUT FOREX https://ift.tt/T5QPNSE

via IFTTT

Monday 10 April 2023

List of foreign exchange (FX) spot risk margin rates for Canadian and U.S. base currency accounts

from Google Alert - ALL ABOUT FOREX https://ift.tt/fPoilzV

via IFTTT

Russian central bank says rouble weakness due to lower forex sales by exporters - KITCO

from Google Alert - ALL ABOUT FOREX https://ift.tt/zu3RXsi

via IFTTT

APAC Week Ahead: All eyes on the US CPI, with earnings season kicking in | CMC Markets

from Google Alert - ALL ABOUT FOREX https://ift.tt/8RoLkSB

via IFTTT

BTC/USD Forex Signal: BTC Sits at a Key Support - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/gNiTpMe

via IFTTT

Popular emerging market FX trade back with global rates peaking - Mint

from Google Alert - ALL ABOUT FOREX https://ift.tt/ep7L1U3

via IFTTT

India's Forex Reserves Drop by $329 Million to $578.45 Billion; FY23 Sees $29 Billion Decline

from Google Alert - ALL ABOUT FOREX https://ift.tt/yFRgVIf

via IFTTT

Sunday 9 April 2023

Mayor Of Ekiti on Twitter: "I lost all my life savings to forex in 2014 i was following one ...

from Google Alert - ALL ABOUT FOREX https://mobile.twitter.com/Ekitipikin/status/1645188572603985921

via IFTTT

Bollinger Band + RSI Trading Strategy That Actually Works with macd and rsi

OpenAI's ChatGPT is a product, not AI research: Meta chief AI scientist | Deccan Herald

from Google Alert - ALL ABOUT FOREX https://ift.tt/evHaKs2

via IFTTT

Saturday 8 April 2023

Stone and Home Releases the Better Bath Mat: The Instant Drying, All-Natural Bath Mat that ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/C1esLb9

via IFTTT

dYdX token dips after exchange announce Canadian market exit | Invezz

from Google Alert - ALL ABOUT FOREX https://ift.tt/2FKXMi3

via IFTTT

The BEST Forex Broker For SMALL Accounts! (FOREX STRATEGY FACTORY)

Solana (SOL) & Polygon (MATIC) Endeavor to Replicate TMS Network's (TMSN ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/1goz5bw

via IFTTT

Six Forex Tools You Can't Afford To Ignore! - Globe Echo

from Google Alert - ALL ABOUT FOREX https://ift.tt/3lTDxic

via IFTTT

Friday 7 April 2023

U.S. Adds 236k Jobs in March; Unemployment Rate Drops to 3.5% - FX Empire

from Google Alert - ALL ABOUT FOREX https://ift.tt/CiJs57Z

via IFTTT

Weekly Forex Outlook: 07/04/2023 - US CPI data, Fed minutes, and BoC decision on investors' radar

from Google Alert - ALL ABOUT FOREX https://www.youtube.com/watch?v=6iSPNx_NdYE

via IFTTT

Gold Price Forecast: Gold Pulls Back - Can XAU/USD Bulls Hold 2k - Action Forex

from Google Alert - ALL ABOUT FOREX https://ift.tt/P1NxdMs

via IFTTT

forex chart patterns | learn to trade forex - forex trading signals - Assocham

from Google Alert - ALL ABOUT FOREX https://ift.tt/e6yaQZ9

via IFTTT

Thursday 6 April 2023

US dollar analysis Will NFP help the USD rise from the dead - Forex.com

from Google Alert - ALL ABOUT FOREX https://ift.tt/SEBwObc

via IFTTT

Forex Today: NFP is the only game in town - FXStreet

from Google Alert - ALL ABOUT FOREX https://ift.tt/9r1HDk8

via IFTTT

Delta International U.A.E Launches Personalized Financial Trading Education Programs for ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/gn7dpqY

via IFTTT

FOREX-Dollar bobs near 2-month low ahead of pivotal US jobs data - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/hx5CNkd

via IFTTT

Watch Kia Debuts First All Electric SUV - Bloomberg

from Google Alert - ALL ABOUT FOREX https://ift.tt/xyvLWqC

via IFTTT

Princess Of Forex - BW - Win Yourself An All Expenses Paid For Get Away Trip To Kasane ...

from Google Alert - ALL ABOUT FOREX https://ift.tt/3RHWmSM

via IFTTT

Best Trend Lines Advice and Trading Strategy (Advanced)

In forex trading, trendlines are lines drawn on a price chart to identify the direction of the market trend. They are graphical representations of the price movement, connecting two or more points on a price chart, typically highs or lows. Trendlines can be used to identify the overall trend of a currency pair, as well as potential areas of support and resistance.

Here are the basic steps on how to trade trendlines in forex:

Identify the trend: Look for a series of higher highs and higher lows for an uptrend, or lower highs and lower lows for a downtrend. Draw trendlines connecting the highs or lows in the direction of the trend.

Confirm the trendline:

A trendline becomes more significant if it has been tested and confirmed by multiple touches. The more times a trendline has been touched and respected, the stronger it is considered.

Enter trades on trendline breaks: When price approaches a trendline, you can use it as a potential entry point for a trade. If price breaks above a downtrend trendline, it could signal a trend reversal and a potential buying opportunity. Conversely, if price breaks below an uptrend trendline, it could signal a trend reversal and a potential selling opportunity.

Use other technical indicators: It's important to use trendlines in conjunction with other technical indicators to confirm trading signals. For example, you can use candlestick patterns, support and resistance levels, and momentum indicators to confirm trendline breaks and increase the probability of a successful trade.

Manage risk: As with any trading strategy, it's important to manage risk by setting stop-loss orders to limit potential losses and trailing stop orders to lock in profits as the trade moves in your favor.

Be mindful of false breakouts: Sometimes, price may temporarily break a trendline but then reverse and move back within the trend. These are called false breakouts, and it's important to be mindful of them and wait for confirmation before entering a trade.

Remember, trendlines are not foolproof and should be used in conjunction with other technical analysis tools and risk management techniques. It's also essential to practice and gain experience in using trendlines in forex trading before applying them in live trading situations. Always consider the overall market conditions, news events, and other factors that may impact currency prices. It's recommended to consult with a qualified financial professional before making any trading decisions.

Wednesday 5 April 2023

Technology Vendors Aim Algo Solutions at Institutional Traders - Finance Magnates

from Google Alert - ALL ABOUT FOREX https://ift.tt/nacgd7q

via IFTTT

Tuesday 4 April 2023

FOREX-Dollar slides on sluggish US data, Aussie steadies ahead of RBA - Yahoo Finance

from Google Alert - ALL ABOUT FOREX https://ift.tt/dFugWmU

via IFTTT

Monday 3 April 2023

Create your personalized DP for LEARN ALL ABOUT FOREX & CRYPTO CURRENCIES

from Google Alert - ALL ABOUT FOREX https://getdp.co/K_O

via IFTTT

Traders Union experts name the 5 Best Forex Brokers in 2023 - Benzinga

from Google Alert - ALL ABOUT FOREX https://ift.tt/BnCD32a

via IFTTT

S&P 500 Forecast: Continues to Reach Above 4100 - DailyForex

from Google Alert - ALL ABOUT FOREX https://ift.tt/avIQJr6

via IFTTT

The Advantages of Using a Forex CRM for Your Company - Digital Journal

from Google Alert - ALL ABOUT FOREX https://ift.tt/8CUSgk7

via IFTTT

Sunday 2 April 2023

When you lose all money on forex?

from Google Alert - ALL ABOUT FOREX https://ift.tt/6VbX8Jo

via IFTTT

Saturday 1 April 2023

Pakistan forex reserves fall to less than a month's import cover - Telangana Today

from Google Alert - ALL ABOUT FOREX https://ift.tt/SMuT0fD

via IFTTT

'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...