Are you a forex trader or affiliate marketter that wants to trade forex or make money online.we have the best tips for you here.

Wednesday 30 November 2022

The only technical analysis video you will ever need (full guides: beginner to advanced

from forex strategy factory https://www.youtube.com/watch?v=IB4cKYg3bmU

via IFTTT

Stocks making the biggest moves after hours: Salesforce, Snowflake, Costco, Five Below and more

Tuesday 29 November 2022

EURUSD & GBPUSD Forex Signals | Euro | USD |Scalping forex strategy (Day trading strategies)

from forex strategy factory https://www.youtube.com/watch?v=u634bTLvErw

via IFTTT

Stocks making the biggest moves after hours: Workday, CrowdStrike, Horizon Therapeutics and more

USD/CHF Mid-Day Outlook

http://dlvr.it/SdXPp7

GBP/USD Mid-Day Outlook

http://dlvr.it/SdXPkB

Monday 28 November 2022

GBP/USD Daily Outlook

http://dlvr.it/SdTLYk

USD/CHF Daily Outlook

http://dlvr.it/SdTLW4

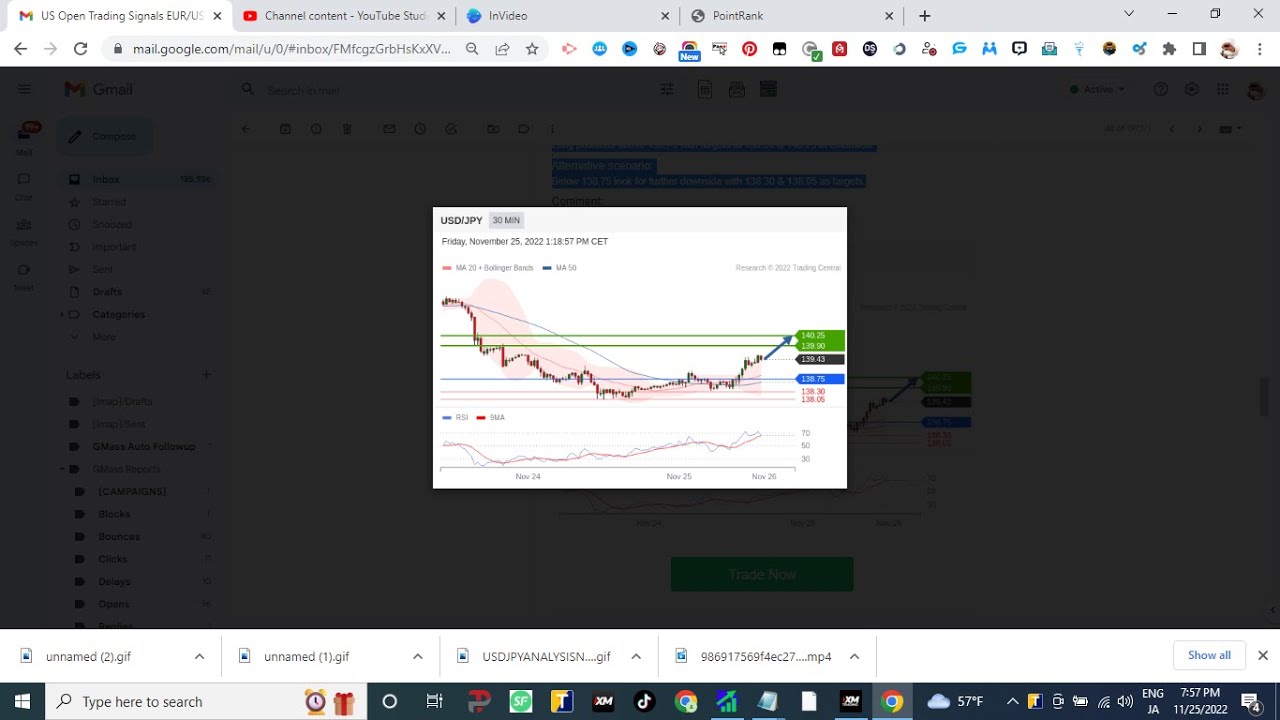

USD/JPY Daily Outlook

http://dlvr.it/SdTLTT

AUD/USD Daily Report

http://dlvr.it/SdTLRX

USD/CAD Daily Outlook

http://dlvr.it/SdTLNy

Sunday 27 November 2022

'India is one of the greatest opportunities in the world'

'India is one of the Greatest Opportunities in the World'. US corporate restructuring specialist Houlihan Lokey is slowly exploring a post-covid investment situation in India, where promoters are open to sell, prune their businesses or partner with a financial sponsor to grow. As the insolvency and bankruptcy processes mature, mid-sized Indian firms are looking a bit more aggressive towards global capital pool said Scott Adelson, co-president & global co-head, Corporate Finance.

'India is one of the Greatest Opportunities in the World'. US corporate restructuring specialist Houlihan Lokey is slowly exploring a post-covid investment situation in India, where promoters are open to sell, prune their businesses or partner with a financial sponsor to grow. As the insolvency and bankruptcy processes mature, mid-sized Indian firms are looking a bit more aggressive towards global capital pool said Scott Adelson, co-president & global co-head, Corporate Finance.

Saturday 26 November 2022

Warren Buffett explains his $750 million charitable donation on Thanksgiving eve

NZD/JPY:Volume Profile,VWAP and price Action Analysis by forex strategy factory

from forex strategy factory https://www.youtube.com/watch?v=lWFjXspcZuA

via IFTTT

Friday 25 November 2022

USD/JPY Technical Analysis for November 25, 2022 by FOREX STRATEGY FACTORY

from forex strategy factory https://www.youtube.com/watch?v=aw5iSNoZEp0

via IFTTT

Crypto Exchange Bitget Introduces Brazilian Real Trading Pairs

Bitget, a cryptocurrency exchange now based in Seychelles, has introduced Brazilian real (BRL) trading pairs as the first batch of its new on-ramp fiat trading pairs for spot traders on its platform.

Bitget announced on Friday that the new pairs includes USDT/BRL, ETH/BRL and BTC/BRL even as “the team is looking to roll out more fiat currency trading pairs on the plaform.”

“The new solution provides users with the option of spot trading cryptocurrency direct with fiat currency, therefore, lowering the reliance on stablecoins and over-the-counter services,” Bitget said.

The new development comes a week after Bitget launched its operations in Brazil and enabled crypto purchases with Brazilian reals. The firm also integrated with the Brazilian government’s Pix payment system and announced that its users will be able to executive withdrawals in the country’s fiat currency by November 30.

In the Friday statement, Bitget noted that it launched the fiat on-ramp service in partnership with Pix. However, it added that the system runs alongside off-ramp solutions it current provides globally.

Furthermore, Bitget noted that the trading pairs will first be introduced to markets in Latin America “where the adoption rate of crypto is highest amongst the general public.” The exchange added that the region is an important market for its global expansion.

Eyes on Global Expansion

Speaking on the new development, Gracy Chen, Bitget’s Managing Director described the launch as “one of our significant milestones this year.” Last month, the firm launched ‘Biget Insights,’ a feature that makes trading insights from verified traders on social media accessible to Bitget’s users.

“To create accessible gateways to serve the international communities, we will be working hand-in-hand with top-notch and recognized payment solution providers to be compliant in linking local economies, businesses, and marketplaces with digital assets. We hope this will bring a better experience and easier accessibility to more users, which is crucial for crypto mass adoption,” Chen explained, speaking on the trading pairs.

Earlier this month, Bitget increased its protection fund, which was first introduced in July, to $300 million following FTX's collapse. The exchange also announced the opening a Seychelles office some days ago, months after disclosing that it will double its global workforce despite contrary developments in the crypto industry.

Meanwhile, in Octobr, Bitget expanded its sports deal roster by unveiling football star Lionel Messi as it brand ambassador. The crypto firm currently manages sports deal with football clubs Juventus F.C. (Italy) and Galatasaray (Turkey).

This article was written by Solomon Oladipupo at www.financemagnates.com.EUR/AUD Daily Outlook

http://dlvr.it/SdLKjv

Thursday 24 November 2022

Credit guarantee fund on drawing board for building warehouses

Earlier this year, the Reserve Bank of India increased the limits for bank lending against negotiable warehouse receipts (NWRs) or electronic NWRs to Rs 70 lakh from Rs 50 lakh per borrower to ensure increased flow of credit to farmers against the pledge or hypothecation of agricultural produce, and encourage greater use of NWRs and e-NWRs issued by regulated warehouses as a preferred instrument for farmers availing such finance.

Earlier this year, the Reserve Bank of India increased the limits for bank lending against negotiable warehouse receipts (NWRs) or electronic NWRs to Rs 70 lakh from Rs 50 lakh per borrower to ensure increased flow of credit to farmers against the pledge or hypothecation of agricultural produce, and encourage greater use of NWRs and e-NWRs issued by regulated warehouses as a preferred instrument for farmers availing such finance.

EUR/USD Daily Outlook

http://dlvr.it/SdHXQT

Wednesday 23 November 2022

best time to trade forex

Chapter 1:

Assess the Right Time toInvestTo trade successfully in Forex, you must be able to understand the trading signals that can contribute greatly to your profits. Select a chart that describes these trading indicators and rationally opt for a trading system that can optimize the benefit of these trading indicators.

These signals can help in making important decisions regarding market entry and exit or to make any adjustments in currency exchange. Technical indicators describe the trading facts and figures by making certain mathematical calculations and state the time period that was selected for reckoning these indicators. Charts in Forex display continually updated exchange rates of various currencies, the upward or downward trends and the technical indicators. Every chart is being updated after a specified time period.

You must be acquainted with these charts and the technicalindicators before making an investment. It is a sensible norm to consult the charts before making an entry to Foreign exchange market. You can even consult multiple charts to figure out the best time of entry. After mastering at entry signals' evaluation, you must pay attention to the exit signals. Consider many options from trailing stops, fixed stops and limit exits that you can use for your exit.

If you intend to make short trade, try concentrating on 'turning points' by understanding any short-term pattern which can recur in long run. Monitor the currency pairs to figure out any such swing. Usually traders prefer to set a higher percentage for a short period, opting for the limit exit. You can also consult exit signals that are based on real time transactions, to make a decision regarding your exit. In addition to consulting the technical indicators carefully, you must use a signal that best suits your conditions. Instead of making a decision randomly you must stick to a logical mechanism. Try using multiple signals in accordance with many parameters that will lead you to risk aversion.

Page 6 Forex Trading Fortunes Evaluating various Forex signals along with technical indicators allows you to control your investment and anticipate the possible fluctuations in market. Trading in Forex requires rigorous attention and observation and any negligence can cause big losses. Technological advancements have made it possible to analyze foreign exchange market 24 hours a day through internet.

You can even buy and sell currency on phone, because the need of physical presence has been eliminated in Modern Forex trading. Now-a-days if the Forex trading indicators meet the defined parameters, you'll receive an alert to invest or sell your stock. To ensure the maximum possible gain from your investment, decide on following the trading signal of an experienced service provider's signals. You must find out the best trading system that suits you. Logical evaluation of figures and signals allow you to grab the right opportunity.

You must conduct a thorough research before making a transaction and don't just rely on one source. Read reviews, online trading forums, business newspapers and magazines on foreign exchange to deeply understand the underlying system of Foreign exchange trading. Use software to evaluate signals or a method developed by any foreign exchange expert. Make notes and find out the right trading system that works for you. Page 7 Forex Trading Fortunes Chapter 2: Education with Forex Tradi

1000pip climber forex system review

Any information communicated by 1000Pip Climber is solely for educational purposes.The information contained within this message neither constitutes investments advice nor a general recommendation on investments.It is not intended to be and should not be interpreted as investment advice or a general recommendation on investment.Any person who places trades, orders or makes other types of trades and investments etc., is responsible for their own investment decisions and does so at their own risk.It is recommended that any person taking investment decisions consults with an independent financial advisor.1000Pip Climber is for educational purposes only, it is not a financial advisory service, and does not give financial advise or make general recommendations on investment.

U.S.Government Required Disclaimer - Stocks, Options, Binary options, Forex and Future trading has large potential rewards, but also large potential risk.You must be aware of the risks and be willing to accept them in order to invest in the stock, binary options or futures markets.Don't trade with money you can't afford to lose especially with leveraged instruments such as binary options trading, futures trading or forex trading.This website is neither a solicitation nor an offer to Buy/Sell stocks, futures or options.No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website.The past performance of any trading system or methodology is not necessarily indicative of future results.You could lose all of your money fast due too: poor market trading conditions, mechanical error, emotional induced errors, news surprises and earnings releases.End of U.S.Government Required Disclaimer.

The term '1000pip Climber' or 'us' or 'we' or 'our' or 'author' refers to the owner of the website www.1000pipClimberSystem.com and other associated websites, materials, software, services and communications etc.1000pip Climber is a trading name and member of Traders for Fair Trading Ltd (09181896).Registered in England & Wales.All kinds of trading (including but not limited to Forex, binary options, cryptocurrencies and spread betting) carries a high risk to your capital and it is possible to incur losses that exceed your initial investment.Trading is not suitable for all investors.Before making any trading decision ensure that you fully understand all the risks involved and have read warnings on, but not excluded to, trading websites.If you are in any doubt about the risks involved with trading seek advice from an independent financial advisor.We take no responsibility for any investment decisions made by the reader of our website or any recipient of our materials, software, services, emails and communications etc.and the information contained within any materials, software, services, emails and communications etc.provided by us is opinion only and does not constitute investment advice.They represent the author's personal views and trading experience and are subject to change without notice.By visiting our websites, or viewing our materials, software, services, emails and communications etc.you acknowledge that we are not providing financial advice and what you do with the information provided by us is your decision.We have no knowledge on the level of money you are trading with or the level of risk you are taking with each trade.There is no guarantee that you will earn any money using the information, techniques, ideas or materials provided by our websites or other associated materials, software, services, emails and communications etc.No information contained within our websites, materials, software, services, emails and communications etc.constitutes any recommendation to buy, sell, order, or trade any product in the financial or spread betting markets (including but not exclude to currencies, binary options and cryptocurrencies).The information contained in our websites, materials, software, emails, services and communications etc.is not necessarily real-time nor accurate, and analyses are our opinions only.It is important to know that past results are no guarantee of future performance.We have no liability to you or any third party for any loss or damage arising out of or in connection with, the disclosure of our websites, or our materials, software, services, emails and communications etc by us to you.We shall not be liable for any loss or damage arising out of the creation of our websites or our materials, software, services, emails and communications etc.All results and performance figures stated by us are estimates, hypothetical in nature and do not represent evidence of actual results achieved.Your use of our websites, materials, software, services and communications etc.and any dispute arising out of such use of them is subject to the laws of England, Northern Ireland, Scotland and Wales.We reserve the right to amend or replace our websites, materials, software, services, emails and communications etc.at any time and undertake no obligation to inform the user or to provide additional information.All materials, software, services, emails and communications etc are for the sole use of the recipient.No recipient, may rely on them for any trading or non trading decisions.Neither the whole nor any part of our materials, software, services, emails and communications etc.may be copied, published, quoted, disclosed, distributed, circulated, reproduced, transmitted in any form or stored in or introduced into a retrieval system by any means or in any form, without the prior written consent of us.

forex godfather is turning eleven dollars into eleven hundred dollars in 12 hours

if you thought turning eleven dollars

into eleven hundred dollars in 12 hours

was insane wait till you watch me turn a

thousand dollars into ten thousand

dollars in only three trades.

Do not expect this to be very likely because

this is very unlikely you ever get the

same results you guys have to remember

and I don't know I have millions of

dollars to trade with and I don't mind

losing a thousand dollars at any given

time.

I've been trading for six years and

I've been doing it religiously I

probably trade more than I breathe

regular air

so just remember that and always keep

that in mind as you guys can see man we

got a new setup let me know what you

guys think. New camera new mic

everything's new if you guys can see a

difference and you enjoy it let me know

in the comment section so I know with

that being said I don't want to bore you

guys at all I want to get straight into

the breakdown how I was able to turn a

thousand dollars into ten thousand

dollars in only three Forex trades let's

get to the breakdown so let's go and pop

the history tab up on the screen right

here as you guys can see man we start

with a thousand dollars we had a two

thousand dollar win a six thousand

dollar win and then a twenty five

hundred dollar win all followed by a ten

thousand dollar withdraw and I don't do

these withdrawals for no reason I do it

for one to show you guys that it is a

real account I also withdraw that way I

can show you guys that I made that money

anytime in Forex when you make any type

of money whether it's a dollar or a

hundred dollars or a million dollars if

you don't withdraw that money you cannot

say you made that money if it does not

hit your bank account you did not make

that money I've seen too many times

where Traders go and make a certain

amount of money on their accounts and

then they blow it withdrawing is is a

very important part of Forex you have to

be able to withdraw secure some profits

and make some real life money where it's

all literally for nothing so make sure

you're withdrawing all right guys so

let's go and hop into the very first

trade we're gonna make it about two

thousand dollars on this trade I'm gonna

break down exactly how I did it what I

saw and all that good stuff okay so

price overall to me in this exact area

it's bearish I would say we're in a

bearish market structure we have those

lower lows those lower highs lower lows

whatever the case may be

however price did create a support Zone

in this area during that previous

bearish Market structure all I need to

see for me to take this by position and

be happy with where I'm at I need to see

this support zone right former support

zone now resistance Zone be broken so

first we have a rejection we have a wick

and we have a rejection here

once price actually becomes bullish and

I see a nice bullish candle start to

develop I'm going to take that by

position I'm not going to wait for the

candle to close but instead I'm going to

take that by position based off of

momentum all of my trades are based off

momentum where's price going how fast is

it moving do I feel like I can get in

and catch this move as it's going up

those are the questions I'm asking

myself when I'm taking these trades so

again for me price just has to become

very bullish I want to see a strong

bullish candle appear here and I'm going

to take my buy position because I

believe Market structure is going to

become

bullish

just like this I also believe

that prices

coming off of a support Zone and I see

that prices breaking through resistance

we have multiple confluences

as price starts to come up I took my buy

position right here at about 109.45 as

you guys can see very strong bullish

candle I'm very happy with where price

went here very tight stop loss as well

because if price does reverse back to

this little bit of a resistance former

support Zone then I believe we're going

to see a lower low be created Market

structure is going to stay bearish and

we're probably going to lose that trade

so a very tight stop loss here very

simple I had no Target in mind I wasn't

targeting any previous zones I just

wanted to throw my stop loss and kind of

see where things went I knew I needed to

catch a lot of Pips here to make a lot

of money it's only a 0.10 we need at

least 2 000 Pips to even make two

thousand dollars so as price started to

come up I felt good now price did start

to retrace here's my thing if I can draw

my Fibonacci long position here and

price does not break through this gold

Zone that

0.568618 rejection Zone

then I'm fine okay it's not a deep

enough retracement for me to get out and

break even it has to break through this

Zone as you guys see man price never

broke through that zone we had a couple

rejections but we never stayed bearish

very good sign that a trade is going to

keep going your way if you get in for a

powerful buy look for that Fibonacci

Zone and make sure that price does not

break through that zone because if it

does that's a pretty deep retracement

and chances are you're gonna get stopped

down okay so I felt good price continue

that price continued up

again I didn't have any Target in mind

so once we caught about 2 000 Pips I'm

up 2 000 bucks I closed my trade yes we

could have caught more and it continued

after a little bit but at the end of the

day I'm okay catching 2 000 Pips two

thousand dollars on my thousand dollar

account doubling tripling my account

even just in one trade okay I'm very

happy with that and you definitely

should be too I don't care if it's ten

dollars or thirty dollars a hundred to

three hundred whatever the case maybe if

you can 3x your account be satisfied

close your trade and uh do what you got

to do okay along the way I did Trail my

stop loss very very very not

aggressively okay as price was up in

here I was probably stopped pretty much

down in this area price was up here my

stops were pretty much down in this area

and then once we hit 2000 Pips I did

close my trade and uh was very happy

with where I was okay now let's go and

go over to the next trade now for trade

number two this was a big boy winner man

we caught six thousand dollars on this

single trade right here ended up risking

a little bit more of course you know

higher a higher lot size I knew what I

wanted to do I knew I wanted to make 10

grand I knew I wanted to do it fast

again I knew what I wanted

so it's a very simple setup man we're

coming off of a beautiful support Zone

price to me is really consolidating here

I don't see much of a trend down or up

so once I see a breakout either to the

downside past this support zone or past

this resistance Zone then I'll know

which way we're going I was pretty much

in this trade not even in the trade

pre-trade looking at it from both sides

we could either buy we could either sell

it just depends on what price gives us

but we're in a pretty much a medium Zone

where I'm not sure what we're gonna do

however I did know that if price broke

through this trend line we would flood

okay so just to show you guys what my

cells would have looked like it would

have looked like that okay same thing as

my buys look like but on the opposite

end a lot of Trades that I take are like

this you're either going to get a buy

you're gonna get a sell it just depends

on which way the Market's moving which

way market structure ends up being and

all that good stuff as you guys can see

price did though start to break out to

the upside for a buy position we have

that trend line and we have that

resistance I'm a breakout guy I'm

trading breakouts whether it's a trend

line or a support or resistance Zone I

am trading breakouts based upon Market

structure in which way I believe we're

going as price comes up here we have now

broken resistance broken a trend line

and now created bullish Market structure

we're now creating higher highs and

higher lows at least that's what I'm

expecting to happen now as messy as this

looks it's pretty simple okay I'll draw

that out for you guys a higher high

higher low

a higher high okay it's very very simple

we went ahead we took our buy position

another really tight stop loss I only

want to risk about 120 Pips here and I

want to aim for as much as I can get as

comfortable as I am going to Trail my

stop loss and if my stop loss gets taken

out well then so be it I get took it out

but it's going to be in profit

regardless okay now again price ended up

Fed officials see smaller rate hikes coming 'soon,' minutes show

Tuesday 22 November 2022

Stocks making the biggest moves after hours: Nordstrom, Autodesk and more

USD/CHF Mid-Day Outlook

http://dlvr.it/Sd9M9L

Monday 21 November 2022

Stocks making the biggest moves after hours: Zoom, Dell, Urban Outfitters and more

AUD/USD Daily Report

http://dlvr.it/Sd6HzK

Sunday 20 November 2022

CII bats for I-T cut, higher public spend

Saturday 19 November 2022

'We're going to dream a little less': Sequoia's Doug Leone on fallout from FTX's collapse

EUR/USD Daily Outlook

http://dlvr.it/Sd1vbL

Friday 18 November 2022

US SEC Starts Administrative Proceedings against American CryptoFed

The United States Securities and Exchange Commission (SEC) on Friday kicked off administrative proceedings against American CryptoFed, a Wyoming-based decentralized autonomous organization (DAO).

The regulator wants “to determine whether a stop order should be issued to suspend the registration of the offer and sale of two crypto assets, the Ducat token and the Locke token,” SEC announced in a statement issued on Friday.

Ducat token is an algorithmic stablecoin while Locke is a government token created by American CryptoFed.

The US securities regulator’s action comes over one year after American CryptoFed filed a Form S-1 registration before the Commission. Form S-1 is an initial registration required of companies that want to offer new securities to the public. American CryptoFed also filed a Form 10 registration that sought to register the tokens as equity securities. However, SEC rejected the registrations.

In November last year, the regulator halted the registration of the two tokens, alleging that the DAO failed to provide information on its “business, management and financial conditions.” This included audited financial statements.

The firm’s filing also “contained materially misleading statements and omissions, including inconsistent statements about whether the tokens are securities,” the regulator said. In the same month, the regulator issued an order examination to determine whether a stop order should be issued against the DAO’s registration.

However, in the Friday statement, SEC alleged that American CryptoFed failed to cooperate with its examination of its registration statement. Regardless, Marian Orr, the firm’s CEO, told CoinDesk last year that it refuted “point by point” the criticisms raised by the regulator.

Recent Developments

According to a recent SEC filing, American CryptoFed in May 2022 wrote to the Commission that it would proceed with issuing the tokens in July 2022. But in June, the firm instead filed an application to withdraw its registration from the Commission. SEC said it rejected the application on the ground that “granting of the withdrawal request is not consistent with the public interest and the protection of investors.”

In the new SEC statement, David Hirsch, Chief of the Enforcement Division’s Crypto Assets and Cyber Unit, noted that an issuer that wants to offer crypto assets as securities transactions “must furnish the required disclosure information to the SEC.”

“American CryptoFed not only failed to comply with the disclosure requirements of the federal securities laws, but it also claimed that the securities transactions they seek to register are not in fact securities transactions at all,” Hirsch said.

Are Cryptocurrencies Securities?

In 2018, Jay Clayton, the former SEC Chair, noted that most cryptocurrency products qualify as securities and should be registered with the Commission as such. In August last year, Gary Gensler, current SEC Chair, echoed the same thought, noting that the securities regulator counts many cryptocurrency coins and tokens as securities.

As a result of this disposition towards digital assets, the SEC has been waging war against crypto startups flying crypto offerings without registering them as securities.

These battles include those the regulator has fought or is fighting against creators such as Kik Interactive which raised almost $100 million from the sales of its 'Kin' digital tokens, digital asset lender BlockFi Lending, which offers interest-bearing accounts, and Ripple Labs which raised over $1 billion dollar from sales of its token XRP, all of them without registering them as securities.

With US President Joe Biden's recent executive order calling for a harmonious regulation of the emerging cryptocurrency industry, it remains to be seen what final direction the world's largest economy will take with regard to cryptocurrency regulation.

This article was written by Solomon Oladipupo at www.financemagnates.com.GBP/USD Mid-Day Outlook

http://dlvr.it/Scz0F2

Thursday 17 November 2022

Visa says Ryan McInerney will replace Al Kelly as its next CEO

USD/CAD Daily Outlook

http://dlvr.it/ScwLnN

GBP/USD Mid-Day Outlook

http://dlvr.it/ScvvqM

Wednesday 16 November 2022

Stocks making the biggest moves after hours: Cisco, Bath & Body Works, Nvidia and more

AUD/USD Daily Report

http://dlvr.it/ScrqqQ

USD/JPY Daily Outlook

http://dlvr.it/ScrqgR

USD/CHF Daily Outlook

http://dlvr.it/ScrqVg

GBP/USD Daily Outlook

http://dlvr.it/ScrqHm

'Shōgun' banked on authenticity. It became one 2024's most successful shows

/ FX . All Japanese characters are played by Japanese actors speaking period Japanese (with subtitles) while dressed in painstakingly detai...

-

IS CFD TRADING WORTH ITTORIAL: Trading Stock CFDs Worth It? 📝 A topic that is only tangential to Forex, the question of whether to trade st...

-

FX Eagle Dashboard Forex System provides extraordinary trading assistance for its users. THE CURRENCY MATRIX. The indicators are all avai...

-

On the daily chart below for WTI crude oil, we can see that after the price filled the gap created by the surprising OPEC+ production cut an...